The Monthly FP&A Calendar

Best practices and templates for running the FP&A function

Today’s Sponsor: NetSuite

Board Meetings & Dashboards: I partnered with NetSuite on a deep-dive on How to Run a Board Meeting where I also give the financial dashboard template I use to walk my Board through the financials.

A great financial dashboard allows everyone to quickly get on the same page and start making important strategic decisions faster. Grab my template!

What does a well-run and efficient FP&A team’s calendar look like?

There are several workflows / calendars that FP&A follows. Three of the primary ones are:

Annual Operating Plan

Long-Range Planning

Monthly FP&A Calendar

I have talked about #1 and #2, but not really on #3 (and there isn’t much good content out there about it). But the monthly FP&A calendar is a critical foundation for a best-in-class FP&A org.

FP&A Monthly Calendar

What are the Objectives?

Facilitate strategic conversations

Obtain buy-in from department leaders

Support accounting’s close

Variance analysis between actuals and forecast/budgets

Update forecasts and investor guidance to prepare for quarterly earnings call and/or board meeting

Improve forecasting methodologies and approaches to hold finance accountable and drive accountability to the company’s leaders

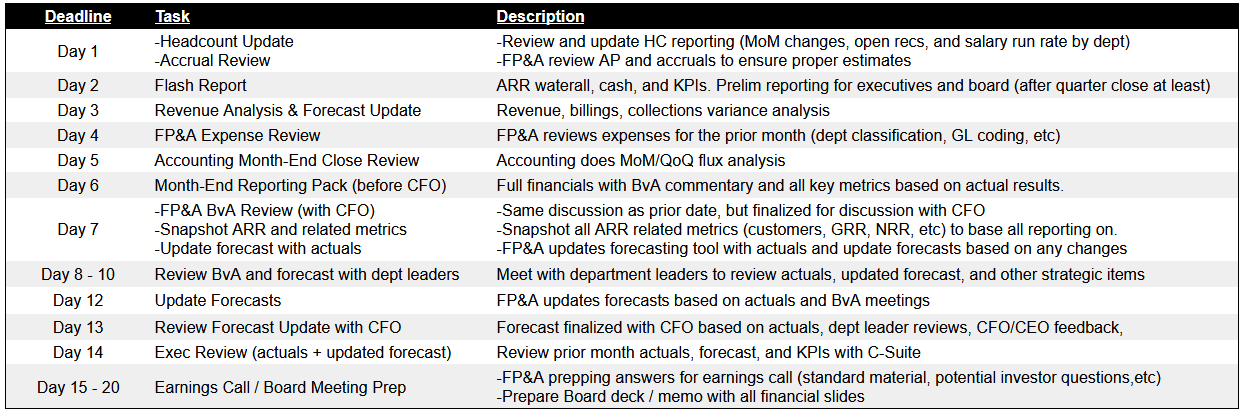

The Calendar:

Below is a good starting place for most companies’ monthly FP&A calendar. You might need to adjust the deadline depending on your size and complexity, but this is a high-level overview of the main tasks.

Timeliness is Critical

A critical point that many finance folks fail to realize is the importance of timeliness of information (especially today when everything moves so fast). The “Flash Report” that contains the main financial highlights should be ready by business day ~2 of the period.

Your flash report doesn’t have to be perfect (preliminary numbers are OK) but you want to get this to your investors and management team as quickly as possible so they know how the prior month went.

If they are waiting until the middle of the month then it’s too late, they don’t care about last month anymore. And investors are already expecting things are bad…

The Copy + Paste Trap

Before just repeating the same tasks and following the same calendar, make sure the calendar and the outputs are still meeting your objectives:

Has the audience or their priorities changed?

Do deadlines need to change given changes in the business (like being much bigger today)?

Has the audience changed (internal or external)?

Does process or tooling changes require any updates to the calendar?

As the company grows or needs change, the monthly FP&A calendar should change as well.

The Budget vs Actual (BvA) Review

When done properly the BvA gets everyone aligned, improves forecast accuracy, and makes a lot of other processes better.

Variance Considerations:

The size of the variance (what was the overall variance by percentage?)

The correlation to other variances (do the variances relate to each other?)

The inherent character of the variance (how does business performance correlate to the variances?)

Goal of BvA:

Control: Ensure accuracy of actuals. I tell my team to provide 90%+ coverage in variance explanations of material accounts. So if a variance is $100K, the team should list drivers for net $90K of the variance. The best was to provide this explanations is to list the drivers in descending order of impact, followed by large offsetting drivers.

Insights: Use the insights gained from another month of actuals, BvA explanations, and discussions with leadership to inform rolling forecast. Document the drivers in forecast changes such as strategy change, forecast methodology, accounting policy/election changes, etc.

Performance Indicator: How far off is the forecast from the actuals? While this can be REALLY hard for early stage companies (or very fast growing companies), it’s important to still measure it and monitor improvement progress. There are always interesting discovers of unexpected drivers when you do.

A critical piece here is the monthly BvA (and forecast) meetings with leadership. These are SOO important to uncover needs/wants/issues and to start strategic conversations.

Measuring Forecasting Accuracy:

What does good forecast accuracy look like?

I look at the variance percentage for major lines like revenue, gross margins, EBITDA and other material metrics.

A decent size public company will target to have a revenue and EBITDA variance percentage within +/- 2% on a quarterly basis. While smaller companies might be closer to 5%+.

The important thing is you are improving over time.

What does FP&A do after their monthly close?

What I covered above is the stuff that must get done every single month, but there are plenty of other items that FP&A needs to do (or wants to do) as well depending on the month/quarter in the year or other strategic projects. Such as:

Implementation and adjustments to FP&A tools

Quarterly/Annual reporting — earnings call prep, board meeting stuff, investor reporting, etc.

Detailed review of expenses and vendors (find things to cut!)

Ad hoc analysis — NRR, GRR, cohort stuff, pricing, etc

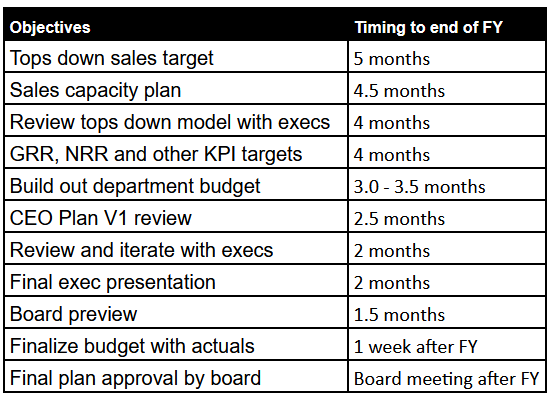

Annual planning for the next year kicks off ~5 months before the end of the year.

Final Thoughts

Document and continue to improve your monthly process. If you just keep doing the same thing then it probably isn’t very effective today.

Make sure you are measure what matters and having strategic conversations with leadership regularly. Ask them for feedback on the process — few FP&A folks actually do this and I promise that most people have something to say.

**Subscribe to the OnlyCFO newsletter and join the 35k+ others

Footnotes:

CFOs (and obviously lawyers) with customers in the EU need to be aware of the potential impact on the EU Data Act, especially on multi-year contracts, that goes into effect next month.