Should Your Company Reprice Underwater Stock Options?

With valuations dropping, you should consider it. Below is a guide on stock option repricing and PTEP extensions.

Today’s Sponsor: Deel

Which global payroll model truly supports scale and cost control? This guide breaks down the three most common global payroll models with real examples, CFO-level pros and cons, and key tradeoffs to consider as you expand. Learn which model fits your operating and risk profile and which pitfalls to avoid.

The Talent War

Software companies are seeing their top talent flee to hot AI-native companies that are growing 10x+ faster and receive valuation multiples that are 10x+ higher.

Cash comp might be similar, but their equity comp may go from likely worthless at their current job to potentially life-changing at a hot AI company. Losing top talent during the AI platform shift is a death sentence. Everything (product, sales, etc) will come to a screeching halt if you lose your best talent.

There is a lot more to retaining talent, but competitive compensation is definitely important. In today’s post I am going to walk through two of the most common things I get asked about related to stock option compensation:

Repricing when stock options are underwater

Extending post-termination exercise periods (PTEP)

*Nothing below is legal or tax advice. Below information is just based on my experience from what I have seen.

5 Steps to Stock Option Repricing

As the software public market continues to crash, a lot of private company stock options will be underwater.

I’ve gone through a stock option repricing before. Luckily only once in my career but I learned enough about it that hopefully this is helpful in making your decision.

1. Update Your 409A

A 409A is typically updated once per year (as required by the IRS) or sooner if there is a material event that will likely change your valuation (such as raising money).

As a company gets larger (and potentially closer to an exit such as an IPO), a 409A may be performed more frequently such as semi-annually or quarterly.

2. Consider Repricing

I would not reprice stock options for a small drop in stock price. That’s just part of the risk of equity compensation. But something more material?

Here is my rule of thumb:

<20% 409A price drop = do nothing

20-30% drop = consider repricing

30%+ drop = reprice

3. Socialize with the Board

Not every board member loves the idea of stock option repricing.

4. Understand the Impact

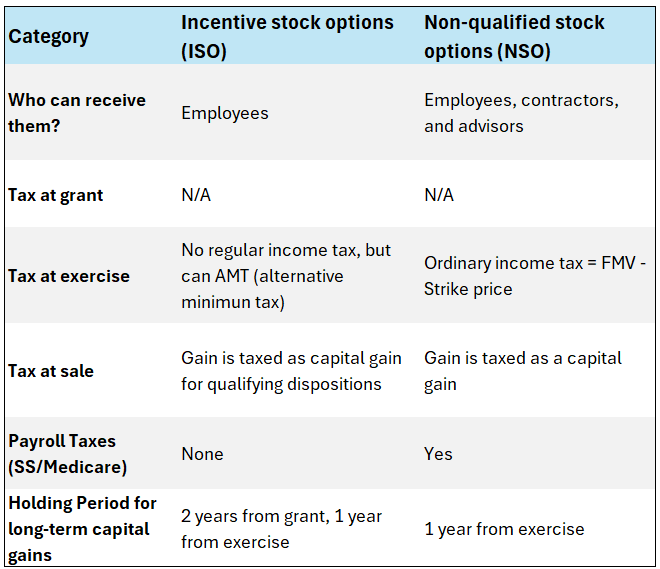

There are two types of stock options that companies grant to their employees and each type has different consequences from a stock option repricing:

Incentive Stock Options (ISOs)

Non-Qualified Stock Options (NSO)

ISOs give favorable tax treatment to employees and companies are afraid to screw up that favorable tax treatment.

If you are unfamiliar with the rules, below is a quick recap. The two biggest things are 1) all ISO gains can receive long-term capital gains taxes (will save you a lot in taxes) and 2) there is no regular income tax upon exercise of ISOs (beware of AMT though).

So how does a stock option repricing screw things up?

NSO Grants:

If you grant NSOs, it shouldn’t impact anything… Although I am sorry your company gave you NSOs instead of ISOs. Just have your legal counsel draft a letter that you can send to employees that basically says “You are welcome that we are so nice”.

ISO Grants:

Repricing ISOs does impact some tax stuff, but it’s usually not that bad if structured right. A lot of leaders think a stock option repricing will automatically flip an ISO to an NSO, but that is not true.

A stock option repricing does reset the ISO holding period. ISO holders must now hold for 2 years from the stock option repricing date (instead of the initial grant). But it’s almost always a good tradeoff for a significantly lower 409A price.

Tender Offer Rules: In some circumstances your legal folks may say the potential negative tax consequences trigger tender offer rules and that you have to give employees the option to accept/reject the stock option repricing. Tender offers have lots of rules to follow, but just know that tender offer rules = more legal fees and headaches.

Unilateral Repricing: Some boards (and legal folks) may approve a unilateral repricing based on circumstances. In other words, you are not asking employees to accept/reject an offer (you just reprice everyone) so you can avoid tender offer rules. For example, if the repricing results in a 50%+ decrease in strike price, then every employee should be happy. But if some folks would only get a 10% decrease, then tender offer rules may make more sense.

Annual ISO Limit: I won’t get into the details here, but just know that your big ISO grants may actually have more that flip to NSO status under the $100K per year rule. Check on this with your external legal/benefits folks.

5. Board Approval & Notices

Get formal board approval (obviously).

Once you have obtained formal board approval then you follow what the lawyers tell you to do for the process you decide: 1) tender offer rules or 2) unilateral repricing.

Tender Offer: Lots of rules so get your lawyers involved and just pay their crazy fees to get it done right

Unilateral Repricing: Fairly easy. Lawyers draft a letter letting them know about the adverse ISO tax consequences of resetting the ISO holding period for preferential treatment. You can also have people acknowledge the notification in Carta (or whatever equity tool you use) to protect yourselves a bit more. They aren’t accepting/rejecting it, but rather just acknowledging they received it.

Extended PTEP

The vast majority of companies grant stock options with a 90-day post-termination exercise period (“PTEP”). This means that employees only have 90 days after they leave a company to decide if they want to exercise their options before losing them.

Pros of 90-day exercise window:

Theoretically better for employee retention. “Golden handcuffs” keep employees at the company.

Cleaner cap table and easier administratively to manage the shorter window.

Limits dilution overhang. A lot of employees leave and don’t exercise. You don’t dilute upside for the employees that choose to commit long-term to the company by giving more to employees that choose to leave.

Cons of 90-day exercise window:

Unfairly hurts those with less disposable income to exercise their stock options. Not everyone can participate in the equity they earned because they don’t have the cash.

The “golden 90-day handcuffs” keeps employees that don’t want to be there anymore and don’t do great work anymore.

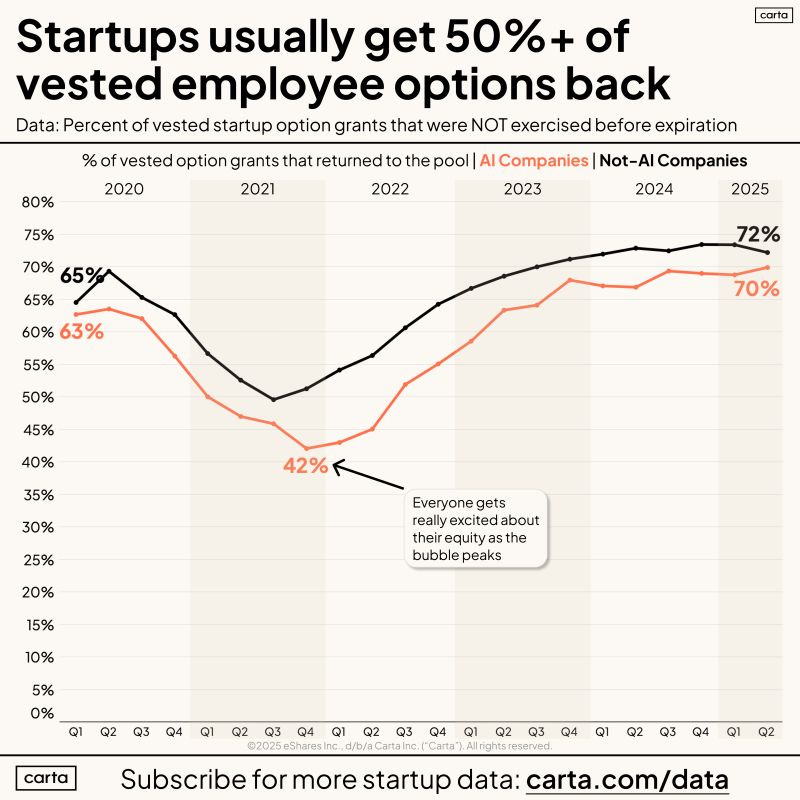

Dilution Overhang:

I understand the arguments on both sides for the employee benefit, but there is no question about the dilution overhang that long PTEPs can create. And it can be massive…

Carta data shows that during more uncertain times (like today) 70%+ of vested options are not exercised! That is honestly massive and may be reason enough not to do an extended PTEP.

But if you want to…then here is what you need to know.

Modifying Existing Stock Options’ PTEP

If you decide to extend PTEPs, then most companies will want to modify existing employees too (not just future grants). Otherwise, your early and current employees are going to be pissed because it’s a really generous benefit that they are not getting.

Modifying stock option grants to extend the PTEP will automatically flip ISOs to NSOs. As a result, the more legal-intensive tender offer process is applicable.

Extended PTEPs in New Grants

Doing it for new grants only is actually really easy and only has upside for employees. Board just needs to approve them and you need to update your grant template.

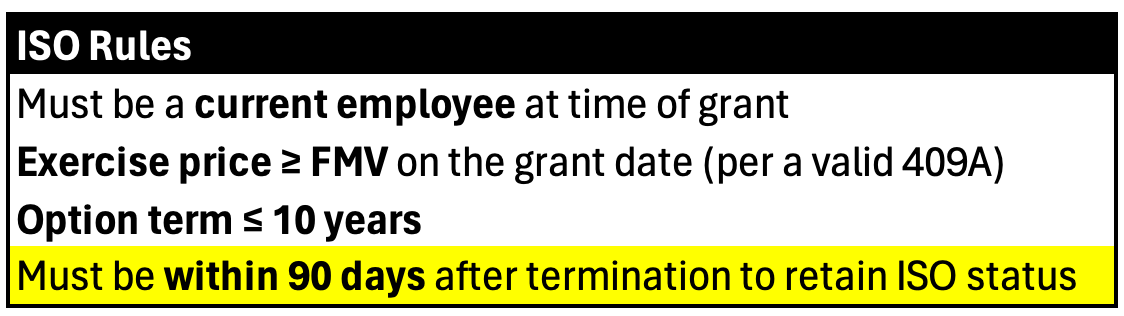

Granting stock options with an extended PTEP does NOT impact ISO eligibility. This is a common misunderstanding…Below are some of the basic rules for keeping ISO status:

Employees must exercise within 90 days after termination to retain ISO status, but that doesn’t mean you can’t grant options with a longer PTEP period. So if an employee doesn’t exercise after 90 days then the status flips from ISO to NSO on day 91.

How Many Companies Offer Extended PTEPs?

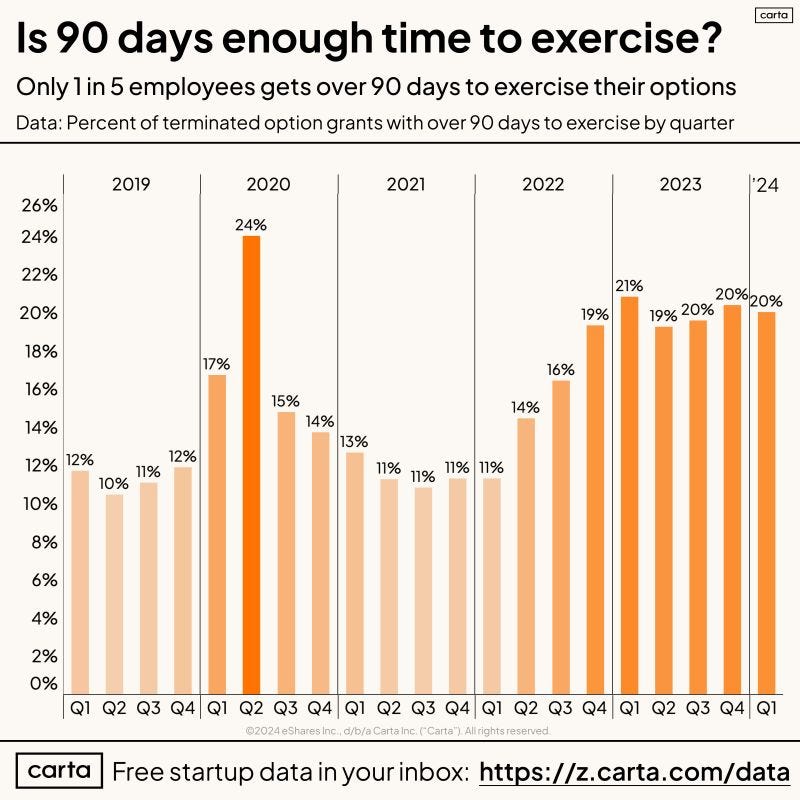

I don’t have a lot of data on the number of companies that offer extended PTEP, but Carta provided the data below about a year ago.

The trend was that during periods of high layoffs, extended PTEPs are offered (Covid layoffs saw a spike and then as layoffs started to rise in 2022 so did extended PTEPs).

Also, from what I have seen, a significant amount of the >90 days below isn’t a huge amount. It’s often between 6 and 12 months. That’s certainly better, but if an employee doesn’t have the cash in 3 months then adding a few more months might not be that helpful.

There is also a website that tracks companies that give longer extended PTEPs. Below is some of the public companies that give extended PTEPs while private.

What do VCs and Board think about Extended PTEPS?

Some are supportive, but less so today given valuation multiple compression and uncertain company outlooks.

Why? Scott Kupor (former a16z Partner) said the following:

A 10-year exercise window is really a direct wealth transfer from the employees who choose to remain at the company and build future shareholder value, to former employees who are no longer contributing to building the business/ its ultimate value.

Also, potential acquirers usually don’t like it either so it could make that process harder. It will 100% be part of M&A discussions.

Some VC firms hate extended PTEPs more than others. See where your investors stand first before pursuing…

One-Off PTEP Extensions

I have been referring to company-wide extended PTEPs, which are fairly uncommon. But what many folks may not realize is that one-off PTEP extensions are pretty common.

Often when a VP or executive leaves (particularly when they are pushed out because the company outgrew them) then the company will grant an extended PTEP to them. Whether you think it’s fair or not, this is usually done only for VPs and above.

Impact on Stock-Based Compensation

Both stock option repricing and extended PTEPs are treated as a modification for accounting purposes, which means addition SBC expense is usually necessary.

I won’t get into stock option modification rules, but just make sure you consider it in your analysis.

Final Thoughts

I think stock option repricing is generally a good idea for large valuation declines, which will probably hit a lot of software companies when they do their 409As this year.

With regard to extended PTEPs, I have mixed feelings. The dilution overhang can be incredibly brutal if you give a long PTEP extension. My only advice here is to really consider the dilution and exit math from doing the extended PTEP. If you want to do it then a reasonable trade might be to give a lot less relative stock options to control the dilution overhang.

Non-AI-native companies are experiencing a massive brain drain. Top talent is fleeing to the hot AI companies. If you want a chance, then you’ve got to keep your best people. Perhaps doing some generous equity stuff is one way to do that.

Footnotes:

Companies are going global earlier than ever. Read this guide on three most common global payroll models.

Want OnlyCFO’s accounting models, templates, policies, and memos? I am building something. Reply to this email and I’ll get you on the list

*Disclaimer: This post is for informational purposes only and does not constitute investment, tax, legal, or financial advice. Always consult your own qualified advisors before making decisions regarding stock options, equity compensation, or related matters.

This is all so much easer if you are careful about how you issue options in the first place.

Another great article! Curious your thoughts on other options for underwater options (say that 5 times fast 😅)