🤖 Real AI Agent Use Cases in Finance

Three actually useful things you can do with AI agents in finance/accounting today

Today’s sponsor: Brex, the intelligent finance platform

Welcome to the era of intelligent finance

With AI agents that automatically categorize, review, and approve spend based on your rules and policy, your business can run smarter and faster. Explore what’s possible with agentic finance in our Fall Release, and learn even more ways Brex augments your other core tools — Zip, Oracle Fusion, QuickBooks, Microsoft Dynamics 365, and more — to effortlessly control spending.

AI Agent Use Cases

I hate taking demos. But that changed in 2025. I may not love it, but…I take a lot more finance and accounting demos today. Why? Because I learn so much about what AI can (and can’t) do well today. Those conversations are informing how I’m building my teams today and planning for them for next year.

And because of this newsletter, I get a lot of inside looks on what folks are building and have seen what is coming…

AI Agents vs Automation

A lot of “AI” that is being sold today is just automation. They use a bit of AI to make automation seem sexier and then sell it for a lot more money. Beware. If a tool is just using IF/THEN statements, it’s automation. Not AI.

AI Agents: Make contextual decisions using reasoning, data, feedback, and goals.

Automation: Set of rules that execute the same way on repetitive tasks.

Automation is great and has its place, but it’s been around for a long time. Don’t pay a premium for automation disguised as AI. The opportunity is much different.

Where AI Agents Work

The first thing companies need to do is evaluate where AI can have the biggest impact. It’s a balance between:

Money/time saved: Less headcount and/or software needed as we scale

AI risk: What areas does it touch? Is it sensitive? How long does it take to train? What is the risk if it screws up?

Here is my checklist for where AI will produce the highest ROI today:

Requires judgment. Task needs context or reasoning (not just specific rules)

Messy inputs. PDFs, emails, Slack threads, screenshots, etc

Multiple systems & touch points. Context from multiple tools and people.

Same process, different flavors. The work repeats, but every instance looks slightly different.

Clear end goal. Has a measurable goal that has process and context to achieve.

Can an AI Agent do this?

If you can (or already are) offshoring something, then it’s probably a good candidate. Maybe not all of their work. But potentially a significant portion can be accomplished through AI agents and then a human can bridge the gap.

None of the above checklist items are super complicated (any trained person can do them). Which is why the same things that are great offshoring candidates may be good AI Agent candidates.

This is exactly where I started implementing AI…

Rise of AI Agents

I asked my friends at Brex to give me an early demo of the three AI Agents that they released today (Expense, Review, and Audit AI agents). There’s some really cool stuff you can do with these agents…

Based on the AI agent useful checklist I provided earlier, a company’s Spend Management process is a perfect place to get real value from AI.

Expense Agents

These AI agents can categorize, attach receipts, and add descriptions to expenses. Users can give the AI agents access to their calendar and email to feed them additional context for better descriptions and organization.

Basically, you have a 24/7 EA (a “Brex Assistant”) that handles all your expenses. Like a human EA, these Expense Agents continually learn.

Repeat Merchant Example: If you always use the same memo / documentation for a certain merchant, the Agent will automatically use the same description with the current context.

Business Trip Example: With access to your calendar, the Agent can group business travel expenses together and provide detailed explanations with context.

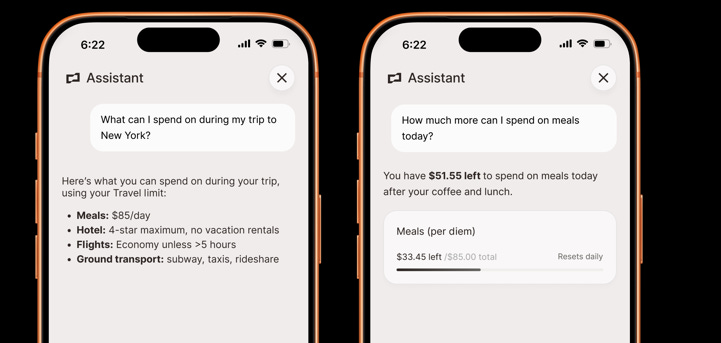

Employees can also ask specific T&E policy questions directly with the AI instead of figuring out where your company stores the policy, looking for the right section, and then seeing how it applies. Or worse, constantly asking the accounting team about it.

You can also have AI agents flag T&E policy issues before employees even submit an expense so there isn’t back and forth on submitted expenses. And avoid delays on employees getting reimbursed.

Audit & Review Agents

This is what I am really excited about.

Previous Credit Card Process:

Managers review their team’s expenses and then it goes to accounting for review.

Guess what? Most managers are terrible at reviewing expenses (and asking them to make sure it’s in policy is a joke). The accounting review may do a little bit better, but the volume is too high to be thorough. Fraud, waste, “accidents”, etc happen at every single company.

New AI Agent Process:

Agents can massively help this problem.

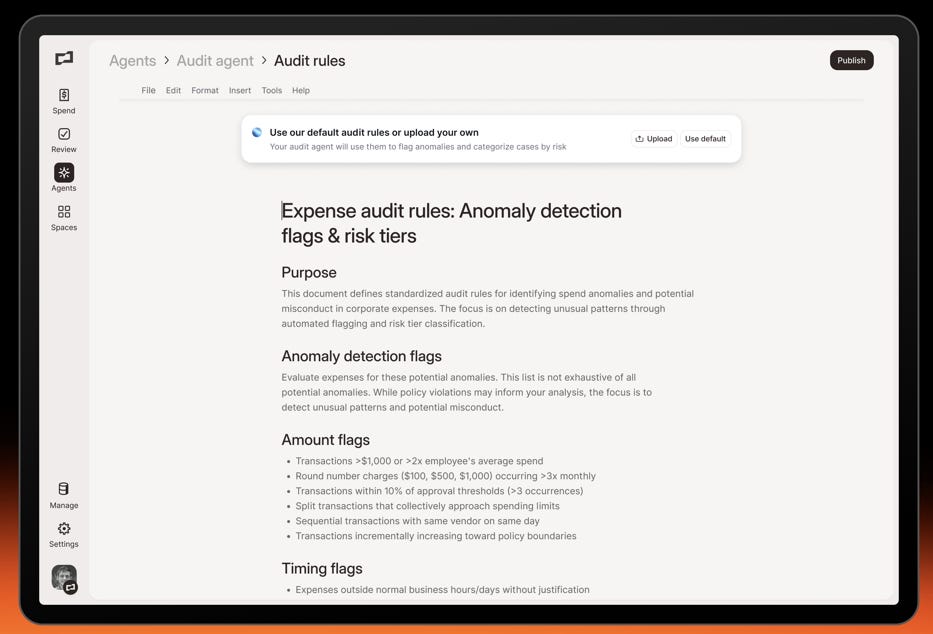

First, the Audit Agent identifies and investigates violations, and the Review Agent determines whether something needs to be escalated or can be auto-resolved.

Audit Agent: identifies spend anomalies, patterns of problem spend, waste, abuse, etc

Review Agent: Auto-resolves issues for you and escalates to human review for the exceptions where manual review is needed

You create the AI agents by feeding them your policies and SOPs (standard operating procedures). Just like you would for an offshore transactional resource. Tell them exactly what to review for and they will do a good job. And they will continually learn from you as you tell it how to resolve things.

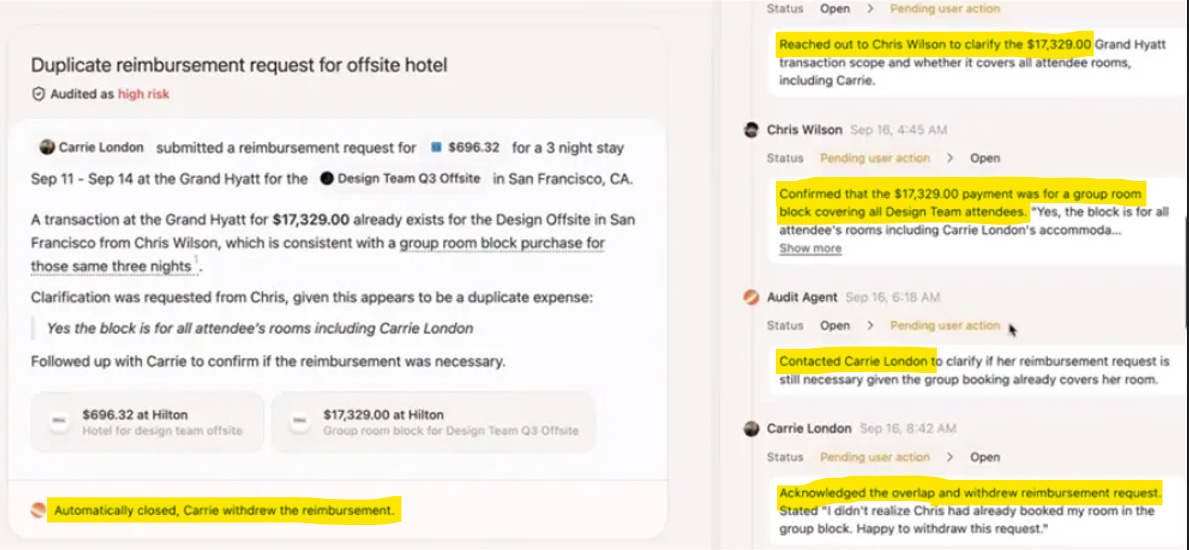

Example: Duplicate Reimbursement Request

The Review Agent is told to look for duplicate expenses and flag them.

AI agent sees that an employee booked a block of hotel rooms for the same time period and location as an individual who booked a room just for themselves.

AI agent asks the person who booked the block of rooms if it also covered the individual who submitted their expense.

Since the person said it did include them, the AI agent asked the individual if their expense was valid.

It wasn’t so the individual canceled the request.

Most T&E accountants and managers would not have caught this…And now it’s all done without their involvement.

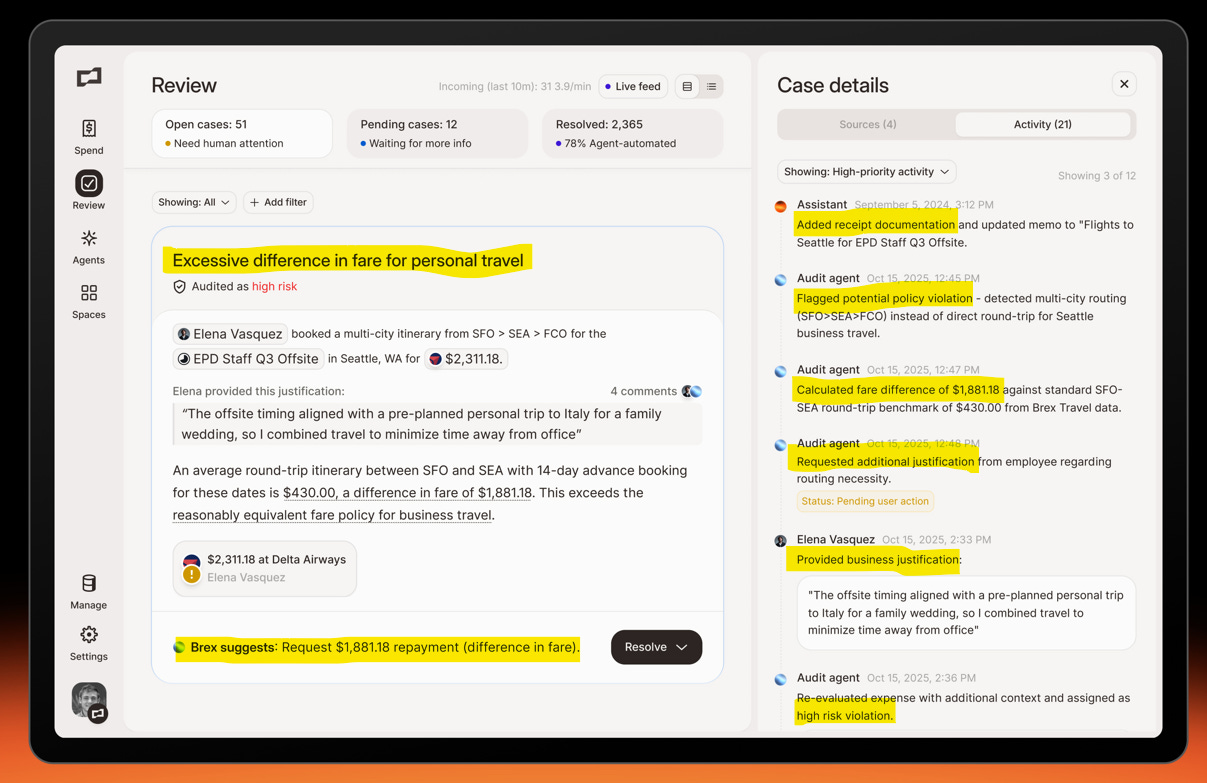

Example: Business and then Vacation Travel

This regularly comes up. Someone travels for work but instead of coming home first they go straight to vacation.

What amount does the company reimburse? I usually say they can get reimbursed for what a normal flight back to their home location would be. Anything extra is personal. There is often back and forth with the T&E accountant on this.

AI agent detected that the receipt showed the individual not returning to the same location so it asked them to justify why.

The employee adds a justification.

AI agent flags that the amount being requested to be reimbursed far exceeds the average airfare back to the employee’s home location.

AI agent puts it into a queue for human review.

Crazy! It gets flagged and context gets added before the manager or accounting ever look at the expense request.

Final Thoughts

These are just a few of the AI Agents that everyone will/should be using very soon.

Before you finalize 2026 headcount and software plans, make sure your teams have taken a serious look at where AI can be leveraged. Everyone is trying to be more efficient in 2026. Thoughtful planning on what new tools can be leveraged is an important place to start.

Before anyone gets additional headcount in 2026 you need to ask, “What AI tools have you evaluated?”

Footnotes:

Learn more real AI use cases from Brex (today’s sponsor) in The finance team’s guide to leveraging AI.