New Tax Rule is Terrible for Software Industry!

A huge tax change for software companies that everyone needs to understand

⚠️ I need you to share this post with founders/CEOs, investors, anyone else who will listen. This new tax rule that has gone into effect really hurts startups and the entire software industry. There is still a small chance it can get repealed.

One of the best parts about being at a venture-backed software company is that we have been able to basically ignore income taxes because we lose so much money in the early days 🤣. In all seriousness, the significant investments needed upfront in software is how the model typically works.

But a new tax rule that went into effect last year (for tax returns being filed this year) is going to cause lots of pain for software companies. A lot of folks still don’t know about this new tax rule or it’s negative impact on innovative companies.

The new tax rule (Section 174) will cause cash burning startups to pay income taxes and greatly increase income tax bills for profitable software companies.

New Tax Rule - Section 174

IRS rule Section 174 requires companies to capitalize and then amortize research and experimental (R&E) expenses over 5 years (for domestic expenses) and 15 years (for international expenses). Software development was added to this definition by President Donald Trump’s Tax Cuts and Jobs Act (TCJA) in 2017 and took effect in 2022 (for tax returns being filed this year).

This means that certain software development expenses that were previously deductible immediately for income tax purposes are now only deductible over several years. This is a big deal because it means unprofitable software companies that are heavily investing in development efforts may now be on the hook to pay income taxes!

Congress intended to, and was widely expected to, repeal this before it took effect... but they didn't...so here we are.

Note - this change only impacts taxes and not the financial reporting of research & development (R&D) expenses.

How Section 174 Works?

Let’s go through a couple of examples so you can see the potential impact for both a startup and a larger profitable company.

Early Stage Startup Example:

How tax rules previously worked:

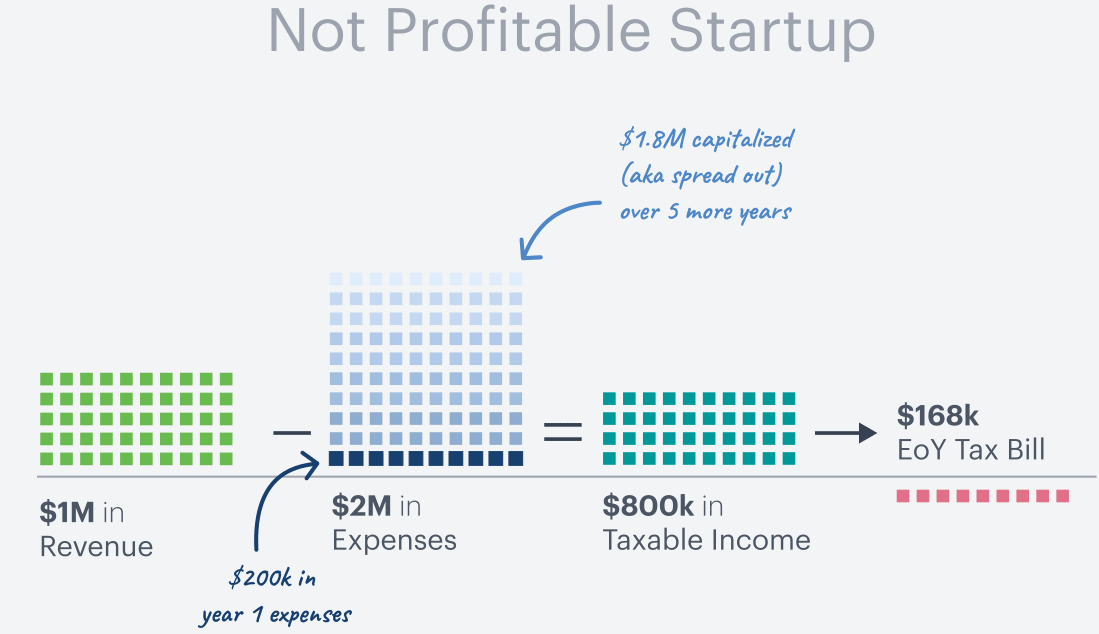

An early stage software company might have $1m in revenue and $2m in expenses (mostly R&D and Sales). Pretty standard ratio and upfront investment for an early stage company.

The Company has a net loss of $1m ($1m revenue minus $2m expenses) for financial reporting. For income tax purposes the net loss would have been fairly similar with potentially some small tax adjustments.

How it works under Section 174:

Under the new rules, as much as $1.8m of expenses could be added back for income tax purposes — assuming all expenses to that point were for software development. Domestic expenses can be deducted over 5 years, but for the first year you can only deduct 50% of the 1st year. This is why only $200K is expensed below rather than $400K ($2m / 5 years).

In reality not all of the $2m of expenses would likely need to be capitalized under the new rule because some of these expenses would be for sales, marketing, G&A, etc., but R&D expenses are often a significant portion of expenses for early stage companies.

Also, not all R&D expenses that show up in financial reporting must be capitalized either, but it can be a high % for startups.

Let’s look at a more detailed example:

Let’s say a startup had the below assumptions for its revenue and expenses.

Below is what the income tax difference might look like. Instead of getting $75K in a payroll tax refund for your startup you are paying $93K in income taxes for your cash burning startup!

You might be thinking, “hey, for my startup it is only like $50K extra in income taxes per year. That’s not a big deal!”

This is wrong for a couple of reasons:

It may only be $50k now but the closer you get to profitability the more significant it becomes

Companies now have to think about incomes taxes a lot more closely, hire tax advisors to help support the complicated calculations/rules, and do tax planning to reduce the impact of this tax law as much as possible.

The additional time for tax planning and costs for tax experts navigating Section 174 can be huge for startups.

Near Cash Flow Breakeven Example:

When a software company is near cash flow breakeven (or profitable) then this rule may significantly accelerate income taxes to be paid. Take a look at the below example…

For a company still not generating a profit, it has $11m in taxable income under the new rules while $0 under the old rules. The below assumes all R&D is capitalized but even if you assume only 50% of the R&D expenses are capitalized under Section 174 you still have $4.5m in income taxes!

Some of you may be thinking, “But we have a ton of NOLs (net operating loss) carry forwards that we can apply to that taxable income!”.

Not so fast…Under the new NOL rules those NOLs can only be used to offset 80% of taxable income so even if you have NOLs from losing money in prior years, you will still have a tax bill due.

For profitable companies without NOLs (or companies that have used up all their NOLs), then Section 174 is a major acceleration of income taxes to be paid. While the cash payments would have been made either way, this is cash that these companies could have used today for further innovations, M&A, etc. that they now can’t.

Take a look at Zoom’s latest 10-K showing that they capitalized $245m from Section 174. Since they are profitable and don’t really have much NOLs, this is adding A LOT to taxable income.

What Gets Capitalized?

As mentioned earlier, not all expenses in the research & development (R&D) line on financial reporting get capitalized. However, the guidance from the IRS leaves a lot to judgement and still leaves a lot of questions.

In general, costs to develop new software, features and upgrades should be capitalized under Section 174 while general maintenance should not. Below is the text from the guidance released by the IRS last month:

03 Activities that are treated as software development. Activities that are treated as software development for purposes of § 174 generally include but are not limited to:

Planning the development of the computer software (or the upgrades and enhancements to such software), including identification and documentation of the software requirements;

Designing the computer software (or the upgrades and enhancements to such software);

Building a model of the computer software (or the upgrades and enhancements to such software);

Writing source code and converting it to machine-readable code;

Testing the computer software (or the upgrades and enhancements to such software) and making necessary modifications to address defects identified during testing, but only up until the point in time that:

In the case of computer software developed for sale or licensing to others (or the upgrades and enhancements to such software), production of the product master(s)

For early stage companies, the capitalized amount might be the majority of their R&D expense. While for later stage companies it is likely <50% of their R&D expense.

International Hiring

Section 174 has the impact of really discouraging hiring internationally since international costs that qualify to be capitalized under the new rules must be deducted over 15 years versus 5 years for domestic.

Companies will need to spend more time tax planning and weighing the pros/cons of hiring internationally as there can be a meaningful cash flow difference from the related incomes taxes of Section 174.

For those companies thinking about hiring more offshore engineering resources to save some money, you need to also consider Section 174 in your analysis.

Is the software industry doomed?

This new tax rule obviously sucks, but companies that understand the rule can plan around it to make sure they minimize the negative impact.

But also…not all hope is lost that it can still be repealed.

Michele Hansen (a SaaS founder) has been a vocal proponent of repealing this tax rule. Below is what she told me and how folks can help. Sign the below letter to pressure Congress to repeal Section 174!

Changing R&D expensing rules so software development must be capitalized rather than expensed is disastrous for the SaaS industry.

Earlier this year, we sent Congress a letter about this, and almost 600 small software companies from all 50 states signed. Now, we're joining a larger effort organized by the National Association of Manufacturers to put pressure on Congress to fix this.

Sign the letter by October 23rd and share it with any other US-headquartered business owners you know at https://ssballiance.org/namletter

Concluding Thoughts

I still have some hope that Section 174 can get repealed and I can continue to not think about income taxes! But that hope slowly dies every day.

If Section 174 sticks then you need to understand these rules, their impact to cash, and how tax planning can minimize the impact.

Make sure your tax consultant understands Section 174 and the software industry. A lot of early stage companies use bottom-tier tax firms that don’t have the expertise here and that will cause you problems.

** Thanks to Cailen Dsa and the Neo.tax team for helping me with this post! They are experts on this topic and have helped lots of companies navigate section 174