Scam Purpose Vehicles (SPVs)

Should you invest in them? Are 3+ layer SPVs scams?

Sponsor: Redefine planning with Abacum’s AI-native FP&A platform.

Check out this guide for how the best CFOs more accurately forecast cash flow, runway, revenue, and expenses. It’s packed with practical examples and the details that software/AI companies need to forecast better.

Matt Grimm, Co-founder of Anduril (super hot private company) put a VC on blast last week because of a scammy looking SPV claiming exposure to Anduril stock that was littered with red flags.

What is a Special Purpose Vehicle (SPV)?

An SPV is a temporary investment entity. It is usually formed as an LLC and it is created for one specific deal, so a bunch of investors can pool money together and show up on a startup’s cap table as one line item instead of 50.

But when there are multiple SPVs layered on top of each other….that’s when it often starts looking like a scam.

🚨 Warning: If you invest in 3+ layer SPVs (after reading this) I will no longer be your friend. It’s usually very stupid. Let me explain why…

The Anduril SPV

Let’s walk through the SPV that was being marketed to potential investors for “exposure” Anduril stock.

SPV Layer 2 (Team Ignite SPV)

This is the SPV that was being marketed to investors and was seeking up to $10M of investment.

8% upfront fee: Charged immediately upon investment commitment.

3% annual management fee: Assessed for the first two years.

20% carried interest: This is how much the organizer of the SPV takes from any profits that come from the SPV.

A potentially sneaky fee in the price per share that the SPV was stating the price was at. The price per share was 115% higher than Anduril’s recent Series G price that closed just 6 months earlier. Maybe the price actually increased 115% in just a few months, but an issue with many of these investments is you have no idea because you don’t get access to Anduril’s financials.

Investors in many SPVs rely on diligence like “trust me bro” and vibes.

SPV Layer 1

The inner SPV is likely managed by a separate firm/person who sourced the deal from an early Anduril employee (the unnamed seller). This person or entity would handle the forward contract execution, taking on the legal risks of Anduril’s bylaws violation.

This layer isn’t where the funding comes from to buy the early employee’s forward contract. Rather, it is likely intentionally created to do one or several of the following:

Market and fund SPV Layer 2 without transparency of naming the early employee

Not having to provide additional information to investors.

Assume legal risk of creating a contract that is against Anduril’s stock plan

Forward Contract with “Early Anduril Employee”

This is a derivative agreement where SPV Layer 1 purchases the right to a fixed number of Anduril common shares from the early employee (the seller), which are settled when there is a liquidity event (IPO, M&A, etc).

So not actual Anduril shares, but “economic exposure”.

This is what Matt stated is not legal or enforceable because forward contracts are explicitly banned in their bylaws and stock plans.

Death by SPV Layer Fees

Not all SPVs are bad. There are lots of single SPVs that provide access to great companies with reasonable economics and risk. Even some double-layered SPVs aren’t necessarily scams.

But you should be VERY cautious of 2-layer SPVs and you should likely run away fast from any 3+ layer SPVs.

But I want access to OpenAI, Anduril, and other hot private companies?

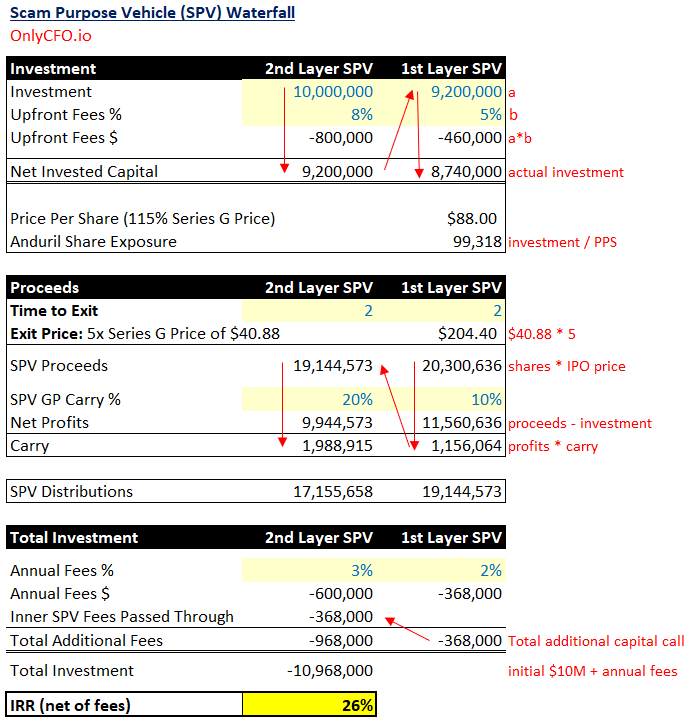

Let’s do some hypothetical math based on this Anduril SPV example.

The Anduril 2-Layered SPV Return

Multi-layer SPVs can screw you in both directions:

Money flowing into the actual investment

Proceeds coming back to you if there is an exit

The one thing we don’t know in this example is the fees and carry associated with the 1st layer SPV. So for illustration purposes, I made some assumptions. The actual deal could have been worse or better, but there are certainly SPVs that look like the below (and some will be even worse).

Initial Investment (1st Time Getting Screwed)

Invest in 2nd layer SPV ($10M in the below example)

8% in fees is immediately taken out. So $800K in fees for this SPV

$9.2M goes to 1st layer SPV

1st layer SPV charges 5% upfront fee. Another $460K gone.

$8.74M of remaining capital to invest in the forward contract

SPV Return (2nd Time Getting Screwed)

Ok, your investment in Anduril (or other SPV) worked! They just IPO’d at 5x the Series G price!!! Pop the champagne.

So how much money am I going to make from my investment?!?!

I got bad news for you…

1st layer SPV is taking 10% carry on profits (assumption)

Then the 2nd layer SPV takes 20% on remaining profits

And you didn’t invest at the Series G price even though that price was just a few months earlier than your investment. You paid a lot more than that….

SPV Annual Fees (Bonus 3rd Time Getting Screwed)

Remember those annual fees for the first 2 years?

Well, you also have to pay those in addition to the initial total $10M investment. So if you invested $100K then you would have to also pay $3K per year for two years.

But it’s not just the 3% from the 2nd layer SPV….

The deal memo says that fees from the 1st layer will be passed through. So in addition to the 3% annual management fee, I mad an assumption in the example above that there is a 2% annual management fee on the 1st layer SPV.

This adds up to an additional $968K in fees over the first 2 years…

Actual SPV Return

So after all is done, the actual return is only 26% per year in my example above. Not even close to 5x.

A 26% return isn’t bad though! But…there was a crazy amount of risk to get there. Risk that there even is a liquidity event and risk that the SPV can actually enforce an illegal contract.

Not All SPVs Are Scams

Single layer SPVs are generally fine. Just make sure you understand the economics and the risks.

Even some 2-layer SPVs are OK. The second layer is just set up to sell positions in the 1st layer SPV so those investors can get liquidity after holding a position for a while. And sometimes there is no additional carry or fees (or they are minimal) associated with those 2-layer SPVs.

But I’m not sure how many 2+ layer SPVs aren’t illegal. I am all for allowing investors to make dumb decisions (e.g. paying crazy fees), but everything needs to be very transparent with the proper context.

Final Thoughts

I don’t know all the details with the Anduril SPV. I made some assumptions on the 1st layer SPV because we didn’t have details about it. Maybe the 1st layer SPV has 0 carry and 0 fees. That would certainly make the economics better but even the 2nd-layer SPV high upfront fees, annual management fee, and high price per share being paid still makes it appear VERY expensive.

And not to mention that the whole forward contract is in direct violation of Anduril’s stock plan and bylaws….This could be a messy legal battle with this employee.

The good news is that I was told that the VC killed this SPV and are not moving forward with it. Seems like a wise move…

TLDR: Don’t jump into investments based on hype. There are a lot of scams and grifters out there with hidden fees, huge risks, etc. If it seems confusing and not transparent, then run away.

Footnotes:

Download this guide (from Abacum) to better forecast and partner across departments.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for OnlyCFO readers)

Want to sponsor OnlyCFO and reach 35,000 finance and other tech leaders? Email onlycfo@onlycfo.io

*Nothing contained in this post is investment, legal, tax, or any other kind of advice. Certain assumptions were made about this specific deal for educational purposes.

Huge respect for using your platform to call these out.