The IPO Preparation Guide

Deep dive into IPO preparation and things companies should be thinking about now

Today’s Sponsor: NetSuite

CFO's Ultimate KPI Checklist: 50 Step-By-Step Checklists to Drive Your Company's Success

Maximize your business’s success by measuring the right KPIs. Get clarity on which metrics should represent your company’s needs and goals HERE.

An IPO (initial public offering) is where a private company lists its equity on a public equity index (secondary market) for the first time. The private company goes from being “private” to being listed (or a “public” company).

The “IPO window” (best time to go public) has been mostly closed for the past two years, but that could start to change in 2024. There were only a few tech IPOs in 2023 — Klaviyo and Instacart. Reddit is planning to IPO later this month.

There are a TON of software companies thinking about an IPO within the next few years. Below is a comically large list of “unicorn” companies — private companies that last raised money at a $1B+ valuation.

If all of these companies were to go public, we would have an IPO every day for the next 5 years! 🤣

IPO Prep Timeline

In 2021 every Silicon Valley tech company seemed to think they were going to IPO in 1 - 2 years….Anyone who understands what is required to IPO would quickly realize that most of these companies were not remotely close though.

There are two primary aspects of being IPO ready:

Public market investor ready

IPO/Public company ready

Both of these are critical and both are frequently underestimated.

1. Public Market Investor Ready

Being public market investor ready is by far the hardest hurdle to an IPO. The big question is if public market investors will be interested and excited about the company and can the company maintain that enthusiasm. If not, then the company will struggle with an IPO and being a public company.

There are plenty of companies that IPO’d in 2021 that should never have been public companies (most SPAC transactions). These companies’ stock prices since their IPO have cratered….But now they are public they have the high costs and scrutiny of being a public company.

What does it take for a software company to IPO?

Meritech did a post on SaaS companies that went public in 2021. Here are some of the results (all non-GAAP):

Revenue: $225M in ARR and ~$185M of LTM revenue.

Growth: 55% year-over-year revenue growth

Gross Margin: 74%

S&M %: 46% S&M spend as a % of revenue.

R&D %: 22% LTM R&D as a % of revenue.

G&A %: 17% LTM G&A as a % of revenue.

Profitability: Still losing money with a (9)% operating margin.

Revenue growth was clearly great in 2021, but they were also very unprofitable on average.

What will it take to IPO in 2024?

Klaviyo was the only SaaS IPO in 2023. At its time of IPO Klaviyo was growing revenue at 57% (at $585m LTM revenue) and 24% free cash flow margins, which is a Rule of 40 score of 71 (very very good).

These are the type of metrics that will be expected in the non-ZIRP IPO class of 2024. There is clearly an increased focus on gross margin and profitability, but revenue growth still needs to be strong as well.

Revenue growth is the most correlated metric with revenue multiples, but companies have to be showing efficiency to get full valuation credit for their revenue growth. Companies thinking about an IPO should look at current public market comps to understand what might be expected of current IPOs.

Look at how fast public software companies have been able to improve FCF margins in the past couple of years!

Any 2024 IPOs will need to also show strong FCF improvements. My guess is most 2024 IPOs will already be FCF positive or show evidence of rapid improvement toward it.

2. IPO/Public Company Ready

While the hardest part about getting ready for an IPO was the previous section (i.e. having an amazing business), getting the company actually ready to be a public company can take a surprisingly long time and require a lot of hard work.

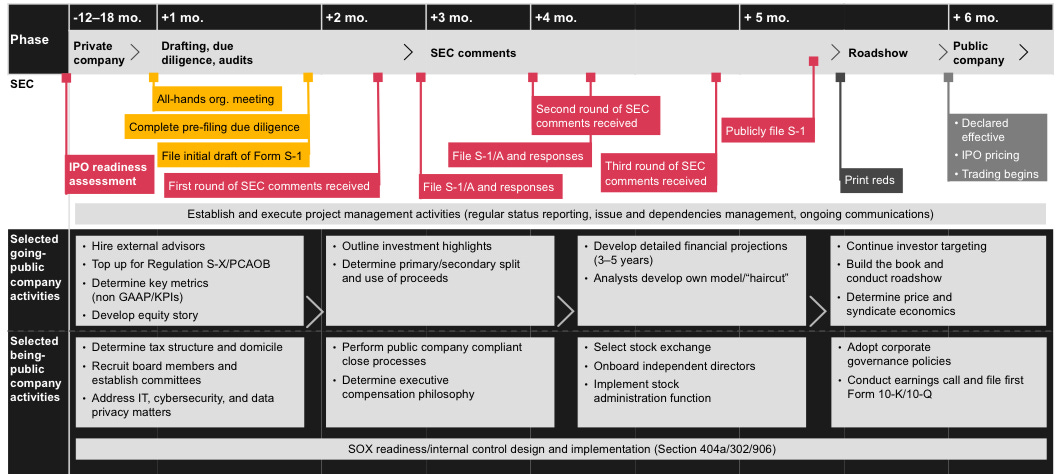

In the next section I will go into some of these requirements (specifically on the finance/accounting side). Below is a summary from PwC on rough timelines and milestones for an IPO — the biggest takeaway is that IPO planning should start 18 to 24 months before the IPO.

IPO Preparation

Creating the IPO & Public Company Team

The management team is the single most important, non-financial factor in preparing for an IPO and being a public company. But beyond the management team there are A LOT of people both internal and external to the company that you must get right for a successful IPO and life as a public company. Many people start thinking about these things way too late…

The Board of Directors

Determine early if your board composition will satisfy SEC and listing exchange requirements so you have time to make the necessary changes. Boards are required to have a majority of independent directors within one year of being public.

Finding good independent board members can take time. Begin early so you can find the right people.

Set up the required board committees. The first two committees below are frequently established earlier while the third is often set up shortly before an IPO.

Audit committee

Compensation committee

Nominating & corporate governance committee

The CFO Team

The most responsibility for IPO preparation is on CFO’s team — specifically the accounting and finance departments.

At the top of this team is obviously the CFO. Having the right CFO with IPO and/or public company experience will make things way easier and smoother. It can be OK for the CFO to not have IPO experience (many have done it) but they need to rely heavily on their network and advisors for help through the process.

Below are a few of the important resources that companies need to think about:

Technical Accounting - Should have someone internal but will likely also need outsourced technical folks. There is lots to do in an IPO process to make sure all complex accounting matters are handled properly

Controller - You really want an accounting leader public company experience

Financial Reporting - Often not hired until IPO preparation begins but large private companies might need someone earlier. You will likely also need external help as well.

Tax Specialist - becoming a public company can have huge tax implications and a tax expert should be brought on early in the process to help with optimal legal tax structures, internal controls, tax positions, etc.

Internal Audit - Maintaining a proper internal control environment is critical, especially as a company prepares to be compliant with Sarbanes-Oxley Act (known as “SOX”)

Investor Relations - Often hired during some point of the IPO preparation process.

Management Team

Are there any other areas of the management team that need to be built out?

Do any current leaders need to be “topped” (i.e. add someone above them) with the right experience?

External IPO team

There are a lot of external experts and advisors you need during the IPO process.

Underwriters - These are the folks that run the show and should be found early in the process as they will help guide everything else.

IPO legal counsel - You should have a strong internal legal team too!

Capital markets advisors

Auditors - You may need to upgrade to bigger firm if you aren’t using Big 4. Also, ensure you have proper independence with the audit firm.

Accounting Advisors - Your internal team still has their day jobs to do so the accounting advisors will help with additional technical accounting documentation, drafting financials needed for an IPO, etc.

Risk Advisors - help support and enable companies to become SOX compliant

Accounting & Finance IPO Preparation

Accounting is the #1 reason for delayed IPOs. A delayed IPO can add significant risk into missing the IPO window, so it is important to get ahead of these issues early.

What financial information is required?

An S-1 is a document that the SEC requires companies to file in order to publicly offer new securities (i.e. an IPO). The S-1 is a couple of hundred pages document that contains a ton of information about the company. It is NOT just financial statements and disclosures that your accountants can handle.

There is a massive amount work to prepare the S-1 and basically your entire IPO team will be involved. While your accounting team may own a large portion of the required work, it will be time consuming for many others as well.

S-1 Financial Requirements

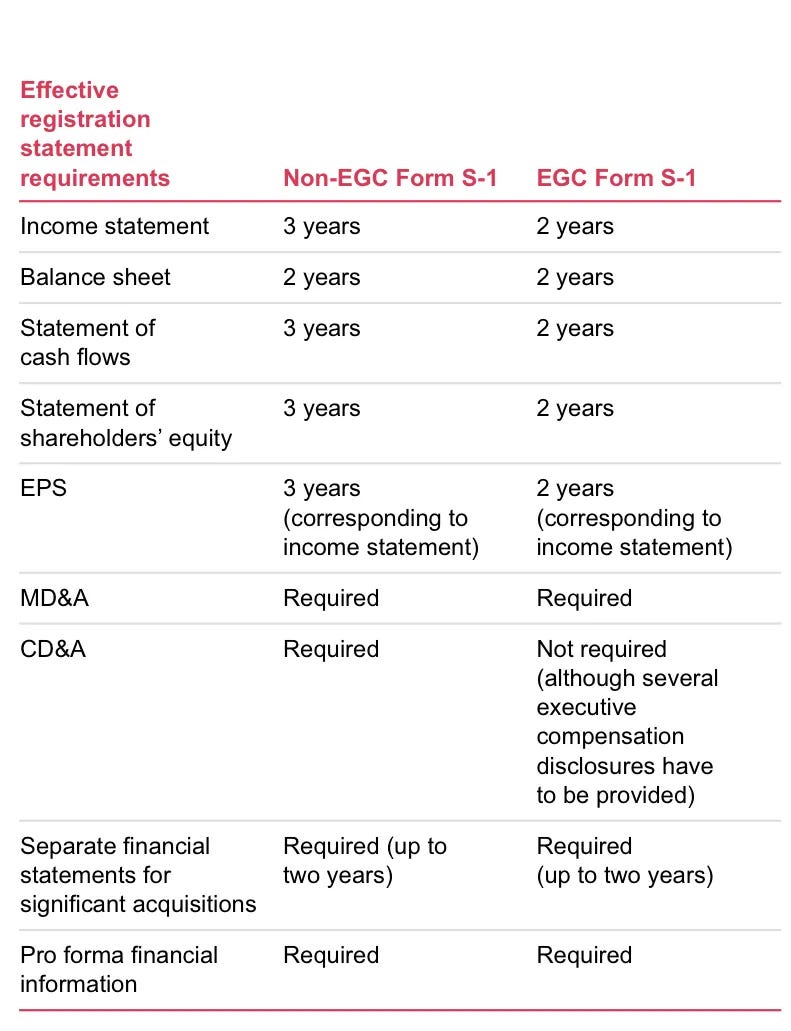

Most tech companies IPO under the EGC (emerging growth company) requirements. The Jobs Act of 2012 provides a time period of relief from certain public company requirements:

Less financial reporting requirements (2 years of financials vs 3 years)

Can adopt new accounting standards at the same time they are required for private companies, which is usually a year later.

Provide less detailed executive comp disclosures.

Exempt from the requirement to get an audit over internal controls over financial reporting

While these exemptions provide a ton of relief, companies need to monitor when they will no longer qualify for these EGC exemptions so they are prepared to meet the full public company requirements.

Below is a nice summary from PwC of the financial reporting requirement differences between EGCs and non-EGCs.

Getting the auditors involved early is critical because even the EGC requirements can take a long time. The below two items are two of the major milestones that the internal accounting team and auditors must perform:

“Audited” financial statements for the last two years

“Reviewed” quarterly financials for at least 8 quarters

In addition to the annual audited financials, companies will want to present the last ~8 quarters of financial information so investors can see a trend. Quarterly financials don’t need to be audited but they must be “reviewed”.

Having been on the other side of this (as a Big 4 auditor) both of these (annual audits and quarterly reviews) can take a REALLY long time. Audits are by far the most time intensive, but the reviews can take quite a bit of time as well for both internal resources and for the auditors. If your company hasn’t been closing the books properly on a quarterly basis then they may have a lot of work to make sure each quarter is correct (often referred to a “quarterization”)

Accounting Issues

There are a lot of complex accounting areas and SEC hot topics that companies should make sure are buttoned up early in the IPO prep process. Below are many of the ones I have seen that require a lot of work and/or frequently receive SEC comment letters.

Non-GAAP stuff and KPIs - The SEC pays a lot of attention to these areas and they are a frequent area of SEC comment letters (a letter from the SEC requiring a response from the company)

Risk factors - Legal helps drive this but it can take a lot of work to capture everything.

Revenue recognition - Revenue is the most critical line item on the financials so it receives a ton of attention.

Cheap stock - Refers to equity awards issued 1-2 years before an IPO that is significantly below the expected IPO price. If the fair value of those awards were significantly less than the IPO price there may be concern that not enough expense is being charged.

Acquisitions - Material acquisitions within the 2 year financial requirements may require separate financials for the acquired entity. Be careful with acquisitions during this period as it could delay an IPO because of this requirement.

Related party transactions - The SEC requires >$120k. Start tracking related party transactions early

Management Discussions & Analysis (MD&A) - The SEC loves to poke here and provide comment letters.

Consolidation accounting

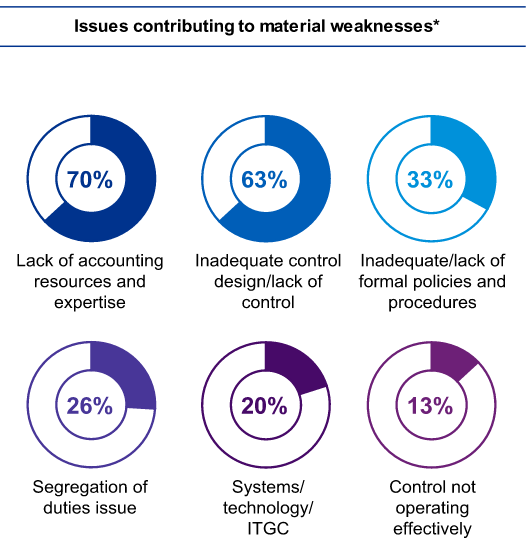

Control Environment - While there are certain SOX exemptions for EGCs, companies still need to disclose whether there are “material weaknesses” in the financial control environment. A material weakness means that controls are bad enough that there is a reasonable possibility that material misstatement in the financials may exist.

The below image is from a KPMG study on material weaknesses of recent IPOs. A lot of IPOs have a material weakness, but you need to make sure it can be quickly cleaned up. The last thing you want is to add a material weakness after you go public.

Other Accounting Considerations

Can the team consistently close the books timely and accurately?

Upgrading systems and tools appropriate for a public company (like NetSuite)

Evaluating the impact to NOLs (net operating losses) with an ownership change of IPO. When there is a 50%+ ownership change over 3 years then some of the company’s NOLs will be limited, which can create a major tax loss once the company is profitable.

Perform tax analysis to understand tax exposure and ensure proper sales tax, VAT, GST, etc are being properly collected and remitted.

Finance & Investor Relations Considerations

Finance IPO Preparation

By far the most important requirement is for the finance team to be able to consistently provide accurate forecasts. The public markets will destroy a company that is unpredictable and can’t accurately forecast revenue and expenses.

One of the most important things in preparing to IPO is acting like a public company for at least one year before the actual IPO. The finance team needs to show they can set accurate forecasts and create a good “beat and raise” strategy where they consistently beat forecasts (by a reasonable margin) and raise forward looking guidance.

Executive Coaching & Education

Many CEOs and other executive team members don’t have IPO experience and/or it has been a while before they have been at a public company. These folks (and the broader company to a lesser extent) need to be educated and coached in preparation for being a public company

As I mentioned earlier, acting like a public company at least one year before an IPO is critical. Part of acting like a public company is performing mock analyst and investor presentations, test the water meetings, roadshow presentations, etc. Earnings calls and investor presentations become a major part of life for a CEO and CFO. They need to be handled well so preparation and practice are key.

Other IPO Preparations

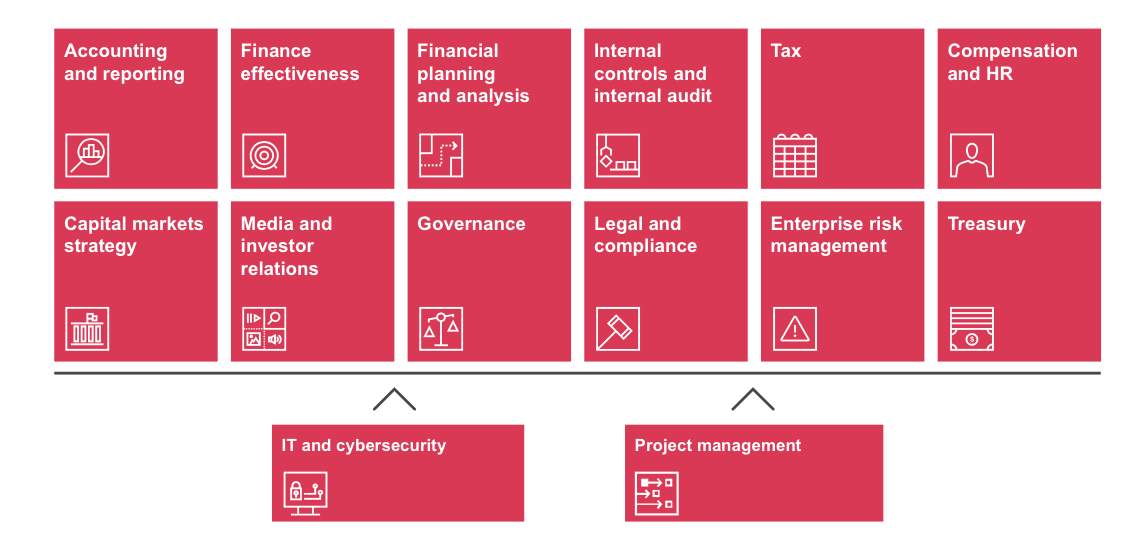

As you can tell from all the work mentioned so far, IPO preparation is a company-wide effort. While a lot of the work is concentrated in a few areas, a successful IPO requires a lot of cross functional work.

Here are some other things to think about in IPO preparation:

HR and policies - Make sure all of these are updated and will meet a public company’s needs

Rule 701 - Your lawyers are hopefully tracking this…

409A valuation reports:

Increase frequency to quarterly 1-2 years before an IPO

Switching to the PWERM method 1-2 years

Related party transactions - Make sure you consider this early and have a policy in place. It never looks good when there are a bunch of related party transactions with the CEO and their family (check out Domo’s S-1 for a bad example of this)

Corporate insurance needs - Exposure to liability is much higher for directors and officers of public companies than for private companies. Talk through required insurance changes with an experienced broker.

Concluding Thoughts

There is no way to cover everything a company should do in preparation for an IPO without it being a thousand pages long, but I think I touched on most of the key areas.

The biggest takeaway is that preparing for an IPO can take a REALLY long time, a lot of work, and can be very expensive. So start the conversations early (two years in advance).

Also, get the right advisors early in the process to help guide you through it.

Looking forward to hopefully seeing more tech IPOs in 2024!

Footnotes:

Join the community of finance and other leaders of software companies!

Sponsor OnlyCFO Newsletter and reach 16k+ CFOs, CEO, and other leaders in the software industry.

CFO's Ultimate KPI Checklist: Check out this great checklist of KPIs that companies and CFOs should be tracking