Seeking Higher Valuations

From market darling to huge valuation multiple drops

*Disclaimer: Not investment advice. Author may hold positions in the securities discussed.

The year 2023 will be remembered as a year when software companies started actually focusing on efficient, durable growth rather than lighting all their money on fire in the name of growth. It’s a healthy and needed shift.

One public company is on the very extreme end of this seismic shift - SentinelOne. I wanted to understand how things shifted and what companies like SentinelOne need to do to return to good graces with investors.

While SentinelOne is an extreme example in the public market, there are a lot of companies in similar positions in the private markets. For those companies to successfully IPO they need to seek out a path to more efficient growth first. Efficiency changes don’t happen overnight so the ones that act fast will be rewarded.

Growth vs Profitability

Here are a few facts about SentinelOne’s IPO:

IPO’d in June 2021

IPO price of $35 and reached $76 by November 2021

Had growth of 116% at IPO with $161M in ARR (amazing growth at that level)

Had world class GRR of 97% and amazing NRR of 124%

BUT….for the year ended 1/31/2021, cash burn was $73M

In November 2021, SentinelOne had the 3rd highest revenue valuation multiple at 74.7x!

Side note - every time I look back at 2021 valuations my brain explodes a little bit on how we thought those valuation multiples made any sense. But we had our justifications that seemed perfectly logical at the time…

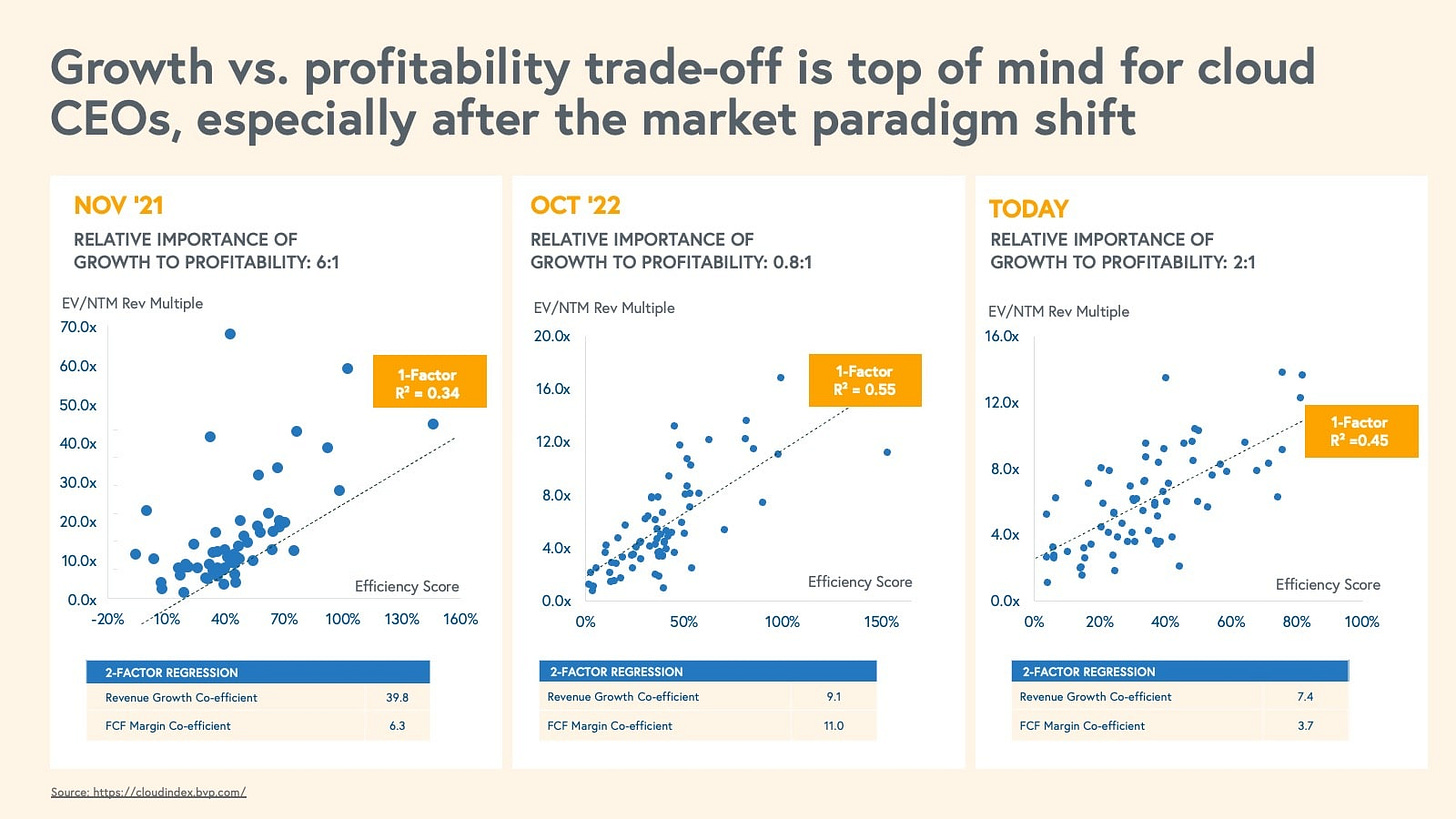

During 2021, revenue growth was by far the most correlated item with a company’s valuation multiple. The general idea was that gross margins and profitability could all be fixed in the future because SaaS can be extremely profitable at scale, but during periods high-growth stages lots of money had to be spent. We found out though that spending habits and inefficiencies are sticky and not all companies can achieve the same level of profitability.

Valuation multiple = a ratio that reflects the valuation of a company in relation to a specific financial metric. The multiple I am referring to is the company’s enterprise value divided by the next twelve months (“NTM”) revenue estimate.

The relative growth vs profitability importance completely flipped once the Fed started raising interest rates at the fastest clip we have ever seen, cash now became a lot more important than cash in the future, and valuation multiples significantly compressed.

Peak Bubble to Today

At peak of software valuation craziness (November 2021), below is where SentinelOne (ticker symbol “S”) stood in terms of NTM revenue growth vs it’s revenue multiple. In other words, SentinelOne had the 3rd highest valuation multiple!

A few notable things happened since 2021:

Valuations multiples for all SaaS companies compressed significantly. As you can see from the chart below from Bessemer, interest rates and SaaS valuation multiples are closely negatively correlated.

But interest rates doesn’t explain all of the compression in multiples….things got a little bubbly in 2021 and the enthusiasm for software companies got out of control.

Relative valuation importance of growth vs profitability took a major turn. During November 2021, growth was 6x more important than profitability to a company’s valuation! Today that relative importance is only 2x (growth to profitability).

*Note that the data below is from public companies in the BVP Nasdaq Emerging Cloud Index. At different company stages investors will value the trade-off differently.

So what does this mean for SentinelOne?

In addition to all software valuation multiples compressing from 2021 to today, SentinelOne’s valuation multiple went from the 3rd highest to 28th for public SaaS companies and from a EV / NTM revenue of 74.7x to 7.2x (ouch!).

SentinelOne is still expected to grow revenue faster than all other SaaS companies this year though. But…they still have one of the worst free cash flow margins at -47% (although a major improvement from the -86% FCF margin in 2021.

If you compare the chart above from 2021 to the chart below as of today, you will see SentinelOne as a revenue growth leader on the x axis, but the relative valuation multiple (y axis) fell off a cliff. While revenue growth has decelerated significantly, so did every other company’s growth expectations. Profitability and expectations of its ability to be a highly profitable software company is a major reason for SentinelOne’s multiple collapse.

How have other SaaS valuations reacted?

Below is a comparison of SaaS valuation multiples (EV / NTM Revenue) from November 2021 to today. I looked at companies that had the biggest relative change to other SaaS companies.

Highest Increase: The companies in green increased in ranking the most. Most of these relative changes is likely attributed to the investor shift in focus to free cash flow (FCF) margin from growth. A lot of SaaS companies that were growing quicker than these companies were ranked higher, despite how much cash they were burning, and they dropped in the ranking the most.

Largest Decrease: Expectations were astronomical for software companies at the peak in 2021. Everyone was focused on revenue growth to determine the valuation of a company with the assumption that profitability would be fixed later and they would all eventually have world-class profitability margins.

Turns out that expenses are a lot stickier than many realized and not all software companies are capable of having those world-class free cash flow margins.

Some of the companies below never made sense why they had such high valuation multiples though….hype, covid tailwinds, etc propped a lot of these up and when reality set in they came crashing down where they probably belong.

SentinelOne and Bill.com share a similar story. There were among the fastest growing public companies in the world. When growth was all that mattered they received an enormous valuation premium, but now those revenue growth rates are also decelerating at incredible speed.

SentinelOne is going from 106% revenue growth to 51% over the next twelve months. And FCF margin was -47% and is expected to improve to about -27%. While great to see improvements in profitability, they are still burning a ton of cash! And this would move them to a Rule of 40 score of 24%, which is not great…

Rule of 40: Growth rate + free cash flow margin. The best SaaS companies have a score > 40%.

The Rule of 40 score balances revenue growth with efficiency. During different economic times and company stage, the relative importance of growth to profitability varies.

Seeking Higher Valuation Multiples

Companies obviously can’t control the broader market multiples. Going from an average 60x revenue multiple for the top 10 companies to 11.5x is a major swing!

BUT…they can partially control the relative valuation multiple ranking based on the current market conditions.

Too many folks haven’t fully realized that 2021 isn’t coming back, particularly VC-backed private companies. Companies can’t just grow revenue into an amazing valuation multiple. Yes, growth is still #1 and is the biggest influencer of valuation multiples….but investors now need proof of efficient, durable growth.

The unit economics need to show that at scale a company can be highly profitable. If the financial history tells a different story and/or there isn’t a clear path to rapidly increasing profitability then those companies’ valuations are going to suffer.

Who are the future winners?

Companies with super high revenue growth deceleration (like Bill.com and SentinelOne) have been punished significantly relative to their peers. Partially because when revenue growth hit a wall, their efficiency metrics didn’t improve enough to justify their relative valuation multiple rankings staying flat.

But here is one consideration…revenue growth rates can easily drop while improving efficiency is hard and takes time.

Those that take the medicine sooner will be rewarded, but we likely won’t see the full impact of those efficiency improvements until later.

Concluding Thoughts

The macro environment is tough, but 2021 valuation multiples are not coming back. Operators need to find ways to create more efficient, durable growth (something we probably should have always been doing). We can no longer count on the next fundraise coming.

Investors should look for those companies that are taking the medicine now. While the efficiency gains might not be fully seen until later, the companies that start now will likely see their relative valuation multiples increase the fastest.

Recommended Reading

Mostly Metrics is one of my favorite newsletters to read each week. CJ covers financial metrics and business models.

Join 25K+ people reading his newsletter👇

Looking for a fractional CFO for a software company?

Email me at onlyrealcfo@gmail.com about your needs and I will send some referrals to you.

Great stuff. What can investors look at now to see who is taking the “medicine”? Are there certain metrics you would recommend a non-finance guy (me) should look at in a 10-K, etc?