🤮Tech Crash? | It's So Over

DeepSeek tanks tech stocks. What’s the valuation impact of uncertainty?

Today’s Sponsor: NetSuite

Download the CFO Agenda for 2025: An array of ever-changing regulations, technologies, and trends have CFOs wondering: What do I need to prioritize this year to set my team and company up for success? We’ve got you covered with 25 actionable ideas to help CFOs dive into 2025 without missing a beat.

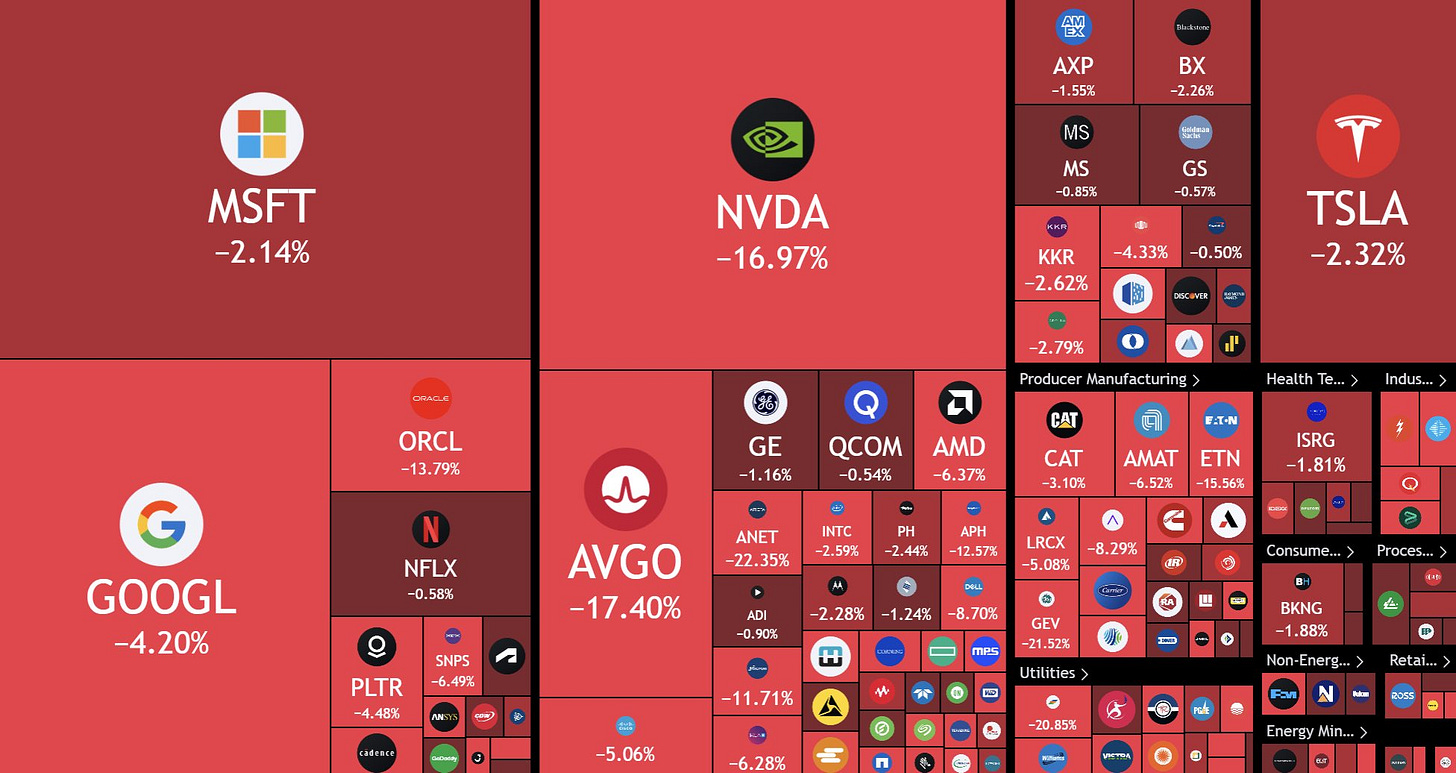

DeepSeek tanked the stock market on Monday with AI hardware (like Nvidia) leading in losses. Nearly $1 TRILLION was wiped out from the US stock market 🤯!

And it was just last week that President Trump announced the Stargate project — a $500B investment in building AI infrastructure for OpenAI. AI infrastructure and power stocks were near all-time highs when DeepSeek came out of nowhere and pooped on the parade.

But…it was a decent day to be long SaaS…SaaS companies were up nearly 1% while the rest of tech was crashing. SaaS is not dead!!!

I honestly have no idea how DeepSeek will impact cloud companies, but DeepSeek definitely creates uncertainty for AI hardware companies.

Not sure if DeepSeek really impacts the outlook of SaaS in either direction. Maybe money flowed out of AI hardware and since it had to go somewhere SaaS seemed like a decent place to put it?

Positive for SaaS - AI bills for SaaS companies will be getting slashed a lot sooner than expected. Higher gross margins and efficiency!!

Negative for SaaS - The rapid decrease in costs and better models also means more competition and pricing pressure. So those higher gross margins may not last very long…

People are quick to point out the efficiency gains that will come from AI but slow to consider the other side (more competition and pricing pressure).

Impact of Uncertainty

We talk about the Rule of 40 Score and similar metrics a lot in the SaaS world because they have a high correlation with revenue multiples. And the correlation is decently strong with an R squared of 0.30 (the Rule of X is even better at ~0.50).

But there are still some very large differences in revenue multiples for companies with similar Rule of 40 Scores — Palantir at 50x+ while Monday.com is at 10x, Crowdstrike is 20x, Zscaler is 11x, etc.

What causes these huge revenue multiple differences with similar Rule of 40 Scores?

Two related things are primarily responsible for these valuation differences:

1. Long-Term Forecasts

The biggest valuation driver should be the long-term revenue growth and profitability. Revenue multiples are a good indication of how things are going today (or forecasted over the next 12 months), but they fail to account for the long-term value creation which is where most of a company’s valuation is derived.

SaaS companies have historically had fairly predictable revenue growth endurance (how growth decays each year) which has enabled investors to somewhat accurately predict what revenue growth may look like 2, 5 or 8 years out based on growth today. But AI is adding uncertainty on how growth will change in the future.

Similar idea with profitability. We have expected that high SaaS gross margins would eventually mean you could get to 25%+ FCF margins at scale because that is how the SaaS model worked. But again…maybe AI throws a wrench in that as well.

2. Uncertainty

This is where huge stock market drops like Monday can happen. AI is moving so fast that A LOT of uncertainty can be created very quickly about the future. DeepSeek rocked the AI world last weekend and created a plenty of uncertainty.

On the one hand, you have people discussing Jevon’s paradox and that this advancement is a good thing (Microsoft CEO below).

And then you have others saying NVIDIA stock still needs to drop a lot because a lot less chips are needed.

I have no idea how NVIDIA sales forecasts in 2-3 years changed because of DeepSeek….But I know there is a lot more uncertainty today then there was last week.

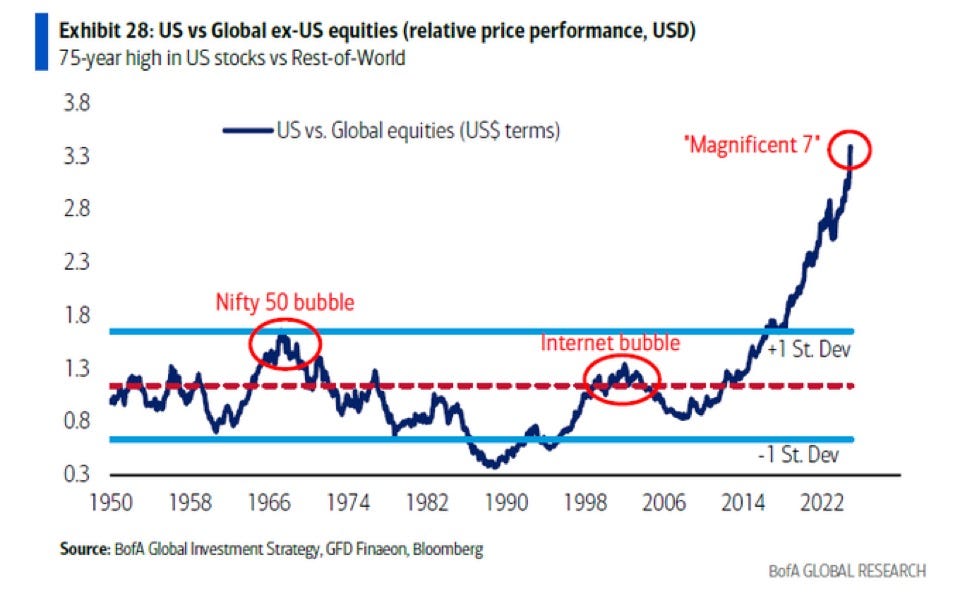

When stocks are trading at high levels then adding uncertainty can cause big stock price drops. I am not saying we are in a bubble, but the Magnificent 7 definitely trades at high levels…

Fighting Uncertainty

The best time to raise money, sell your company, or IPO is when uncertainty is low and you can somewhat accurately forecast the future.

From a financial perspective this means being able to consistently have a “Beat & Raise”. Beat your targets and raise them for the rest of the year.

Can you consistently set aggressive targets and beat them?

A lot of due diligence is around this topic. Showing you can hit your plans gives investors significantly more confidence about the future. Timing these things when uncertainty is at its lowest will mean a higher valuation.

Footnotes:

Download the CFO Agenda for 2025 from Netsuite

Sign up for the OnlyCFO webinar series! Our next webinar is on February 19th on the M&A environment in 2025.

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Wild to watch, but I think healthy overall. That being said, related companies like Vertiv took a huge beating (dare I say overcorrection) that is a potential buying opportunity. We're not stopping using tech anytime soon, and as AI matures there will be space for low price AND premium providers. I question if it becomes a commodity/utility though.