Sales in 2023 & Rise of CFO Power

CFOs should always have power when companies make purchase decisions, but when money was essentially free and growth at all costs was the name of the game, a lot of CFOs felt a bit powerless.

During this prior period of craziness, CFOs had a difficult time controlling costs and being efficient because investors were right behind them yelling “we don’t care how much you spend. Just grow faster!”.

Glad to see we have mostly reversed course here. Growth will always matter and is still priority #1 for most VC-backed software companies, but now efficient and durable growth is much more heavily rewarded (and rightfully so).

The sales playbook needs to be adjusted as we enter this new phase. Those who fail to adjust will likely lose more deals.

Recent Software Sales Data

My friends at Vendr provided me with some interesting data points on recent purchasing trends. Vendr has unique insights since they are plugged into hundreds of companies’ procurement processes to help companies save money.

A few observations on the top 10 net new purchases in the last 30 days:

Six tools that were in the top 10 last year are no longer in the top 10.

5 of the top 10 relate to security, up from only 3 last year. Mission-critical software is still important and if companies can get leverage from software on these expensive projects then that is even better.

Purchases of non-critical tools with less defined ROI are slowing down.

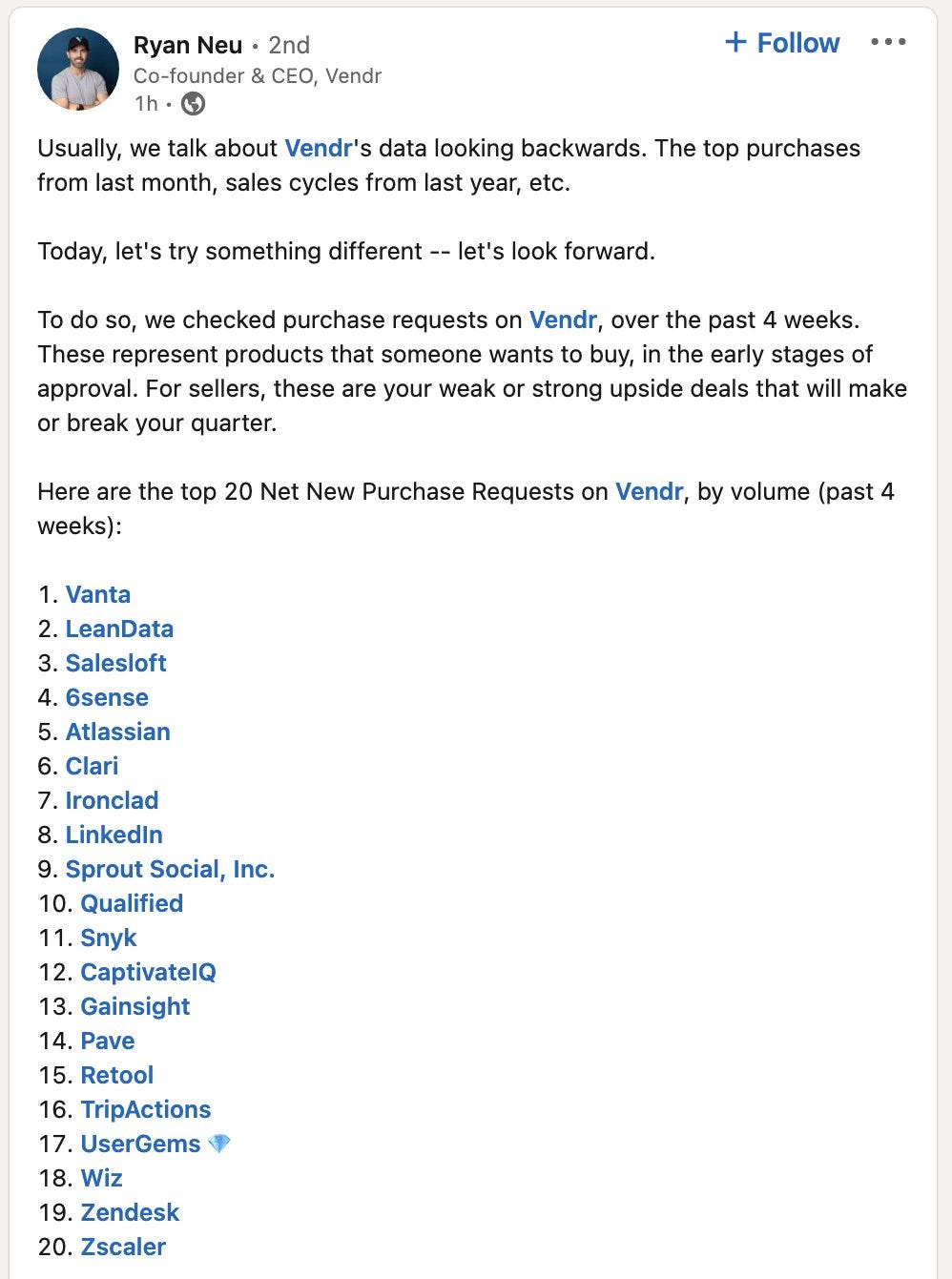

Given economic uncertainties and that most companies have finalized their financial plans for this year, I am also interested to see what net new purchases that companies are thinking about right now. Last week @ryanRneu provided the top 20 net new purchase requests data.

Lots of security tools are still on this list - no surprise.

Still a lot of GTM tools - perhaps a bit more surprising. A good reminder that growth isn’t dead, just growth at all costs is dead. If a tool can help enable efficient, durable growth then it is still in demand.

Companies still want tools that add leverage and can help reduce costs. Those with the clearer ROI are the highest in demand.

Rationalizing Incremental Spend in 2023

How companies rationalize spend in 2023 is very different than it was previously.

VC funding is down significantly so purchase decisions are more heavily scrutinized. Cash-burning companies are looking for ways to make their cash last longer.

Growth at all costs is no longer rewarded. Efficient and durable growth is what investors want now.

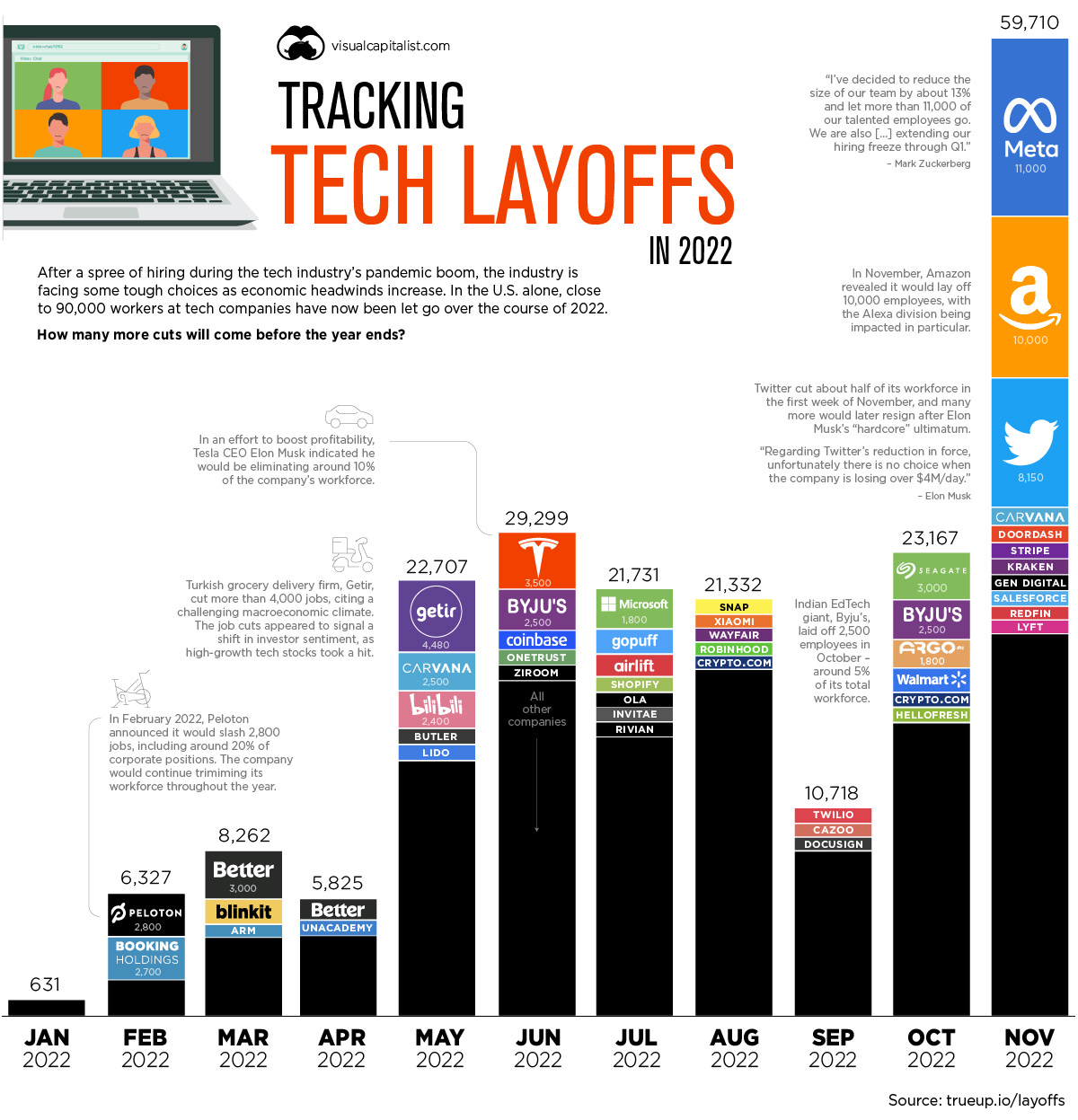

Individual buyer risk is elevated. With tech layoffs happening everywhere, individuals don’t want to take as much risk in purchasing the newer, lesser-known tools because they can no longer go out and find a job the next day if the project/software fails.

The hurdle rate (i.e. the minimum rate of return on a project or investment required) for new spend is higher. With interest rates skyrocketing within 2022, the required ROI on investments is higher.

CFOs and others are more deeply involved in the purchasing process. Not just for new purchases, but also renewals. They are reviewing all of these in greater detail and quantifying the impact of the purchase to determine if it’s worth the cost.

In the current economic environment, any software purchases must fit directly into one of the below. The others are all nice-to-haves.

Make money - increase revenues

Save money - increase efficiencies, reduce headcount needs, etc.

Business critical - cybersecurity, accounting tools, etc.

Most software tools already fit into one of the above categories, but they have wide ranges of ROI. The tools with the highest and best-explained ROI will win.

Purchase blockers

The below purchase blockers have always been barriers in the purchase decision process but their order of priority and level of attention in the buying process has changed.

1) Money (and ROI)

People like to put the money (or budget) blocker at the end of this list, but in this tough macro environment and CFO scrutiny to become drastically more efficient, the money blocker deserves the #1 spot.

Sales folks need to spend time defining and clearly articulating the ROI of their tool. Most CFOs can see through salespeople’s 💩 when it comes to quantifying value, so they need to be honest and make it real. Get Rev Ops and the finance team involved to help with the messaging.

Salespeople also need to arm their buyer champion with this information because this individual is usually talking directly to their manager and CFO about the request. If the messaging isn’t clear then it might get shot down before it has a real chance.

I have heard some pretty lousy reasons why someone wants a tool. The more trusted the person championing the purchase and the clearer the ROI message, the higher the chance of receiving CFO sign-off.

2) Risk

There is a) individual buyer risk and b) risk to the buyer’s company that salespeople need to consider. While related, there are some different concerns.

The individual buyer who owns the responsibility for the software takes risk buying your tool versus all the other tools out there. They have risk to their career if the purchase doesn’t work out as planned. Salespeople need to have better answers to questions like the ones below:

Why would the buyer risk their career purchasing a lesser-known tool when they can buy a well-known product? Is the risk/reward with it?

Why risk purchasing from an earlier-stage company given the VC funding environment? They might go out of business, struggle with new features, have issues supporting existing customers, etc.

Can the company delay purchasing any tool? They didn’t have a tool before so do they need one now?

Is the risk of switching tools worth it if they already have something in place?

Both the individual and the company take on risk that the tool will not work out as expected.

De-risking the purchase decision is even more critical than before because the stakes are much higher.

3) Time

The more time a solution takes the more indirect costs that need to be considered. A lot of individual buyers don’t properly account for this, but with more CFOs heavily involved this will come up in discussions more often.

Here are some questions CFOs might be asking:

Does the solution have quick to time to value (TTV)?

What’s the risk if we wait?

How much internal time does implementation take?

How much time does it take to administer the software going forward? Does it require additional headcount?

Does the tool add enough short-term value to be worth the investment? While potentially shortsighted, a lot of CFOs are most worried about getting through the next ~12+ months, so if there isn’t enough near-term value then maybe the tool purchase can be delayed.

Concluding Thoughts

SaaS sales will look a lot different in 2023. Those who understand and adapt to those changes will be best positioned to hit their targets. Salespeople need to focus on de-risking the purchase decision for all the new people involved in the process.

While I am somewhat biased, understanding the view of CFOs in this new environment is critical in the sales process. CFOs are scrutinizing all deals and getting way more involved in the process.