SaaS + Recession = Doom?

What will happen to software companies in a recession? Sales impact, budget cuts, and valuations

Today’s sponsor: Runway — the finance platform you don’t hate.

What do AngelList, Superhuman, and ConvertKit have in common?

They all use Runway to create financial clarity for their teams. Runway connects your data, context, and plans to give you a holistic understanding of your business. Show everyone how their work fits into the big picture, and how each decision impacts your bottom line—so you can create more value together.

Discover how these companies made finance fun and simple.

Correction, Bear Market, or Crash?

The Nasdaq is down ~10% from its recent all-time high with large intraday swings of 3%+.

As a result, the VIX has also rocketed higher. The VIX is referred to as Wall Street’s fear gauge and it hit its highest level since the global pandemic caused the stock market to plunge in early 2020.

This past Monday morning the VIX briefly hit a high of $65, which is 4.5x what the VIX was a couple of weeks earlier. High VIX = high investor fear and volatility.

There has been a lot of talk about a stock market correction, bear market, stock market crash, recession, etc.

Correction - defined as drop between 10% and 20% from the recent high

Bear Market: A drop greater than 20% from the high is considered a bear market

Crash: Is more about the suddenness of the drop rather than the magnitude. It would be referred to as a crash if the stock market dropped 20% in one week.

Recession: A period of economic decline typically defined by a decrease in a country's gross domestic product (GDP) for two consecutive quarters or more.

Market corrections are quite common while bear markets are relatively rare. Only 5 market corrections turned into bear markets in the last 50 years.

The bull market periods can last a really long time, but corrections and bear markets are often very quick and abrupt. It’s nice to see small daily gains over a long period of time, but it can be painful to watch huge one-day market drops like we have seen over the past week.

The S&P 500 almost entered correction territory by dropping ~9% from its recent all-time high. The Nasdaq did dip into correction territory by dropping as low at 14% from its recent high.

The markets have recovered a bit since then so we are still pretty far away from a bear market, but volatility remains high and fears of a recession continue.

What happens to SaaS in a recession?

If we do enter a recession then most of SaaS will enter the recession already out of investor favor. The broader stock market has been doing really well (until this recent pull back), but SaaS companies have been struggling for a couple of years already.

Since the beginning of 2021, SaaS companies (represented by the WCLD ETF in the blue line below) are down nearly 50% while the broader market (represented by the QQQ ETF in the purple line below) is up 39%.

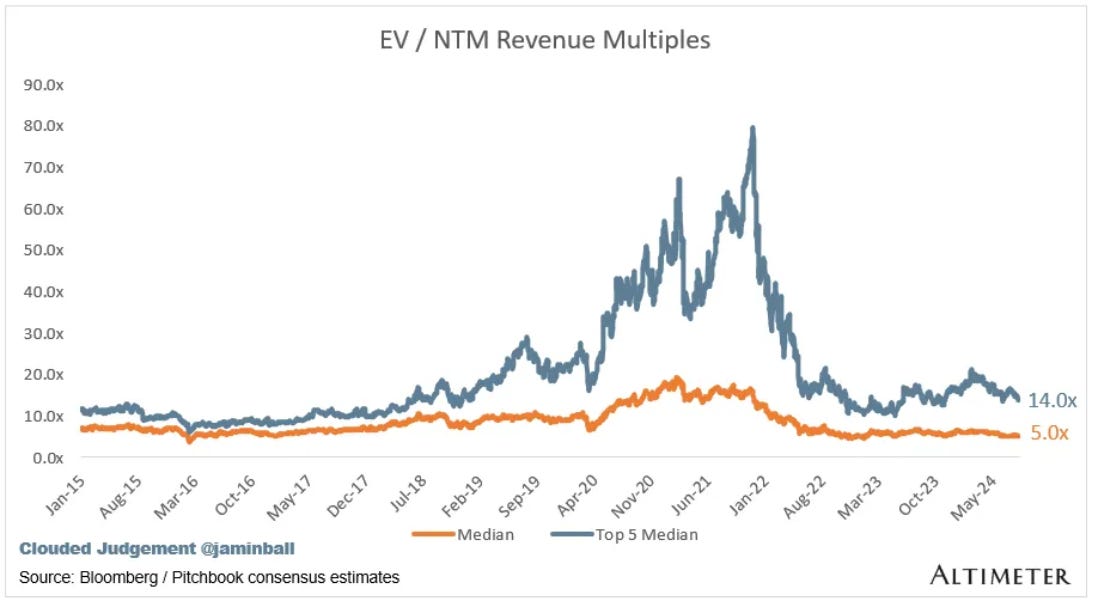

Revenue multiples for software companies have been falling but they aren’t far off from their historical averages (excluding the crazy Covid period).

The big question is where should revenue multiples sit today relative to their long-term historical averages. Revenue multiples bake in a lot of assumptions about the future (not just the next year) because most of the value capture comes from long-term profit potential from continued high growth.

But the outer year assumptions are a lot more uncertain today for software companies. A recession will only amplify that uncertainty and cause revenue multiples to potentially drop even further. There have been lots of uncertainty for SaaS and a recession just adds to the list:

Revenue growth is slower

GenAI adds a lot of uncertainty into the moats of software companies

Interest rates are much higher

Stock market volatility is higher

A potential recession is looming (potential new or more near-term fear)

Recession Impact

Companies typically go in defensive mode in a recession, similar to any other events that break confidence in the future.

Executive teams, often guided by their CFOs, take measures to be more conservative:

New expensive initiatives are cut or scaled back

Hiring freezes or slows significantly

Backfilling employee turnover is more heavily scrutinized

New software purchases are scaled back and/or cheaper alternatives are considered

Travel and team offsites are reduced

And as you can probably tell, this creates a viscous loop in spending as all companies take the same measures to cut costs. While the SaaS industry has already been prioritizing efficiency because of uncertainty and slowing revenue growth, a recession will be another reason to ramp up these efforts.

And lots of software companies still have plenty of fat to cut.

One of my most popular posts ever is Winning Software Budgets in 2024:

CFOs: hopefully helpful guide of some things companies should do in a recession to continue to become more efficient

Sales: a guide for sales to understand how CFOs are thinking about budgets so they know how to increase their odds of winning deals.

Software Valuations

If the economy does enter a recession, then things can certainly get worse for software valuations. Revenue growth estimates potentially come down even further, which will cause lower revenue multiples.

But how much further can valuations fall from today’s multiples before they start to look silly cheap?

A recession will push companies to be even more efficient. There is still a lot of fat at tech companies that can (and should) be cut. AI will also help push toward greater efficiency.

But there are two competing factors that will quickly come into play:

Greater efficiency will drive higher free cash flows which will be good for investors.

Competition and pricing pressure will intensify because of GenAI and more people building startups, which will decrease free cash flows. A recession intensifies this because sales will already be slower.

The companies with the larger moat (high complexity, data, etc) will be able to see significantly more benefit from #1 before #2 can negatively impact them.

While a recession is another reason to get more efficient, revenue growth is still the most important driver of valuations. Some companies (maybe pushed by over eager CFOs) will cut too deep and destroy revenue growth. The compounding effect of high revenue growth is much more powerful to a company’s value than a bit more efficiency today.

Investors want both - revenue growth AND efficiency.

I believe a recession will create an even higher revenue multiple separation between the best companies and all the others. Right now the top 5 public cloud companies trade at 14x NTM revenue while the rest of SaaS is a just 5x. I think this gap could widen even further in the future. Many investors will try to catch the falling knife on cheap SaaS deals, but will get their hands cut — revenue growth will continue to slow, profits won’t come or will decay. These companies deserve even lower revenue multiples because the future is bleak.

M&A probably come in and save all of these companies either (at least not at favorable valuations). There are too many companies with limited options because of bad metrics. These zombiecorn companies may live a long time, but they won’t live a life worth living for their investors.

Not all deals are good deals.

Hunting for Deals

A lot of investors have been sitting at home refreshing their brokerage portal and repeating to themselves the below quote from Warren Buffett…

If you liked Nvidia at $135 then you will love it a $99, right? But when things start falling and there is a lot of uncertainty then it becomes really hard to pull the trigger and buy discounted stocks.

And an important question is what dip are we buying?

So what dip should we buy?

The answer is that we should probably buy all of the dips of the companies you have high convection on. No one can time the market so averaging in at discounted prices is probably something Warren Buffet would recommend. You just don’t want to go all in all at once…

*not investment advice*

Footnotes:

Check out Runway if you want beautifully easy financial planning (today’s sponsor)

Reply to this email with any questions or feedback

Sometimes, all you need is a good cup of coffee and all is jus fine :)