Pivot, Sell, or Shutdown

Many companies will shutdown in 2025. Some data and thoughts on navigating the process.

Today’s Sponsor: NetSuite

Download the CFO Agenda for 2025: An array of ever-changing regulations, technologies, and trends have CFOs wondering: What do I need to prioritize this year to set my team and company up for success? We’ve got you covered with 25 actionable ideas to help CFOs dive into 2025 without missing a beat.

I caught up with a software founder who decided to shutdown his company and give the remaining money back to investors. This is the third founder I have talked to in the last few months that did something similar.

Growth was too slow, customer churn was too high, and cash burn was too much.

This is NOT just a small startup problem. ZIRP created some massive companies that are very broken (even some public companies too).

Failure IS an option. Many VC-backed companies should seriously consider if continuing is the right decision.

Not all companies work out (that’s the VC model) and changes like AI is disrupting many businesses. It would be naive to not consider the possibility that your business no longer makes sense to continue as it is.

What are your options?

If you have decided that things are not working and you can’t continue as you are then there are three primary options to consider:

M&A

Sell the company (PE/Strategic) - often not an option if things are not going well, but you should try! The larger you are the more likely this is an option (but maybe not a good outcome for shareholders)

Sell the team (Acquihire) - relevant if you have a killer team (like awesome AI folks)

Sell the asset (IP only) - did you build something kind of good?

Pivot - take the remaining money and do something different. The Board will only support this if they *really* believe in the team.

Shutdown - just kill the company and give back the remaining money.

Below is my decision tree to decide what to do if things aren’t working.

Best Case: The ideal scenario is to sell to a strategic because that is almost always where you can get the best valuations. Having decent metrics is critical for selling your company for a decent outcome. But also the more ARR a company has the more likely it can sell to a strategic/PE (even if it’s not for a good outcome).

Worst Case: The other side is just shutting the company down and giving investors what ever money is left. But actually the worst case is just wasting time and money on something you know won’t work. Not good for anyone (investors or the team)

More Shutdowns Are Coming

All the data suggests that more shutdowns and poor M&A outcomes will increase in 2025.

Which might also mean there are some really good deals for acquirers to pick up some IP and customers for really cheap (but not all cheap deals are good deals).

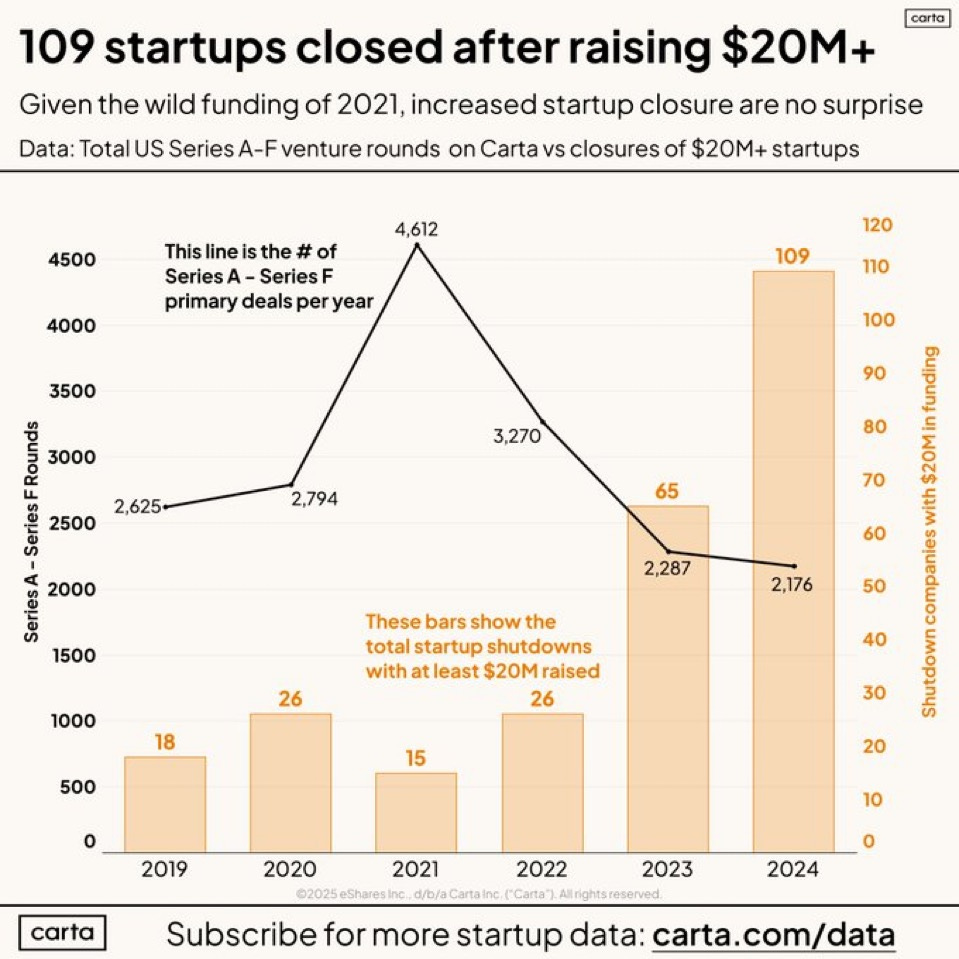

Below is from Carta on companies with >$20M that have shutdown.

And the number shutting down after raising $50M+ is growing as well. There are still a lot of broken late stage companies.

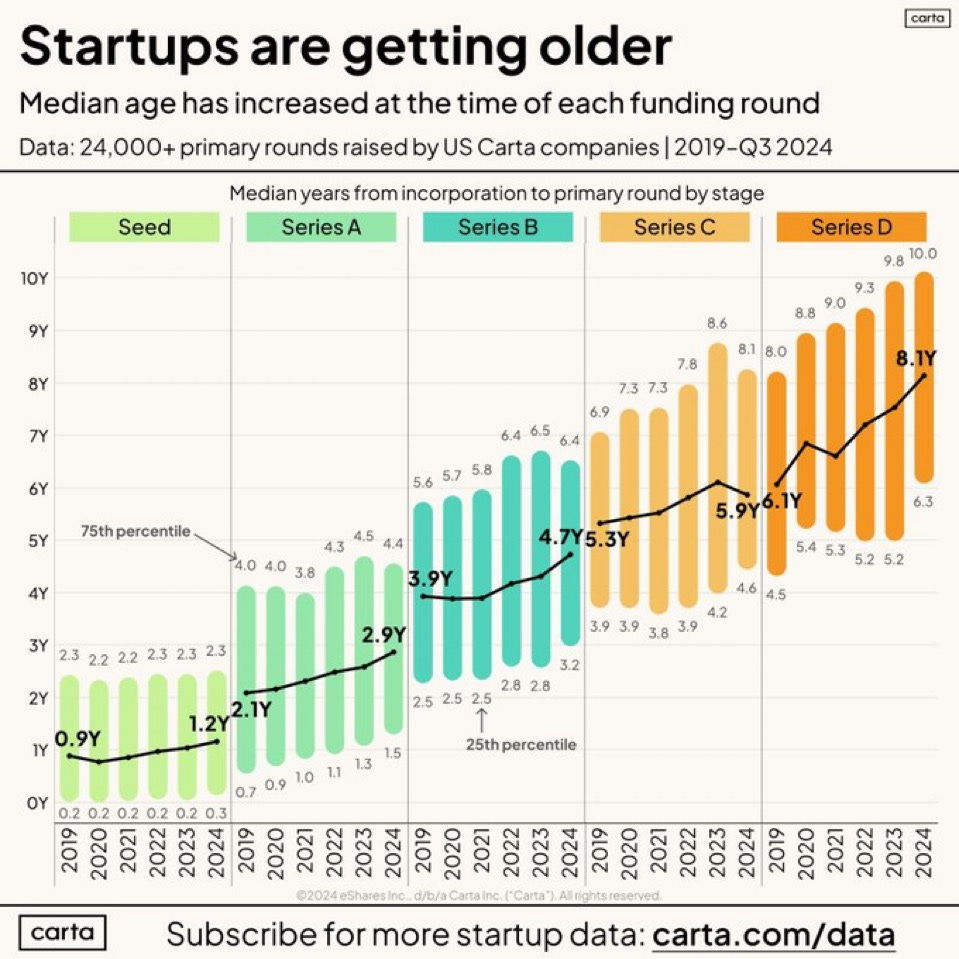

The average age of VC-backed companies are older at almost every stage. This might be for a variety of reasons (raised too much in the ZIRP days, more efficient with capital today, etc), but there is a high number of companies that are running low on cash and they can’t raise money.

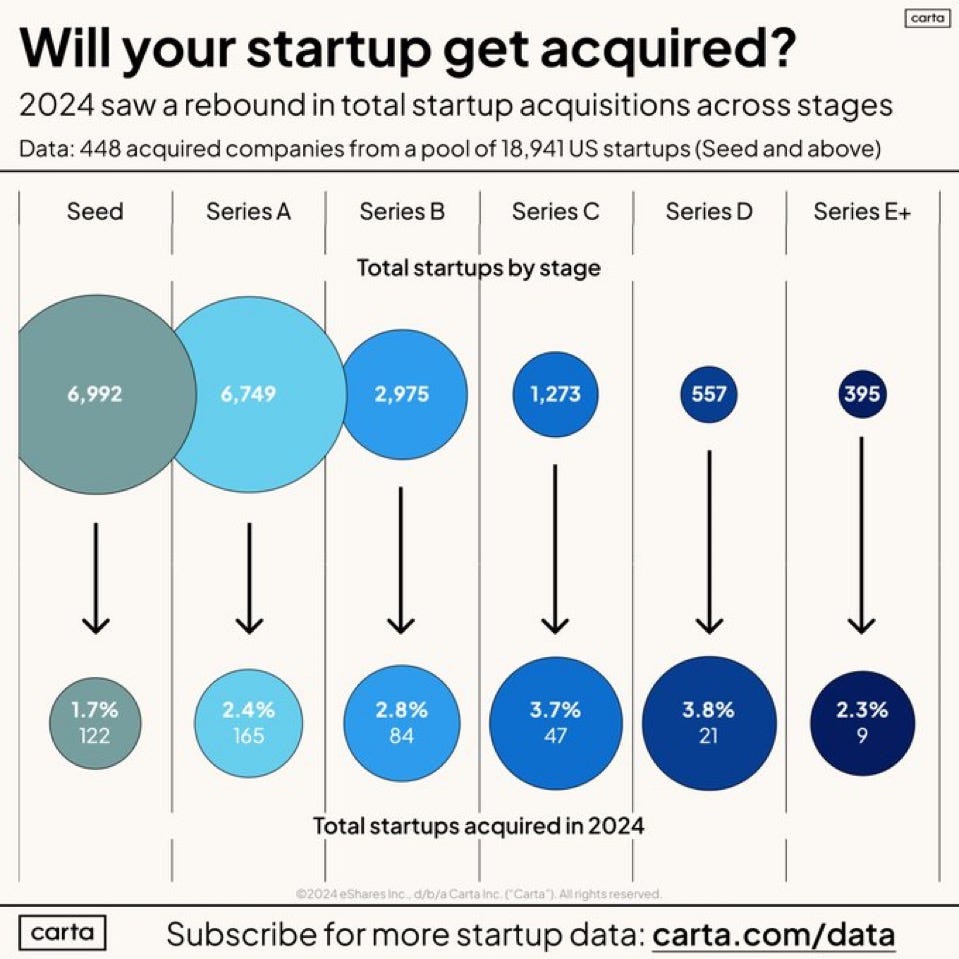

The larger you get the higher the likelihood you can be acquired. Doesn’t mean it will be a good outcome acquisition, but at a certain scale getting acquired becomes almost a guaranteed option.

Good Time for Acquisitions

On the positive side…there may be some *really* good deals in 2025 if your company is in a good financial position.

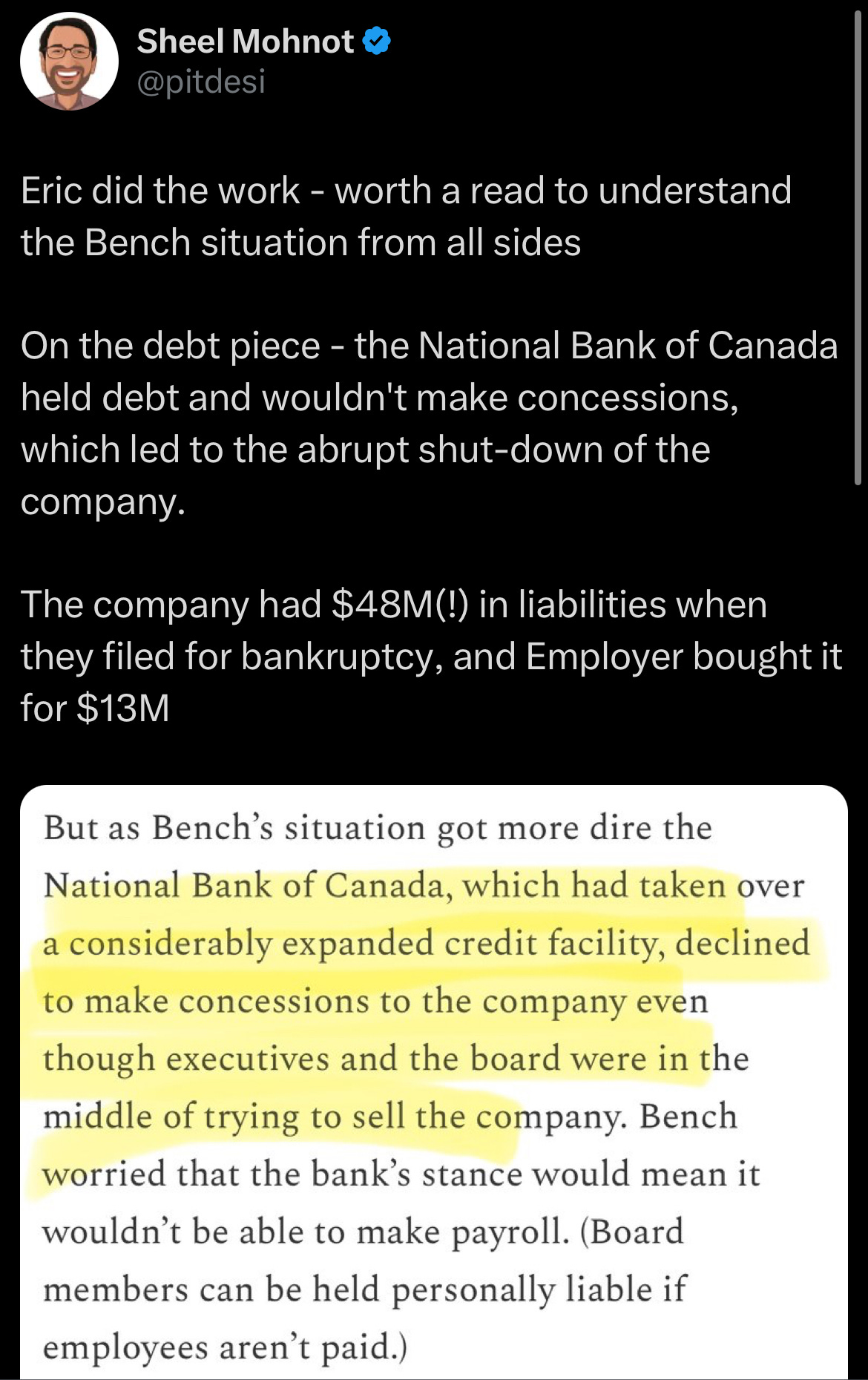

As a recent example, the abrupt shutdown of Bench shocked A LOT of people since Bench was their bookkeeper and tax support. In Bench’s case, they found out that debt can kill a company overnight.

Employer.com though was able to swoop in and buy the company for a fraction of its ARR. We shall see if it turns out to be a good deal for Employer.com.

If you have a strong acquisition muscle and are in a good financial position then 2025 could be a really good year for acquisitions. Buyers have a lot of power.

Footnotes:

Download the CFO Agenda for 2025 from Netsuite

Sign up for the OnlyCFO webinar series! Our next webinar is on February 19th on the M&A environment in 2025. We have two amazing guests - a software PE investor and the CEO of a company that sold to one of the largest cloud companies in the world last year.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

How do these dynamics potentially impact the due diligence process in M&A?