Wealthfront S-1 | More Fintech IPOs

Wealthfront files S-1 with explosive revenue growth and incredible profitability metrics, but...there are risks.

Today’s sponsor: Brex, the intelligent finance platform.

CFOs are building for 10 scenarios, not one.

Can resilience be a strategy? Brex CFO survey data says it is now. Tariffs, AI, and global uncertainty have made stability a moving target and adaptability the next big edge. But 69% say their finance stacks are too complex to move fast, and 75% feel pressure to accelerate AI results. See how CFOs are making flexibility, automation, and speed their new KPIs.

📊 Wealthfront Key Metrics

Revenue

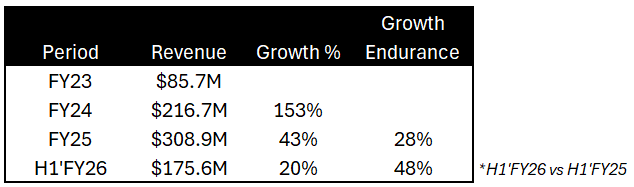

Scale: $364M annual revenue run rate (based on recent quarter revenue * 4)

Growth: 20% (using H1’25 vs H1’24).

Wealthfront will be near top quartile in terms of LTM revenue growth rate compared to public cloud companies but its revenue scale is near the bottom. They will certainly be a test for smaller IPOs. I would love to see more smaller scale tech IPOs!

Growth Endurance: <50%, which is not great. Over the last two years Wealthfront’s growth endurance is one of the worst out there amongst public companies.

Growth Endurance = the ratio of this year’s growth rate to last year’s growth rate

Wealthfront has been around for 17 long years. In FY23 they were just at $86M and then had explosive growth in FY24, but then….growth slowed dramatically to 43%, which is strong but not amazing given the revenue scale.

And then in the first half of this year Wealthfront only grew 20% YoY.

Revenue growth endurance is one of the most important metrics for an IPO. Investors will need to know future revenue growth will be strong, especially for a small scale IPO.

Historical Revenue:

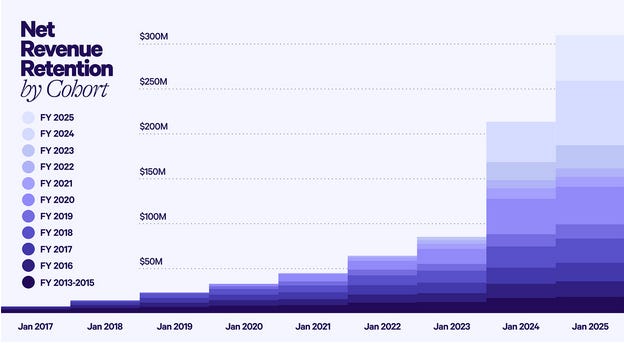

The more historical revenue numbers aren’t explicitly disclosed, but they are shown in the NRR graphic below. Growth has been pretty slow for a LONG time and then exploded in FY24, but now they seem to be slowing back down quickly (as noted above).

Profitability

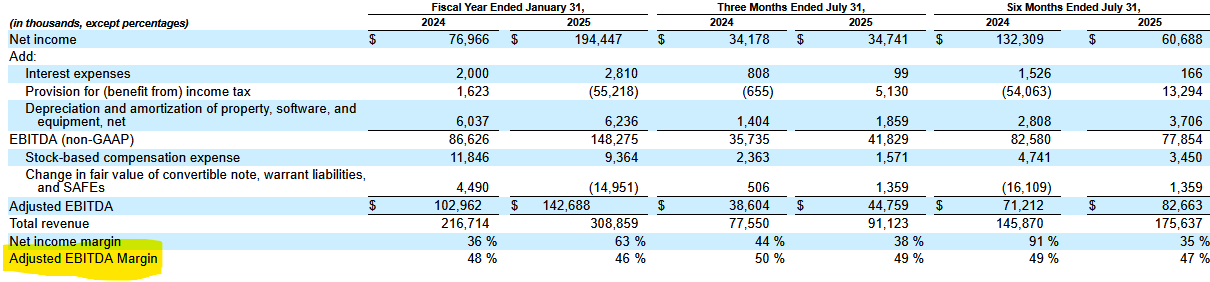

EBITDA Margin: 47%….wow!

Wealthfront went from net losses since inception to massively profitable starting in FY24 as revenue surged and expenses dropped as a percentage of revenue. Wealthfront is fintech (not SaaS), but they have better profitability metrics than most SaaS companies

Gross margins = 90%

OpEx = 49% of revenue

Interesting to note that 50% of their employees are software engineers and they have no dedicated salespeople or financial advisors. It’s all PLG with just 11% dedicated to marketing.

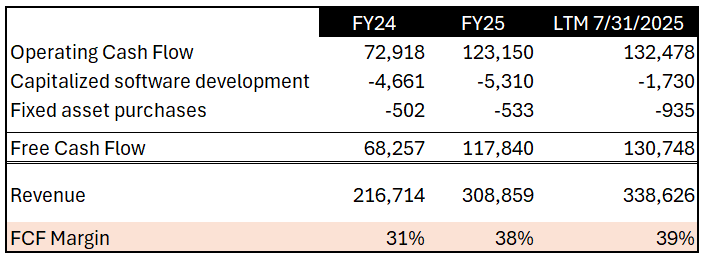

Free Cash Flow: 39% FCF margin

The explosion in revenue growth has also enabled Wealthfront to become massively FCF positive in the last two years.

39% FCF margins would put Wealthfront in the top decile when compared to public cloud companies. I know they aren’t SaaS but this is the group of companies I think about, especially with profit margins like Wealthfront.

Retention

Retention seems to be strong as well.

Over the past two fiscal years, over 50% of new clients were referred by existing clients and our annual client retention rate was approximately 95% for each of fiscal 2024 and fiscal 2025.

For each of the last eleven fiscal years, our annual net revenue retention was greater than 120%

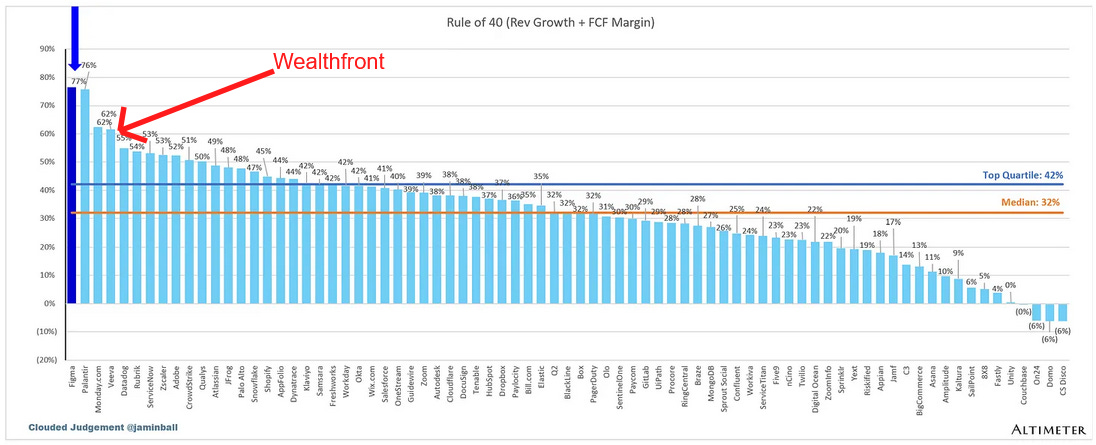

Rule of 40 Score

Rule of 40 Score: 59% (20% growth + 39% FCF margin)

A Rule of 40 Score of 59% is amazing! Only a few public cloud companies have a higher score. Again…I know they aren’t SaaS.

But….as we all know, revenue growth is more valuable than profitability. If we give revenue growth a ~2x multiplier, then it becomes slightly less impressive, especially considering its scale.

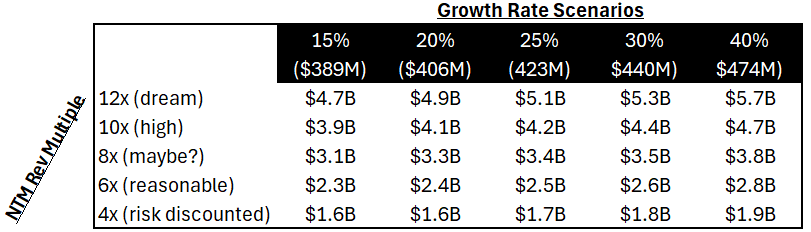

Wealthfront’s Valuation

Failed $1.4B Acquisition

In early 2022 UBS announced its intent to acquire Wealthfront for $1.4B, but the acquisition later fell apart in large part due to the drop in tech valuations (especially fintech). It was also reported that there were regulatory concerns and UBS shifted focus.

Secondary Transaction at $2B Valuation

In late 2024, there were several company repurchases and secondary sales that valued Wealthfront at ~$2B.

IPO Valuation

Wealthfront will want a high revenue multiple because of:

Incredible profitability metrics

Top decile Rule of 40 Score

Great revenue growth from the last full year

But there are plenty of things that should discount the revenue multiple:

Revenue growth has quickly decelerated after its two-year explosive growth

Hasn’t proven it can consistently grow revenue at a fast rate (only 2 years of strong growth and not quickly slowing down)

Market is becoming increasingly commoditized so profit margins will get squeezed. “Your margin is my opportunity.”

Revenue is slowing on one of the continued best bull runs ever. What will happen if the stock market falls? And interest rates come down?

I would likely give it a ~5.5 - 6.0x revenue multiple (or potentially event lower) given the risk I see with this business (but I could definitely be wrong!). I could also easily see it going out at 8x+ depending on the IPO hype and story built around the business.

Final Thoughts

Wealthfront seems like a great business. They have seen explosive growth and have become highly profitable.

While I am certainly not an expert in Wealthfront’s space, there seems to be lots of risks. I would have rather have seen at least a couple more years of consistent, strong revenue growth before an IPO. I also think Wealthfront would have made a really strong strategic acquisition target that could fetch a high revenue multiple. UBS obviously considered it.

Regardless, I hope Wealthfront does well in its IPO. It’s a great business and I hope we see more smaller IPOs.

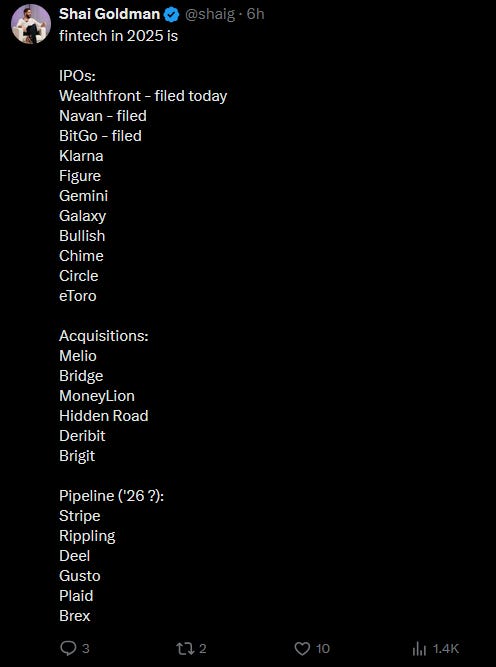

Side note - fintech is on fire! Lots of IPOs, acquisitions, and future IPOs in the pipeline.

Footnotes:

Download this CFO survey data on top concerns and priorities in 2025 (from Brex)

Checkout OnlyLawyer (cousin to OnlyCFO) for all things legal for tech companies

*Nothing in this article constitutes legal, tax, or investment advice.