☠️ RIP to Financial Planning | Killed by AI

Best practices for long-range planning and how the current environment is changing it

Today’s Sponsor: NetSuite

CFO's Ultimate KPI Checklist: 50 Step-By-Step Checklists to Drive Your Company's Success

Finance professionals: Maximize your business’s success by measuring the right KPIs. Get clarity on which metrics should represent your company’s needs and goals HERE

Is Long-Range Planning Dead?

There has never been a point in my career where long-range financial planning has felt more useless. — anonymous SaaS CFO

Nick Mehta (CEO of Gainsight) shared the below meme on LinkedIn that sums up how a lot of leaders are feeling right now — everything is changing so fast that it can feel pointless to try and forecast very far out.

In retrospect, forecasting at SaaS companies was sooo easy just a few years ago. Not only could we build really accurate annual financial plans (with all the detail), but we could even build 3-5 year long-range plans that we could feel pretty good about. And were often decently accurate.

Today? Not at all.

The impact of AI is changing things so dramatically (and fast) that accurately planning very far out has become laughable for most tech companies. And if you think you can accurately predict 5 years out then you are blissfully naive.

Is Financial Planning Useless?

Of course not….I still need a job :)

Building the actual financial model has never been the hard part. Any Excel monkey can build a financial model.

It’s everything that should be going into the model based on an understanding of the business, the changing environment, and discussions with leadership. A good CFO needs to take the input from all these sources to build financial plans that are useful.

Two Types of Financial Plans:

Annual Operating Plan (AOP)

Long-Range Plan (LRP)

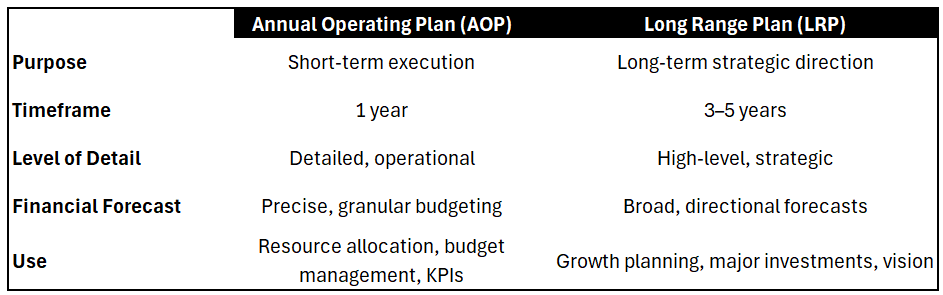

Difference between AOP and LRP

Below is a summary of the differences between these two types of financial plans:

Earlier Stage Companies: Typically just focus on the AOP because further than one year is just a pipe dream. What often happens though is that some investor wants to see a 5 year forecast so we make ARR follow the T2D3 model (triple twice and double three times) to show them what they want to see, spend 10 minutes making up some P&L assumptions, and call it a day.

Companies With Some Scale: This is traditionally where both AOPs and LRPs provide meaningful value. Not only can they predict the future a bit better, but the value of the longer-term discussions is significantly greater as planning further out is important when you have some scale.

Your AOP is what investors really hold you accountable for. If you are a public company then you have all the analysts and investors watching your guidance numbers (forecast) closely and asking questions about it on earnings calls. For private companies, there is less scrutiny but still plenty of pressure from your board of directors and maybe even more importantly it will impact your ability to fundraise.

Are Long-Range Plans Stupid in 2025?

People are talking about having Artificial Super Intelligence in a couple of years and you think I know what my software economics will look like?

I don’t think so…

But the point of an LRP is NOT to develop a highly accurate forecast. No one is accurate 5 years out…especially today.

LRP Purpose:

Create a roadmap for the longer-term strategic vision of the company and how you are thinking about allocating your resources — cash, people, technology, etc.

Performing an LRP acts as a forcing function for the company to define the longer-term strategy of the company. This is where the value lies in LRPs. If finance just does the LRP by themselves as a checkbox for an investors or 409A then it will be useless.

When LRPs are performed properly (more on the in the next section) then they still have value in 2025, but…maybe you need to think about (and maybe also update) the longer-term visions/plans a bit more often today. It’s not something you want to be continually updating, but as material fact and circumstances change then at least have the discussions again.

Below are some of the other reasons why LRPs are needed:

Informs your AOP. Many folks miss this. You can’t build a proper AOP without some level of LRP (at least one additional year out). A lot of the stuff you do in the current year (especially in the second half) should be based on growth targets and other strategic moves you are planning in the following year. Without a proper LRP you won’t build that into your AOP.

Investor Comms. Depending on your stage, investors may want to know your high-level 3-5 year plan. This helps management clearly discuss the broader vision/goals with the board and investors.

Cash Runway & Fundraising. Fundraising takes time for most companies (especially today) so you need to properly plan your capital needs and when fundraising will need to kick off. I will be doing a post on what it takes to fundraise in 2025 in a few weeks…

409A (private companies): Your financial auditors only need a forecasts that goes ~12-24 months out from the end of the audit to prove you are a “going concern”, but the 409A folks want a forecast that goes out 3-5 years.

Building an LRP

An LRP is NOT a budget so you don’t need the same level of detail as an AOP. In fact, trying to add that level of detail would likely cause more harm than good when going out 3 - 5 years.

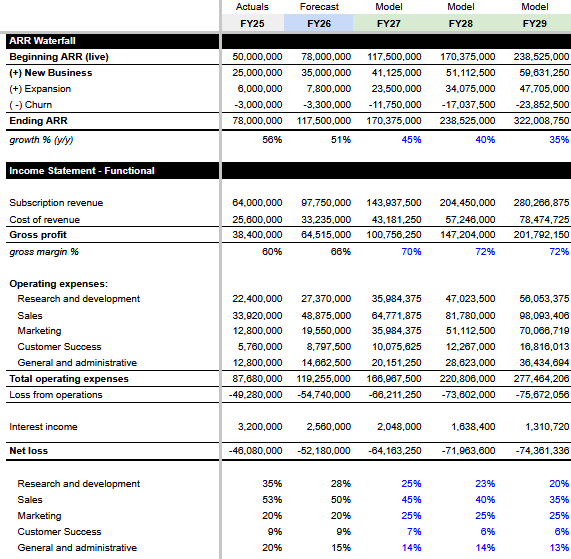

I start with something like the below on my LRP for the P&L and something similar with high-level drivers for the balance sheet and statement of cash flow.

Context is Critical: You can’t have proper discussions without the proper context. Where did you land in the prior year, what is this year’s forecast (AOP) and what is the plan? Show at least one year of actuals, your bottoms up forecast for this year, and 3 years for the LRP.

Keep it Simple: The LRP is NOT a budget so it doesn’t need all the GL detail. You can add more detail (segmentation by geo, product, etc) than above if you are larger with a bit more scale. But keep it simple!

Time Series: For most tech companies my belief is that 3 years is far enough, especially today. It is far enough to accomplish the objective of an LRP without being completely useless (too much will change). I break out the first year of the LRP quarterly as its important to the current year AOP, but subsequent years can just be annual.

Benchmarks: What are the benchmarks for where you want to be in 3-5 years? If you are aiming for an IPO then what are the benchmarks of your peer companies at IPO (and the 2 years before their IPO that is disclosed in their S-1)?

Talk to Stakeholders: Do NOT just let your finance team build the LRP and not talk to anyone. It defeats the point! You want sign off from all relevant stakeholders and more importantly their input.

Trade-offs and Iterations: Finance will start with the first model based on what the CEO wants and benchmarks, and then after talking with stakeholders you will iterate on the model. Things won’t line up — CEO wants 80% growth AND profitability, sales leader says fat chance, compromises happen, etc. After some iterations and trade-offs you will land with an LRP that the leaders should sign off on.

Plans Are Meant to be Broken

AOP and LRPs can/should be broken!

You don’t have to follow your LRP or even your AOP. AI is changing the tech environment quickly so the key is adaptability.

Only the paranoid survive. — Andy Grove

Don’t let your financial plan hold you hostage. When the environment changes so should your plans.

Just because a company is hitting their sales targets does not mean the expense plan should stay the same. Most companies will allow depts to keep their same budgets, but that might not be the right answer in 2025. We should be pushing for more efficiency. If some glorious AI tool comes out then why can’t your accounting team be more efficient? They should! Adaptability is important. You need leaders who understand this.

Summary

Yes, long-rang planning feels a bit more meaningless in some respects— predicting how AI will change our industry in just 12 months feels impossible.

There is absolutely still value in the forcing function of building a longer-term strategy plan and aligning with the key stakeholders.

Financial plans are meant to be broken.

Footnotes:

CFO's Ultimate KPI Checklist: 50 Step-By-Step Checklists to Drive Your Company's Success

Get 20% off with OnlyExperts to find offshore accounting resources