The Metrics to IPO | Brex IPO Soon?

From high cash burn and slowing revenue growth to cash flow breakeven and a massive reacceleration of growth

Spend smarter and move faster with Brex, today’s sponsor.

CFOs finally get speed AND control.

Control usually means red tape, speed usually means chaos. CFOs have been forced into that tradeoff for too long. Brex rewrites the rules: expenses flow in real time, categorized automatically, with full visibility baked in. It’s why 30,000+ global businesses, including 250+ public companies, trust Brex’s intelligent finance platform to spend smarter and move faster. Join them in breaking the tradeoff.

Brex IPO?

Brex (who happens to be today’s sponsor) announced last week that they reached $700M in total gross annualized revenue, 50% YoY growth, and is near profitability.

On a standalone basis, these metrics are already impressive…

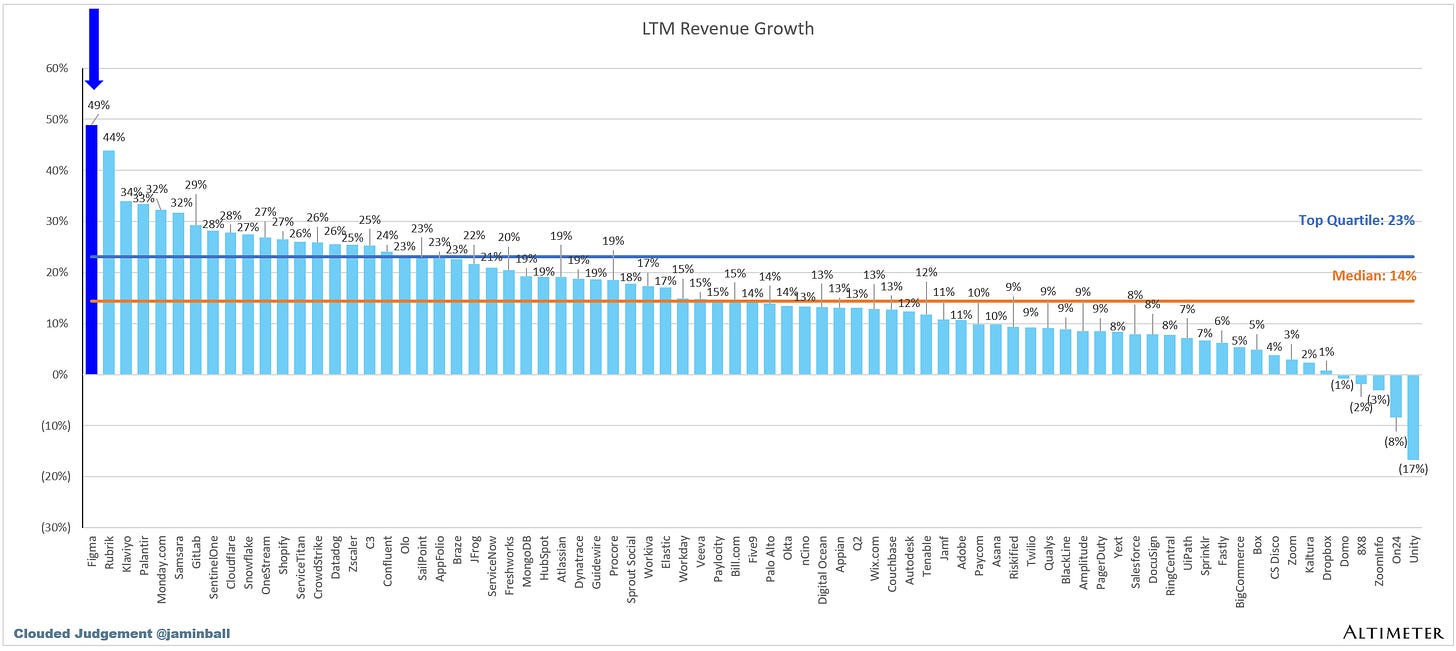

Revenue Growth

Brex would have the highest LTM revenue growth (ahead of Figma). While Brex’s revenue scale would be on the lower end for public software companies, the growth rate is still impressive given its scale.

For example, Netskope (a cybersecurity company that recently filed to go public) has 33% revenue growth at $700M of ARR (“total gross annualized revenue”). Brex is growing significantly faster than them at nearly the same scale and a similar burn rate.

Efficiency

Public market investors want evidence that a company can eventually be highly profitable, which is why recent IPOs have occurred when the company was near or above FCF breakeven.

With regard to when Brex would be profitable, Pedro Franceschi, Brex’s CEO, said:

It’s going to happen in the next two quarters, at this point it’s sort of inevitable.

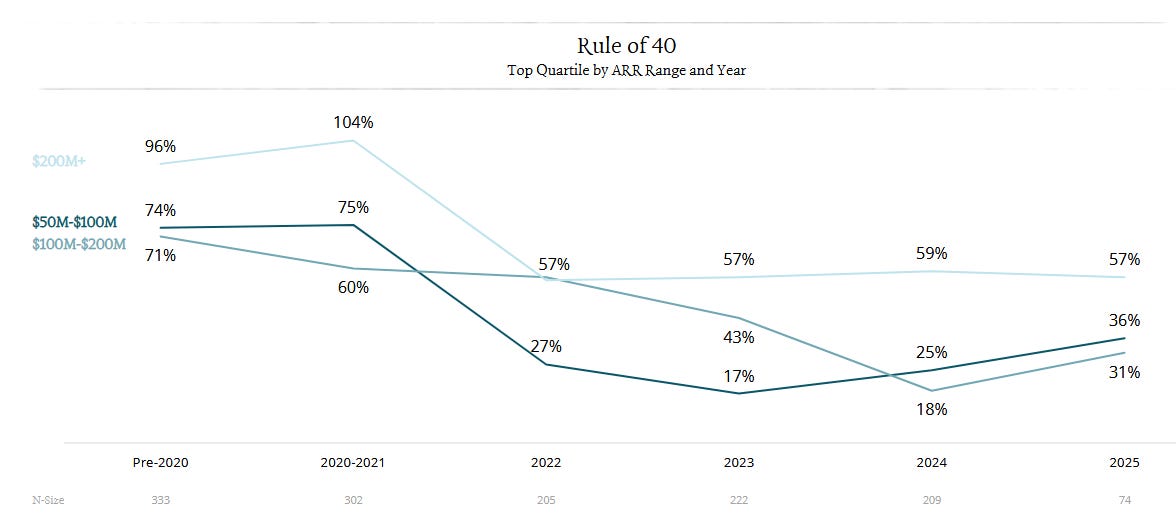

The Rule of 40 (or Rule of X) is a great shorthand for evaluating the balance between revenue growth and profitability.

Brex’s Rule of 40 Score = 50. This assumes Brex is basically profitable (or growth won’t change that much in the next 1-2 quarters when they are). A score of 50 would put Brex in the top 10 of public cloud companies.

If you compare it to ICONIQ’s recent report for all their portfolio companies above $200M in ARR, Brex is basically top quartile. And Brex is at a much larger scale than most of the companies that would be included in this group since it starts at $200M.

The Story Matters

Just the above numbers (revenue and efficiency) without any other context make Brex a strong IPO candidate, but it isn’t what makes Brex’s story really interesting. Brex didn’t go from 70% revenue growth to 50% growth, which would be a decent revenue growth decay.

Brex went through “hard times” and is now accelerating revenue growth while massively reducing cash burn…

Brex’s History

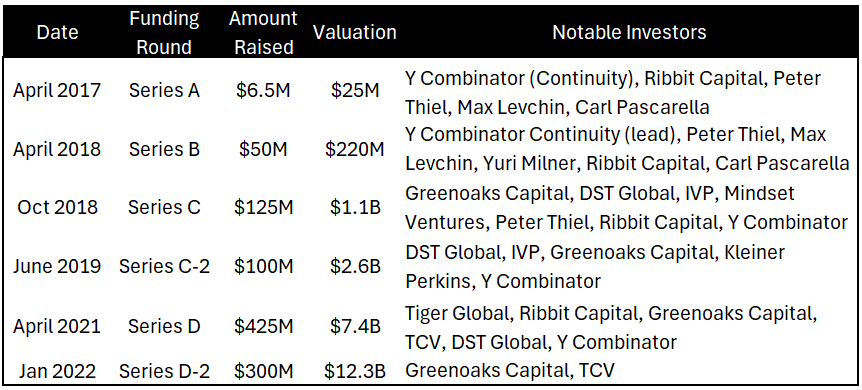

Brex was founded in 2017 and experienced incredible growth, so it was able to raise a lot of money at high valuations. It went from $0 to a $12B valuation in ~5 years. And revenue soared from $0 to ~$250M over the same period of time.

Like most companies building in this era (especially growing at the speed of Brex), cash burn was high and things weren’t very efficient. Companies accepted this as a trade-off with high revenue growth.

Brex Struggles in 2022

Brex was one of the fastest growing companies in the world. A bit of inefficiency was accepted given its growth rate — hired too many people, spent too much, tried to do too many things, etc.

So when revenue growth quickly slowed down from its astronomical levels in 2021, Brex’s unit economics started to break.

High revenue growth is a double-edged sword:

High revenue growth solves most problems in software

When revenue growth stalls all the problems are revealed

Brex’s cash burn got really high in 2021/2022. And in the context of Brex’s situation (slowing revenue growth) it was REALLY high.

If I play a little financial math detective, I would guess that Brex had higher than a 1x burn multiple during this time based on the revenue numbers and estimated cash burn that had been previously disclosed.

Is a 1x+ burn multiple good?

It depends. In Brex’s context at that time, the answer is NO.

Revenue growth was slowing quickly

Fintech revenue has lower gross margins so profitability needs to come faster

Uncertainty in the markets hit quickly in 2022 so everyone needed to reduce burn fast

Brex lost focus on its core card business and sales slowed because of that in early 2023 due to the competition.

The Turnaround

A few of the major changes Brex made are below. There is an obvious theme…(hint: focus and reducing excess).

Pedro Franceschi named sole CEO

Cut staff by 20% in early 2024

Cut management layers

Cut back on the number of products it planned to develop and focused on

its core credit-card business

Brex focused on their card business and went upmarket

I spoke with Ben Gammell, Brex’s President & CFO, earlier this year about the RIF and he said:

It was a cultural mindset shift. It wasn’t just finance saying we need to cut people to save money, but broad based executive leadership bought in that it will help them move faster. We needed to create an environment with less blockers of decisions and people who were doing the work closer to the decisions.

We were victims of our own success because things were going so well and Brex wanted to do everything. We lacked focus.

The Trend & Story Matters

Fast forward to earlier this year and Brex was forecasting 40% YoY growth, which was significantly higher than the growth they were reportedly doing in 2022. And now, just a few months later, Brex hit $700M at 50% YoY growth rates (continued acceleration).

And based on Pedro’s tweet, Brex plans on continuing to accelerate growth as it expands its European business.

When IPO?

Brex seems to have the profile and story to go public soon, so what’s next?

The IPO prep is definitely happening. They need to act like a public company for a few quarters — get accounting, finance, legal, etc ready.

They will want to show positive free cash flow, which Pedro said is coming in the next 1-2 quarters.

Want to show continued accelerating/high revenue growth (hint: Europe is part of their plan)

Want to clear their last valuation ($12.3B).

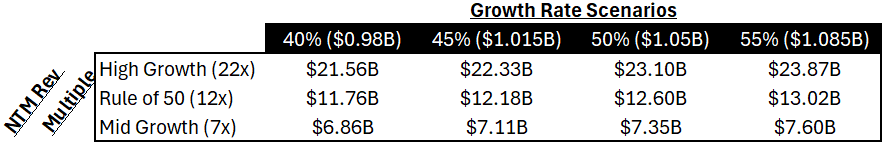

Valuation

So if they want to clear their last valuation are they close to doing that?

Yes. While Brex would be considered “high growth” based on the fastest growing public companies today, they are at a smaller scale and there are some major outliers that are pulling the “high growth” revenue multiple bucket up to 22x.

I think Brex could be around the Rule of 50 revenue multiple bucket in the chart below (a 12x NTM revenue multiple), which is based on other public cloud companies around the same Rule of 50 score.

The big question for public market investors is how to value a company like Brex that derives a significant portion of revenue from fintech, which generally has lower gross margins. How profitable can Brex become? This is where seeing Brex’s full unit economics (which will be more evident in an S-1) will be critical in determining its valuation.

Can Brex be a 20%+ FCF margin company? If so, then who cares if some revenue has lower gross margins. While getting to breakeven at Brex’s growth rate and scale is impressive, Brex will also need to prove it has strong unit economics and that it can eventually generate meaningful FCF margins.

Final Thoughts

Re-accelerating at $700M gross annualized revenue is awesome. And it’s REALLY hard. Not many companies have the muscle to make the hard decisions to do it.

The big open questions for Brex (or any other IPO candidate):

Getting to breakeven is awesome but it isn’t the end goal. Does Brex have the unit economics to become meaningfully profitable?

Where do they take their AI story? Will it be compelling?

Will Brex have high revenue growth endurance from here?

Good luck to Brex on their journey!

Footnotes:

Get CFO-specific playbooks, templates, and advice in the CFO Corner from Brex (today's sponsor)

Subscribe and share OnlyCFO with your friends :)

update?

Great post. Silly question here - why do you say that fintech generally has lower gross margins?