Palantir - Is it a bubble?

What is the difference between “expensive” and “overvalued? Which one is Palantir?

Today’s Sponsor: Ramp

Tired of being the policy gatekeeper and chasing down manual expense reports? Ramp's corporate credit card automatically enforces spending rules, allowing employees to snap and go with instant receipt capture. Get financial visibility and control with expense management software employees actually love to use.

Is Palantir Stock Expensive?

What makes a stock “expensive”?

Investors use several measures to determine if a company’s stock price is expensive, cheap, or fairly valued…

For software companies, the most common valuation metric used is revenue multiples, which takes a company’s valuation divided by revenue (valuation/annual revenue).

Revenue multiples frequently become the basis for whether investors believe a stock is expensive or cheap.

Based solely on revenue multiples, one public cloud company sticks out…Palantir trades at a nearly 50x NTM revenue multiple while the median software company trades at just 6.2x 🤯!

Is Palantir expensive based on its NTM revenue multiple?

Duh! Palantir looks absurdly expensive based on this metric relative to the rest of the SaaS market. It is 2.5x more expensive than the company with the next highest revenue multiple (Cloudflare at 19x).

You can buy a company like Domo for only 1x revenue. Domo seems like a much better deal, right?

Are the huge differences in revenue multiples justified? What causes the differences?

All else being equal, it appears like Domo is a much better deal. But…this is where a simple revenue multiple falls apart. A revenue multiple is a shorthand valuation metric that fails to account for the long-term impact of three important variables:

Revenue growth & endurance

FCF margins

Dilution

And these three variables can be summarized as a company’s ability to grow FCF/share.

A key failure of revenue multiples is that they typically only look at the next year (short-term focused) and it only looks at revenue, which assumes all companies will be able generate similar profit margins at scale (but this is clearly not true).

Let’s look at each of these valuation factors for Palantir:

1. Revenue Growth & Endurance

For high-growth companies, revenue growth dominates the weighting of variables for valuation. Revenue growth explains 2x-3x more of cloud company’s valuation than profitability.

Growth matters A LOT!

Palantir has amazing expected revenue growth (at least in today’s environment). However…relative to its 50x revenue multiple Palantir certainly stands out….

Revenue Growth: Palantir’s NTM revenue growth is good compared to other SaaS companies today, but it isn’t even the highest and there are several other companies that have similar growth, but they trade at a fraction of Palantir’s valuation. And relative to historical SaaS growth rates Palantir’s 25% growth is just OK, but Palantir trades at one of the highest multiples ever.

Growth Endurance: Investor expectations of revenue growth endurance also plays a critical role in valuations. It’s also the thing that most frequently blows up an investor’s thesis in a stock.

Growth Endurance = this year’s growth rate / last year’s growth rate

Great companies can have revenue growth endurance of 80%+ for a long time.

Palantir investors believe that its revenue growth is far more sustainable than other SaaS companies (and may even accelerate). And maybe they are right…Palantir’s revenue growth appears pretty durable:

AI tailwinds will accumulate to a company like Palantir

Palantir has significant government revenue. The government isn’t going anywhere (unlike many other cash burning VC-backed software companies) and when the government implements software, they keep it for MANY years…

Palantir software is complex and so are the problems that they solve. This means the switching costs are high.

2. FCF Margins:

While revenue growth is the most important factor as it accounts for 2x-3x more of valuations than profitability, investors have put a lot more focus on FCF margins in recent years.

Investors are realizing that not all software companies are created equal in terms of their ability to generate profits, so those companies that show high profit potential are rewarded with premium valuations.

FCF margins are another reason that Palantir commands a premium revenue multiple. Palantir has 39% FCF margins! There are only a handful of companies with FCF margins near that level and none of those companies are growing revenue nearly as fast as Palantir.

Rule of 40:

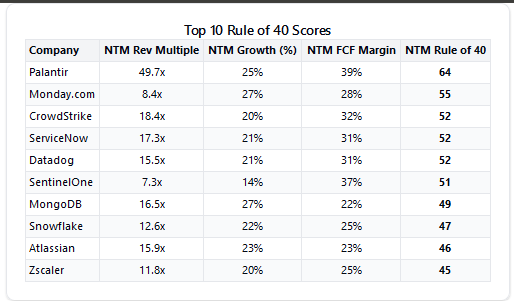

Due to Palantir’s top growth rates and FCF margins it has the highest Rule of 40 Score amongst public cloud companies.

Does a 16% higher Rule of 40 Score justify a 500% higher revenue multiple (Palantir vs Monday.com)?

In isolation, Palantir’s Rule of 40 Score doesn’t justify the huge revenue multiple premium.

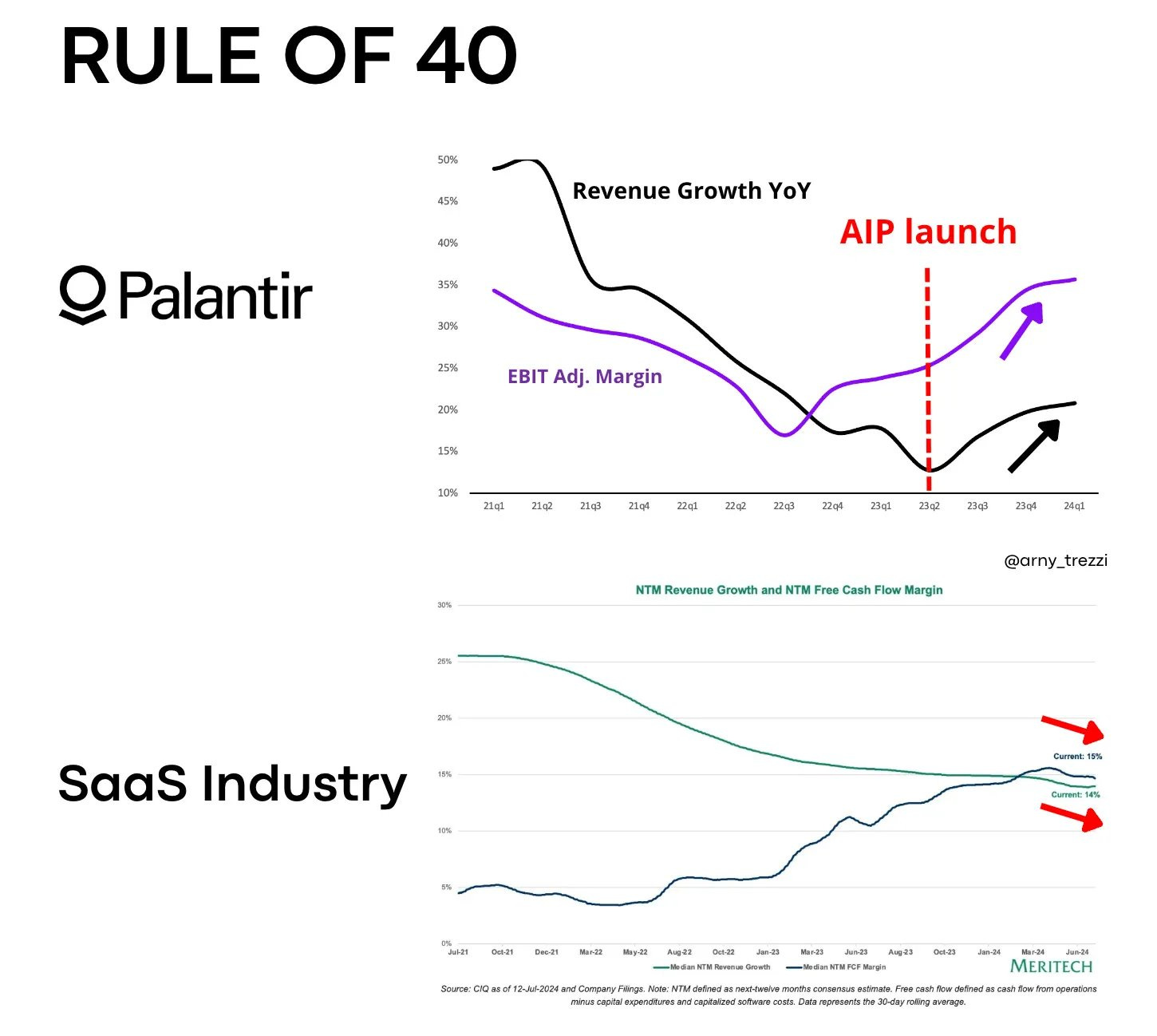

But what also gets investors excited is the HOW - what was Palantir’s journey to get to the best Rule of 40 Score.

Unlike most cloud companies, Palantir has accelerated its growth and profitability at a rapid rate to get to its top Rule of 40 Score.

The journey matters a lot to valuations - are metrics improving, worsening, or staying flat?

Just look at what happened to Zoom…they would likely be worth a lot more today if they had a more steady state of growth rather than the huge COVID pull forward and flat growth today.

At one point Zoom traded at a 38x revenue multiple (top 5 revenue multiple at the time). Today it sits at just 3.7x (bottom quartile). While its FCF margins are great (33% NTM), its current revenue growth is only 3%.

3. Dilution

Dilution doesn’t directly impact valuation (although it can indirectly), but it does significantly impact investor returns.

A common expectation is that cloud companies should be able to get to similar dilution levels at scale, so any differences today should be mostly temporary.

However, some companies are able to make this transition a lot quicker than others…For many companies, high dilution becomes so sticky that it can take a REALLY long time to get it under control. And during that time shareholder returns suffer a lot.

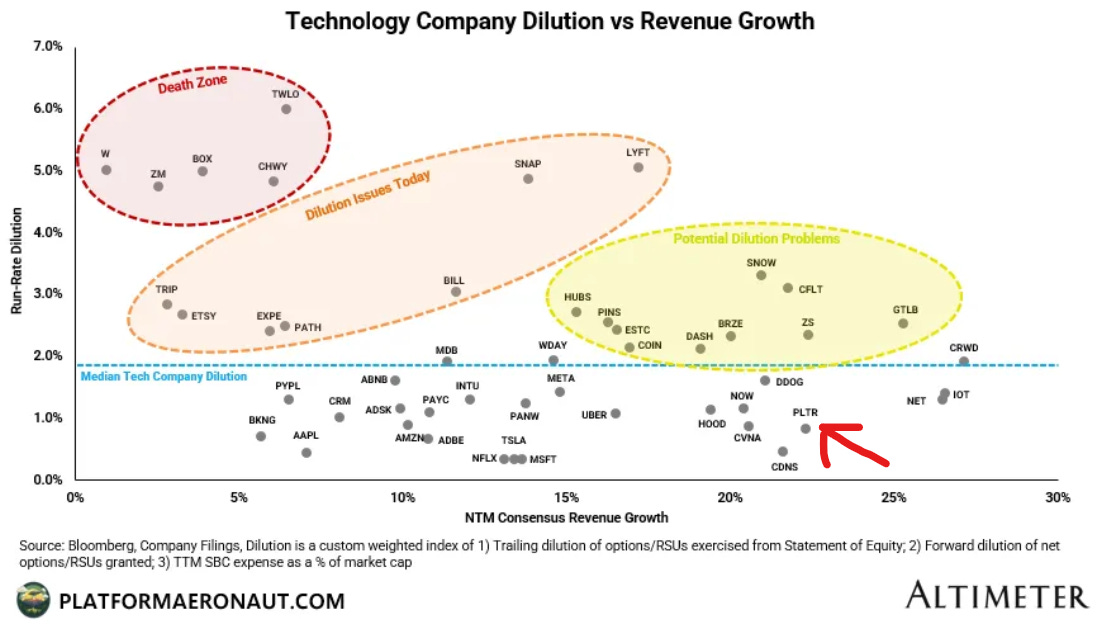

I really like the below chart from Thomas Reiner that shows run rate dilution relative to growth. Palantir has one of the best dilution rates relative to its growth rate.

Is Palantir too expensive?

So just because Palantir is relatively “expensive” based on its revenue multiple does it mean that the company is overvalued?

And does it mean Palantir’s investors today will underperform the SaaS market?

As discussed earlier, being “expensive” based on a simple revenue multiple doesn’t necessarily mean the stock is overvalued. This is where short sellers can get really burned (especially in the short-term)….And there have been many short sellers of Palantir that have lost A LOT of money over the past 12 months.

Having said that….Palantir is certainly more expensive than it was. It just recently hit a high of ~$85 when it was trading at just $6 two years ago.

And with that meteoric rise in stock price, its revenue multiple went from ~5x to nearly 50x. Almost all of this increase in value is attributed to its expected future performance (since near term expectations haven’t changed enough to justify this increase).

Are analyst estimates too conservative?

Perhaps analysts (and the company itself) are being too conservative in revenue forecasts so the stock appears extra expensive. Below are the analyst forecasts from 2022 and those estimates ended up being very conservative. Palantir use-cases are accelerating and maybe the flywheel takes off to enable even higher revenue growth.

Is Palantir a bubble that is ready to pop?

Some companies can get so much hype behind them that valuations stop mattering because the bulls always have a way to justify the price.

One Palantir bull said earlier this month that Palantir has a 100X potential from its current levels, which is a ~$170B market cap. That would imply…checks calculator….Palantir will be a $17 trillion dollar company…

I am old enough to remember the crazy times of 2021 and how investors justified the insane software company valuations back then:

Expensive stocks stay expensive

The valuation makes sense because of the high growth.

They will keep growing fast (maybe accelerate) for a long time.

They can become really profitable when growth slows

Dilution will get under control when they are at scale

The winner takes all so the top company deserves a very high valuation

Many of the above points can be true to some degree but just be careful when you use them justify sky high valuations.

Margin of Safety

The concept of “margin of safety” refers to the difference between the intrinsic value of an asset and its market price. Investors use this concept to minimize risk by purchasing stocks only when the market price is significantly below their estimated intrinsic value. The margin of safety provides a buffer against errors in valuation or unforeseen market events.

Below is what Warren Buffet said about margin of safety:

If you understood a business perfectly and the future of the business, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger margin of safety you'd need.

If you're driving a truck across a bridge that says it holds 10,000 pounds and you've got a 9,800 pound vehicle, if the bridge is 6 inches above the crevice it covers, you may feel okay, but if it's over the Grand Canyon, you may feel you want a little larger margin of safety..

The higher a company’s revenue multiple, the more understanding and certainty an investor must be about its long-term future of a company (primarily its long-term revenue growth and profits).

Final Thoughts

Palantir quickly transitioned from being hated by institutional investors to becoming a market favorite in 2024. Palantir’s meteoric rise has significantly rewarded earlier investors. However, I would caution new investors that the current margin of safety looks a lot different than two years ago.

Palantir is priced in such a way that it will need to execute nearly perfectly for many years for its current valuation today to make sense — Like 30%+ revenue growth for 10+ years at 38% FCF margins….Is that possible? Maybe, but it’s a REALLY high bar.

Can you understand and have enough confidence in Palantir’s business to build a reasonable margin of safety at these levels?

*Thanks Arny Trezzi for reviewing and providing feedback on this post

Footnotes:

Check out Ramp if you want to automate your accounting

Sign up for the OnlyCFO webinar series! Check out our Metrics webinar on January 8th!

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

**none of the above is investment, tax, or legal advice. Author may have positions in stocks mentioned

Comprehensive. Balanced. Accurate.

Great article!

Asymmetric risk/return skew. Good work!