Timing the Top | Buy Low, Sell High

Dilution benchmarks, employee equity compensation at Nvidia, BILL’s acquisition of Divvy, stock buybacks, and more

Today’s Sponsor: NetSuite

I wrote a SaaS Chart of Accounts Guide in collaboration with NetSuite. It includes my best practices that most software companies should follow.

This guide includes a full sample chart of accounts and department listing. It is exactly what I use as a finance leader at software companies.

Buy Low, Sell High

We all know that investors want to “buy low, sell high”. However, a lot of investors end up on a path like the below when investing in individual stocks.

When investors let emotion drive decisions they make sub-optimal investing decisions - they end up buying high and selling low.

The “buy low, sell high” concept also applies to companies and the various ways they buy/sell their own stock.

Selling: When companies sell/issue their stock then dilution is created. All else being equal, dilution is a bad thing for existing shareholders because their slice of the pie decreases.

Buying: Stock buybacks are when a company purchases its own shares to reduce the share count. Existing investors’ slice of the pie gets better.

Companies usually do a lot of “selling” of stock until they start generating some meaningful cash flow and then they may start doing buybacks as well.

Reasons for issuing equity:

Below are the main reasons companies will issue (sell) more equity and create dilution:

Additional cash for acquisitions or other investments

Employee compensation. This is usually referred to as stock-based comp (SBC)

Fund ongoing operations. Tech companies often lose money for a long time so they need extra funding.

Pay down expensive debt

Reasons for stock buybacks:

Below are some of the reasons for stock buybacks:

Offset the impact of dilution (especially from SBC)

Increase earnings per share

Perceived discount on stock price

Signaling management confidence that the stock price is undervalued

The distinction between the last two reasons above is important - management either actually believes the shares are cheap or they want investors to think that they think that the stock price is cheap….

Creating Shareholder Dilution

I’ll discuss the two primary areas for shareholder dilution:

Stock-based compensation (~20% of equity issuances)

Selling stock for acquisitions (more than half of all equity issuances)

1. Stock-Based Compensation

Issuing undervalued stock = value transfers from shareholders to employees.

Issuing overvalued stock - value transfers to shareholders (employees cost less)

An issue with SBC (particularly with public tech companies) is that it is generally just thought of as another form of cash compensation. Employees are granted $XX of stock that is earned over time. And employees want at least that much cash when it vests. If the stock price plummets then many employees will expect companies to issue more stock to make them whole (and many do).

So frequently employees get all of the upside with limited downside, which means shareholders would just get the downside.

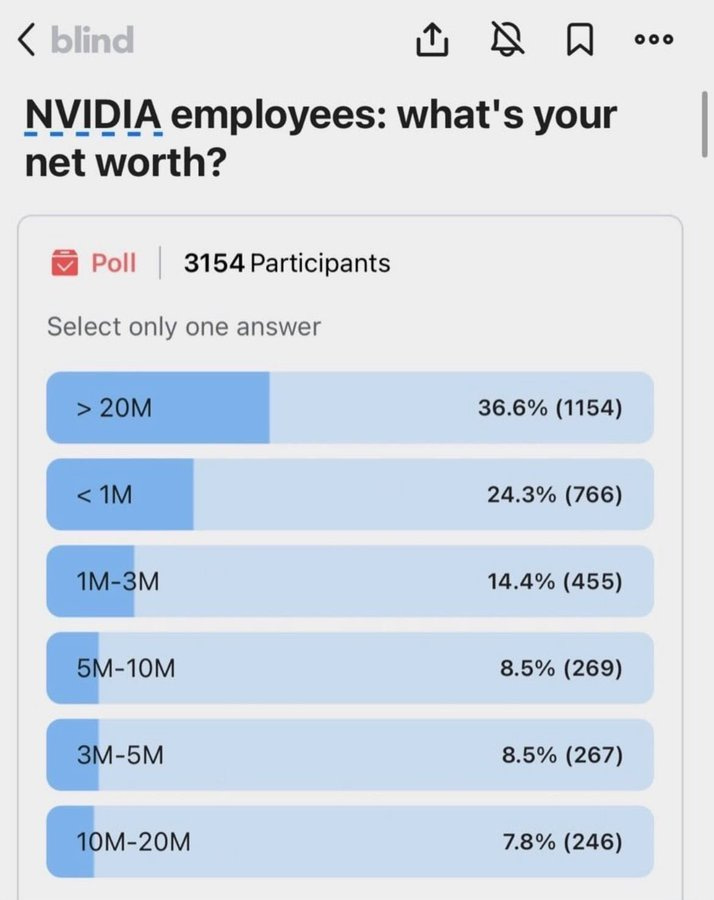

And there can be a lot of upside for employees. Nvidia employees seem to have done pretty good from equity compensation….

Then the question becomes “was the stock based compensation worth it?”. If Nivida knew its stock price was going to increase by 2,500% in 5 years, should it have issued less stock-based compensation? Probably, but it’s also not a clear decision.

Would Nvidia have gotten the same employee talent if it wasn’t competitive with its employee equity? Probably not. And if that is true, then maybe Nvidia wouldn’t be where it is today.

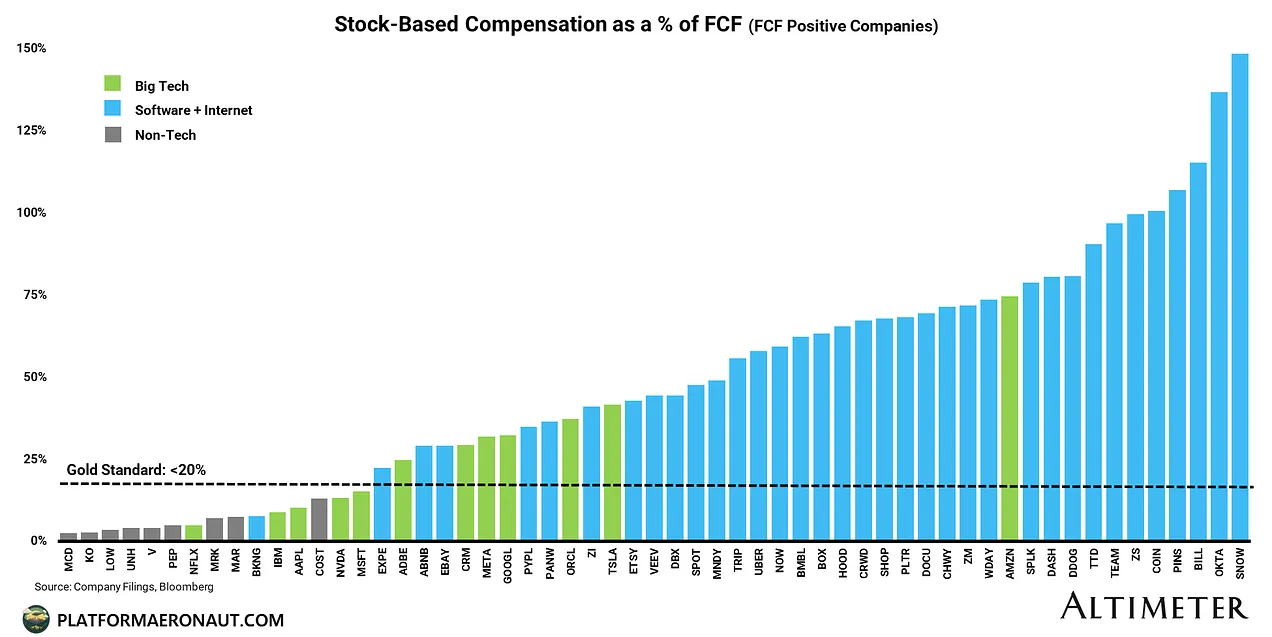

SBC Dilution Benchmarks

There are a few ways to look at dilution from SBC. Below are two benchmarks of public companies that Thomas Reiner put together on dilution:

Annualized dilution %

SBC as a % of free cash flow (FCF)

Below is a rough framework from my friend CJ Gustafson on how the various classes of equity holders of private companies change over time. Investor equity from additional rounds of fundraising eats up a lot, but employee equity can be a really high percentage as well.

2. Acquisitions

The same basic “buy low, sell high” rules apply for equity issuances for acquisitions:

If acquirer stock is overvalued = use more equity to fund the acquisition

If acquirer stock is undervalued = use more cash to fund the acquisition

The above rules obviously are also relative to the price/value of the company being acquired.

Divvy Acquisition Example

BILL (aka Bill.com) acquired Divvy in June of 2021. At acquisition close BILL’s stock price was ~$157. However, BILL’s stock went bananas (like many other software companies) for the rest of 2021 and peaked at $340 just a few months later.

Did BILL create or destroy shareholder value with the Divvy acquisition? I.e. did BILL issue/sell stock that was overvalued or undervalued to acquire Divvy?

Cash vs Equity

First, we need to know how much of the acquisition was cash versus equity. In large acquisitions companies often have to finance at least some of it with equity. In this case, BILL used 71% equity and 29% cash.

If BILL’s stock was overvalued relative to Divvy’s longer-term value to BILL, then they did well by selling high given how much equity BILL used.

Perfect Timing

Timing the exact top is hard to do for anyone. Obviously if BILL could have issued equity for the Divvy acquisition at the very top (nearly $340/share) the equity portion of the acquisition would have been less than half the cost!

But in retrospect, the $157 BILL stock price was still overvalued. Software (and particularly fintech) multiples were crazy high back in 2021. The price today of just $52/share proves that.

BILL’s Overvalued Stock Price

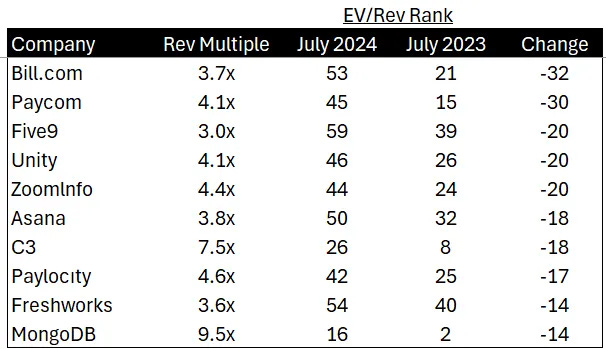

It’s been just a little over 3 years since the Divvy acquisition. In retrospect, almost every software company was overvalued 3 years ago, but BILL might have been the most overvalued…

In June of 2021, BILL held the #1 revenue multiple spot for cloud companies at 60x revenue multiple!

Software multiples have compressed a lot since 2021 due to broader macro conditions and investor enthusiasm toward cloud/fintech companies, but BILL got hammered well beyond the normal compression….

BILL is the biggest revenue multiple loser. It has the largest revenue multiple ranking drop in the past 12 months and over the last 3 years. BILL’s revenue multiple dropped from the #1 spot (which made it the most richly valued cloud company) to the 53rd highest (out of ~80) over the past three years. Over the last 12 months alone it dropped 32 spots…

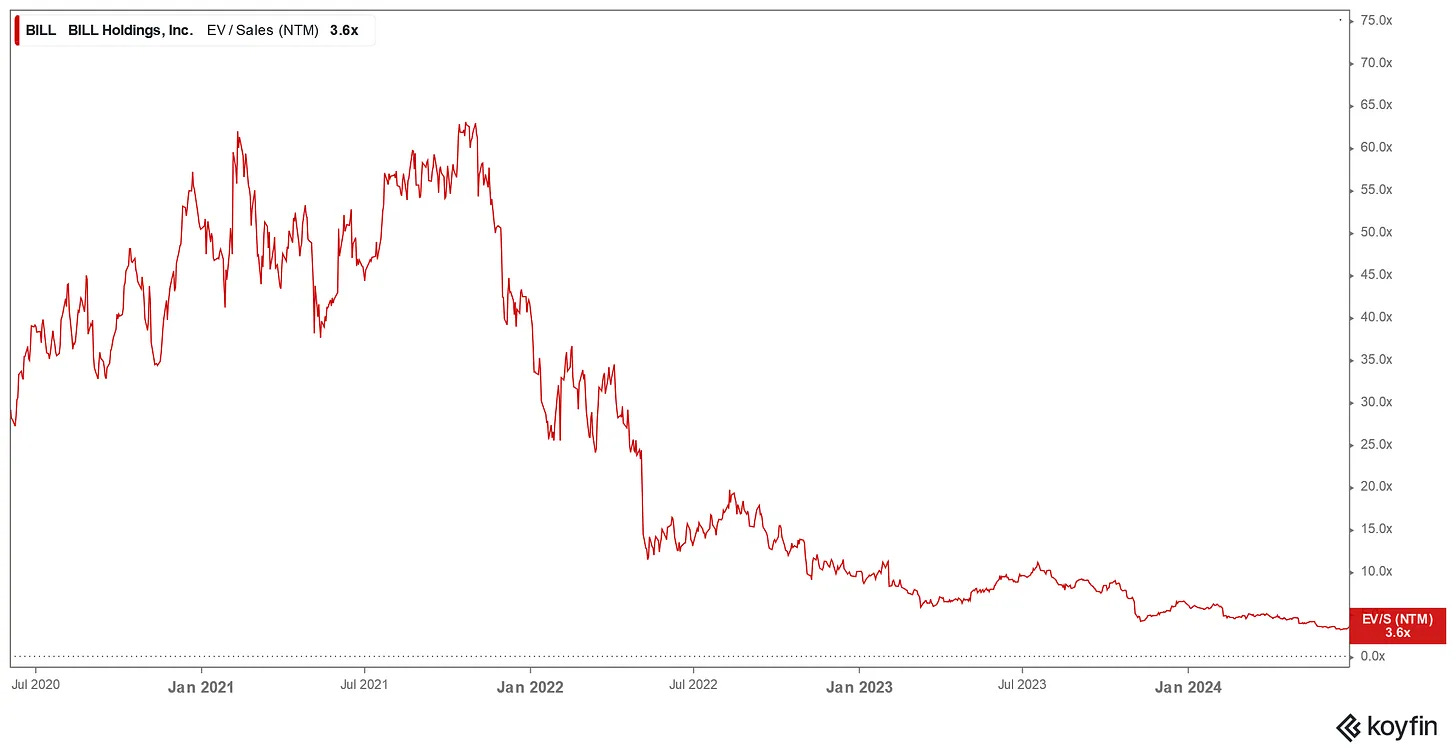

You can see BILL’s revenue multiple compression below - from a peak of about 65x all the way down to 3.7x (94% drop). For BILL to get back to the same valuation it would have to increase revenue by 1,757%!

Was the Divvy acquisition positive for shareholders?

Divvy’s quarterly revenue prior to the acquisition was $21M (or $84M annual revenue run rate). So the $2.3B acquisition price represents a 27x revenue run rate multiple the acquisition. The multiple to consider though is based on its forward looking revenue (more on that below).

Divvy’s revenue for the 12 months following the close of the acquisition was $208M 🤯! Using the actual NTM revenue from the acquisition we get an ~11x NTM revenue multiple at the time Divvy was acquired compared to BILL’s 50x NTM revenue at the time the acquisition closed.

Obviously, synergies between the two companies and the ability to cross-sell the Divvy product to BILL customers drove a lot of growth, but the combined company’s ability to drive that much revenue for Divvy is amazing.

When we had started the acquisition, we had 1,000 joint customers. And what we disclosed today is that we have 7,200 joint customers so roughly up 6,000. Of that, around 5,000 are BILL customers adopting Divvy. The others are Divvy customers adopting BILL. — from BILL CEO in 2023

I tracked BILL’s total ARR by quarter split between Divvy and everything else through September of last year to see how Divvy performed since acquisition.

As of September of last year Divvy was at a $424M in annual revenue run rate (36% YoY growth). In September 2021, immediately after the acquisition, Divvy accounted for 31% of BILL’s total revenue while today it accounts for 35% (Divvy has grown faster than BILL’s core revenue).

The below image shows hypothetical valuations for Divvy if it was a standalone company:

3.7x multiple is what the entire BILL company currently trades at

4.5x multiple is under the scenario that Divvy should trade a bit higher than BILL standalone

You might read this and say, “BILL paid $2.3B so they overpaid!”.

Not so fast…$1.6B of that price tag was with BILL’s overvalued stock price. The stock price at the acquisition was $157 while today it trades at $53 — a 66% decline.

If 2021 was just a crazy valuation time (which it was) and today is the new normal, then you can think about the total acquisition price being closer to $1.3B — broken into $0.7B in cash and $0.6B in equity (assuming today’s price is the true value).

If the above is true, then BILL acquired a company for $1.3B that under today’s multiples may be adding as much as $2.2B in value. Pretty decent return in 3 years!

BILL issued overpriced stock to acquire Divvy. The issuance of these overpriced stock created the following valuation transfer:

FROM: shareholders of Divvy and/or investors who bought the newly issued stock

TO: BILL continuing shareholders.

While BILL shareholders would have clearly done better by selling their shares alongside BILL when they issued shares for the acquisition, they still appear to be better off had the acquisition not been done. BILL timed the top pretty well when selling shares.

Note - many Divvy shareholders probably sold their BILL stock in the following months before the stock price crashed, which left new investors that bought at the higher prices holding the bag.

Stock Buybacks

Michael J. Mauboussin released a paper on the topic of stock buybacks that is an excellent read. It is centered around the idea that companies that are both issuing and buying stock in a short period of time are not optimizing capital allocation.

A big discussion has been around companies that issue a high amount of stock-based compensation (which means high dilution), but then the company says its OK because they are doing a lot of buybacks so the net dilution is small.

So these companies are both buying and selling at the same timing continually…Both of these can’t be optimal capital allocations decisions though.

If you are doing both at the same time where is value being added?

The answer for many companies is that value is not being added. Rather companies are trying to manage the bad perception/impact of high employee stock based compensation by buying back stock in order to manage the dilution.

There are a lot of good reasons for doing buybacks, but if they aren’t done because the stock is undervalued then value maybe is being destroyed.

All stock repurchases should be price-dependent. What is sensible at a discount to business-value becomes stupid if done at a premium. —Warren Buffett

Issuing equity to employees and then immediately buying back stock to manage net dilution is the admission that stock-based comp is just a method of paying employees more, but pretending it’s not by removing the expense when discussing profits. Lies…

Concluding Thoughts

Understanding a company’s dilution activity (inflows and outflows) is a critical data point for investors. Not only can dilution destroy shareholder returns, but how management manages dilution may say a lot about the future of the stock.

Some companies are much better than others at buying low and selling high.

Not all dilution is created equal.

Footnotes:

Grab my SaaS Chart of Accounts Guide and get your books set up the right way

Check out OnlyExperts if you need offshore accountants.

While you make a really solid point about simultaneously issuing equity and buying back to minimize dilution, you assume stakeholders (public or private investors) understand this as well. For some, the tail wags the dog. But for the best, the dog wags the tail.

Amazing breakdown