Vertical Software | Riches in Niches

Lessons on TAM, competition, and valuation from a Veeva short seller

Today’s Sponsor: NetSuite

I published a SaaS Chart of Accounts Guide in collaboration with NetSuite. A good chart of accounts is the foundation for all financial reporting so make sure your company is set up properly!

This guide includes a full sample chart of accounts and department listing. It is exactly what I use as a finance leader at software companies.

Shorting Veeva

Veeva raised just $7M before it IPO’d in 2013. Veeva is one of the most capital efficient and successful software companies in the world.

Veeva is a vertical software provider for the life sciences industry.

Vertical Software: products designed for use by a specific industry or business vertical. Focused on solutions for industries that are often poorly served by general software providers

Horizontal Software: general-purpose software solutions that apply to multiple industries, rather than providing solutions that are relevant to one specific market.

Vertical software is interesting in the world of generative AI because there are some unique aspects of vertical software that can make its revenue growth relatively more durable than others.

I recently came across an old short seller report on Veeva, which as we know now became one of the biggest vertical software successes ever.

Suhail Capital issued a short seller report on Veeva in November 2013 (one month after the IPO)…At the time the stock price was $40 with a $6B market cap. Today the stock price is $183 and it has a $25B enterprise value.

To Suhail Capital’s credit, they later admitted they were wrong on several of their original points and went long Veeva. It was interesting to see their own analysis of what they got wrong on their initial analysis.

There are three main components of the short thesis:

Small TAM

Significant competition factors

Frothy Valuation

Small TAM

One of Suhail Capital’s main arguments against Veeva (an argument many investors have with vertical software) is that there is a limited TAM (total addressable market).

A company’s TAM represents the maximum annual revenue opportunity for a company’s product. TAM represents the *current* revenue ceiling because it doesn’t consider what a company realistically can obtain because of competition, geography, price, etc. The serviceable obtainable market (“SOM”) is usually a much smaller portion of TAM and represents what a company can realistically obtain.

Below is a visual representation of how to think about TAM and what a company can capture.

Investors frequently pass on investment opportunities (or short stocks) because of a perceived TAM issue. Below is a slide from Suhail Capital’s short report regarding its TAM issues:

Their focus was on the TAM for life sciences CRM. At the time of IPO, Veeva’s additional modules/features outside of CRM were unproven with little revenue so Suhail Capital basically ignored them.

Suhail Capital also believed that Veeva’s strong international competition and large customers on competing products would severely limit the TAM that could actually be captured.

If all the above was true, then Suhail Capital would have been 100% correct — there would have been no way for Veeva to grow into its high valuation….

What they got wrong on Veeva’s TAM

If there is one thing true about TAM it’s that the number is always wrong. And even if you have a pretty good estimate of your TAM, it will likely be materially different in the future. Calculating TAM is more about how you are thinking about the market opportunity versus the actual specific number (although hopefully it is directionally accurate and informative).

Great companies that are run by great people will continually find ways to expand. Veeva’s TAM has certainly expanded over the years to make its continued high revenue growth possible (more on revenue growth later).

Vertical software often starts as a small TAM, but it has the potential to become huge as more opportunities can be captured.

Growth in the vertical

Acquisitions to expand to adjacent areas

Creation of additional products to expand TAM

At the time of the IPO Veeva’s TAM was estimated to be $5B. Today the TAM is $20B and they have only captured about 12% of it.

In Veeva’s recent investor slide below they show that the TAM they are targeting is only 1% of the total life science TAM. While they certainly aren’t going after that entire TAM, there likely is still more opportunity for them to continue to expand beyond the current $20B TAM.

Veeva capitalized on the international opportunity and many companies moved their global operations to Veeva despite the opinion that the strong international competitors would limit their ability to capture that part of the TAM.

Competition

Suhail Capital mentioned a couple of competitive factors that would limit the revenue Veeva could capture.

Some very large pharmaceutical companies (20% of global pharma reps) were already on competing or homegrown tools and they were unlikely to move to Veeva

Companies would start just customizing Salesforce.com CRM to meet their needs. Or maybe Salesforce.com puts a bigger focus on life sciences and takes market from Veeva.

Both of these turned out to be wrong. Veeva got most of these large companies as customers eventually and Salesforce/homegrown was never a big threat that limited Veeva’s growth.

Frothy Valuation

Profitability

Suhail Capital said the revenue multiple on Veeva was crazy high at the time of the IPO.

One of the specific reasons they mentioned for Veeva’s high revenue multiple is because it was one of the only real profitable cloud companies at the time, which implied that the market was overvaluing Veeva because they were profitable.

Fast forward a decade and it turns out that a lot of cloud companies can’t be really profitable, at least in the way Veeva is profitable.

Veeva is a cash printing machine with 46% free cash flow margins over the last year! They hold the very top spot for profit margins of public cloud companies. Companies with these types of profit margins should for sure receive a premium on valuation relative to other similar software companies that will never be that profitable.

Revenue Growth

Below is Veeva’s revenue since its IPO. While Veeva wasn’t a hyper-growth company at a significant revenue scale, it has been able to consistently grow revenue for a really long-time. With high growth endurance, a decent revenue growth % can turn into a REALLY large amount ($2.4B) of revenue over time.

Vertical software might be harder to scale as fast, but as more opportunities open up vertical software can have very durable and consistent revenue growth. I also think the revenue growth can be more durable, especially in a world of generative AI.

Veeva’s revenue has grown well past original expectations of what was possible.

Relative Valuation

A major component of the short thesis comes down to the following argument from Suhail Capital about Veeva’s valuation compared to Salesforce.com:

How is a vertically limited value added reseller [Veeva] trading at nearly one quarter of the market cap of the world's largest enterprise cloud company and their own platform provider [Salesforce.com]?

Suhail Capital was looking at Veeva’s CRM business that focused only on life sciences and questioning how it could have such a high valuation compared to Salesforce. It certainly was not an unfair critic of the valuation.

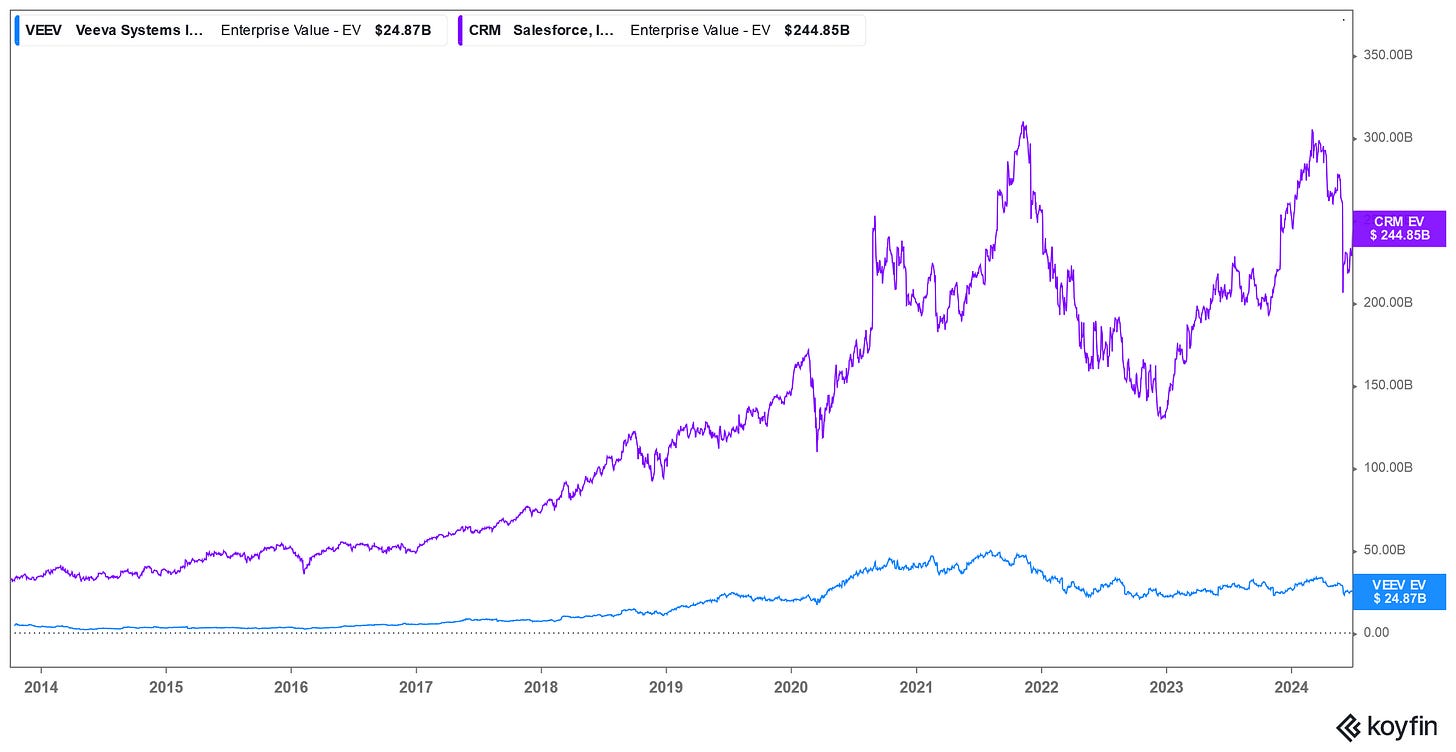

Below is a comparison of the enterprise value of Salesforce.com (purple) and Veeva (blue). Salesforce.com clearly took off compared to Veeva. Veeva went from nearly 1/4th the valuation of Salesforce.com to 1/10th.

So was Veeva expensive at the time of the IPO?

Based on the stock price performance, the answer to this is probably yes. At the time of Suhail Capital’s short report the price was ~$40 and it took about 3 years before it saw that price again.

Also, compared to QQQ (technology stock index), Veeva also under performed:

Veeva’s gain since the close of the first day after IPO through today is a 389% gain

QQQ gain over the same period of time is 500%

Maybe another lesson here is to just invest in index funds….But Veeva still did very well over a longer time horizon.

Shorting Stocks

Below was Suhail Capital’s slide on how to think about shorting Veeva.

Shorting stocks is really risky and the majority of investors should probably stay away from it. The loss potential is unlimited in shorting stocks because the stock price could keep climbing….while the loss potential in a long position (normal stock purchase) is limited to the amount you invest.

And shorting stocks anytime in the last decade has been particularly difficult given the long bull market - stock prices keep ripping higher (despite some weakness in certain areas like software recently).

Shorting stocks is typically the result of one of the below:

The stock is overvalued

The company is bad and will get worse

You would generally believe #1 is true if #2 is true, but often people will short a stock just because of #1, which is what Suhail Capital initially did. Below is from their initial short report:

We point this out because there are going to be some people who view this robust short-thesis as an attack on the company when in reality it is nothing more than a very systematically driven critique of the wildly mispriced stock of a well-run business.

The problem with shorting a stock merely because it appears overvalued is that a good company with good management will often find a way to grow into their premium valuation. So longer term it is very risky to short a stock just on the basis of valuation. In the short term it may work but you have to enter and exit at the right time, which is much harder to do.

Depending on when Suhail Capital shorted and when they covered their short (i.e. exited the position) they probably made money. The stock price dropped by nearly 50% at one point from Suhail Capital’s original short - although nowhere near their price target of $8. And it definitely was not a “dream short” as they described it.

So maybe Veeva’s valuation was a bit frothy at the time of IPO but Veeva was (and appears to continue to be) a great company with great management that is great at executing so they grew into their valuation and have become a leading public cloud company.

It’s near impossible to make many investors admit they were wrong, which can cause a lot more losses…but Suhail Capital did admit they were wrong on several of their original issues with Veeva.

Two years later we can humbly say that on the four points Veeva has proven us wrong, and as far as the fifth point goes, the market has gradually taken care of that.

The 5th point was the valuation concern. They admit they were wrong on the TAM, competition, etc but the valuation slowly took care of itself given they were wrong on the other core issues.

Final Thoughts

In the long term, a well-run business will find ways to succeed.

Vertical software companies can run incredibly efficiently. Veeva is taking nearly half of revenue to profits!

Vertical software might be harder to disrupt so while growth might be a bit slower it may be more durable.

TAM is not static and great companies/management won’t be limited by their current TAM

Footnotes:

Grab my SaaS Chart of Accounts Guide and get your books set up the right way

Check out OnlyExperts if you need offshore accountants (good name :). I am partnered with them to help CFOs and finance teams hire offshore accounting talent.

*Not investment, legal, or tax advice obviously

great piece!

This is for Veeva. Do you see this playing out for other companies?

I write about the tech services firms. Mid-tier firms, the hottest segment at present, built a growth playbook that builds verticalized offering and GTM capability.