The AI Growth Endurance Problem

Implications of growth at all costs. And a guest post by Abbas Haider Ali (SVP of Customer Success at GitHub) on the new math of Customer Success

Today’s Sponsor: Nominal

Every CFO knows the “impossible triangle” of finance: you can pick two of speed, accuracy, or cost, but never all three.

Agentic Performance Management (APM) breaks that trade-off. By assigning reconciliations, eliminations, and flux analysis to intelligent Agents, finance teams deliver all three simultaneously—closing faster, reporting with precision, and doing it without expanding headcount.

→ Read: Breaking the CFO’s Impossible Triangle with APM

Balancing Growth vs Efficiency

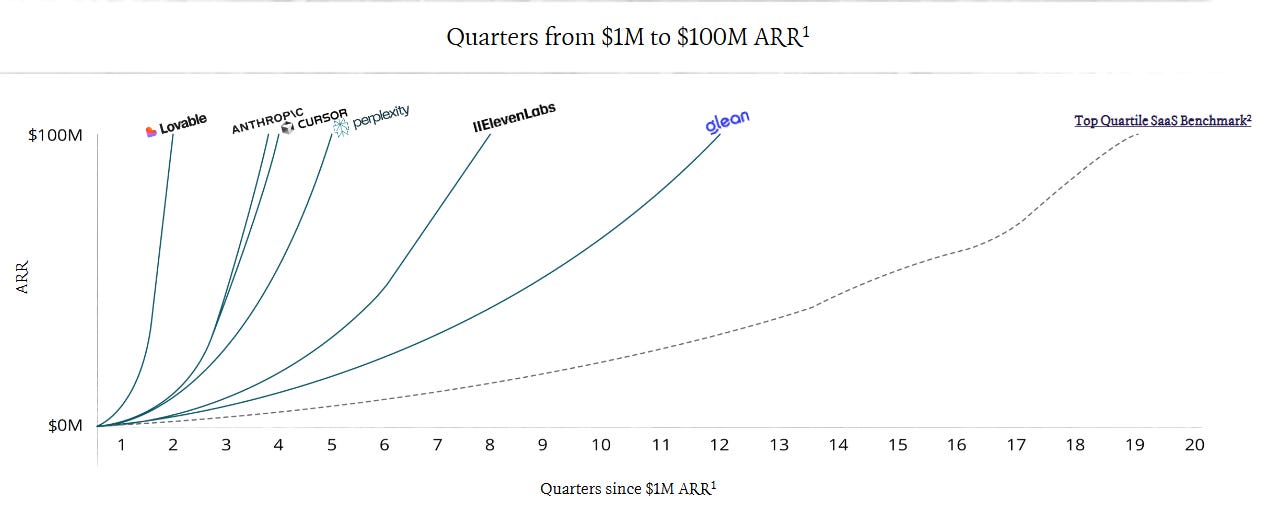

The top quartile AI companies are growing much faster than T2D3 (triple, triple, double, double, double). And since the VC model is built on achieving outlier returns, VCs will seek out the new benchmark for the fastest growing companies.

And AI is producing some VERY high growth companies…

During periods of high exuberance (dare I say bubble territory) the unit economics and long-term profitability matter less to investors (and therefore operators).

“Growth at all costs” is back! Kind of…A lot of public companies have never been more profitable than today, but many of the new AI companies that are growing really fast are losing money and/or have razor thin margins.

All of this should create major concerns for the long-term valuation of these companies…

The Growth Endurance Risk

There are two (related) risks that are critical to long-term valuations that get ignored during “growth at all costs” periods:

Customer retention

Growth endurance

Many of these super growth companies will eventually blow up as a result of failing to maintain high growth at strong unit economics. Either investors ignore these when funding companies at high valuations or the company’s management ignores them when allocating resources.

Maybe AI growth rates are just a massive pull forward of growth (like COVID did with SaaS companies)?

Maybe the early AI companies are getting all the upfront growth but as AI competition continues to explode (which it will) then growth will hit a wall

Or…with ease of switching vendors, churn spikes up a lot for all these companies

Maybe AI gross margins will always be low. Even if token costs come down, competition will squeeze pricing.

There are many scenarios that lead to revenue growth hitting a wall for these AI super growth companies.

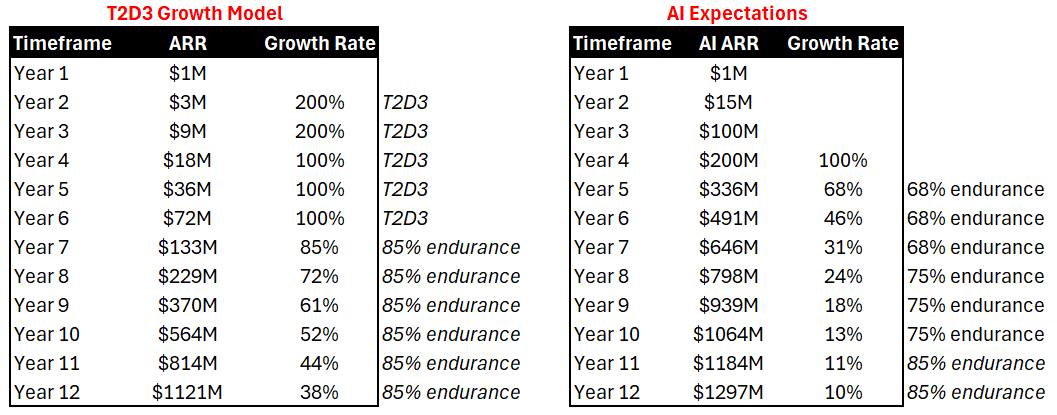

Below is a comparison of the previous gold standard, T2D3, versus what the new AI growth model could look like if growth endurance is low.

A small change in growth endurance can make a big difference…. Notice how the two scenarios end up in nearly the same revenue spot. But the AI super growth valuations in year 1-3 will be significantly higher but then they will be lower in the later years as growth endurance is weak.

If the above is the trajectory, then I would rather own T2D3 companies over the long-term and AI companies over a short-term (if I can sell my bag before the sky high valuations fall).

The faster they grow, the harder they fall.

Growth is AMAZING for many AI companies right now simply because they are early (can’t have high churn when most customers <1 year old), it’s incredibly easy to adopt, they are losing money on their revenue, etc.

I think most people are severely underestimating how hard it will be to continue that growth, which will require high customer retention. To secure long-term high growth you need to focus on both customer acquisition AND customer success / retention.

A lot of folks are neglecting retention because high revenue growth can hide a lot of sins. But when the tide goes out…

Retention has (and always will be) critical to companies that rely on a recurring revenue stream. How customer success gets done will change, but that doesn’t impact the need to invest in customer success.

For the rest of this post I asked Abbas Haider Ali (SVP of Customer Success at GitHub) to discuss customer success in the age of AI, budgeting for customer success in 2025, and how they should work with finance.

The benchmarks Abbas lays out are useful today but may be irrelevant in 6 months. The point is not to focus on a specific budget allocation but rather inform how you should think about allocating budget for customer success. Without strong retention the economics of software/AI companies will blow up so it needs to be a priority.

New Math of Customer Success

by Abbas Haider Ali

TL;DR for CFOs

New benchmark: 7% of revenue for all post-sales, down from 10%

Org design: Build like a product roadmap — allocate based on ROI, not tradition.

Metrics: Tie everything to retention, margin, and % of revenue for each function.

Call to action: Push your CS leader to give you a line-by-line map of spend and expected returns and what they plan to do with them

Flex org and role design: AI offers the opportunity to reimagine how CCOs build, structure, and operate their teams to deliver outsized outcomes for their companies

Hiring Profiles: Load up on CS Generalists

One of the trickiest metrics to get your hands on for any SaaS business is the expense envelope for the scope of a Chief Customer Officer where you consider the full breadth of all of the Customer Success functions. Between a blend of COGS and OPEX, investments made by the company vs. offerings & services paid for by customers, the picture can get fuzzy even inside a company, much less from the outside.

Not satisfied by the industry benchmarks that often began with the phrase “it depends,” I spent time with leaders from multiple public and private B2B SaaS companies to get into the details and build a generalized rule of thumb for this CFO and CCO aligned metric. Up until a year ago, that number held steady at 10% of revenue as the investment envelope for CCO’s scope. I talked about it at SaaStr and TSIA Envision, and in over 50 small groups and 1:1 conversations. There were early signals of AI productivity and it took a few more months of refreshing the data from peers and firsthand experience at GitHub to update the number.

At SaaStr AI this year, I shared that the new benchmark was now 7% of Revenue and this 30% gain in efficiency comes from the impact of AI across all functions. In considering any given use case for AI, it’s helpful to have a framing for evaluating the impact. A simple one to consider is the level of “AI-ness” from incremental, through evolutionary, revolutionary, and reimagined. And also the level of visibility for the application from deeply internal processes to external customer interactions. The combination of the two provides a mechanism to consider the benefits and exposure to risk.

Where to put the 7%: Organizational design

Think of your CS budget like a product roadmap. It evolves with the needs of customers, new capabilities in the market for talent & tech, how the rest of the company is evolving, and the growth of your company.

To illustrate how this 7% target can be utilized, let’s use a $100M B2B SaaS company as an example:

1️⃣ Customer Success

Scope: Invest to drive adoption, expansion, risk management, and opportunity identification.

Budget Target: 3% of revenue

Roles: CSMs (high touch, scaled, and digital), CSAs, Community, Digital and Customer Experience, Forward Deployed Engineers, Field Engineers, Customer Engineers

Financial KPIs: Net Retention (NRR), Gross Retention (GRR), % of Net New ARR (NNARR) from existing customers

Operating KPIs: Customer Health, Customer Success Qualified Leads (CSQLs), Customer Advocacy Rate

Key Considerations: These roles are bets that have to add productivity to overall GTM engine while driving measurable impact to customer adoption and growth. It’s often the least mature, but potentially most impactful investment from the CCO budget. If, and only if, you have the ingredients right, maximize investment here.

AI Use Cases: General productivity tools, CS tools, Content Creation, Customer health / sentiment tracking, Customer-facing chat and multi-mode interactive tools

2️⃣ Renewals & Account Management

Scope: For businesses with annual or multi-year contracts, this team can significantly increase productivity of AE roles which should be focused on NNARR

Budget Target: 0.5% of revenue

Roles: Renewal AEs/Specialists, Account Managers

CFO KPIs: Gross Revenue Retention (GRR), $ per RAE, Net Revenue Retention (NRR)

Operating KPIs: Forecast accuracy, on time renewal rate, renewals per AE

Key Considerations: Informed by a good customer health model, this team should focus on moving deals through the system at volume and focus on the green customer base where there is minimal risk and potentially “organic” growth that doesn’t require significant selling work such as seat growth or usage. Where there is risk in the renewal or a cross-sell into a new organization or a new product sale, the overall opportunity inclusive of the renewal should go back to the AE.

AI Use Cases: General productivity, sales tools, account review/evaluation systems, meeting preparation and summarization, forecasting tools

3️⃣ Support

Scope: Reacting to customer problems, this team handles the “it’s broken” class of questions from your customers

Budget Target: 1.5% of revenue for company invested roles

Gross Margin Target: 20-50%, depending on scale

Pricing: 8-15% uplift on product price

Role: Support Engineers, Incident Managers

CFO KPIs: Support ARR, Support GRR, Support NRR, Margin

Operating KPIs: Initial Response Rates, Resolution Times, Escalation Rates to Engineering, CSAT, Support Health (composite metric)

Key Considerations: Support is one of the first CS functions to monetize with enterprise customer demand supporting multiple premium support offerings that provide SLAs, assigned support engineers, and incident management assistance. Consistent Knowledge management, AI, and monetization are particularly powerful levers here as you look to minimize the cost of delivering reactive support and redirect the savings to teams that drive adoption and growth

AI Use Cases: General productivity, Customer-facing support chat / multi-mode interfaces, Inside-customer-boundary agents, AI-powered search, Initial response systems, Support response assistants, Knowledge extraction / creation flows, Sentiment analysis, Escalation prevention

4️⃣ Professional Services

Scope: Consultative and technical team who help customers realize customer value quickly by being deeply engaged and hands-on for extended periods of time during key customer lifecycle stages - onboarding, adoption of new use cases, refreshes with significant product changes, training, etc.

Budget Target: ~0.5% of revenue for company invested roles & non-billable time

Gross Margin Target: -20 to 50% for billable time, depending on scale

Pricing: Fixed cost and hourly rates to get to margin goals

Role: Consultants, Trainers, Service Delivery Engineers

CFO KPIs: Services Revenue, Training Revenue, Margin

Operating KPIs: Productive Billable Utilization (%), Attach Rate ($), Attach Rate (%), GRR/NRR Increase from Attach, Lead Time, Delivery % by Channel

Key Considerations: Often monetized late, companies tend to invest their budget too heavily and for too long in onboarding and adoption assistance for customers where they could charge for the services without significant friction. This shift provides relief to the CCO’s budget & team allowing for a services function to scale quickly and efficiently. Training Services should be monetized more carefully and optimized for reach rather than revenue or margin. As the company scales, options for services delivered and contracted through partners become available.

AI Use Cases: General productivity, meeting preparation / note taking, Statements of Work creation, Proposal reviews, Sentiment Analysis, Knowledge extraction / creation, Customer-facing expert systems (including inside customer boundary agents)

5️⃣ CS Engineering & AI

Scope: A full stack engineering organization that helps deploy, manage, and build the technology stack to operate and scale all functions in the CCO scope, with an eye on AI in particular

Budget Target: 1.0% of revenue

Role: Engineers, Data Scientists, Data Engineers, AI Architects

CFO KPIs: Software Spend, Infrastructure Spend, AI Spend

Operating KPIs: Self Help Score (composite metric), Deflection Rate, Utilization

Key Considerations: This function is still uncommon, or diffuse, for most CCOs but is the primary engine of scale and efficiency for teams to take advantage of the scale and efficiency opportunity that AI represents. As the ROI of AI systems for support as one example become apparent, CCOs have the opportunity to be the leaders in their company of delivering impact through AI.

AI Use Cases: General productivity, Software Engineering AI tools, Agentic DevOps tools

6️⃣ Operations, Analytics & Program Management

Scope: Partnering with each of the functions to take on the underlying rhythms of the business from budgets, systems administration, running x-functional programs, planning & analysis and running release readiness rhythms across teams as new products ship

Budget Target: <0.5% of revenue

Role: Operations, FP&A specialists, Program Managers, Analysts

Key Considerations: This team’s work is often a tax at earlier stages but at $100M+ should become its own team and can grow to encompass strategy and monetization experts in roles similar to product managers for customer success offerings.

AI Use Cases: General productivity, Data analysis tools, Reporting systems, Internal facing ops/analytics chatbots

When 7% isn’t 7%

The 7% of revenue investment envelope is a very helpful rule of thumb to follow and also varies in how it looks in as many ways as actual thumbs do. Here are some variations I’ve observed:

Rocketship growth: If a company is breaking revenue growth records, tapping into a virtually unlimited stream of venture capital, and is blitzscaling in their market, then the 7% number goes out the window. The CCO’s ability to make an impact isn’t limited by budget, only by their ability to quickly scale up their team without breaking culture & overwhelming onboarding/ramp bandwidth, keeping pace with evolving market demands, maintaining skill & expertise at the pace of product ships, and adapting to customer needs.

Private Equity: 3-4% is about the highest investment rate that I’ve observed for PE-backed companies with compression on all of the teams’ budgets. Leading PE firms are investing heavily in exploring AI use cases to drive this number even further down.

Growth Plateaus: Most businesses hit plateaus as the momentum of different phases of product-market-fit and their go-to-market starts to stall out. At that inflection point, it’s common for CCO budgets to shrink to focus on the essentials with support and revenue retention aligned work. Doubling down on monetization is an option to help prepare the organization for the next phase of growth and do so with fiscal discipline. In general it’s not uncommon for the investment envelope to shrink down to 4-5% in these moments of retrenchment and for CFOs to shift investment into product, engineering, and sales teams.

The mix of how the investment envelope can also vary across companies by ARR, vertical, technical complexity, market & competitive dynamics:

$10M ARR, high technical complexity product: In this stage, the CS team is likely to look more like a split between proactive help that feels like a field services team and reactive help that is technical support and shield for engineering involvement in too many customer conversations. The budget here could be split 50/50 between these less sharply defined teams until you get to $25M ARR.

$50M ARR, vertical SaaS in established market: Roles start to get more defined in post-sales with Support, Professional Services, and CSMs coming into the mix. Given that it’s an established market, migration assistance & training with a new platform might need to be funded at a higher level than the earlier example. An established market also means you’re likely to deal with more competitive pressures and CSMs focused on articulating realized value to customers becomes another investment area you prioritize. Support should be less complex here so there’s room in the budget to make these prioritization decisions, unless NRR is in the top quartile in which case you could increase the overall envelope, but it would generate stronger ROI by establishing in CS Engineering or Customer Success teams.

$250M ARR, high technical complexity with an AI-first product: Growing quickly and building a company at the frontier of any technology, but AI in particular, means that you have to invest deeply in the proactive success side of the house. That means company invested services and forward deployed engineer type roles. That has to pull from elsewhere in the envelope and Support is a common place to do it as is overall Operations. By maintaining investment in a CS / GTM Engineering function and scaling through AI to run the company itself and drive product adoption, you can maximize ROI from the CCO’s budget.

Headcount and AI

With the impact of AI maturing quickly over the last year, the efficiency gains are no longer theoretical. For CCOs leaning into these changes vs. waiting for the changes to roll over them, one of the most difficult paths to navigate for their teams is the question of headcount. It may be tempting for companies to look at the efficiency gains and pull back. I don’t believe that is the right answer.

In describing the impact of AI to CCOs as a Cataclysmic Opportunity, (i.e., adapt, or the AI meteor sends you the way of the dinosaurs) I focus on the second part of the sentiment. The opportunity this moment of change represents has other options:

Reallocate headcount across different parts of the organization

Get deeper with the customers you’re already engaged with to move them further up the value/maturity curve of your products

Go broader across your customer base. Where expertise might have been limited to high-touch customers, customer-facing AI systems backed by small teams can create new high scale programs

Increase the scope of what a CCO can do by bringing in additional account management functions or partner programs under the budgetary umbrella

It’s up to CCOs to not only take advantage of the efficiencies, but also the opportunities those gains represent to deliver additional breadth and revenue back to the business.

Rise of the Customer Success Generalist

AI is collapsing specialist silos. The next durable CS hires are Generalists who spike high on practitioner empathy to the market you sell into, account management chops, sharp eyes for risk/opportunity identification, crisp use-case fluency, and comfort in a wide range of customer conversations. Augment them with AI agents that carry deep product and technical expertise on demand. One person who can morph to fill what are specialized roles today. Other industries are noting this shift toward “generalist behavior” as AI takes on more of the narrow tasks.

Practically, this looks like a single owner orchestrating an agent bench: a doc-grounded product copilot for solutioning, a health signal bot to surface risk/opportunity, a QBR composer that assembles data and narrative, an ops copilot to run segment experiments, and a renewal forecaster that flags leakage early. The human sets intent and judgment; the agents provide recall, precision, and speed. Enterprises moving from “experimentation” to scaled gen-AI workflows report that role redesign—toward broader, orchestrator roles—is where the real productivity dividend shows up.

For CFOs, the math is straightforward: coverage increases, time-to-value compresses, and cost to deliver goes down without starving expertise—because the expertise is encoded and fetched, not headcounted. For CCOs, it unlocks flexible staffing: one Generalist can credibly play portions of CSM, solutions, support SME, renewals desk, and CS ops while still escalating the deepest needs to specialists.

Leading through Seismic Shifts

The current climate and pace of change challenges all leaders, and CCOs are no different. It’s crucial to have a strong network of peers to compare notes with, stay on top of trends, keep an eye out for talent, and seek opportunities to learn. To that end, I keep my LinkedIn open to build new relationships and learn from the experiences of the community. I’ve also been experimenting with publishing these learnings in a new format - a custom CCO-GPT fed by my notes and evolving perspectives. Try it out and let me know how it works for you!

Footnotes:

Read: Breaking the CFO’s Impossible Triangle with APM (today’s sponsor)