The State of M&A

Read this if you are considering M&A in 2025

Today’s Sponsor: Ledge

Hard truth: Your manual month-end reconciliation is burning out your team and costing your company money.

Ledge automates cash reconciliation with AI, reducing manual work by more than 90% and keeping your financial records updated in real time.

AI-driven matching eliminates tedious tasks, while automated journal entry posting syncs seamlessly with your ERP. Direct integrations with PSPs, banks, and databases ensure fast, frictionless setup.

Learn more and schedule a demo at ledge.co

State of M&A in 2025

There are certainly some positive factors that we were thinking would increase M&A activity in 2025:

Expected further interest rate cuts

Inflation hopefully cooling

Election is behind us

Recession fears easing

But now we seem to be entering a more “risk off” market. Jamin Ball summarized these uncertainty factors well:

Political: What is Trump going to do with tariffs & what are the impacts of DOGE and pulling out that much government spend in the time frame they’re discussing

Economic: What is happening to economic growth

Technology: What is happening with AI and what impacts will it have

Plus, there has been a lot of stock market volatility related to the above things over the past couple of months. When stocks fall so does M&A because a company’s stock is a big chunk of its M&A currency.

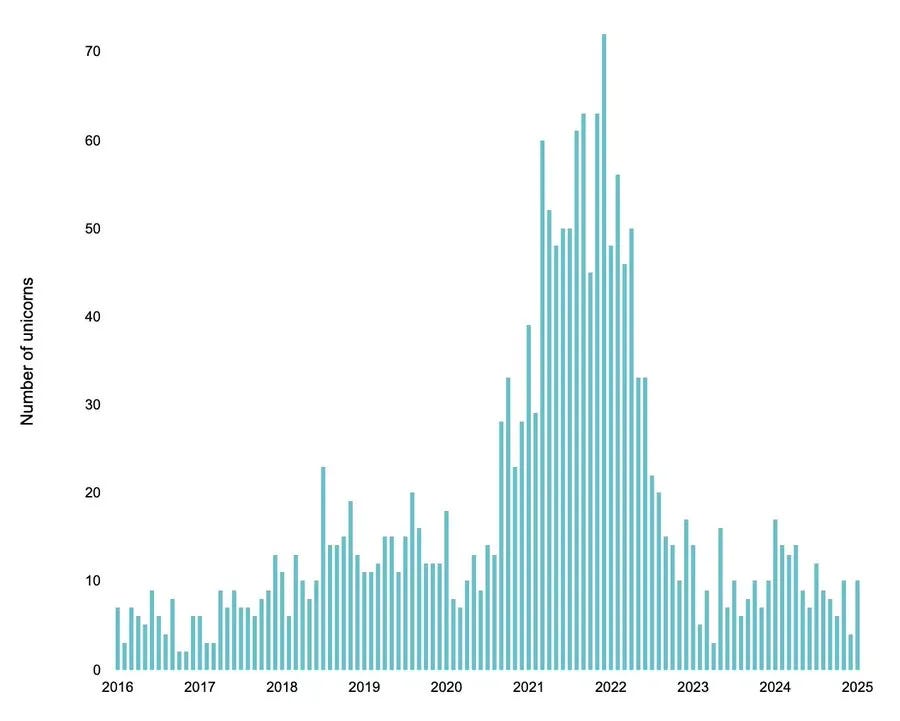

Below is M&A deal volume for the software industry. We peaked in 2022 and things started coming down as interest rates rose and software growth slowed.

3 Types of Exits

Below are a company’s exit options ordered from the typical best outcome to the worst:

IPO

Acquisition

Strategic acquisition

PE acquisition

Shut down the company

IPO:

VERY few companies will ever IPO.

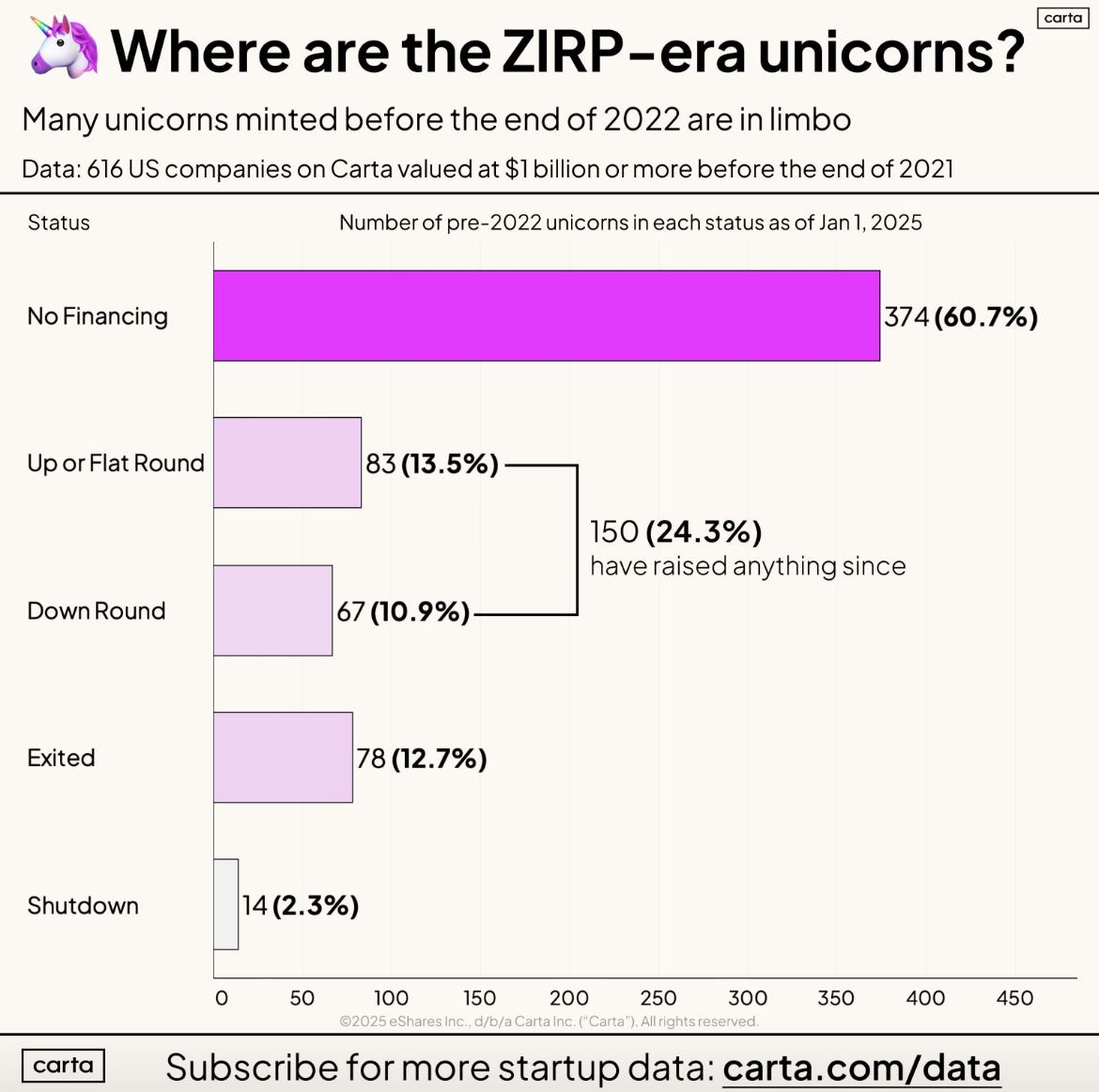

The number of companies that still think they are on the IPO but actually fell off is shocking. The issue is that they raised so much money that they are “IPO path or bust” — the amount raised means it will basically be impossible to have a good outcome without an IPO.

There are a lot of companies that raised too much money a few years ago…The number of “unicorns” we minted is insane 🤯

The majority of these companies are no longer IPO candidates but many remain in denial. Many are hoping they can get back on the path, but they probably won’t.

M&A

Some founders realize that 99% of companies won’t IPO. And some companies luckily didn’t raise so much money that an IPO isn’t their only option for a successful outcome.

The goal when getting acquired is to sell to a strategic because a company will almost always get a higher valuation from a strategic than private equity.

PE can also be a good outcome, but founders generally don’t seek out PE until things aren’t working as they had hoped. All else being equal, PE valuations will almost always be lower.

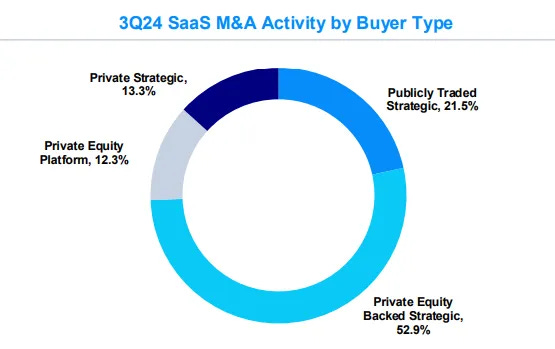

The below is a breakdown from last year on who is acquiring SaaS companies.

Pure strategics (private and public) account for about 1/3rd of acquisitions while the remaining 2/3rds come from PE — either PE platform or PE backed strategic. Most companies should learn what PE investors are looking for because most exits will be to them.

When getting acquired there are three types of acquisitions:

Buying the company (want everything)

Buying the IP (want the assets)

Buying the team (want the people)

Below is an OnlyCFO flowchart on how I think about these things.

Shutdown

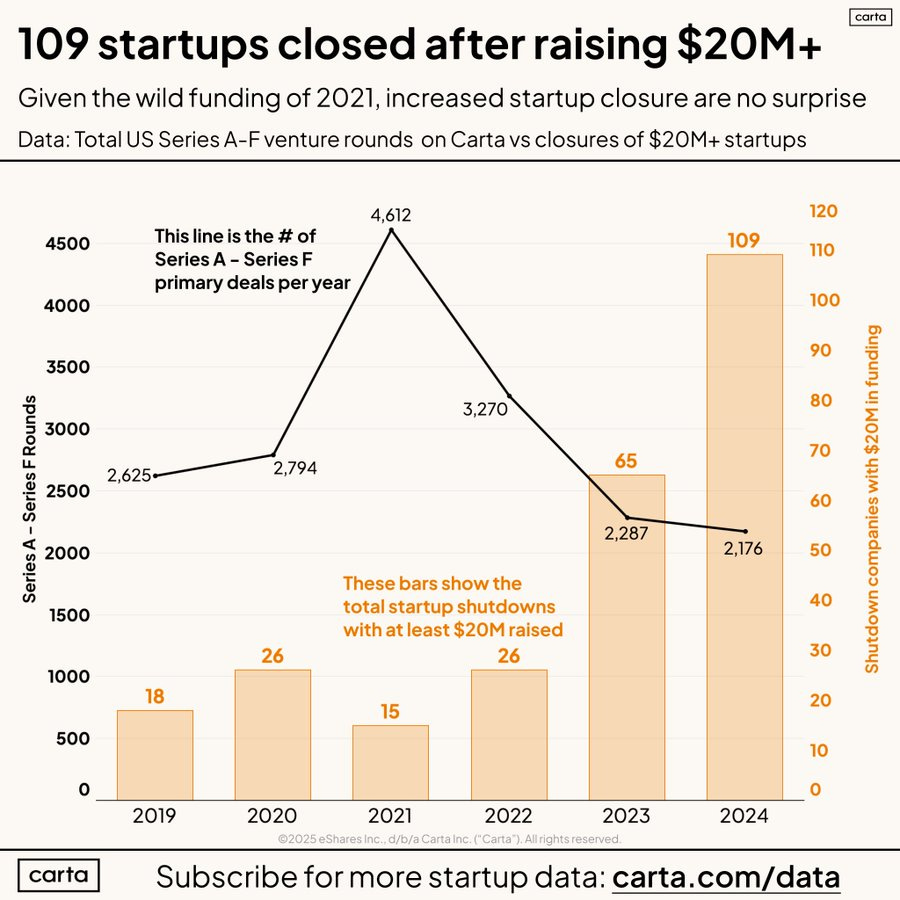

More shutdowns are coming…

Shutdowns have increased significantly over the last 3 year and 2025 will not be an exception. Money is running out, growth is slow, fundraising environment is still weak for most companies, etc…

And the number of unicorns shutting down will also increase…At a large enough ARR, M&A almost becomes a guarantee but it doesn’t mean anyone will make money (so it’s almost like a shutdown).

M&A Pressure

I have talked with several founders over the last few months whose board has pressured (or commanded) them to explore M&A.

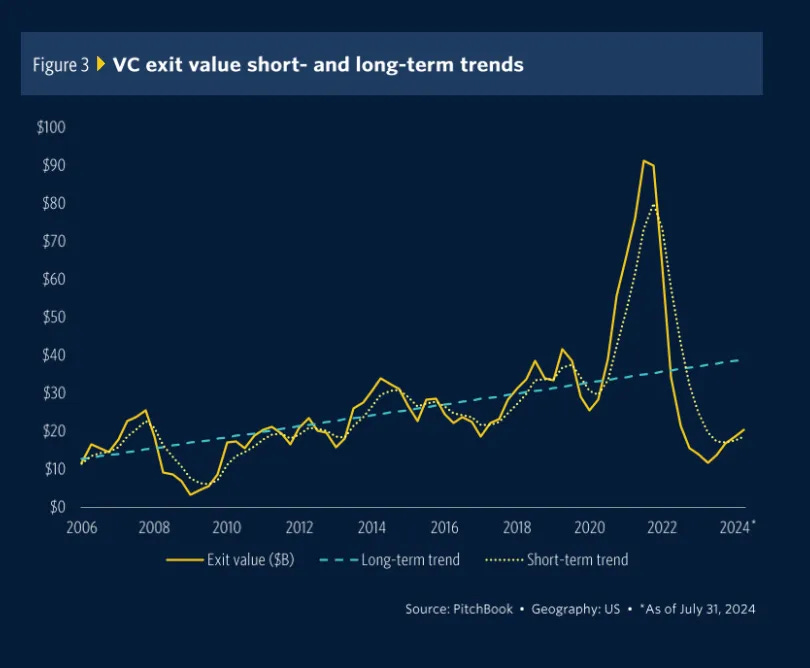

VCs NEED liquidity. Exit values has fallen off a cliff (chart below). Investors are feeling the pressure and they are putting the pressure on founders.

In some of these cases M&A may be a decent outcome. But in MANY other cases, the board is just taking a polite way of pushing for the company to shut down and give investors back the remaining money because they know the likelihood of being acquired for any decent outcome is near zero.

Founders just need to realize that this might be the case and have an honest conversation with the Board. Discuss with the board what types of offers they would accept.

Some Other Advice on M&A

Network with potential buyers

Network early with the top few strategics that might acquire you (remember selling to strategics is the goal!). BUT…don’t spend too much time here unless you are actively trying to sell. A founder could spend all of their time networking with buyers. Make sure to talk to the right people.

Investments and partnerships with strategics

One of the best ways to start a relationship that leads to an acquisition is to:

Have a strategic participate in a fundraising round (assuming they aren’t directly competitive)

Develop a sales partnership with them

Often strategics decide they want to enter a space and the least risky option is often to buy someone they are already working with.

Use an investment bank

If there isn’t interest in from strategics then find a boutique investment bank (don’t go straight to PE funds). These boutique investment banks are MUCH better at negotiating with the PE firms than you are since its all they do.

Time kills all deals!

This is 100% true in M&A deals as well. There are two groups of people on the acquirer side in M&A:

Those that want to buy the company and are staking their career on the deal

Those that want to kill the deal for some reason (political reasons, they like another company, they want to build it internally, they have a friend at a competitor, etc)

Group #2 will look for any reason to push hard and try to kill the deal. So don’t let them!

Know what the buyer wants

The below image (from Software Equity Group) is an interesting comparison of top metrics that PE versus strategic buyers focus on.

Summary

I hope 2025 M&A picks up because we need it, but it is definitely not certain

The vast majority of M&A deals don’t happen overnight so build relationships early

Understand who your potential buyers are and what they are looking for

Build a great finance team that can help the company get ready

Footnotes:

Check out the show on M&A we did with Jeron Paul (founder of Spiff) and carry_no_interest (software private equity guy).

Sign up to join the next webinar → GTM Incentive Comp Strategy

Very informative article! Thank you.