VC Money Makes You Dumb

Simply asking the question "What would a bootstrapped company do?" is sometimes all you need to do.

Today’s Sponsor: Vertice

Did you know – businesses are wasting 385 hours every year in meetings alone to renew software contracts?

Senior leaders in finance are bearing the brunt of this software burden. Finance departments have the highest share of software contract owners (36%).

Vertice analyzed data from 1000 companies to understand the time they put into SaaS and cloud spend management. Read more of the insights here.

VC-backed companies frequently lose sight of the things that actually matter in their pursuit of high revenue growth and hitting perceived VC funding milestones of success.

I see dumb things that companies do and think “a bootstrapped company would never have done something so stupid”. I am by no means judging any company because almost every VC funded company is guilty of this at some level.

Bootstrapped = building a business with minimal or no external capital

Raising money isn’t a bad thing. In fact, cloud unit economics usually requires VC money in order for companies to grow really fast. BUT….VC money often pushes people to make stupid decisions.

When cash is abundant then people find a way to spend it. And VCs want you to spend the money (to a degree) because VC math only works if companies are growing quickly and can provide huge outlier returns. VCs don’t give us bags of money so the founder and executive team can create a lifestyle business by making the cash last forever by not trying to grow.

However, when cash is scarce then creativity is abundant. The trick is balancing between having the VC cash so you can use it as appropriate to fuel growth, but staying smart and creative as if cash is scarce.

Metric Tunnel Vision

VC money can make us stupid, especially related to benchmarking, metrics, and milestones. We easily lose sight of where the ship is going because we are distracted by shiny objects.

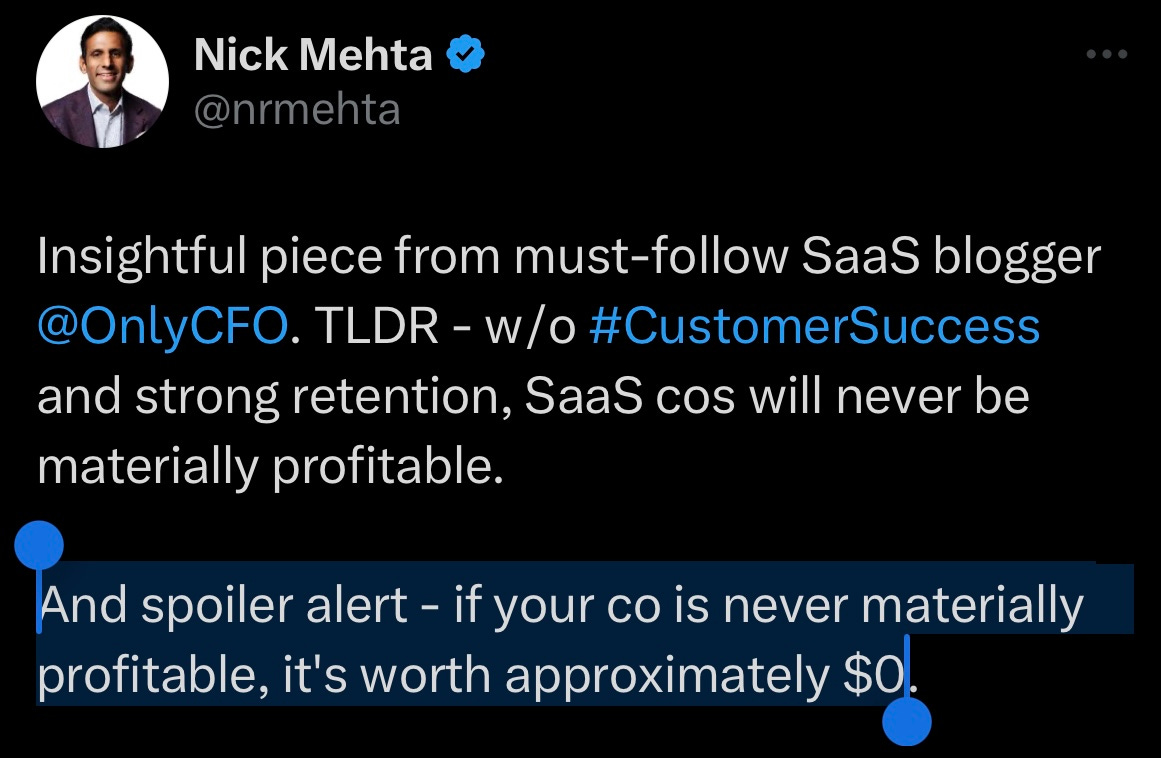

I liked Nick’s tweet (not only because he said to subscribe to OnlyCFO) because it hits on a point that many forget in the VC journey of high growth.

If your company is never materially profitable, it’s worth approximately $0.

We can become so focused on investor milestones, certain metrics that are popular, etc. that we lose sight of what matters. Building a real, sustainable business that generates profits!

Below is a type of conversation I have all the time (on various metrics).

VP of Sales: Our Quota:OTE ratio was 7x last year! We have been really focused on efficiency.

Quota : OTE = shows the relationship between a sales rep’s quota (their sales target) and their OTE (their total compensation if quota is 100% achieved)

Me: Not bad, that is probably top quartile for your company profile [which is mostly mid-market]

VP of Sales: We are really focused on efficiency and have been pushing this ratio up over the past couple of years.

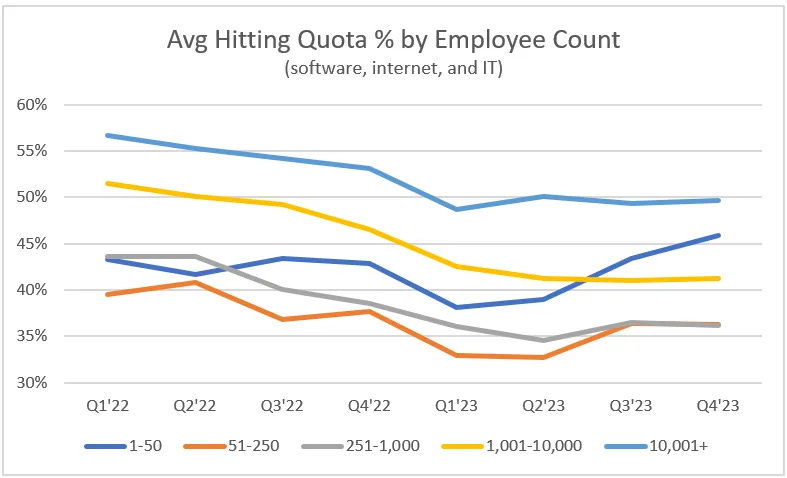

Me: So how is quota attainment?

VP of Sales: Well…we are working on improving quota attainment. Right now only about 35% of sales reps are hitting quota.

Me: Definitely not great attainment, but most sales orgs have been hit pretty hard over the past couple of years. Although it is certainly on the lower side

Me: What does the rest of the “GTM Pod” look like? By GTM Pod I am referring to all the supporting functions around the sales rep that are needed to sell — Solution Engineer (SE), Sales Development Rep (SDR), Customer Success Manager (CSM), etc.

VP of Sales: We plan to improve those as well, but right now it looks like this:

Me: O wow….you have a full SDR and SE for every AE?!?! That is really high. The Customer Success Manager (CSM) and Account Manager ratio also seems really high.

Me: Hopefully your churn rate is extremely low to justify all that spend to acquire and maintain customers…

VP of Sales: Well, we are working on that too…We currently have 20% annual churn rate.

Me: Yikes. Hate to break it to you, but you are not efficient at all. In fact your unit economics seem to be broken. [assuming an overall 50% sales rep attainment]

Here is the model I created to show GTM Pod efficiency that you can play with.

Alright. Story time is over.

Hopefully you get the picture. The CEO and VP of Sales became fixated on a single metric and benchmarks that they believed equaled efficiency.

The above case is clearly a disaster. The unit economics are broken but is being overlooked because of metric tunnel vision (focusing on the metric flavor of the month). It is critical to both 1) zoom in to the atomic metric and 2) zoom out to the broader metrics.

Zoom Out

There are different levels of “zooming out” that are relevant for different stakeholders. For the leaders of specific departments, they should understand the zoomed out metrics focused on their department.

In the case of the VP of Sales, this might be the CAC ratio, Sales as a % of revenue, etc.

The next higher level of “zoomed out”, which is discussed with a broader group might be the CAC Payback period since its calculation touches a few different departments.

Then there are metrics like the burn multiple that look at the entire company.

Burn Multiple = free cash flow / Net New ARR

There is no escaping the burn multiple because it captures all costs. But even the burn multiple isn’t a perfect metric.

Despite what many software leaders and investors may think, the goal of a business is to eventually make money 🤯….not just lose less money 🤣

Key Takeaways

Don’t let VC money (or IPO money) make you dumb. Stay creative and smart as if you don’t have the money, but use it wisely to fuel growth.

Don’t lose the forest for the trees. Zoom in, but also zoom out to make sure the broader machine is working.

Make sure your individual leaders and executive team are tracking the right level of metrics. (creating effective metric dashboards is a future post!)

Make sure all leaders are reading OnlyCFO 😎

Footnotes:

Check out the Hidden Cost of SaaS and Cloud

Join the community by becoming a paying subscriber and get access to me and other finance leaders in software companies! Ask questions, get answers, and communicate with your peers.

Sponsor OnlyCFO Newsletter and reach 18k+ CFOs, CEO, and other leaders in the software industry.

So just set better, more considered key results. The game has always been about preventing "gaming" of key results by thinking through the incentives, creative strategies for achieving them, negative externalities, and then revising the key results perhaps with additional qualifiers or parameters.

This has nothing to do with where your funding comes from. Hopefully organizations are setting similar goals for themselves on their own. If anything, the board should be helping them realize the risks of poorly defined KRs and the likelihood of running into scenarios like the one you describe based on their experience, if the founders don't have it.