Netskope IPO: Window Dressing or Real Growth?

What companies do to prepare for an IPO and the levers they can pull to make things look better

Sponsor: Free Accounting Workshop: Automate Rev Rec with AI

Imagine describing your most complex revenue recognition process and then watching as the complete automation workflow gets designed for you – and runs perfectly – in minutes.

That's what you’ll learn to do in this live workshop from Leapfin. Go beyond generic ChatGPT answers and learn AI techniques to accurately and efficiently automate the heavy lifting of rev rec.

IPO Window Dressing

A LOT of preparation is required to go public (legal, accounting, FP&A, security, etc), but none of it matters if the financial profile and the company story aren’t compelling. Investors need to believe you can grow fast and generate above-average profits in the long-term.

Companies typically start serious IPO prep 1.5–2 years before listing. Management will start considering the levers they can pull to make the financials a bit more compelling long before the S-1 drops.

There is nothing wrong with this (usually)…everyone does it to some degree — “how can we make revenue growth stronger and how can we burn less cash before the IPO?”

In today’s post I will cover some levers that an IPO candidate (like Netskope) might use or even private companies looking to fundraise or hit board targets.

Netskope definitely saw some of its key metrics improve in the past 6-12 months, but regardless of any potential “window dressing”, they have some pretty solid metrics.

** I am providing some examples of what companies might do and pointing out how this might show up in financials using Netskope as an example. Educational purposes only.

1. Topline - ARR / Revenue Growth

It may not be the glory days of “growth at all costs” from 2021, but…growth is still ~3x+ more important than profitability for most public companies today. Without strong growth the IPO will be a flop.

Below is Netskope’s estimated ARR growth from Dylan Reider:

Here are the ARR / revenue levers:

Price Hikes: a big price hike a few quarters before an IPO will make growth and NRR look great.

Tighter Discounting Rules: Similar to price hikes, but a different approach. Management will tighten sales rep discounting thresholds so the pricing is effectively higher on new deals.

Increased Sales Discounting: This is the exact opposite of the above approach, but might be done by companies with a more price sensitive sale (highly competitive or price sensitive customers)

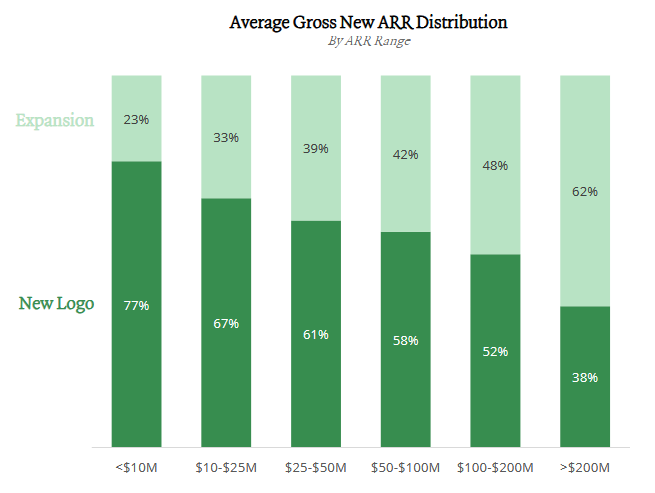

Expansion Revenue Push: As a company scales a significant percent of new ARR comes from expansion. By the time a company IPOs it often represents >50% of growth so pushing for more expansion is a key lever.

What levers did Netskope maybe use?

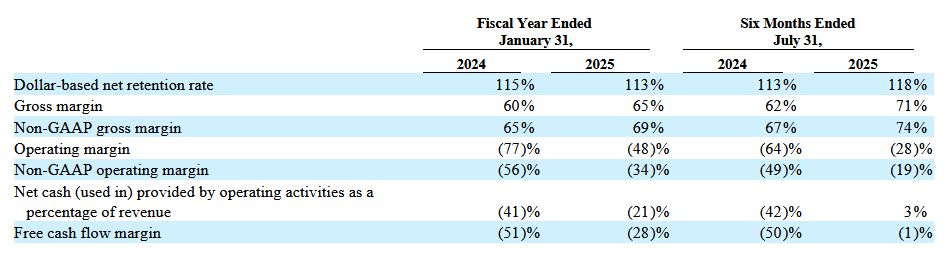

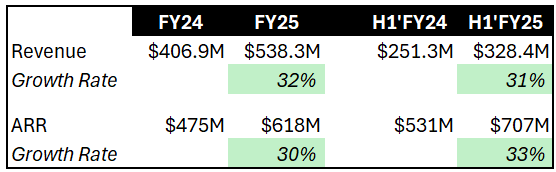

Netskope’s ARR growth is up 3 percentage points while revenue is down 1 percentage point over the time periods shown below.

How does this happen? When ARR growth is accelerating GAAP revenue will lag. When GAAP revenue is decreasing while ARR growth is increasing (like Netskope) then that probably means there is A LOT of back-end loaded ARR in H1’FY26 driving the acceleration which doesn’t really show up in GAAP revenue during the period since revenue is recognized over time.

Increasing Expansion and NRR:

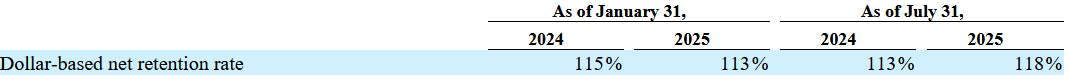

18 percent of Netskope’s 33% (or 55% of the total) ARR growth is coming from net expansion (expansion less churn/downgrades). That seems like a pretty reasonable range given Netskope’s scale, but in the last 6 months NRR increased by 5 percentage points — increasing from 113% to 118%, which is a lot.

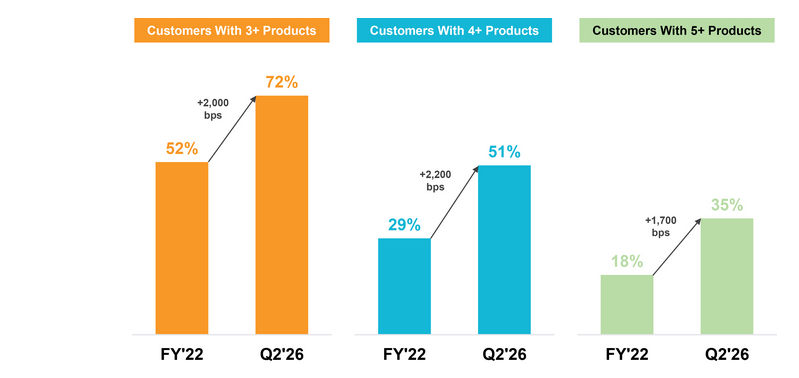

Netskope implies that the NRR boost is coming from more customers adopting multiple products. Based on the chart below that certainly looks like a big reason and maybe the sales team had a really big push in H1 of this year to cross-sell these products.

But I also wouldn’t rule out some of the other tactics I mentioned above like formal/informal price hikes or pushing early renewals with upsells to also show stronger ARR growth leading up to the IPO.

2. Cutting Expenses

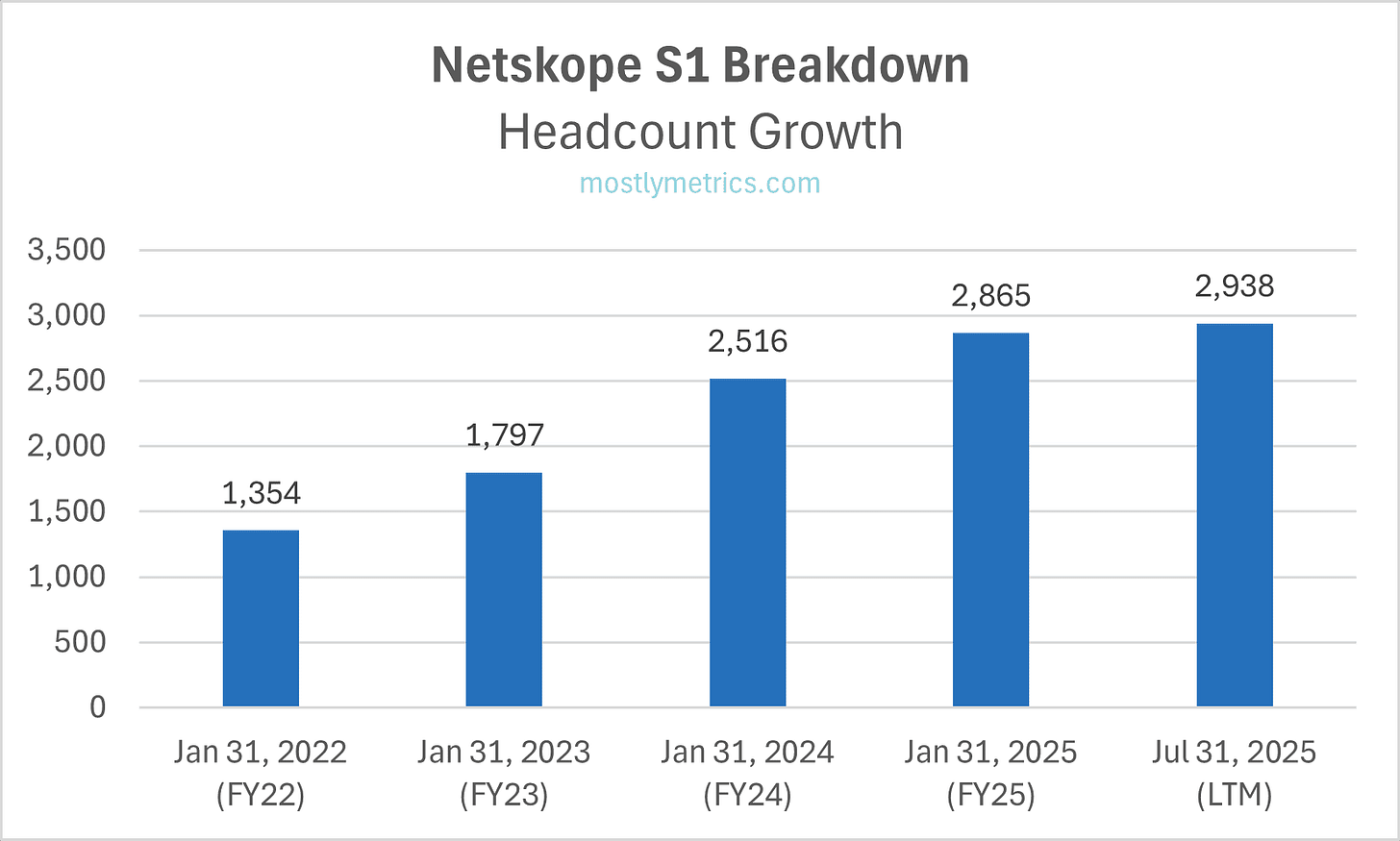

Hiring Freezes / Layoffs - This may have been happening at Netskope over the past 6 months leading up to the IPO. For most software companies, 70%+ of cash burn is people related so simply freezing hiring while revenue is increasing can improve cash burn a lot. As you can see below, headcount is pretty flat over the last 6 months.

Cut Facilities: Facilities expense can be very expensive and lots of companies are finding savings by cutting back here. Netskope reduced facilities expenses by $1.3M in FY25. Not huge dollars, but certainly helps.

Reduce Travel: Netskope’s T&E within sales & marketing decreased by $1.2M in FY25. It’s an easy lever to turn down and get more strict on leading up to an IPO when you are trying to get to positive free cash flows.

Reduce Marketing: Marketing is one of the first things management looks at when cuts need to be made. There is a lot of spend in marketing that is easy to turn off and the ROI is often very fuzzy.

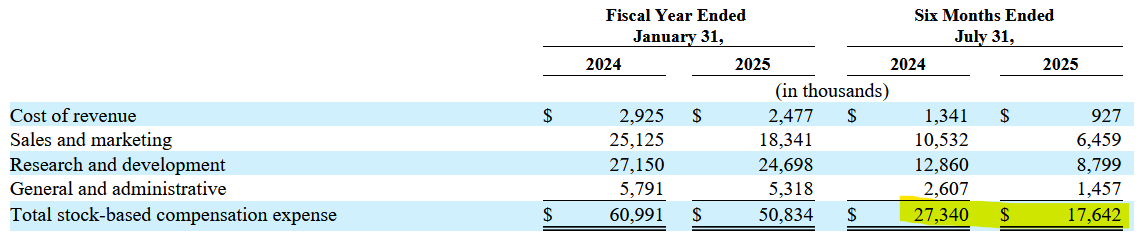

Shift from stock options to RSUs: This is non-cash, but does impact the GAAP expenses being reported. The shift to RSUs before an IPO is typical but beware of improving GAAP expenses leading up to an IPO because of this change.

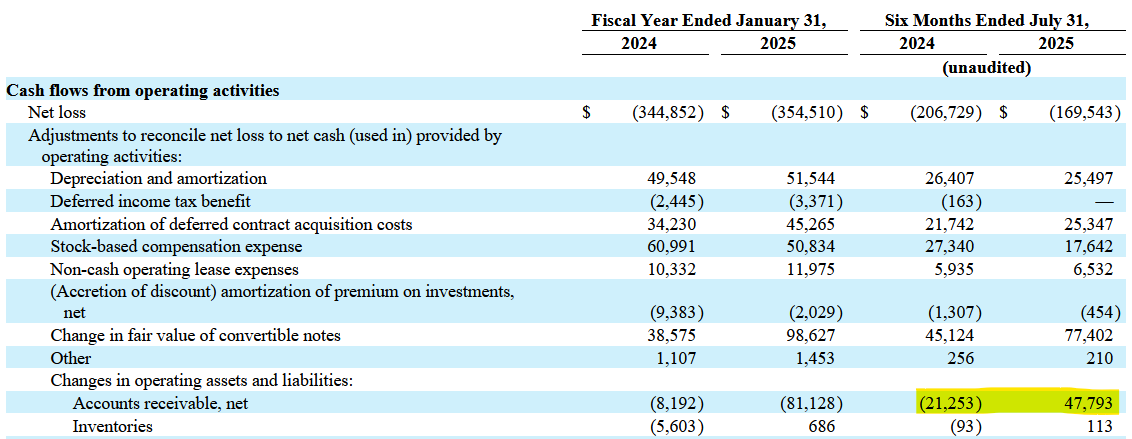

Net loss improved to $170 million for the six months ended July 31, 2025, compared to $207 million for six months ended July 31, 2024.

Yes, GAAP net loss improved but $10M of it came from an accounting thing by using more RSUs. Netskope switched to providing mostly RSUs for new hires, promos, etc and no stock-based comp is recognized on those until the IPO happens because it is contingent on the IPO.

If the offering had been completed as of July 31, 2025, we would have recognized approximately $315.8 million of stock-based compensation expense associated with the satisfaction of the performance-based condition for certain outstanding RSUs

A LOT it dilution (and GAAP expense) is coming…

3. Improve Free Cash Flow

All the cost cutting levers mentioned above (except SBC) will help with improving free cash flow, but there are also several other tricks companies can do to artificially show strong free cash flow improvements. The problem with these though is that they usually catch up to you in the next period:

Pull Forward Collections: Be super aggressive in collections and get more money from your customers — discounts to pay early, shorter payment terms, more threatening notices, etc

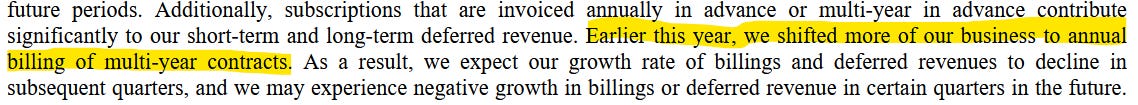

Upfront & Multi-Year Billing: Similar to collections…If you bill more upfront then you will get more cash today. Netskope disclosed that at the beginning of 2025 they move to more annual and multi-year upfront deals.

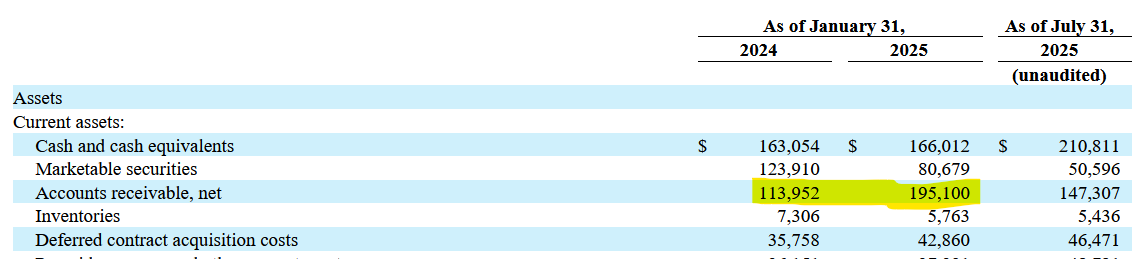

One of the biggest causes of Netskope’s free cash flow increase in H1’FY26 was from accounts receivable (+$47.8M). There may be some seasonality of Billings, but the period relative period (H1’FY25) was a decrease of $21.3M to cash.

This was driven by the 70% spike in accounts receivable in FY25, which was likely driven by the push for more upfront billings. This was then subsequently collected in H1’FY26

This push also shows up in the growth in long-term deferred revenue (i.e. billings for amounts that will be recognized as revenue after 1 year). Noncurrent deferred revenue increased by 58% in FY25, which shows a push for multi-year upfront at the end of FY25.

Holding Accounts Payable: This is the oldest trick in the book. A little bit below cash forecast? Just hold paying some of your larger vendors.

Delay Capital Expenditures: Just wait a bit longer (after the IPO) to purchase fixed assets. Netskope purchased $18.5M of fixed assets in H1’FY25 and only $9.0M in H1’FY26.

Other Interesting Netskope S-1 Things

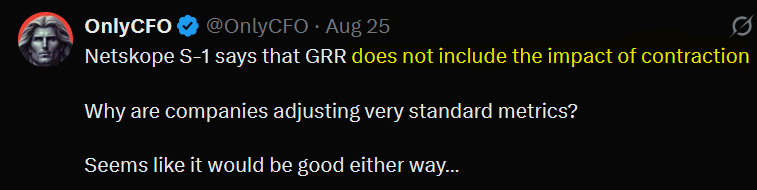

Gross Revenue Retention (GRR)

We should be happy because most companies don’t even report GRR, but Netskope is reporting both NRR and GRR. And they have a really good GRR!

Our GRR increased to 96% as of July 31, 2025, compared to 95% as of July 31, 2024.

But…for some reason Netskope decided to not include customer contraction (they are only including full customer churn and not downgrades) in their GRR definition so I reserve the right to still be upset.

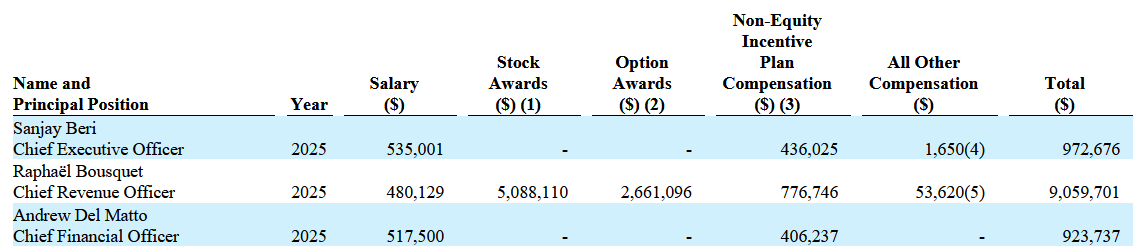

Exec Comp

Just a note that Netskope missed their internal targets in FY25. The S-1 states that executives were only paid 94% of their bonus due to misses on corporate goals (based on ARR, NRR, GRR, organic cash burn, and gross margin). They likely hit (or were close) their board targets but missed the internal stretch targets.

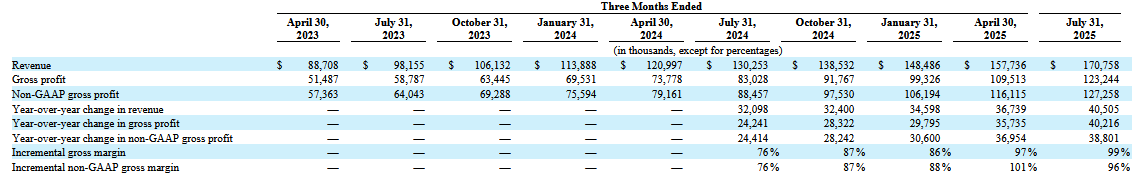

Incremental Gross Margin

Netskope introduced a new metric for public company reporting: “Incremental Gross Margin”

Incremental Gross Margin = year-over-year change in gross profit, divided by the year-over-year change in revenue

It’s an interesting metric but can also be deceiving because in big enterprise contracts you often get a lot of the revenue without much of the related costs for many months because the customer is implementing and pushing more usage over time. Not sure I love this metric…

Final Thoughts

I don’t think Netskope is doing anything nefarious at all. They have a good financial profile and have shown incredible improvement in many areas in the past year. My only warning is that some of that improvement may be somewhat non-recurring.

Also, the Netskope S-1 IPO has received much less excitement than Figma. Not because the financials are bad (they seem pretty good), but a lot less people know much about them.

Will they have a nice IPO pop? Probably, but not like Figma due to less hype/excitement and not as strong financials and story.

Footnotes:

Send me an email (OnlyCFO@onlycfo.io)! Ask me questions and I’ll try to write about it in a future newsletter or tell me what you would like to see more/less of.

Learn more about AI in accounting at this webinar (from Leapfin)

Great write up.

What’s the source of the Avg Gross ARR distribution chart?