The Focus on People Costs

70%+ of total costs are people related for software companies

In this post I cover why employee-related costs are so important to companies. I also do a Q&A with the CEO and team at Pave who provide interesting insights on compensation trends and benchmarks.

Before we get to compensation data/trends, we need to understand why employee-related costs are so important…

The reason software companies get big valuations compared to their revenue is that they have the potential to become cash printing machines at scale (30%+ free cash flow margins). What many investors quickly realized in 2022 though is that not all software companies’ ability to generate free cash flow at scale is the same. At the peak of the software valuation bubble in 2021, revenue growth was all that seemed to matter, but once that bubble popped a healthier balance between revenue growth and future free cash flow emerged.

A lot of public software companies are now down 70%+ from their peak in 2021. Private software companies understand that their previous 2021 valuations aren’t reality anymore (at least the smart CEOs do) but these private companies have the benefit of not seeing their stock trade down every day in front of the world.

Companies are now frantically trying to prove that they too can be highly efficient at scale…

Rule #1: Maximize Shareholder Returns

The majority of companies exist for one primary reason - to maximize returns for shareholders. Smart people are essential to that mission, but it is not the reason for a company’s existence.

Shareholder returns increase when stock prices (company valuation) increase.

What causes a software company’s stock price to increase?

A company’s stock price can increase from:

Increasing the level of revenue

Increasing valuation multiples (i.e. multiple expansion) such as EV/Revenue

The first one is obvious - the more revenue a company generates, the more it should theoretically be valued. The second point is where people can get tripped up because valuation multiples can be a moving target.

Software EV/Revenue multiples can move based on:

Macroeconomic factors

Company-specific stuff

Macroeconomic factors at play right now are the rapidly increasing interest rates and the tech recession. As you can see below, software valuation multiples are highly correlated with interest rates. The zero-interest-rate phenomenon of 100x+ ARR valuation multiples was fun while it lasted 🤣

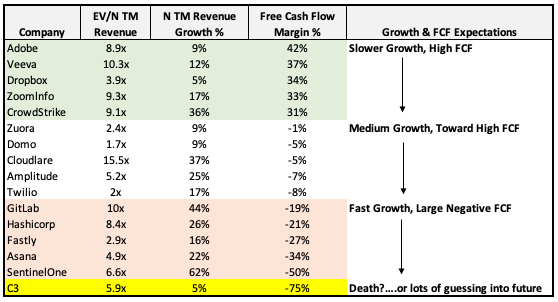

Company-specific stuff that is influencing software valuation multiples is the combination of 1) revenue growth % and 2) free cash flow %. In software metrics land we refer to this as the Rule of 40.

The reason it is called “Rule of 40” is because the idea is that a score greater than 40 is best-in-class. This efficiency score has the highest correlation to a software company’s valuation multiple. In 2021 revenue growth was significantly more valued, but now we have a healthy balance between growth and profitability.

Let’s see how this works with the below sample companies.

Slower growth companies need to have high free cash flow margins to receive high valuation multiples.

DropBox has really strong FCF, but growth is *really* slow so the valuation multiple is much smaller

As companies approach FCF positive they should still be growing relatively strong, otherwise, they are likely in trouble

Zuora, Domo, and Twilio all stick out here. They still have negative free cash flow, but they are barely growing.

The companies that are burning lots of money (large negative free cash flow) should be growing really fast.

C3 looks like it’s in trouble…but maybe having something to do with AI is keeping hope alive that the future will be promising

The revenue growth rates mentioned above, are the next twelve months (NTM) forecast while the free cash flow margins are current actuals. 2023 revenue growth is coming down significantly for most software companies as a result of economic headwinds.

So if revenue comes down, free cash flow must go up in order to receive the same relative valuation multiple.

And now to the main point of this post…

Payroll Accounts for 70%+ of Expenses

Direct payroll-related costs typically make up 70%+ of a software company’s expenses. But even this percentage likely underestimates the cost of headcount because there are also indirect costs associated with people - a big one is all the software licenses that are purchased for people.

Payroll costs are the biggest lever companies have to increase the free cash flow part of the equation in order to boost their valuation multiple - adhering to rule #1 of maximizing shareholder value.

Yes, layoffs suck. They are terrible for everyone involved and they create enormous amounts of stress, anxiety, etc for those impacted. Companies should take layoffs very seriously and do them in the best way possible.

But…they are sometimes necessary even when companies generate enormous amounts of money because of rule #1. Ideally, companies hire the right amount of people for their growth trajectory and layoffs would never be necessary, but unexpected macro events and company-specific stuff happen. The problem for most software companies is revenue growth seemed unstoppable in 2021 but then we all ran into a brick wall…

Revenue growth is significantly slowing down for most software companies in 2023. Related to that, there are macro headwinds (rise in interest rates) that have brought valuation multiples down from the clouds (pun intended).

If revenue growth comes down, then companies must show stronger efficiency and ability to generate better free cash flows.

Hence layoffs even at very profitable companies are happening. A lot of these companies got way ahead of their skis as they planned for a longer time in high growth mode. As growth slowed dramatically, they need to show that they can be more efficient.

High revenue growth can hide inefficiencies, but when growth slows, the ugly inefficiencies appear for everyone to see.

If cuts need to be made, companies should start with non-headcount items first because there is likely other waste in the company. But given how large payroll costs are relative to everything else, companies often have to consider making changes in payroll to really move the needle.

Final Thoughts

Every software company is thinking about its payroll costs right now. Whether they have already done layoffs, thinking about layoffs, freezing hiring, deciding how many promotions or raises employees will receive in 2023, and considering what everyone else is doing in regard to compensation. Given the size of the payroll line item, companies are talking about it and trying to do what is best for both the company and employees to ensure long-term success.

Thanks to Pave for providing some great insights on compensation in the below Q&A! Pave is an amazing resource for both employees and employers on all things compensation.

Q&A With Pave

There have been a lot of changes in the world of compensation trends and best practices in the last few years. So I asked the CEO and team at Pave some questions about what they are seeing. They have some of the best data on employee compensation.

Tell me about Pave

We’re a compensation company with the mission to make pay fair. We support over 5,000 companies with their compensation benchmarking, communication, and planning needs. I started the business in 2020 after realizing that compensation is the #1 spend line item for really any company, yet the tooling and data to help navigate comp decisions are stuck in the dark ages. Pave is a Series C company backed by incredible investors like Andreessen Horowitz, Index Ventures, YC Continuity, and so many more.

What is the most asked question in this environment regarding comp?

Funny enough, the question hasn’t changed from 2020 to today. “How much should I be paying my employees?”. During the early COVID boom when hiring markets were on fire, and employees were moving out of the big cities, companies were trying to navigate rapidly inflating salaries, and today companies are trying to do more with less.

Thanks to our dataset of ~500K real-time compensation data points, we’ve been able to pinpoint the standard behavior companies are taking in difficult times. As a rule of thumb, we’re seeing wages remain relatively inelastic. Businesses are much less likely to reduce compensation than they are to lay off employees. We saw a massive increase in the frequency of layoffs since May of last year, and while the rate of new layoffs seems to have decreased, we’re not sure that this trend has run its course.

Are you seeing any shifts in comp trends this year?

Almost any company with 100+ employees runs an annual or semi-annual compensation merit cycle. Usually attached to the back half of a performance cycle. Historically we’ve seen a ~10% increase in payroll across the board (performance + promotion) with each cycle. Early data in H1 2023 is showing closer to a 5% increase in salaries, likely indexing towards higher performers versus across the board compensation increases.

What are you seeing companies do with equity as tech valuations plummet?

We’ve heard an increased interest from public companies adjusting their equity packages (usually adjusting up the number of issued RSUs / shares) to make up for underwater equity. We’re still early in this trend and expect to see this early behavior become a trend if the hiring market rebounds ahead of public valuations. This hasn’t yet hit private companies likely due to the lag in private market valuations. We expect a different narrative in 12-18 months when down-rounds are more prolific.

Given the focus on cash on startups are you seeing companies offer more equity vs cash raises?

We’re not yet seeing an equity / cash tradeoff from our customers (or below LinkedIn poll we ran), rather just a bit more conservatism when it comes to salary increases.

What is something unique you do at Pave in regard to employee compensation?

The most unique thing about Pave’s compensation culture is that 100% of our employees have access to our full compensation benchmarking dataset. We think this sort of transparency is the future. One where the information asymmetries between employers and employees is closed. We take compensation very seriously and put in a lot of effort to ensure our bands, job architecture, and overall philosophy are thoughtfully designed!

Thank you Pave team!