Snowflake’s Fall to Earth 📉

Deep dive into Snowflake. From its huge IPO to its fall down to earth and what may happen with the stock next.

👋 Hey - welcome to a subscriber-only edition 🔒 of the OnlyCFO newsletter. Subscribe and join 27K+ people getting smarter on finance and the tech industry.

Snowflake has been a rocket ship since its founding. If you invested at Snowflake’s 2020 IPO price then you would have 3x’d your money in just 2 months!

But…if you held that investment through today then you would have actually lost money over the past 5 years while the broader market has doubled over this same time frame.

Let’s dive into what caused Snowflake to be a rocket ship 🚀, then come crashing down, and where it may go from here.

Snowflake IPO

Snowflake generated incredible amounts of investor excitement leading up to its IPO, resulting in unprecedented demand for its stock.

The offering was oversubscribed by a staggering 100x🤯, with all investors clamoring to get a piece of the action. The Snowflake IPO demonstrated how an oversubscribed IPO can create scarcity that can drive crazy valuation moves.

Oversubscribed by 100x

If the cumulative share purchase orders from the IPO roadshow is greater than the total number of shares being offered by the company then the IPO is said to be “oversubscribed”,

Being oversubscribed is the norm. In fact, not being oversubscribed is a very bad sign and may cause the IPO to be delayed/cancelled. But the oversubscribed magnitude is an interesting indicator of demand and excitement about the stock.

A 5x-15x oversubscribed IPO is pretty common for most companies.

Rubrik was 20x oversubscribed

Reddit was 5x oversubscribed

Klaviyo was 20x oversubscribed

100x oversubscribed is pretty insane especially when you consider that Snowflake was by far the largest cloud IPO….Snowflake raised $3.4B.

The below chart shows how much each cloud IPO raised. Snowflake raised 2.5x more than the next biggest cloud IPO 🤯

Everyone wanted a piece of Snowflake. Even the Oracle of Omaha, Warren Buffet, bought Snowflake:

Warren Buffett's Berkshire Hathaway invested $735 million in Snowflake at the IPO. This was the first time Berkshire Hathaway bought stock in a company at its IPO since Buffett became CEO in 1965.

Demand for Snowflake was off the charts….

Snowflake IPO Pop

Snowflake’s initial IPO price range was $75 - $85 per share, but given the incredible demand it set the final price at $120/share. A massive 50% increase from the midpoint of the initial range!

But this huge increase didn’t stop Snowflake’s stock from having one of the largest “IPO Pops” (day 1 gains) of all time. Snowflake’s stock increased 112% on its first day of trading. Snowflake’s IPO pop was the 3rd largest of all public cloud companies, which is incredible given its market cap size compared to the others on the list below.

Snowflake’s Post-IPO Downfall

Snowflake has been on a wild ride since its IPO. 2024 has been a particularly hard year for the stock.

The revenue multiples that Snowflake previously traded at were not sustainable. Most people understood this, but the assumption was that revenue growth was going to be so high that they would quickly grow into their valuation.

A 120x revenue multiple at over a $100B valuation is just insanity….A LOT has to go absolutely perfect for the “grow into a valuation” theory to play out.

When perfection is priced into a stock then any non-perfect results will bring it down.

Snowflake is certainly having a bit of a crash landing as growth slows dramatically. Snowflake still has some of the best metrics out there, but they certainly aren’t perfect…

For a long time, Snowflake held the top revenue multiple spot of all public cloud companies (i.e. they were the most expensive).

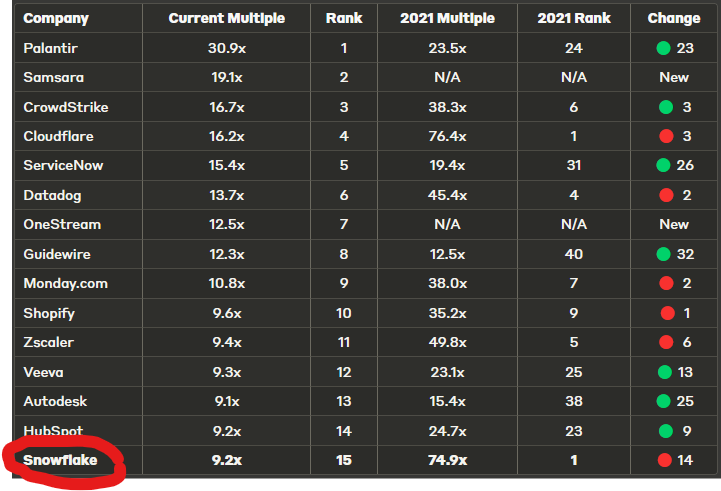

The table below shows how far Snowflake has fallen (currently 15th place) in terms of revenue multiple ranking. In November 2021 Snowflake traded at a 75x revenue multiple (and nearly 120x revenue multiple in 2020). And today it trades at a measly 9.2x…still a great multiple compared to all cloud companies but no where near the top spot.

Even if your metrics are amazing, it is REALLY hard to fight against a 90%+ decline in revenue multiple from its peak (120x at the peak to 9.1x today). Snowflake’s enterprise value has fallen significantly since the peak and it is slightly below the IPO issuance price of $120 (at $117/share as I write this).

This means IPO investors have experienced a 3% loss on their investment if they held until today. But…investors who bought day one on the open market (after the huge IPO pop) have a 54% loss! Meanwhile the overall market is up a lot over this same time period.

Warren Buffett also regrets his decision to break their rules and invest in Snowflake’s IPO. Berkshire sold their entire Snowflake holdings earlier this year to sneak in a small gain.

Snowflake’s Financial Downfall

Yes, revenue multiples were crazy in 2020/2021. And Snowflake’s revenue multiple topped the crazy charts. But Snowflake has fallen significantly more than most and the reason for that is because of its faster than expected deteriorating financial metric health.

Companies are ultimately valued based on how much free cash flow (FCF) they generate for the business (and FCF per share for investor returns).

Let’s looks at Snowflake based on the three primary drivers for their long-term FCF/share potential:

Revenue growth

Profitability

Dilution

Revenue Growth

At the time of Snowflake’s IPO, they had grown revenue by 174% the prior year, were about to finish their current year growing at 124%, and were eyeing 106% growth the next year….That is incredible growth for a company growing from $0.5B to $1B in revenue.

The problem is that level of revenue growth is impossible to maintain over a longer period of time.

Revenue endurance = current year revenue growth % / last year’s revenue growth %

Revenue endurance shows how good a company is at maintaining its revenue growth %.

The chart below maps out Snowflake’s revenue (green bar chart), its annual revenue growth % (red trend line) and its revenue endurance (blue trend line).

Software companies are expected to have a high revenue growth endurance (>80% considered good) and that assumption gets baked into their valuations.

It is hard to maintain high revenue endurance when revenue growth is so incredibly high. But the concerning part is Snowflake has been at just 52% revenue growth endurance for two years now, which is quite low for a company that has a premium valuation.

Palantir has (by far) the highest revenue multiple amongst cloud companies at 31x. As noted earlier, Palantir climbed 23 spots while Snowflake has dropped 14 spots in the revenue multiple ranking. The primary reason for these ranking changes is the future revenue forecasts (and revenue quality) of Palantir versus Snowflake.

Palantir is accelerating while Snowflake is on a rapid deceleration.

If you just look at NTM revenue growth, Palantir and Snowflake look identical. Both are expected to grow by 21% over the next twelve months, but Palantir is valued 22 turns higher (31x multiple vs 9x)!!!

Future revenue growth alone is a major driver in their revenue multiple differences. While over the next twelve months they appear to be the same, the valuation differences is more on their story of how they got here and what the longer term outlook looks like.

Palantir has 100% revenue growth endurance expected (i.e. revenue growth rate will be the same at the last year). While Snowflake’s growth rate continues to fall rapidly at only 68% growth endurance. And more importantly than just next year, investors think Palantir’s long-term revenue will be much more durable with even an expectation of reacceleration (Palantir’s NTM growth rate might be more conservative)

If an investor just looked at NTM growth rates they may give Palantir and Snowflake the same revenue multiple. But valuing a company is much more than just next year (at least it should be). The premium given to Palantir assumes longer term revenue will be MUCH better than Snowflake. We shall see if this difference is justified…