The Death of Point Solutions

The Rippling “compound startup” model might be a requirement to be successful in a crowded and competitive software market today

Today's newsletter is brought to you by ServiceRocket

Learn how ServiceRocket can help you save millions of dollars and increase your Jira ROI by 277%+ while cutting licensing and maintenance costs and boosting productivity. Discover how to maximize your Jira ROI today.

The Rise of Point Solutions

For a long time the popular advice has been to build a best-in-breed point solution and win customers with that product before expanding and building your next product. Focus on one specific niche and do it really well.

But the cloud industry looks a lot different today than 10 years ago. Point solutions are EVERYWHERE and generative AI is rapidly taking software development costs toward zero. It is becoming incredibly difficult to compete on simply being the best point solution software.

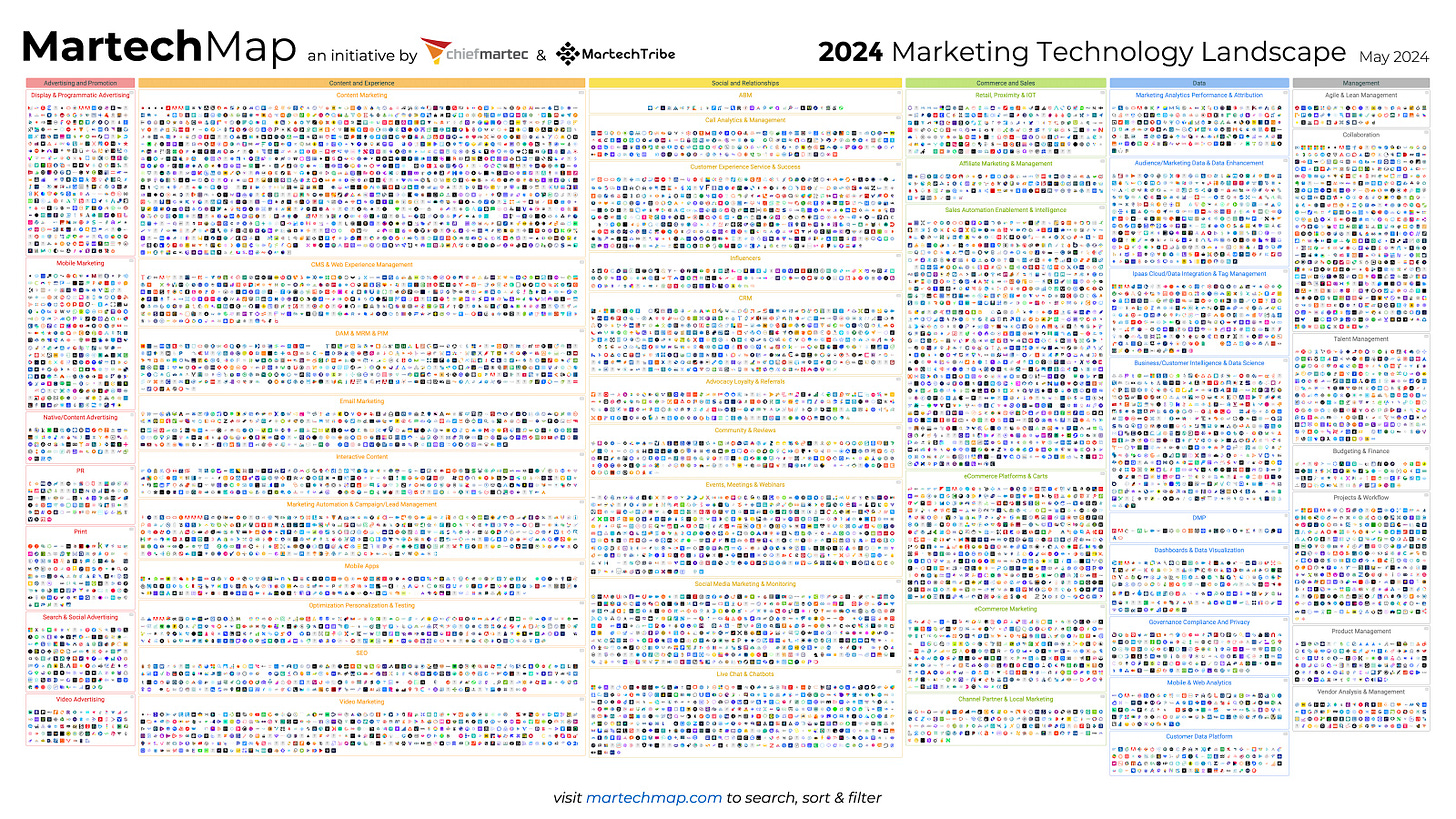

The market maps for various software segments are getting insane….Below is a market map of just marketing software. There are over 14,000 vendors just for marketing with the vast majority of them being point solutions.

Having great software is now table stakes…A slightly better point solution won’t win companies many deals because the competition is fierce and the bar for software quality is already incredibly high. Also, AI has significantly raised customer expectations - being great software just isn’t enough today.

This post will address the two related points below:

Why more companies should build “compound startups”

Why companies want to buy software from “compound startup”

The Compound Startup

Parker Conrad, Founder/CEO of Rippling, took a different approach when building Rippling and I think his argument for building a “compound startup” is even more true today.

Compound Startup: a startup that addresses a range of point solution systems all at once to build a broad portfolio of interoperable products.

Instead of focusing on one single product, Rippling built multiple products at the same time that work together to not only provide a better customer experience, but to unlock even more areas of product-market fit.

It wasn’t about being the best point solution for Rippling, but unlocking new possibilities by being a platform from the start.

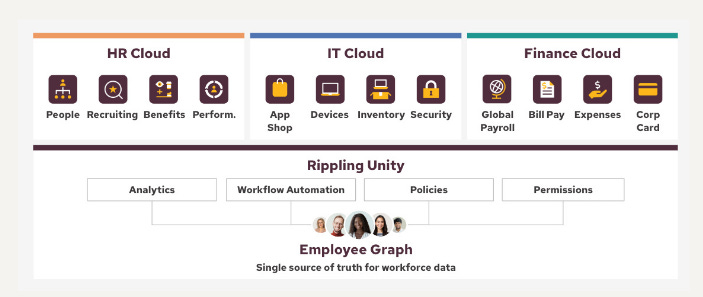

Rippling did this by simultaneously building out HR, Finance, and IT products in one unified platform that work together. **I am sure my friends at Rippling would be happy show you their compound approach 😁

The compound startup model is certainly paying off for Rippling. Ripping announced its Series F earlier this year — raising $200M at a $13.5B valuation during a time when many investors have turned against pure software business models.

Rippling is one of the rare ZIRP unicorns that have been able to subsequently raise at an even larger valuation post 2021.

Software is quickly becoming a commodity but building a compound software company might be one of the last really strong moats left for software companies. It has certainly been a moat for Rippling and has enabled continued high-growth and investor excitement.

The Great Rebundling

There are only two ways to make money. One is to bundle; the other is to unbundle. — Jim Barksdale, former Netscape CEO

For a long time, the trend in software purchasing was to unbundle and buy lots of best-in-breed point solutions. But as ZIRP (zero interest rate policy) ended and efficiency became a high priority, bundling became popular again.

Unbundling made good sense for a long time because the point solutions tools were magnitudes better that the majority of the bundled solutions. But that has changed for most products.

As the cloud industry has matured, more companies have gone multi-product, and development is magnitudes easier….Companies can get the best of both worlds now — really great software with all the benefits of a bundled solution.

Vendor consolidation comes up in all budgeting conversations today. One of the first things I do in annual planning is list out all of our vendors by spend and ask where we can consolidate.

Sometimes the additional functionality is critical. But often it is not. And the bundled competitors will usually close the gap pretty quickly (especially today).

Benefits of Compound Startups

1. The power of data

When Parker created Rippling, he realized the huge opportunity he had because of the employee data that Rippling captured. Building an awesome payroll product is cool, but there are quite a few good payroll products.

A bundled product offering may not always have the best user experience perspective, but that’s not what makes the compound startup model special. Compound startups win by reducing friction and complexity that span multiple systems/processes.

The data that is captured in one place can be seamlessly used throughout all the other products. This not only reduces complexity, but potentially opens up new areas of product-market fit that are only possible because of this data capture.

We really came to see employee data as not just this thing for HR software, but as a primitive that was really critical for business software in a much broader sense. — Parker Conrad

That’s a huge benefit of compound software: Its applications are all built on top of the same underlying data, so they all seamlessly integrate with each other.

2. Platform capabilities amplify impact

Point solutions may offer deep functionality for the problem they solve, but they operate in a vacuum—their individual function isn’t part of a bigger picture.

A compound software solution, on the other hand, is the bigger picture. When multiple applications and products are offered as part of the same software, it becomes a platform.

Rippling’s major selling point is its platform approach which means capabilities like reporting, analytics, permissions, approvals, and workflow automations are deeper and more comprehensive, since they work throughout the platform and all its apps. All the data is available across modules in real-time because they are all interconnected — this is the power of bundling.

We’re never going to win on these “head-to-head” features; our goal is always to tie. — Parker Conrad

Rippling isn’t trying to win on an individual feature basis because that is not the magic of a compound startup. As long as Rippling can tie on a feature basis then Rippling usually wins against the competition because of the unified platform capabilities.

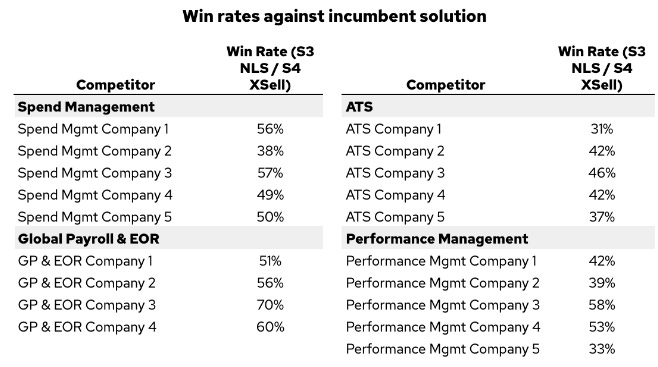

This is why Rippling has been able to consistently win with its relatively new products against legacy competitors. It’s not because Rippling has more or deeper features….

The below image is from their Series F memo. It shows Rippling’s win rates against competitors across the major segments that they compete in. What’s notable about their win rate here is that these products are fairly new for Rippling and they are going against much larger competitors with richer individual feature sets.

3. Bundled Pricing and Contracting

From a pure financial standpoint, there can be some significant cost savings from bundling. Compound startups like Rippling can price much more competitively because of their ability to bundle lots of products.

This efficiency can be seen on the other side by looking at a compound startup’s CAC payback period. Ripplings CAC payback period has continued to decrease as they layer on more products and the cross-sell revenue becomes an even larger portion of their ARR. With a 10 month payback period (yellow line), Rippling can afford to price their products much more competitively than the majority of point solutions.

I have seen this so many times when evaluating vendors. A point solution versus a bundled product - the bundled product is almost always less expensive because of their ability to share costs.

While a point solution has to optimize revenue from a single SKU, a compound startup can optimize for the bundled price. Compound startups can maximize the price of the bundle, but undercut on price for each individual product.

Imagine a company that purchases 5 different point solution tools versus a bundled solution:

Each point solution vendor has to make margin on that one product and they have to cover all of their costs (sales/marketing, compliance, security, etc.). Winning new logos is time-consuming and expensive!

There are 5 separate renewal conversations

There are 5 different customer support teams

There are 5 different devops teams

etc

This not only limits a point solution’s ability to be competitive on price, but there is also a major admin burden on the customer. When each individual product operates in a silo there are more people costs to maintain and manage these systems.

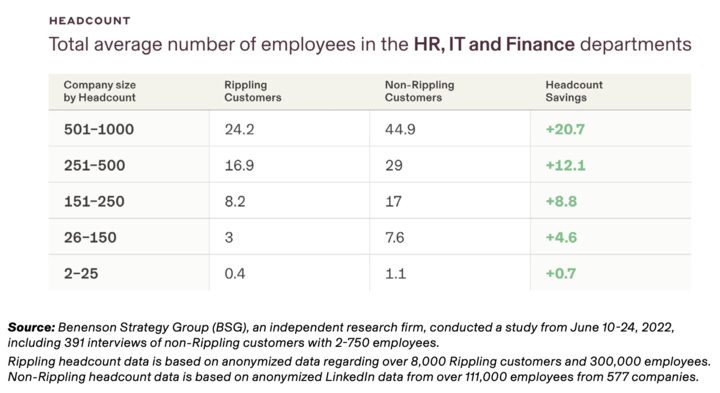

Below is also from Rippling’s Series F memo which claims that Rippling customers have 50% lower headcount in HR, IT, and Finance…

Compound Startup Challenges

Larger Upfront Investments

A compound startup is building multiple products in parallel so this requires more upfront investments. This is similar to a point solution in regards to the revenue scale required to payoff its R&D investments, but amplified given the number of products being built. These upfront investments may require more capital in the earlier days.

The difference with point solutions, however, is the efficiency that comes from building a platform and more code/assets can be shared across products.

Executing in Parallel

The challenge of a compound startup is that you need to be good at parallel execution across all of these different products. You're only as strong as your weakest link. — Parker Conrad, CEO of Rippling

Even larger, mature organizations with plenty of resources struggle with this so in order to be successful as a startup you better have a killer team that is all on board with this approach.

Compound Startup vs Eventual Platform

When I first heard about the compound startup idea it just seemed like an acceleration of going multi-product (and becoming a platform). You go multi-product from the start versus waiting.

Most companies plan to eventually go multi-product anyways:

You either die a point solution, or you live long enough to become a platform. — Kyle Harrison

But a compound startup isn’t just an acceleration of going multi-product. Parker believes if it isn’t part of a company’s DNA from the beginning then it usually won’t happen.

Focused startups often say they’ll broaden their scope as soon as they first build their first specific product. But according to Parker, this tends to not happen. He says that companies are fated to their initial makeup, ”I think a company’s ambition is circumscribed on day one when it’s founded—it’s hard to move beyond that.”

In addition to the above, companies that build with a compound startup mindset from the beginning think differently about the problems they are solving and therefore they build the product in a different way to more uniquely solve problems across systems/processes.

Final Thoughts

The time and skill required to build point solution software has declined rapidly - software development costs are rapidly approaching zero. The moat previously created through building complex and/or better software is diminishing.

One of the remaining moats for software companies is to build multi-product from the beginning (building a compound startup).

From a customer standpoint and a finance lens, vendor consolidation is a high priority for me. Not only does it have the power to reduce tool pricing, but the savings from the reduction of complexity and processes can be huge.

Customers want really great software that also simplifies as many processes as possible. Best-in-breed point solutions are no longer enough.

Are all point solutions dead? No….but it is MUCH harder to compete today by just being a slightly better point solution.

Footnotes:

Get a free tool consolidation assessment → CFO Tool Consolidation Assessment

Sponsor OnlyCFO: Reach 30K+ finance/accounting professionals

Check out Rippling’s compound approach

Great article, as always, thanks!

The economics of the bundling/platform model make a lot of sense, but I'm not sure who the buyer is. Is it the CTO? The Chief People Officer? The CFO? Coordinating budgets across multiple functions is difficult, so who would be the ultimate decision maker?

Love this article, thanks for sharing!