🚔 SEC Charges Software Company With Fraud

Lying to investors and using VC money to buy a house, a car, and go on lavish vacations…

Today’s Sponsor: NetSuite

2026 CFO Agenda: 12 Ways to Flourish

With an unpredictable year ahead, CFOs need to stay on the lookout for fresh ideas. NetSuite compiled a dozen action items that finance experts suggest CFOs should add to their 2026 agenda to achieve their goals.

Download your annual CFO Agenda today to learn how to control costs, drive operational excellence, and extract strategic insights throughout 2026.

The “F” Word

Everyone has been talking about the F word recently…fraud.

The Minnesota daycare fraud has dominated social media discussions. If you are unfamiliar with the daycare fraud allegations, I think my tweet below summarizes what’s going on. The first two are innovations while the last one is fraud 🤣

People often ask how fraud can go on for so long without anyone catching it.

It’s embarrassing to admit

It’s immaterial so not worth discussing or doesn’t get caught

It is never caught because of bad controls, policies, tools, etc

It is rationalized as not being fraud

Fraud = any activity that relies on deception in order to achieve a gain. Fraud becomes a crime when it is a knowing misrepresentation of the truth or concealment of a material fact to induce another to act to his/her detriment.

Often people are afraid to use the F word and call something fraud. But that’s exactly what it is.

The ComplYant Fraud

The SEC recently filed fraud charges against a VC-backed company that lied to investors, stole money for personal use, and lied about her CPA credentials.

ComplYant raised $13M for their tax-compliance software from some well-known VCs (Craft, Mucker, and Techstars). Revenue growth seemed really strong and key metrics appeared great.

Everything seemed to be working for ComplYant to be a good VC outcome and on the path to raise a Series A.

The problem? It was all completely made up. Straight-up fraud…

ComplYant Fraud Timeline

Fundraising:

October 2020 - October 2021: Raised $1.3M SAFE

December 2021: Raised $4M seed round led by Craft

October 2022: Raised another $7.3M via a SAFE from existing and new investors

June & September 2023: Raised another $750K SAFE

Abrupt Shutdown:

On a Friday morning in September 2023 (same month as their latest fundraise), employees woke up to a video recording from their founder telling everyone that the company was in a “wind-down process" and that all employees would be laid off immediately.

So days after they raised another $750K SAFE, they shut down.

Revenue seemed to be growing fast, they raised more money, and the founder said they had plenty of cash runway…..and then they were suddenly out of cash?

Weird, right?

Well…if there was fraud then it’s not weird. An abrupt shutdown makes sense.

Founder probably told investors they needed even more money, investors were confused given the metrics they had been provided, and then investors smelled something was off so they told the founder there would be no more money.

Then the shutdown felt abrupt since everyone thought things were good and there was plenty of cash.

Shutdown Aftermath

Employees waited months to get final paychecks and many claim they weren’t paid what they were owed.

The founder deleted all of her social media profiles and cut off contact.

November 2025: SEC charges Shiloh (founder of ComplYant) with fraud.

The Fraud

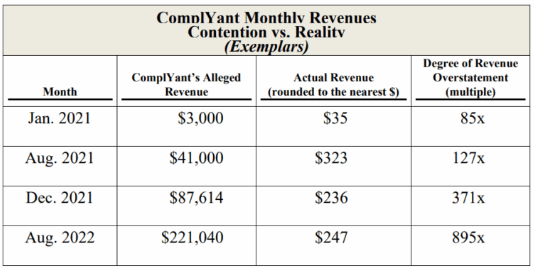

Fake revenue growth numbers. Claimed monthly revenue got up to $250,000 when in reality the average monthly revenue was only $250. Just a 1,000x inflation of revenue…lol

Lied about revenue-related metrics and financials. You can’t just lie about revenue and not also lie about many other things:

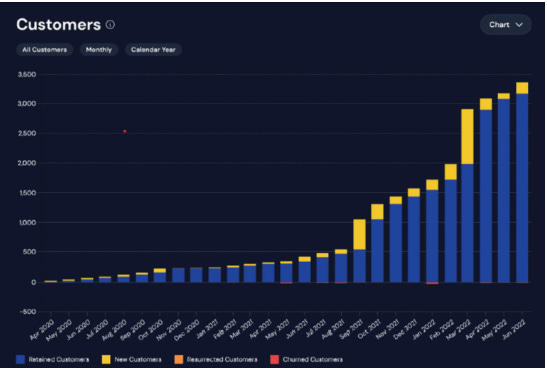

Lied about key metrics (like number of paying customers and gross margins). The below chart was presented at a board meeting, but apparently they never had more than 131 customers (vs the nearly 3,500 per the chart)…In order to make the revenue lie believable they also had to lie about customer metrics.

Lied about cash and runway. If revenue is inflated by ~250K per month then you have to also lie about your ending cash balance or something will definitely look broken in the financials.

Stole $2.5M for personal use: Used VC money on her house, her Caribbean wedding, personal international travel, her car, Super Bowl tickets, etc. Another reason that they had to lie about their cash balance…

Lied about being a CPA. The overall fraud seems to have started from the beginning of ComplYant (and it was a very slippery slope). She lied to investors that she was a CPA to make her seem like an expert in the space to get funding.

How VCs/Boards Can Stop Most Fraud

The ComplYant fraud could have been prevented (or at least detected a lot sooner) if the board just did a few easy things.

Follow the money. Companies can play all sorts of games with ARR definitions, what is included in gross margins, and other GAAP accounting stuff….but cash doesn’t lie.

Two easy things you can do to eliminate the majority of fraud:

Verify bank cash

Pre-audit startups: Just have them provide bank statements on a quarterly basis. Bonus if you have software that integrates with your bank so VCs can just log in and see the balance.

Post-audit: The auditors do a lot of work around cash so at least once a year you will have assurance that cash is accurate. Bank statements are not usually needed at this point.

Review the Cash Flow Statement (and other financials)

Once you have confidence in the cash number, then reviewing the cash flow statement (and other financial statements) will reveal if there are major red flags.

If you understand accounting basics then you will be able to spot any major red flags pretty quickly.

Doing the above two things will prevent/catch 80%+ of material fraud. And below are a few more things I recommend:

A good finance team. This is the most important thing to get right.

Outsource accounting as soon as there is some material amount of revenue

Hire a strong Controller when your scale requires it.

Clean financial definitions. Clearly define ARR, revenue, and other key financial metrics. Put it in the appendix of the board slides. And if you ever change the definitions, explicitly call it out to the board.

Proper board reporting (with financials). Most board members are smart and can smell if something doesn’t add up if they are given all the proper financial reports.

Good policies, controls, and software. Controls will often be non-existent (or easily circumvented) for early-stage companies but they are still important as you grow. Set up the right processes.

Final Thoughts

Fraud is more common than you think.

It’s rarely as shameless as the ComplYant fraud, but it shows up frequently through small rationalizations and justifications.

Humans are good at justifying dishonest behavior.

It’s not worth it. Be transparent and honest with your board. And focus on making a good business, not on just looking like a good business.

Footnotes:

Check out the 2026 CFO Agenda. It’s a good read from my friends at NetSuite

Want to sponsor OnlyCFO and reach 35,000 finance and other tech leaders? Email onlycfo@onlycfo.io

*Nothing contained in this post is investment, legal, tax, or any other kind of advice.

Wowsers. these things always start with a single but significant lie, like you say. Once they get away with one, the subsequent lies come much easier… and before you know it its a snowball of bullshit with it’s own momentum