The Worst Performing Software Stock

Lessons from Expensify — from $4b to $185m valuation

👋 Welcome to a subscriber-only edition. If you are interested in the software industry, then consider upgrading to my premium tier. You probably can get reimbursed by your company for it using software like Expensify :). Everyone should understand finance

Expensify is a spend management platform that went public near the peak of the software bubble — November 10th, 2021. Expensify has been around since 2008 and only raised a total of $27M prior to its IPO. They operated more like a bootstrapped company, so they didn’t need much capital since they ran cash flow positive for a long time.

At the peak Expensify appeared like it may have the potential to be a winner. Things changed quickly for Expensify though and it has become the worst performing software stock since the 2021 peak.

Here are the topics to be covered:

Expensify’s IPO (free)

Expensify’s Current Financial Outlook (free)

Expensify Problems (paid)

Can Expensify Turn Things Around? (paid)

Expensify’s Financial Journey

An IPO with Stellar Metrics

While Expensify took longer than most software companies to reach $100M ARR (~12 years), revenue accelerated in 2021 and it seemed to be incredibly efficient at IPO. Investors that just looked at their key financial metrics at IPO might have concluded that Expensify looked like it was going to be a long-term winner.

In the Q3 2021 earnings call, they called out two impressive efficiency metrics.

A Rule of 40 score of 126, which is an amazing score compared to the rest of the public software companies even at that time in 2021.

Rule of 40 Score looks at how companies balance revenue growth with profitability. A score > 40 is generally considered good. There are a few different ways Rule of 40 can be calculated but Expensify is calculating it as revenue growth % + adjusted EBITDA %

They also had $1M ARR per employee! This is far above other software companies. The average ARR per employee for public companies is ~$300K. They must be extremely profitably, right? Keep reading why Expensify’s $1M/employee metric is deceiving….

Software companies can receive a high valuation premium because of their fast growth and ability to generate large free cash flow margins at scale. A single good year (or even a few) doesn’t justify high revenue valuation multiples. While things looked great for Expensify in 2021, in hindsight there were some red flags and potential concerns.

Expensify’s Current Financial Outlook

The below image shows the top 10 biggest software stock price losers since the peak of the bubble. Expensify tops the list at a 93% drop. Ouch!

Ultimately, company valuations are driven by the amount of cash that they can generate over their lifetime. A company’s cash flow generation potential is driven by revenue growth and profitability.

Revenue Growth

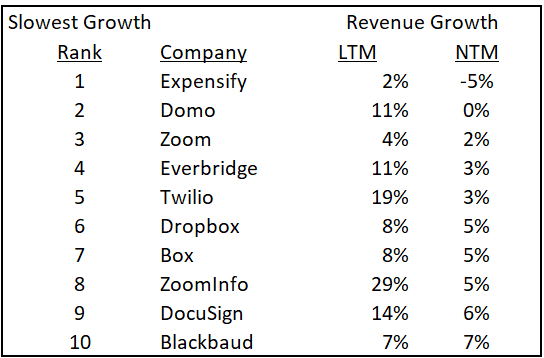

Expensify has both the slowest revenue growth over the last twelve months (LTM) and slowest expected next twelve month (NTM) revenue growth. In fact, Expensify is the only software company I track (~90 companies) that has expected declining revenue over the next twelve months.

Sales efficiency metrics are based on net new revenue, so if a software company has declining revenue then obviously something is broken — in the leaky bucket analogy, you are losing water faster than you can fill it.

Profitability

Before getting into Expensify’s profitability metrics, repeat after me: “positive free cash flow does not mean efficient!”.

The goal of a software business is not to just breakeven or not lose money, but to maximize future free cash flow potential through strong unit economics. A business losing lots of money can have strong unit economics just like a business generating high free cash flow. See my past post on Unit Economics.

Below are the public software companies FCF % (not all are named but are all presented on the graph):

Expensify has 5% FCF margins, which doesn’t look too bad compared to all the other software companies! Wait….what did I say earlier? “Free cash flow does not mean efficient”

The reason software companies can be so valuable is that revenue is supposed to compound and at scale they are expected to generate 25%+ FCF margins. So with negative 5% revenue growth at a relatively small amount of revenue for public companies, the 5% FCF margin is pretty bad. At negative revenue growth, the lifetime cash flow generation potential of Expensify appears extremely small.