The Truth About Trump's Truth Social

There are two types of investors in Truth Social: 1) gamblers and 2) Trump fanatics

Brought to you by: Grandview CFO

Grandview CFO provides fractional CFO and bookkeeping services exclusively for earlier stage tech companies.

👉Email jon@grandviewcfo.com for a free consultation.

Some valuations become so disconnected from reality that the numbers don’t even matter anymore. This is the case with Trump’s social app that recently went public called Truth Social.

Truth Social is owned by a company called Trump Media and Technology Group and trades under the ticker “DJT”, which is Donald John Trump’s initials… (I will just refer to it as Truth Social).

Truth Social officially went public this year via SPAC after originally being announced in October 2021. There was a very long wait due to multiple lawsuits and a Securities and Exchange Commission probe. Not a great start…

This is not a political post or investment advice.

Ownership

There are two types of people who own shares of Truth Social:

Gamblers

Trump fanatics (I am including Trump himself in this category)

Gamblers

The “Meme” Gambler: For some gamblers Truth Social is a meme stock like GameStop or AMC that could rocket higher simply because more retail investors keep buying the stock. They are just betting that they can offload their shares at a higher price in the future to someone else but they probably don’t believe in the actual company.

The Election Gambler: Other gamblers see a small shot of Truth Social actually being worth something. They are essentially betting that Trump wins the presidential election, exclusively uses Truth Social as his platform, and therefore the social media app takes off.

The betting odds have Donald Trump favored to win the election, but just because he wins doesn’t mean anything actually happens with Truth Social. He has to win the election, Truth Social has to build a great product, and they have to convince A LOT of people to use the app regularly. The odds of that seem rather slim.

Not only would the above things have to be true, but the company’s execution would have to be flawless for the company to one day actually be worth what it is valued at today (more on its insane valuation below).

Trump fanatics

Trump himself owns 65% of all outstanding shares of Truth Social.

But there are also A LOT of retail investors that are big Trump supporters that own the stock. They are essentially giving their money to Trump and when the stock eventually crashes, they get losses to offset capital gains! (in the short-term anything could happen with the stock price though).

More than 600k retail investors own shares in Truth Social and the company states “We don't have any institutions, zero Wall Street money”. Maybe that is not the flex that the “investors” think it is…

Trump’s Ownership

The company awarded Trump an additional 36 million shares as an "earnout" bonus for the stock staying above $17.50 a share for any 20 trading days within a 30-trading day period. Making Trump nearly $1.7B richer on paper 🤯 (nice bonus for doing nothing). He now owns 114.75 million shares (65% of the company) or $5.2B worth of stock!

As I will explain later, this is all just on paper though. Trump will never be able to get anywhere near that much actual cash from Truth Social.

Valuation of Truth Social

Truth Social went public via SPAC. The process of going public is that the SPAC, which is a blank check company, goes public first and then looks for a company to acquire. Then the shareholders of the blank check company have an opportunity to review and approve the deal. After it passes all diligence and regulatory stuff then the merger happens and the previously private company becomes public.

Below is the market capitalization of Truth Social (or its blank check company) since being publicly traded.

After it was announced that the SPAC would acquire Truth Social the stock price shot up overnight.

Between October 2021 when it was announced and May 2024 when the merger happened there has been lots of scrutiny and regulatory hurdles for Truth Social to merge with the SPAC and become a public company. The stock price has been extremely volatile but came roaring back up as the merger was approved.

Also, the above chart doesn’t take into account yet Trump’s bonus shares which adds $1.7B to the market cap!

Truth Social Financials

There is no sane person in the world that looks at the current financials and metrics of Truth Social and thinks, “Yeah, an $8B valuation for Truth Social seems about right”. Like I said before, there are only two types of investors in this stock (gamblers and Trump fanatics).

Financial metrics don’t even really matter when revenue is as small as Truth Social’s revenue but given its huge valuation it is important to consider what would actually have to be true for Truth Social to maintain this valuation.

Revenue (or lack thereof)

In Q1 2024, Truth Social brought in a mere $770K in revenue, which is down from the $1.1M of revenue that it did in Q1 2023. So it trades at a valuation of 8,200x annual revenue 🧐.

You can argue that social apps are different because once the flywheel gets going it can rocket upwards faster than almost any other company. This certainly can be true…but…that doesn’t appear to be Truth Social

Truth Social’s average number of daily active US users dropped by 19% year over year in April to about 113,000, according to data from Similarweb. And the decline appears to be continuing in May.

Also, even if Truth Social had the explosion of growth that some are dreaming about, the valuation is still completely insane. Below are the monthly active users of four major social media sites at IPO and their valuation at the time of IPO

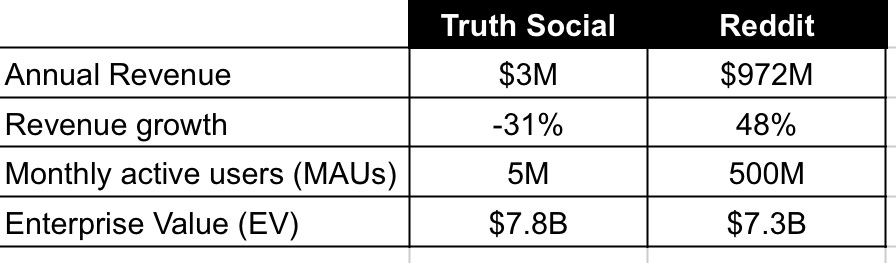

Reddit just went public two months ago (right before Truth Social officially went public). Someone please tell me how the below numbers makes any sense.

I couldn’t find an exact source on monthly active users for Reddit but at least 500M seems directional correct from what I could find. Reddit did disclose 73M daily active users in its S-1 though.

So Reddit has 20 years of data on its site, 100x as many users, has nearly $1B in revenue while growing fast and is worth less than Truth Social????

Expenses ($328M in one quarter!)

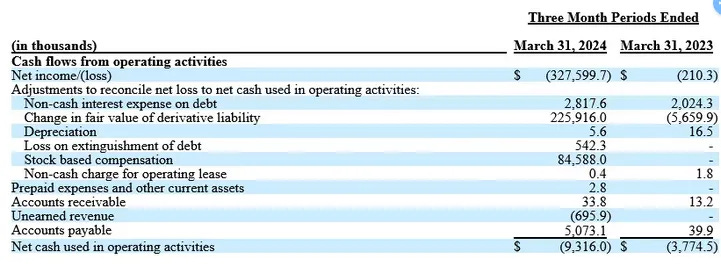

In getting to Truth Social’s mere $770K in revenue they had a net loss of $328M during the recent quarter! This obviously made a great headline for lots of articles but despite the massive accounting loss, Truth Social only burned $9M in cash.

How can the net loss be so different from the cash burn?

$311M of the expenses were related to the SPAC merger and skyrocketing share price which made accounting expenses higher. More detail on these non-cash charges below.

Cash Flow Statement

The cash flow statement reconciles the difference between the massive $328M loss to the $9M in cash burn. It primarily comes from two items:

1 - $226M in a change in fair value of derivative liability

Without getting into the accounting nuances, Truth Social issued a bunch of warrants (like stock options) and convertible debt much lower than today’s stock price so as the stock climbed there is a charge it must recognize on the income statement. This won’t be a recurring charge, but it certainly add a lot to dilution.

2 - $85M in stock-based compensation

While every company has recurring stock-based compensation charges, sometimes companies have awards that are dependent on a change of control or going public so no expense is recognized until that happens. Truth Social gave a lot of awards to executives in March right before the SPAC merger at a conversion price of $10 so there was a big stock-based comp charge to recognized in Q1.

No CapEx 🤔

One particularly interesting thing in the cash flow statement is that Truth Social spent $0 on CapEx (property & equipment) during the quarter….Not sure what they did in Q1 but I guess they weren’t growing (or planning on growing) because apparently, they didn’t need any more computers, furniture, or other equipment.

Key Metrics

My favorite section from Truth Social’s latest financial report was about its key metrics.

Apparently, tracking metrics that make your valuation look crazy is distracting and not in shareholders best interest 🤣.

Below are quotes from Truth Social regarding metrics:

TMTG [Truth Social] believes that adhering to traditional key performance indicators, such as signups, average revenue per user, ad impressions and pricing, or active user accounts including monthly and daily active users, could potentially divert its focus.

TMTG [Truth Social] believes that focusing on these KPIs might not align with the best interests of TMTG or its stockholders.

I am going to tell my board that we don’t track customer retention or cash burn because it’s distracting. Wish me luck 😆

Auditor Disgraced

Truth Social appears to be a mess in many ways and its auditors were no exception.

The SEC charged Truth Social’s auditor (BF Borgers CPA) with massive fraud for basically not performing actual audits relating to 1,500 regulatory filings.

BF Borgers was banned from performing audits of public companies earlier this year, which is why Truth Socials Q1 financials were late on being released since it has to hire another firm asap.

Truth Social hired Semple, Marchal & Cooper LLP immediately afterwards to be its auditor. You would think after their previous auditors blew up that they would opt for a bigger, more recognized firm….Having said that I know nothing about Semple, Marchal & Cooper so they might be a fine group of auditors.

Truth Social didn’t necessarily do anything wrong but the choice of auditors might call into question the executives running the business.

Trump’s Windfall

On paper Trump’s holding in Truth Social are worth $5.2B!!! That would be a lot of money for a guy who has lots of money problems right now, but there are two problems with it:

6-Month Lockup Period

Typically when a company goes public insiders (execs, employees, early investors) are not able to sell stock for the first 6 months. The purpose of this is to limit the amount of selling so the stock doesn’t crash when it goes public.

This lockup period also causes the “Float” (number of tradable shares relative to the total) to be really small, which can cause high price volatility for newly public companies. Below if Truth Social’s float compared to total outstanding shares.

The 6-month lockup period means that Trump can’t sell any of his stock until 6 months after it went public (so late September 2024). However, there is a chance he could ask for a waiver to be able to sell shares earlier.

So Trump will be rich right before the election in November? Maybe on paper, but there is still one more problem👇 of getting cash out.

Stock Price Pressure

With Trump owning 65% of Truth Social any material selling he does will likely make the stock price crash.

Every investor in Truth Social owns the stock because of Trump in some way so any indication that he wants out will likely crater the stock.

So Trump is likely at near the peak of wealth he will see from Truth Social (on paper). The size of his fortune from Truth Social will quickly drop when he decides to start selling because the stock price will drop as he does.

Final Thoughts

First off, nothing here is investment advice. This stock could just keep ripping higher for no reason at all….or it could crash to $0. Both seem possible in the near term.

Truth Social appears to be WAY overvalued and in the long-term it will come crashing down to reality, but in the short-term who knows. Shorting a stock is always dangerous because you can lose a lot more than your investment, but shorting a meme stock fueled by Trump fanatics seems like a really bad idea.

A lot of things have to go perfectly right for Truth Social to be worth the valuation it is at today.

There is high downside risk of highly valued companies since they require near perfect execution to provide meaningful returns to investors. Truth Social has an extreme valuation AND has had a really messy management team….a recipe for disaster.

Footnotes:

Get a fractional CFO and bookkeepers that focus on tech. Email jon@grandviewcfo.com

My sponsorship slots are almost full for this year! Grab one of the last spots

This really puts "Truth Social" in perspective. The DJT fraud continues.

Must be nice when losing billions isn’t an issue