Palantir | Creation of a Cult Stock

Lessons on valuations, stock hype, unit economics and metrics that matter

👋 Join 24K+ subscribers learning more about the software industry, public markets, and operating software companies.

Today’s Sponsor: Runway - the finance platform you don't hate

Runway is the modern and intuitive way to model, plan, and align your business for everyone on your team.

Runway integrates with 650+ tools to pull all your data and context in one place. Invite everyone to collaborate on plans and see the impact of their decisions. Create dynamic reports with live charts, videos, and text to easily explain the why behind your numbers.

Book a demo to see how Runway creates financial clarity for your team.

Palantir | Most Loved & Hated Stock

*Note - this was written before the market crashing today (Black Monday?) so some valuation numbers are obviously different, but relative valuations still generally accurate. Good luck out there….

Palantir is one of the few cloud stocks that has received a retail investor cult-like following. It has been one of the most loved AND hated tech companies of all time - folks are either very bullish on the stock or think it is trash and going to zero.

But regardless of your opinion of Palantir, it currently holds the #1 spot for the most richly valued software company based on its revenue multiple (EV/revenue). Palantir is trading at 19x revenue as of last week, which is a big jump even from the #2 spot of just 15x.

Also, it is just 1 of 6 cloud stocks (out of the 33 that I track) that went public between 2020 and 2023 that has generated a positive return for investors since the day 1 closing price of the IPO.

And second place wasn’t even close…

And it’s probably not just an overpriced meme stock (although it was once a target of Reddit’s WallStreetBets madness). It has some pretty impressive metrics. Although….it doesn’t have the fastest NTM (next 12 months) revenue and it is not the most profitable on an NTM basis. So either it is overvalued (too much hype) or there is something about Palantir’s longer-term potential that investors are baking into the price.

Arny Trezzi has been a major Palantir bull for a long-time (especially when it wasn’t cool and the stock was trading at $8 per share). So I asked him to guest author on what all the Palantir bears got wrong and if/why Palantir deserves to be the most richly valued cloud company.

*As a reminder, this is not investment or tax advice….just the opinion of Arny who has been a big Palantir bull*

What did Palantir bears get wrong?

—a guest post by Arny Trezzi

The SaaS world has been under a lot of pressure over the past couple of years. While the broader market just recently hit all-time highs, the WCLD ETF (representing the cloud industry) is still down ~50% from its peak in November 2021.

However, not all SaaS companies are struggling the same. While revenue multiples are significantly down across the board, some companies are taking the opportunity to get fit (efficient) while keeping revenue growth strong.

Since becoming listed in 2020, Palantir’s stock return is up ~180%, outperforming the Nasdaq by a wide margin and becoming the most valuable SaaS company in terms of its revenue multiple.

Palantir’s story, however, has not always been rosy. Controversy reigned as bears had plenty of reasons to hate Palantir. The most common arguments were:

"Palantir is a black box”

“Palantir is a meme stock”

“Palantir is a consultancy shop”

“Palantir inflates numbers with SPACs”

“Palantir is just analytics”

“Palantir is just a defense contractor”

“Palantir’s SBC is too high.”

Palantir was even mentioned by “The Bear Cave”, one of the most famous Substack newsletters with over 66k subscribers, which wrote a short thesis when the stock was at ~$14, defining the company as an “AI Impostor.”

Not only did Palantir stock resist the attack, but it also roared back. The price has almost doubled since the article was released.

What did bears get wrong with Palantir?

“This is not software“

Since its earliest days, faced the critique that its business is “consulting” and “not software.” Tier 1 VCs refused to invest in it.

Due to this misconception, Palantir was not typically included in SaaS research and indexes. For instance, the Bessemer Cloud Index still does not include Palantir.

Skeptics have a negative view on the centrality of Palantir’s Forward Deployment Engineers (“FDEs”), which are software engineers who work side by side with clients to deploy Palantir and solve use cases.

Bulls realized that FDEs are not mere consultants but “software builders.” FDEs built products in Palantir that customers can use to solve their problems, regardless of the industry.

FDEs:

generate unique R&D from industry-specific use cases while getting paid

commit code to Palantir to improve capabilities

train customers on how to expand Palantir’s usage autonomously

By being “in the trenches,” FDEs become the signal that informs the direction in which new features are built in Palantir. The proximity to the problems puts Palantir ahead of the competition.

In the words of a Palantir employee:

“FDEs are magicians able to build and commit code to the main platform on demand for their customers, whereas consultants build in with a platform and a locked-in set of tools.

FDEs could be seen as an engineer who can design, build, and put together an F1 car, while a consultant is more like a mechanic who can repair the car when it’s broken or builds a kit car of OOTB equipment and parts.” - Chad Wahlquist, Palantir Forward Deployed Architect

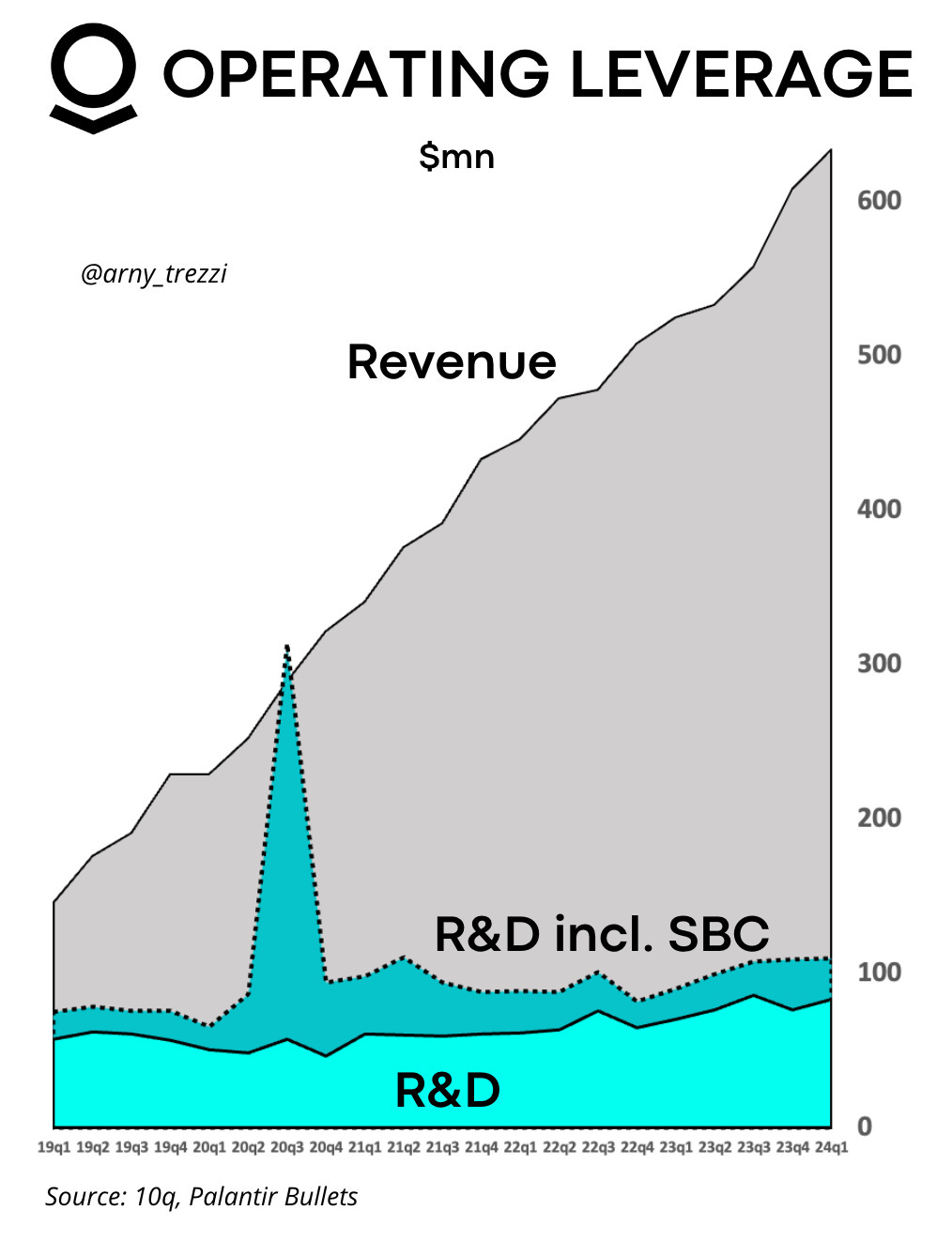

The internal R&D focuses on improving the platform and requires little marginal cost, creating staggering operating leverage:

“This doesn’t scale“

SaaS is a scalable business. The biggest SaaS companies should have better metrics than smaller ones.

A financial metric that helped bulls see that Palantir’s business was solid and scalable is Revenue per Employee, which Mostly Metrics defined as “the GOAT of SaaS Metrics.”

Palantir’s Revenue per Employee keeps expanding and has far exceeded that of leading enterprises SaaS ServiceNow and Salesforce.

If Palantir had been a consulting company, this could not have happened.

“Controversy no thanks”

Investors know that hate could mean opportunity.

However, controversy is difficult for financial professionals. Portfolio managers must preserve their investors' money under management and play internal politics with the investment committee. While companies like the Mag7 hardly get you into trouble, a stock like Palantir could have some career risk if the thesis doesn’t work out.

Controversy is a high-risk play. Therefore, many investment professionals prefer avoiding inclusion of controversial companies in their portfolios.

When Palantir was at a deep discount below $10 not only did it have a “controversial equity story”, but it also had:

negative EPS

slowing growth

high SBC impact

In other words, it was not an “easy buy” to justify.

After years of neglecting the impact of stock-based compensation during the zero-interest environment, many investors turned extremely adversarial toward SBC when rates were raised, creating pressure on SaaS companies. Palantir had very high SBC.

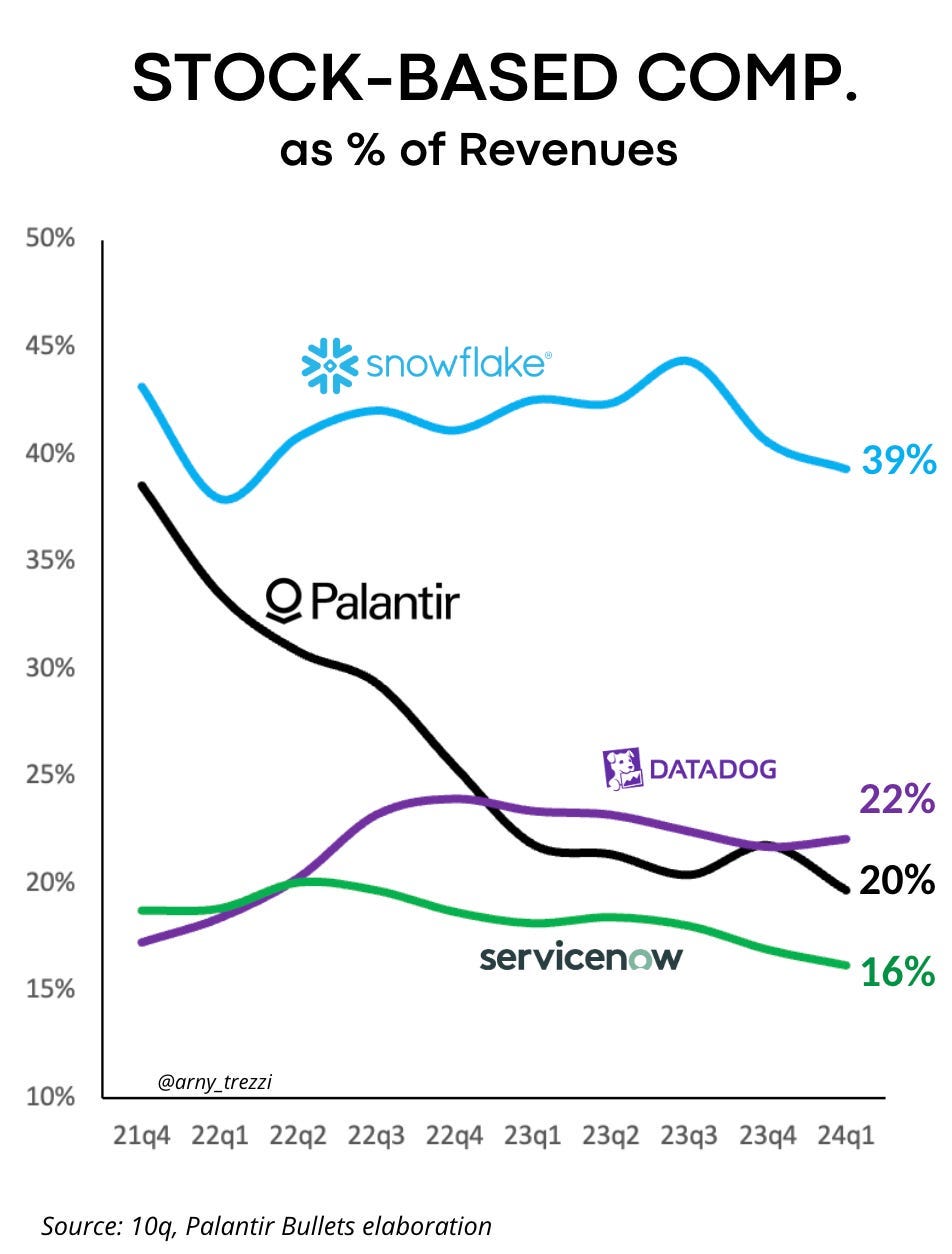

While Palantir’s SBC is high, bears missed that the impact of SBC was steadily decreasing. Palantir’s SBC/Revenue has gradually decreased, and now it is ~20%, similar to ServiceNow's.

ServiceNow is four times larger than Palantir. This means that Palantir’s SBC impact could be further reduced with scale.

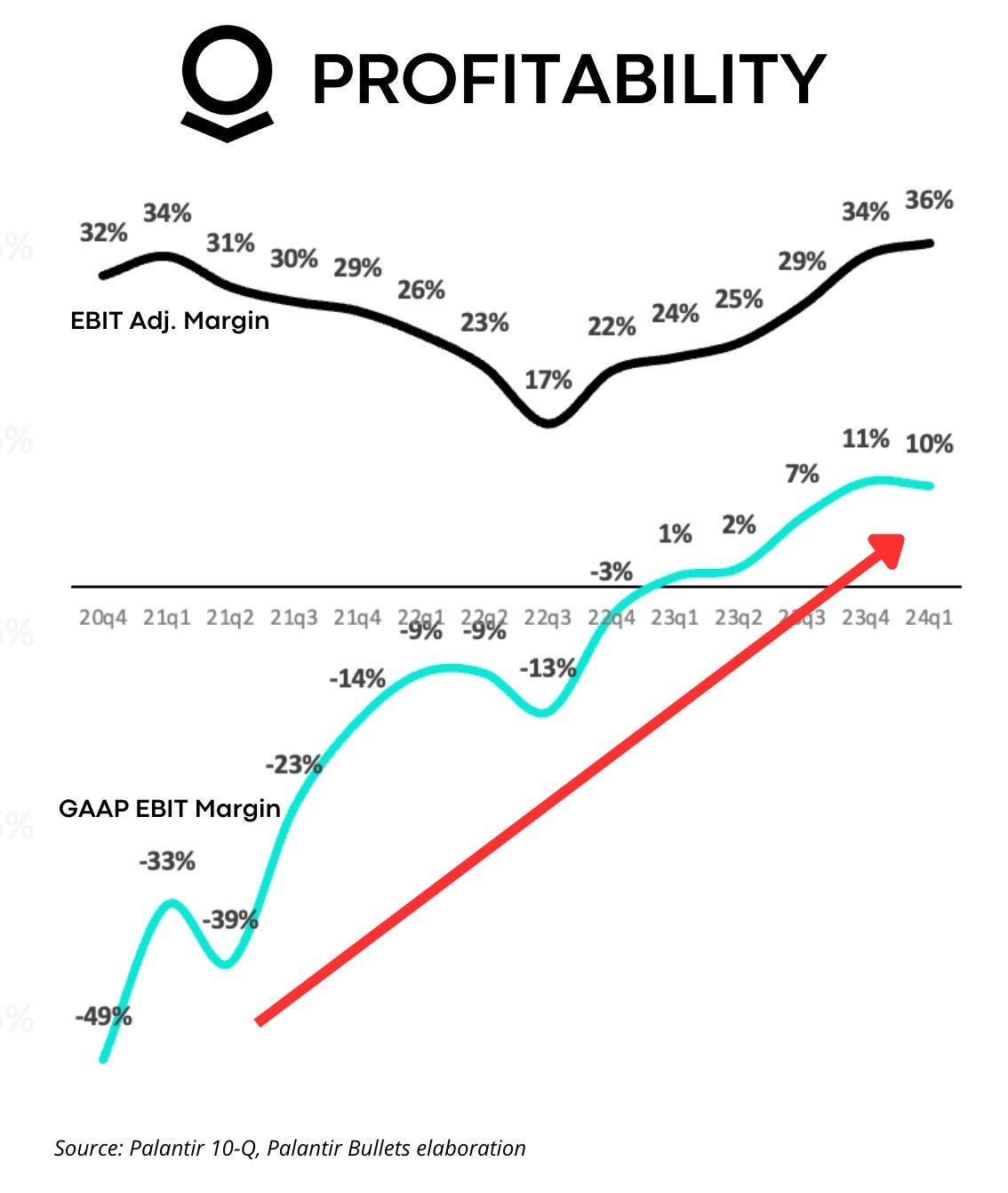

The drastic reduction of the SBC impact helped Palantir achieve steady GAAP operating profitability.

Bears focused on “SBC is too high” rather than its dynamic.

“Military contractor no thanks”

Palantir has been a Military Tech leader for years, providing crucial software to the Army and Intelligence Agencies. However, financial professionals were unhappy dealing with military companies because of the ESG movement.

The war in Ukraine changed perception.

Investors realized that military tech is essential and could be an investment opportunity, and Palantir plays a crucial role.

Palantir has been described as “Ukraine’s AI secret weapon” for its role in what is now called “algorithmic warfare.” This has changed the perspective on the Government side, which had previously seen a “no growth” vector.

The critical role of Palantir in Defense is justified by the recent AI awards from the DoD: Project Maven, which was initially given to Google, and TITAN, which is the first prime contract Palantir achieved.

“The cost of avoiding IPO costs“

Rather than pursuing the classical IPO process, Palantir chose a direct listing (“DPO”), which requires a fraction of the fees.

Choosing the DPO route had consequences.

Due to the lack of a formal IPO roadshow and its relative training from investment banks, Palantir struggled to explain its equity story, making it hard for investors and banks to appreciate the particularities of the business model.

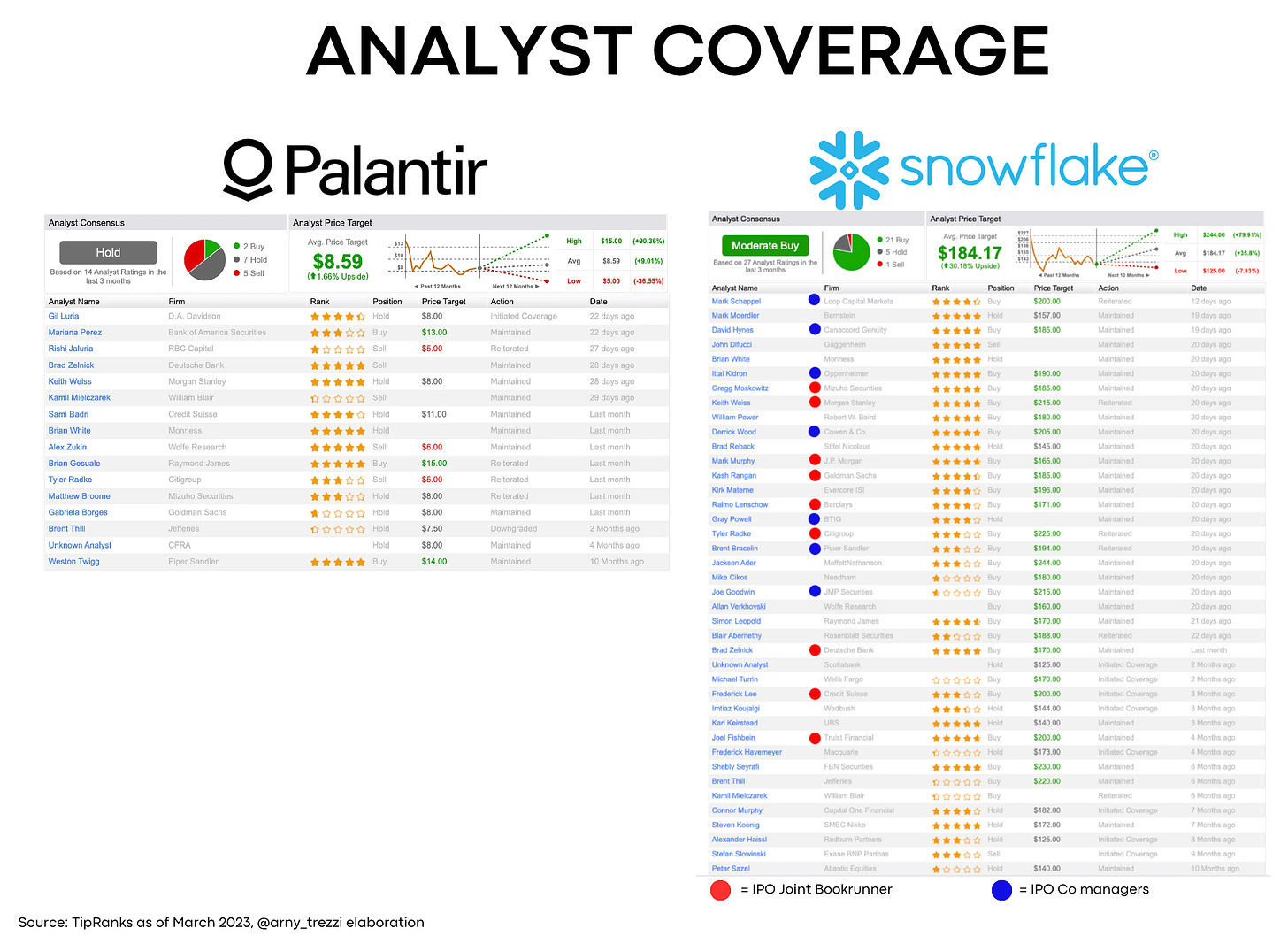

Initially, very few analysts covered the stock: last year, ~16 analysts covered Palantir vs. ~40 covering Snowflake, which went public in the same period but with an IPO.

Furthermore, banks didn’t hesitate to have shallow targets in Palantir. For instance, at the beginning of 2023, RBC and Citi’s analysts issued a $5 price target, nearly half the DPO price. Conversely, banks sustained Snowflake target prices well above its IPO price.

Coincidence?

The asymmetry between this negative perception and the operating reality created Palantir’s outperformance.

The dynamic that matters

While bears focused on data points, bulls focused on the fundamental dynamics:

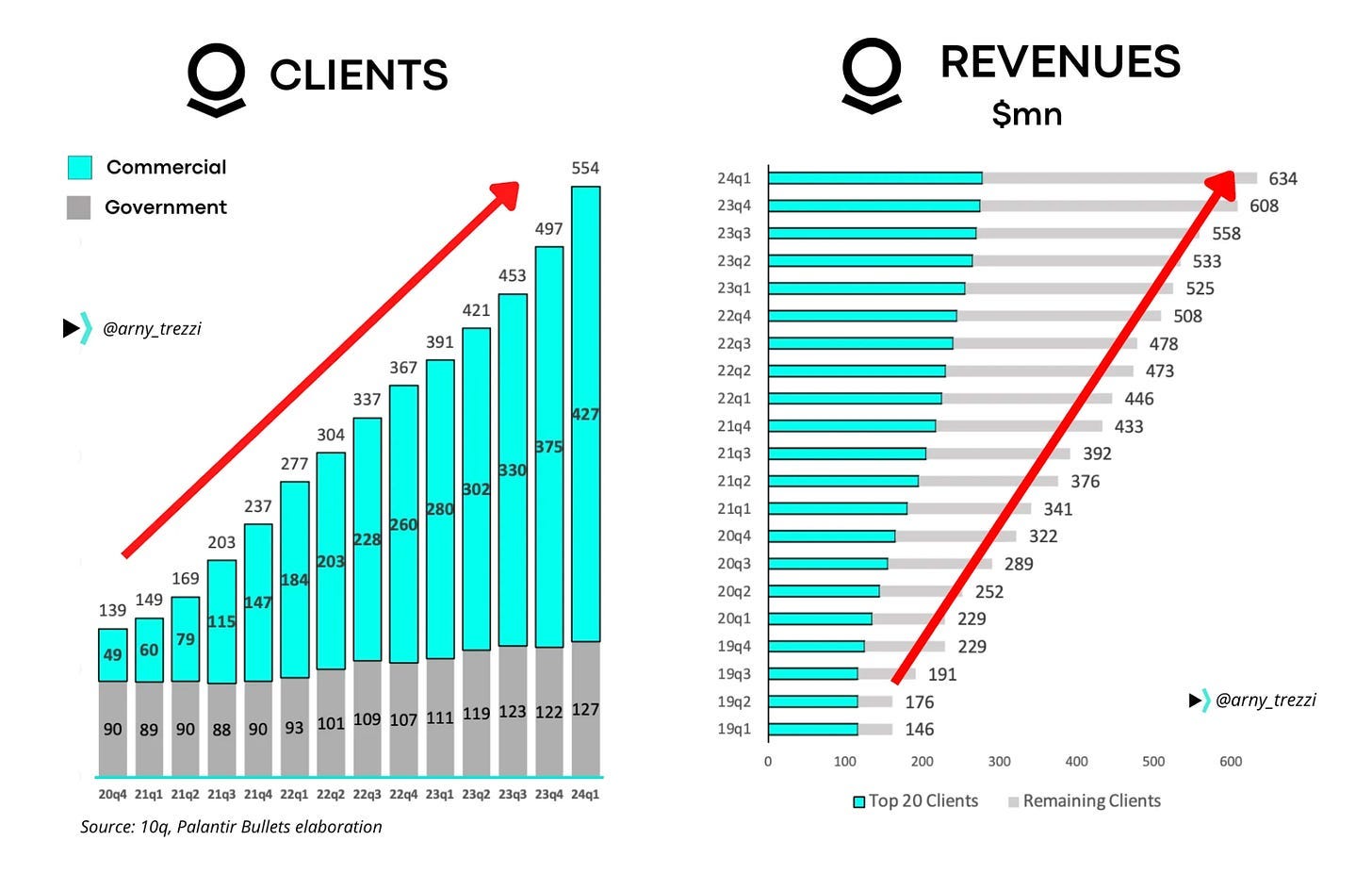

Palantir was steadily increasing the number of clients

The speed in acquiring clients has been steadily accelerating

Existing clients kept expanding their usage of the platform

The Highest Valuation Multiple

After reaching a bottom of 5x EV/Revenue, Palantir now trades at nearly a 20x multiple, the highest in the cloud sector, ahead of Crowdstrike and Cloudflare.

Is the premium deserved?

Palantir currently grows at ~20% Revenue and has a ~35% FCF Margin.

At first glance, 20x EV/Sales doesn’t seem reasonable.

However, if we pay attention to the dynamic, we notice that Palantir unlocked the “holy grail” in the world of SaaS:

Palantir accelerated revenue while expanding margins in a weak SaaS environment.

The new go-to-market strategy, which focused on AIP Bootcamps and AIPCon, which I attended, created a powerful flywheel that allowed Palantir to accelerate while expanding margins.

Rather than leveraging a horde of salespeople, Palantir leveraged the strength of its product to show potential clients they could solve use cases with AI in 1-2 days rather than months.

Furthermore, we need to realize that current revenues fail to capture the total value generated by Palantir because it usually takes a couple of years before new clients start making meaningful contributions.

Palantir’s number of customers, especially in US Commercial, is growing considerably faster than the Revenue, leaving plenty of growth upside as these clients expand.

How to evaluate Palantir now?

The key metric I use to assess valuation is NTM EV/FCF. Based on analysts ' estimates, Palantir now stands at ~60x EV/FCF.

Analysts currently expect:

~20% Revenue 23-26 CAGR

~35% steady FCF Margin

~25% EPS Growth

Both more growth and margin expansion could exceed these expectations since:

AI has strong momentum and Palantir has proven success in any industry

AIP Bootcamps are increasingly more frequent and effective

Palantir internally deploys AI agents in AIP to improve operations

To properly assess Palantir’s dynamics and valuation, it is critical to understand how it differs from other cloud companies:

Big deals can suddenly happen, especially from the Government side

We still don’t know how the benefits of deploying AI agents internally can extend to margins

Current RPO is less indicative than traditional SaaS because it does not include Government contracts, which typically have an IDIQ structure (indefinite delivery/indefinite quantity).

Hate it or love it: the cult

Palantir became a mainstream name in the financial communities when it became a “meme stock” in the WallStreetBets Reddit (~16mn members).

The “meme stock” label has vanished, but the “cult stock” has emerged as retail investors created an active community around the stock.

Multiple factors contributed to making Palantir what is often seen as a "cult":

when the stock was in trouble, many investors were underwater so they felt comfortable discussing their fears in a group

the story of an underdog SaaS hated by all VCs yet working on the most critical use cases in the world is appealing

CEO Alex Karp is an eccentric figure out of the scheme with strong ideas

Bears saw the emergence of this community as a joke, while bulls realized it was a unique asset for investors and the company.

Investors love to share their opinions on social media and have frequent meetings, such as the Palantir Weekly Podcast hosted by Amit Kukreja, which is at the #131 episode.

The community:

Discuss the evolution of the business and the stock

Give feedback to the company

Help leverage awareness, creating business opportunities

Palantir realizes the value of the community and is leveraging it to educate potential clients and investors by sharing valuable content on social platforms.

Conclusion

In tech, capturing the evolution of the story from the details in the financials is more important than any data point.

However, spotting discrepancies between a very negative perception and reality is anything but easy: it requires a deep understanding of the business and emotions unaffected by the sentiment.

Palantir is an excellent example of how investors can turn hate and misconceptions into lovely returns when they realize hate arguments are weak while the fundamental story is emerging strong.

Thanks Arny for the guest post on Palantir!

Footnotes:

Book a demo with Runway to uplevel your financial planning

Check out OnlyExperts if you need offshore accountants

Thank you for the opportunity to share these thoughts with the brightest SaaS community 🙏

Well done guys. Great article as always Arny :)