The Future of Software Pricing

Your pricing model is killing deals!

Today’s Sponsor: NetSuite

New technology brings new opportunities. It also brings hype, "fear of missing out," and disappointment. AI is proving to be no exception to this rule. So the questions that many of us are currently considering include "What is AI really?", "Can it help us succeed?" and "Are we missing out?"

Download this guide from author and founder of Made to Measure KPIs, Bernie Smith, on KPIs, analytics, and decision-making.

AI is Changing the Game

AI is transforming the way companies must price their products, yet many businesses are either failing to adapt or they are adopting ineffective pricing models.

A great product with a bad pricing model can still fail. There are lots of great products…

Companies need to make pricing a core part of their strategy, which is a major shift for most companies that historically spent little time on pricing. Your chosen pricing model can be a growth lever, but it can also kill your company if you get it wrong…

👇Keep reading for my thoughts on pricing in 2025, pricing data, and other insights.

The State of Software Pricing

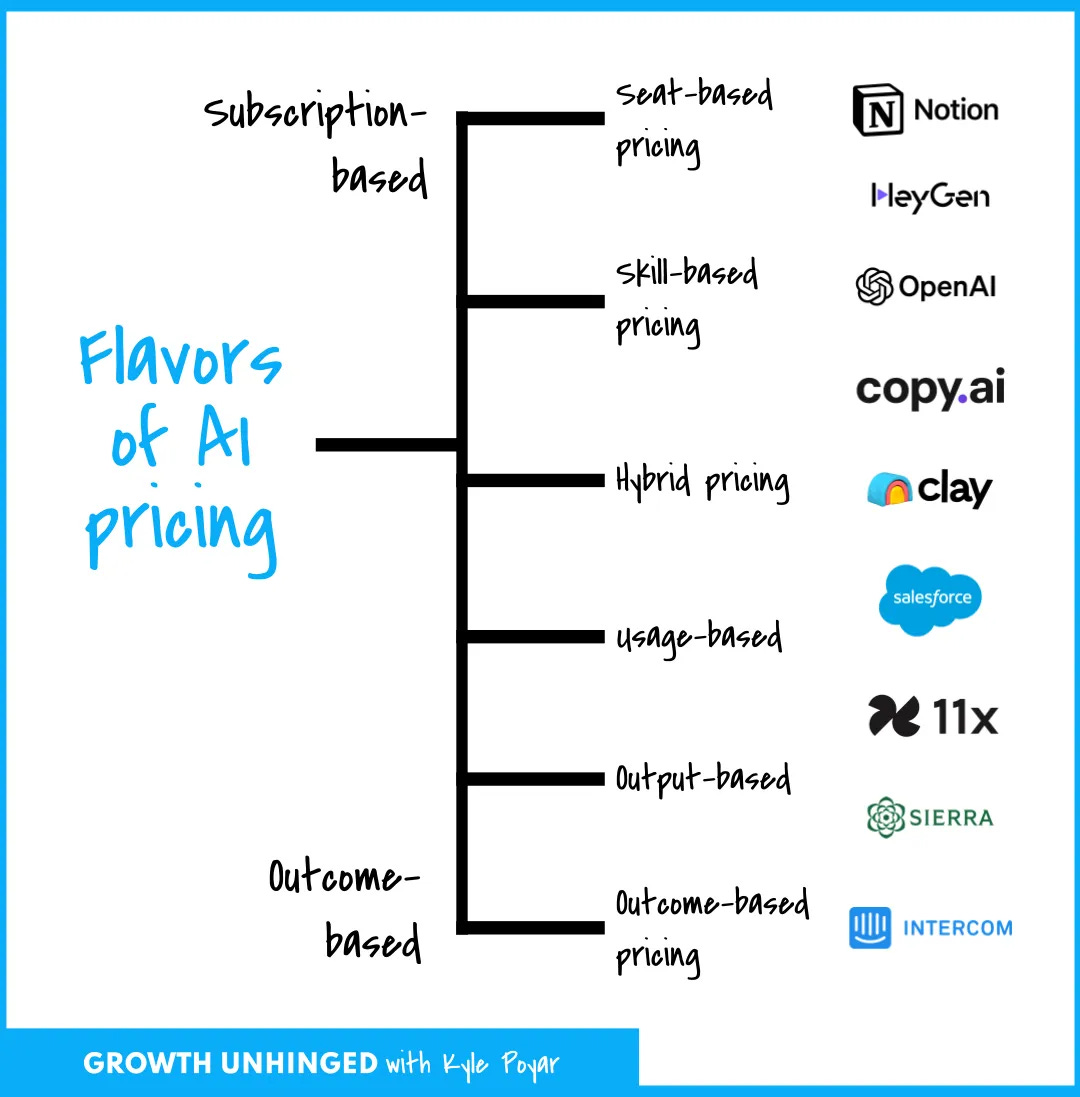

Kyle Poyar is one of the best people I know on all things pricing and he has some fantastic data. Below is a great summary from Kyle on the “flavors of AI pricing” and examples of each.

*Also, check out this webinar with Kyle and Metronome next week on “The Future of SaaS Pricing”, which will be great.

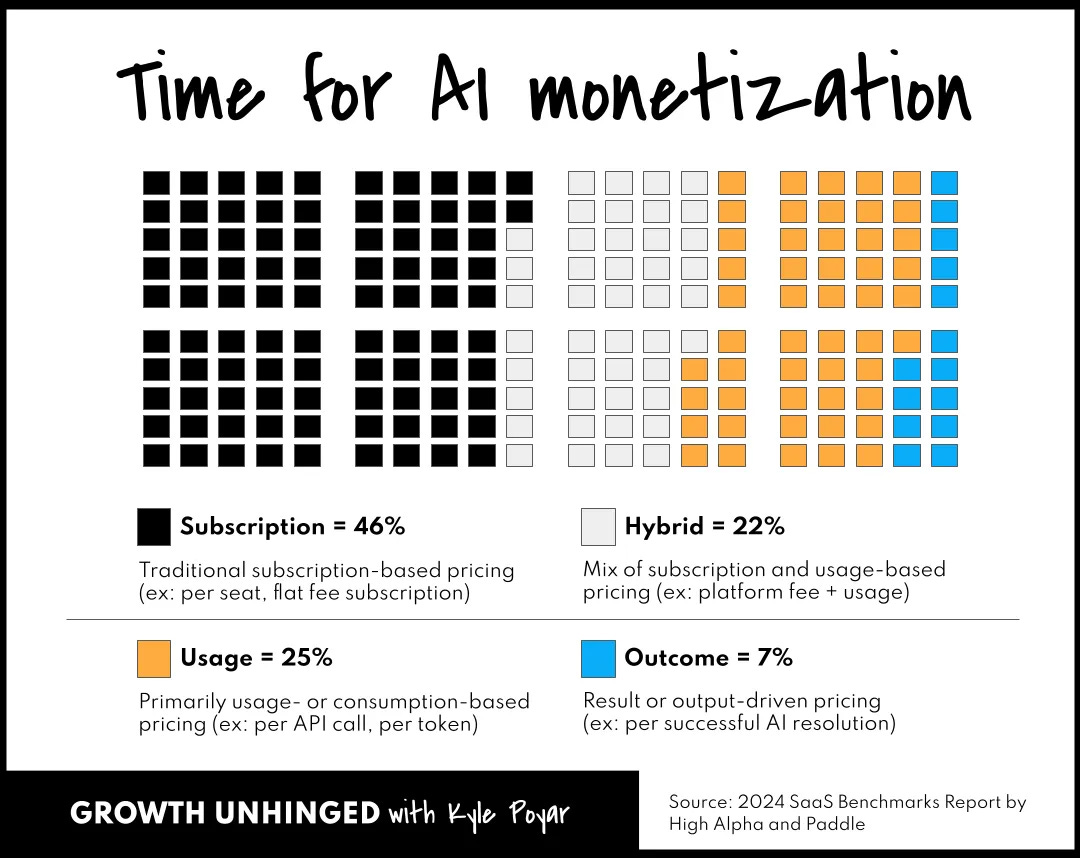

The number of pricing model options is very different from when I started in the SaaS industry and essentially everyone was just on seat-based pricing. It was easy back then…but as technology has shifted, so must our pricing models. How value is delivered and the related pricing has become A LOT more complex.

As a result of these changes, the number of non-seat based pricing models is skyrocketing.

Recent data from Metronome (billing platform for usage based pricing) showed the following:

78% of companies with UBP adopted it within the last five years.

64% of fast-growing young companies operate on a UBP model (of Forbes’ next billion-dollar startups)

What pricing model is superior for AI?

It depends. Seat-based pricing certainly makes less sense for most software tools as AI features cannibalize the number of seats needed, but there are still a large number of flavors of pricing models that can make sense in an AI world.

A specific pricing model is unlikely always going to be superior than others. Rather the ideal pricing model will depend on how the product and value is delivered. In other words, don’t just copy other hot software/AI companies’ pricing model. Spend time determining which one is best for you!

What Buyers Want

I have purchased A LOT of software tools in my career - as both the primary buyer and as the finance leader giving final sign off. Here are the top pricing issues that have caused me to kill a deal (or at least push REALLY hard on it):

1. Weak correlation to value

I see this all the time now with AI features and some of the new pricing models. A company is told that one pricing model is superior for AI products so they implement it, but the correlation with value they their product is delivering is weak.

The pricing model must be strongly correlated to continuing value being delivered (new business and expansion).

2. Overly complex

I have seen many new AI features try too hard to be very scientific about pricing, but then it becomes too complex for anyone to understand (including the salespeople selling it).

If a salesperson can’t clearly articulate the pricing model and its value then it is too complex. It might even be the strongest correlation to value (#1 above), but if it is too complex to understand then that is bad too.

3. Hard to forecast

CFOs need to be able to accurately forecast costs. This was a major pro for seat-based pricing — forecasting was super easy.

Non-seat based pricing is almost always harder to forecast. You must provide tools and/or clear logic necessary for customers to forecast their spend. This is why overly complex (#2 above) pricing can be bad…if I can’t understand it then it will be hard for me to forecast.

CFOs have tight budgets to live by so they don’t want vendor spend that they can’t control/forecast screwing up their budgets.

4. Hidden costs

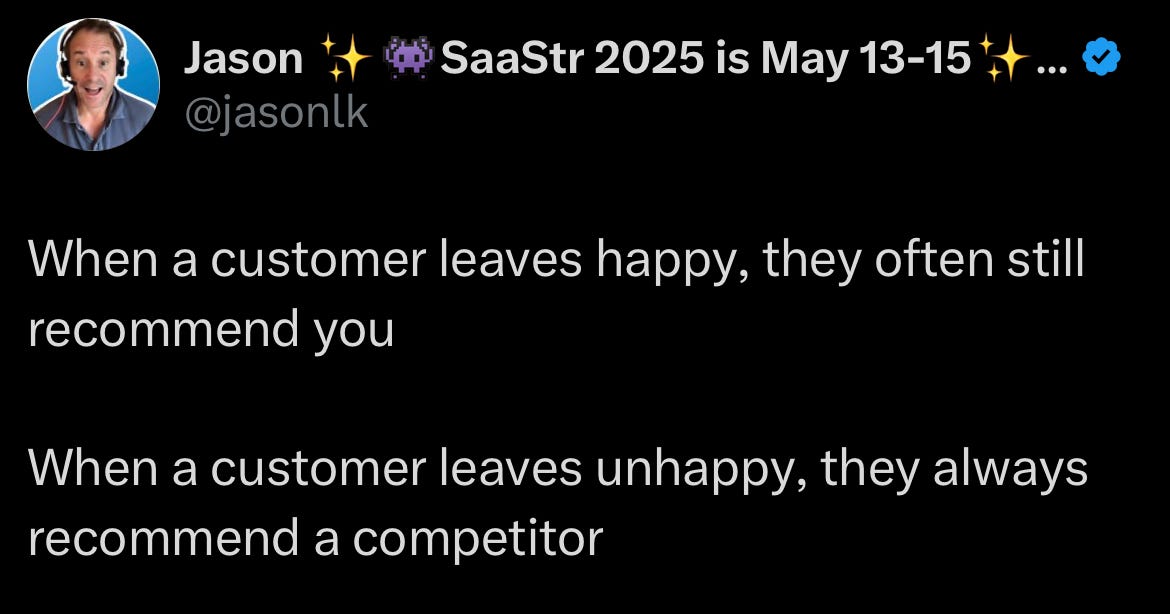

I am always on the hunt for the costs salespeople aren’t telling me about. Salespeople often get deals done but not being transparent here, but it always comes back to bite the vendor.

Customers will churn and talk poorly about your company’s pricing and cost of software.

It’s not worth it. Be upfront about all pricing and how to forecast the full spend.

Pricing Pressure

The ceiling on price is the perceived value you deliver, while the floor is the alternatives. AI will cause the floor to rapidly fall, but what is it doing to the ceiling?

The Floor: Moats in software are diminishing as software becomes 100x easier to create. More alternatives mean more pricing pressure and a lowering floor.

The Ceiling: I think temporarily we will see the ceiling rise for many products because of the massive value these AI products can bring. AI can not only save time, but actually replace headcount which is significant savings. But longer-term that ceiling will fall as AI changes expectations — we will no longer anchor the price to replacing headcount. Some products will be able to keep the ceiling high while others will see it drop significantly over the next few years.

The more basic/simple software apps are going to see pricing slowly (and maybe suddenly) get squeezed. The companies that will succeed with these types of apps will be the ones built for efficiency. The typical VC-backed model will break for a lot of these types of companies.

Companies with real moats will be able to keep the ceiling higher and prevent their floor from collapsing too quickly.

Final Thoughts

Too many of you aren’t paying enough attention to your pricing model. It’s a significant change from when seat-based pricing was standard and you could just “set it and forget it”.

Companies NEED to spend more time evaluating and reviewing their pricing model.

Lots of companies are losing deals because of bad pricing models. They may have the superior (or close to it) product, but pricing kills the deal.

Footnotes:

Download this guide on KPIs and metrics to pay attention as you think about AI’s impact

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Probably like many solution providers, I am almost always agonizing about our pricing model. This actually provided clarity on why our pricing is structured as it is and now, for the foreseeable future, will remain a subscription model.

Our basic pricing is based on active contacts and seats. Only three features are not included in a basic subscription, e.g. the Twilio integration (replaces Gong), the expanded social deck powered by Ayrshare, and the custom chatbot builder. Otherwise, every account, starting from $150/month and up include all the same features.

As far as the discussion about the effects of AI on headcount, that is up to our customers. All of the AI functionality we've been adding for the last two years is included and designed to help people work smarter, faster, and may reduce headcount. We see Seats being for highly productive people who need access to a broad spectrum of tools and the support to leverage them.

I've come to the conclusion this is the simplest, most equitable model for an enterprise-level solution like Venntive.