State of the Cloud | Trends & Benchmarks

Valuation multiples (private vs public), IPO vs M&A, and more cloud trends. Learnings from Battery Ventures 2024 OpenCloud report

Today’s Sponsor: Leapfin

If you’re a Controller (or any accounting/finance leader), check out this 15-minute live talk with Ramp’s Sr. Controller, Edwine Alphonse. Register now! You'll learn:

How to build an Accounting team that leverages revenue data to be more strategic

Edwine's bold prediction about the paths of accounting and FP&A

Advice on transforming tax from a scramble at year-end into a strategic asset year-round

State of Cloud & AI

Battery just released a new report on the state of Cloud and AI (OpenCloud 2024 report). There are some interesting trends that both operators and investors should know.

Below are some of the most important takeaways and my thoughts on these trends.

Private vs Public Valuations

Private companies have never been more expensive. Wait…really?!?

Private companies have an average 3.2x valuation premium over public companies today!🤯 This is nearly twice the private vs public valuation gap in the insane year of 2021.

Public company valuations are down by 67% of what they were in 2021

Private company valuations are “only” down 40%

Either private company valuations haven’t fallen enough (my guess) OR long-term growth prospects are a lot better for private companies (seems unlikely for most).

My internet friend Matt Harney gave the following analysis on the public versus private multiple gap in his recent newsletter:

Assuming a 5-year hold (fair given the likely stage of this sample and the 3x MOIC cost of capital), let’s translate these into required private company growth rates:

2021: 5.5x → 42% revenue growth

2022: 6.2x → 45% revenue growth

2023: 11.5x → 66% revenue growth

2024 YTD: 9.7x → 60% revenue growth.

Translated further: if your private company is not growing 60% year - over 5 years, not just now - investors are (arguably) better off just investing in public companies.

Market Highs (but not for cloud stocks)

There has certainly been some market excitement now that Trump has been elected president. The stock market blew threw new highs this past week.

But the “market” certainly doesn’t mean everyone — the new highs have been driven by a few large-cap companies. If you look at the slide below, the cloud index was still down YTD as of October 31st.

But after this week’s stellar market performance…cloud stocks are in the GREEN!!! Still way behind the overall market, but we will take the small win.

Cloud Multiples

The big question on everyone’s mind - Have cloud multiples finally bottomed and stabilized?

The data points to yes, but that only holds if cloud economics don’t materially change. I really hope growth rates don’t slow down even more for these companies (they are already quite low), but I can definitely see a world where longer-term FCF margin expectations come down. If this happens, then all else being equal, multiples would likely come down as well.

If one impact of AI is that it eats away at cloud’s juicy gross margins then we also NEED to use AI to improve overall efficiency to maintain high FCF margins. Otherwise, revenue multiples will fall lower.

Growth Still Matters…Duh

Revenue growth is still valued more than profitability when it comes to revenue multiples. This should not come as a surprise to anyone.

But a lot of people make this argument as an excuse for overspending, but higher spend is not always correlated with higher growth. The best companies can have both…

“Large staffs of successful startups are probably more the effect of growth than the cause.” - Paul Graham

Make sure you are doing a proper evaluation of spend and its impact on revenue growth when you plan for 2025. An extra $1 of spend is often NOT correlated with an X% of increased sales (no matter what your finance models are telling you)

Thinking of an IPO?

Being a “Unicorn” company is not special. There are SO many Unicorn companies that it would take 20+ years for the public markets to be able to take all of them public.

Majority of these Unicorns won’t have the metrics required to go public. But they will burn too much cash to try and keep the dream alive.

Private companies should more seriously consider being acquired. My post last week was on What to Know About Selling Your Company. Companies need to have more honest conversations about their exit paths. M&A is now significantly more likely than an IPO for Unicorns (2 IPOs in 2024 vs 22 acquisitions)

Companies Have More Budget?!?

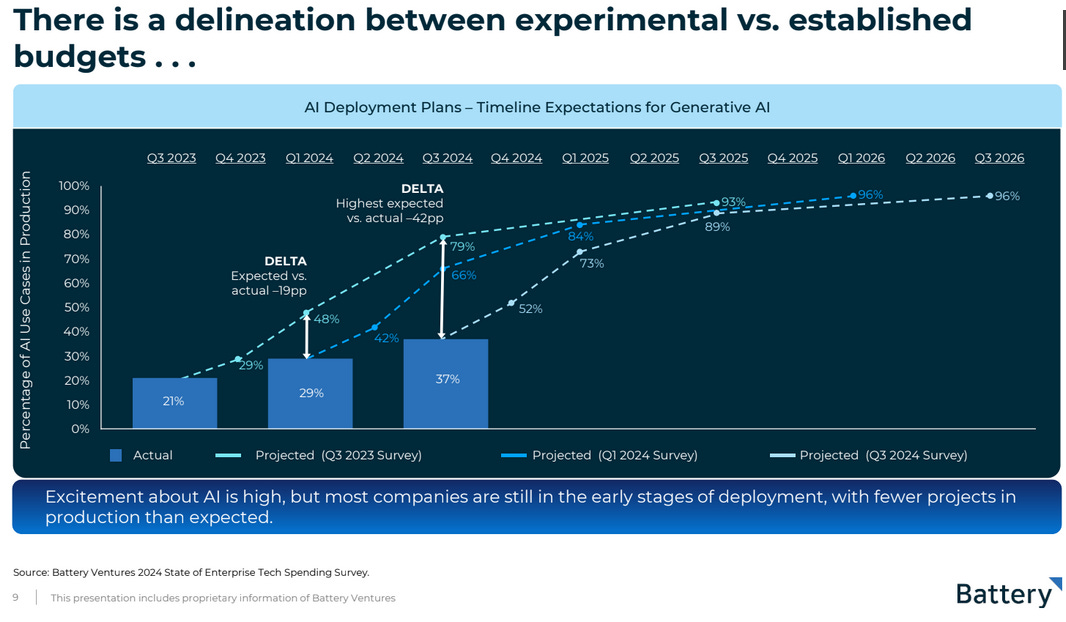

There is a somewhat large gap between actual AI in production versus expected AI in production at companies. Companies are still really early in AI deployment and there are fewer ongoing projects than planned.

But…a word to salespeople…don’t take this as a sign that companies also have lots of extra budget floating around. The budget is certainly there for AI, but most of it is for replacing something else (legacy SaaS or people). The majority of it is NOT incremental budget based on what I am seeing.

Pricing & Sales Commissions

Companies can no longer set and forget their product pricing. Companies need to re-think product pricing as they layer on AI products. This does NOT mean every company needs to reinvent the software pricing model though. 98%+ of companies should just do what everyone else is doing. But make sure your company is keeping up with pricing model changes that come from AI.

With all these pricing model changes (and unit economic changes), sales commission plans need to also be re-evaluated too. Salespeople will likely be resistant, but changes are probably needed. Basing comp plans primarily on ARR probably won’t make sense for most companies in the future.

One of the upcoming CFO Webinar Series will be on sales commission planning. Don’t miss it!

Comeback Time for Cloud?

In recent cloud news…cloud companies have been reporting really solid financial results so far in Q3!

Looking at the subset that have reported so far (29 companies), 100% of them have bet Q3 consensus estimates, with a median beat of 2.4%. For the last ~2 years that figure has hovered around 90% with a 1.5-2% median beat. — Jamin Ball

Cloud companies are beating estimates and at a higher rate! Let’s just hope this continues and we can get back to higher revenue growth.

Footnotes:

CFO Webinar Series - sign up to get on the list! We are launching a full workshop series soon. Some upcoming topics include:

Annual planning

Benchmarking & metrics

Sales compensation planning

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.