RevenueCat Rejects $500M Acquisition and Raises Series C

The non-public details and lessons from RevenueCat’s incredible journey

Today’s Sponsor: NetSuite

Demystifying AI: AI is no longer a futuristic concept; it's shaping how work gets done—in every industry from healthcare to entertainment. Glenn Hopper, an AI expert, covers the increasing importance of AI in his new guide, “Demystifying AI.”

Download it now to learn how to harness AI’s potential—no computer science or engineering background required.

The RevenueCat Story

Turning down a $500M acquisition messes with your head. I could have retired my entire bloodline with the money I would have made. — Jacob Eiting, Founder/CEO of RevenueCat

I chatted with Jacob (founder of RevenueCat) about their journey to recently raising a Series C at a $500M valuation. Jacob is the most honest, transparent, and entertaining founders I have ever spoken with.

Jacob did not hold back and gave me lots of non-public information in the hope it helps other founders and finance leaders.

👇 Keep reading for some inside baseball…

Raising a Series C in 2025

RevenueCat provides a subscription management platform for mobile apps, simplifying the management of payments across Apple and Google app stores so app developers can monetize their subscription-based apps.

Most VC dollars today are going to hot AI companies. While RevenueCat is not an “AI company”, it is hot for another reason - they are a huge beneficiary of the AI boom.

The 3 AI tailwinds for RevenueCat:

The new AI models all have mobile apps and need something like RevenueCat

All existing apps are adding AI features (and have some usage-based pricing)

RevenueCat’s customer base skyrocketed overnight because now everyone can create apps.

All of this created a much easier environment for RevenueCat to accelerate and raise a Series C — a great product, excellent team, and a little luck.

Series C Numbers

Lead Investor: Bain Capital Ventures

Valuation: $500M (post-money)

$ Raised: $30M primary and $20M secondary

ARR: ~$30M (75% YoY growth)

Cash Burn: $0 (slightly profitable)

ARR Multiple: ~16x

👉 And yes, they are hiring…including a Head of Finance.

What Excited Investors?

Growth

I don’t care how much you hear about the importance of efficiency (and controlling cash burn)…if you aren’t growing fast relative to your ARR scale then VCs aren’t going to be interested — they need outlier returns which are only possible from high growth.

Jacob (like most VC-backed founders) set his sights on the coveted T2D3 growth growth model — triple twice and double three times. But like most journeys, the path wasn't a straight line up and to the right…

Revenue growth started strong going from $1M to $3M in one year but then growth was cut in half each year for 2 years in a row…RevenueCat entered what Jacob referred to as the “Dark Times” where a lot of things negatively impacted their growth at once. They re-prioritized, made changes internally, and were determined to re-accelerate growth.

RevenueCat started reaccelerating revenue in 2023 as the product improved and AI became a major tailwind for growth — they went from 50% growth in 2022 to nearly 80% per year for the last three years!

RevenueCat now powers one of the most popular AI apps in the world…

Efficiency

Not only is RevenueCat growing fast, but they are profitable! A rare occurrence in the SaaS world at their stage…

We only have 100 people and are accidentally profitable.

Jacob did not set out to be profitable but he created a culture of “cheapness” and only spending/hiring for what they needed.

I think about the below a lot…the goal is to have the mindset of a bootstrapped founder with a VC-backed budget to capture great opportunities.

Why raise more money?

RevenueCat has now raised ~$80M in primary capital and only burned ~$20M, so before the Series C they still had $30M in the bank. Plenty of cash to keep running if they are already profitable.

I don’t know what we will do with the extra money. I will figure out how to spend it.

Jacob discussed not having a need for the money now but wanted the buffer in case RevenueCat needs to reinvent or be quick to capture opportunities when they come up. Jacob is more concerned about the ability to move fast than a bit more dilution caused by raising the money now versus later.

Primary vs Secondary Capital

$20M of the publicly reported $50M Series C came in the form of secondary capital.

As mentioned, RevenueCat didn’t need the money so the big secondaries accomplished two things:

Take some pressure off from just walking away from a massive $500M acquisition offer (more on that below…)

Enable new investors to get the percentage ownership that they wanted while also allowing existing investors to exercise their pro rata.

The percentage of secondaries relative to total capital does feel fairly high for a Series C company. Most Series C companies aren’t (and shouldn’t be) taking 40% of total capital in secondaries, but in RevenueCat’s case I think it’s just fine.

Here are my thoughts on secondaries:

Secondaries at Series A and prior should typically be really small (if any) because founders are selling a dream versus a real business with financials.

Around Series B and beyond larger secondaries are OK as the financials should speak for themselves.

The level of cash burn should inform how much secondaries relative to primary is OK.

RevenueCat is growing fast and already profitable so they didn’t even need the money so larger secondaries are totally fine in my opinion.

Turning Down $500M

What has never been reported (until now :) is that RevenueCat was nearly acquired at the end of 2024 for ~$500M before they raised a Series C this year.

RevenueCat went deep into the diligence process but ultimately there was too high of a bid/ask spread on valuation to get the deal done. They liked everything else but Jacob believes he can make RevenueCat 5 -10x+ bigger so he wasn’t willing to sell for a price he felt undervalued the business.

The CEO’s Perspective

After 7 years of grinding, a good acquisition offer can be very tempting…

Jacob has taken secondaries along the way though so he doesn’t feel rushed, but he still has plenty of skin in the game. The amount of secondaries he has taken represents <10% of his total holdings.

I live in rural Ohio…I am not worried about the money. I have enough.

Continuing to build RevenueCat is definitely the highest value thing I can do in the world.

I have never met a founder that was glad that they sold. None of them said that it was the best thing they could have done.

My caveat is that I have met a couple of founders who could have sold in 2021 for life changing money but didn’t because they believed they could eventually get more. Fast forward to today, growth has slowed, still burning cash, and no one is interested (at least at valuations near what they got in 2021). They have some regret…

If you get a really good offer and you are burnt out, then you should really consider taking it. If you can see yourselves doing it for another decade then by all means raise more money and keep going!

Investor Perspective of Rejecting $500M

While liquidity has certainly picked up a bit for some VCs, many are still starving.

As you go through diligence you put together the exit waterfall and see how much the investors and employees will make. For RevenueCat, the earlier investors would have made a lot of money, but their recent “mini Series C” in 2024 would have been disappointed.

The earlier stage investors double checked a bit more — “Are you sure about walking away from the offer?”

A desperate or bad board member / investor can cause a lot of headache during times like this. It’s one of the few times that having the right investors make a difference.

They trust the founders to make the best decisions.

All the investors’ chips aren’t on you to return their fund. They have other great investments which takes the pressure off of you.

RevenueCat’s investors were supportive of Jacob’s decision.

What Comes Next

A $500M acquisition offer is VERY distracting to the team.

This is typically why potential acquisitions are kept very quiet to just the executive team until the deal is done. Everyone will be distracted counting their imaginary money and if the deal doesn’t go through then everyone will be disappointed.

Here are Jacob’s current thoughts on RevenueCat’s exit options:

I don’t think about the exit options. I just don’t care.

I used to put a lot of energy into thinking if we should IPO, do a direct listing, get acquired, etc. But now I believe the answer will reveal itself if we focus on building a great business. And when it’s the right time the answer will make sense.

I 100% agree with Jacob with one small caveat — it’s true when things are working really well like they are for RevenueCat. An IPO or strong acquisition is always on the table if they can continue to deliver strong results.

But when things are just OK…. then the team has to be a bit more intentional about exit options.

Although RevenueCat raised a nice Series C, there is still a pretty big universe of buyers at a $500M - $1B valuation. Beyond that $1B valuation the number of buyers start to shrink fast.

But by raising another round, RevenueCat is implicitly saying they want to continue on the journey until they are at least 3-5x+ bigger. But…for the right price, of course M&A is still an option.

Other Insights

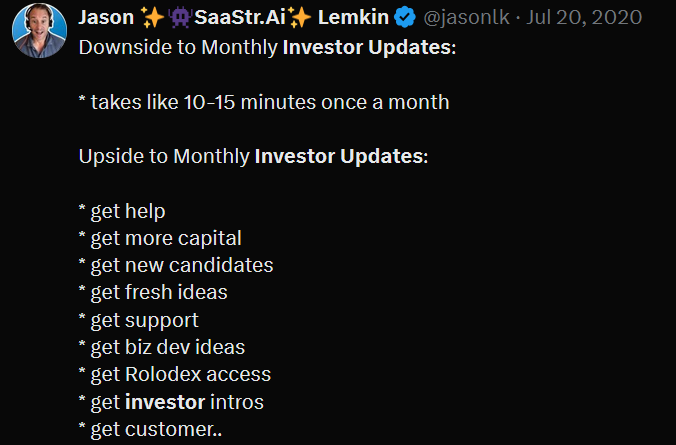

Investor Updates:

I have sent an investor update within a couple days at the end of every month for the past 8 years. I have not missed one or been late (by more than 1-2 days)

There is no reason not to consistently send monthly investor updates. The positives far outweigh the 15 minutes it takes to complete them.

Not sending investor updates (or being very late) almost always means that things are not going well. Just get the update out regardless of results.

In fact, if my company is likely going to miss targets by a material amount then we will send a quick update before the period is even over. We will call out specific potential deals as well in case any of our investors can help.

Hiring Executives:

If I don’t get an amazing executive then it’s a net negative to the business. I am willing to be patient and wait.

I think this general philosophy is why RevenueCat is “accidentally profitable”.

Jacob isn’t hiring (or spending) based on blindly following benchmarks and hiring advice. I am sure RevenueCat could have spent 2x+ more and no one would have questioned it. And revenue growth likely wouldn’t have been very different at all…

Keep It Simple

I am a computer person but financial idiot. Your stuff [OnlyCFO] has been super helpful for me. It’s the one newsletter I read every week because I understand it.

This is one of the best endorsements I have ever received so I had to include it :)

While I talk about all sorts of financial metrics and complex financial jargon, one thing I consistently say is to just use your brain and don’t get lost in all the metrics.

Jacob mentioned that while they look many of the SaaS metrics, one thing he has always reviewed since the beginning of RevenueCat is the movement in cash because cash doesn’t lie. All the SaaS metrics can be useful, but don’t get lost in them.

Wrapping Up

If there is one thing I want people to take away from this post it is that you should not stop using your brain when you raise venture capital.

While Jacob is a self-proclaimed “financial idiot”, he is running a very efficient high-growth business. Folks need to understand the financials, benchmarks, metrics, etc… but they also need to use common sense.

**Thanks, Jacob, for sharing all your wisdom and inside baseball of RevenueCat’s journey!

Footnotes:

Founders, CEOs, or CFOs: I would love to chat with you and do a deep dive on your company like this one. Reply to this email.

Download the Demystifying AI guide from NetSuite to learn how to harness AI’s potential in finance/accounting

This CEO sounds genuinely interesting. Would love to learn more about him.