Week in Tech - News, Lessons, and Tweets

Earnings season, clerical errors worth billions, CEO red flags, and more

👋 Welcome to the OnlyCFO newsletter - a weekly newsletter on software trends, best practices and finance education. Subscribe here!

Brought to you by: NetSuite

CFO's Ultimate KPI Checklist: 50 Step-By-Step Checklists to Drive Your Company's Success

Sponsor OnlyCFO and reach 16k+ finance leaders, CEOs, and other software leaders.

Peak ZIRP Madness is Finally Dying

If your CEO takes photos like this to promote a software business, then your stock options will be worthless.

There were plenty of red flags regarding Bolt’s CEO…

Considered himself a fundraising genius. While ability to fundraise can be important, it’s not what makes a company successful and you certainly don’t brag about it.

Provided his “great” wisdom through TikTok videos. He was acting like a TikTok influencer instead of someone focused on building an actual company.

More focused on culture than building a good product.

Self-published books: Conscious Culture Playbook, an alternative to a traditional employee handbook that brought mindfulness principles together with standards for performance.

He instituted a four-day workweek in January 2022. Soo much ZIRP 2021 vibes

Steps down as CEO in January 2022 to allow himself to focus on his “superpowers” of steering Bolt's culture and vision.

Flat out lied about company performance. There was an SEC probe about Bolt’s fundraising in 2021. According to the letter, Breslow “made material misrepresentations about the Company’s financial condition and product pipeline that resulted in the Series E investors buying into the Company at a grossly inflated valuation.”

Tweets about how many people in Silicon Valley are evil and out to get him

One of the stupidest things he did was promoting what he called “the most employee-friendly stock option program possible.". Breslow encouraged employees to take out loans to buy stock of Bolt under this program when it was valued at $11 billion in 2022.

Fast forward to today and it was discovered last week that Bolt is currently being valued at a mere 3% (just $300M) of their previous valuation!🤯

The employee stock option loans were collateralized against the employees' personal assets. So if the value of the stock declined (they essentially went to zero) or they were unable to repay the loan then their personal assets could be at risk.

Even if Bolt doesn’t force employees to repay the loans the employees will be left with a mess of tax issues (forgiven loans are income…)

When you know nothing about taxes and the risks of loans like this then don’t go around promoting it as the best thing ever and encourage employees to do it.

The most ironic twist was when former board member Activant Ventures’ Steve Sarracino alleged that Breslow removed him and two other board members when they declined to help Breslow repay a $30 million loan.

Bolt’s Stupid Valuation

What’s really wild is that Bolt raised nearly $1B and was valued at ~$11B when its revenue was like ~$30M and burning incredibly high amounts of cash.

While Bolt’s CEO deceived investors about many things, the valuation and amount of money given to Bolt is still absurd in retrospect.

Lyft’s Error

Lyft announced earnings last Tuesday after the bell and the stock went parabolic with the stock price instantly climbing +65%.

I am guessing all of the Lyft folks were watching this in complete shock because while the earnings were good, they were not that good.

That’s when it was discovered that there was a clerical error in the press release…and the stock immediately dropped to +11% instead of +65%

The original press release stated there would be an estimated 500 bps of EBITDA expansion when it should have said 50 bps…In other words, they accidentally said 5% vs 0.5% margin expansion - a big difference.

The CEO took responsibility and shielded his team from blame (but I am sure they won’t make that mistake again).

This was a really bad mistake especially considering the number of people that review these things before they get released.

Software Earnings

Earnings season for software companies is ongoing with many still coming. Keep an eye out for more OnlyCFO deep-dives.

Sticky Inflation

Inflation data was released last week:

January CPI was +3.1% vs expectations of +2.9%

If inflation is stickier (stays higher) then the expectation is the Fed will cut rates slower and we will have higher interest rates for longer.

Higher rates for longer is a negative m bad for software valuations.

TWEETS

Strong agree here with Jason on brand marketing. Lots of budget waste happens because of inexperienced people or folks with the wrong experience. Often a big company CMO (or other exec) joins a startup and runs their Big Co playbook…and it’s almost always disaster.

Be careful of leverage…

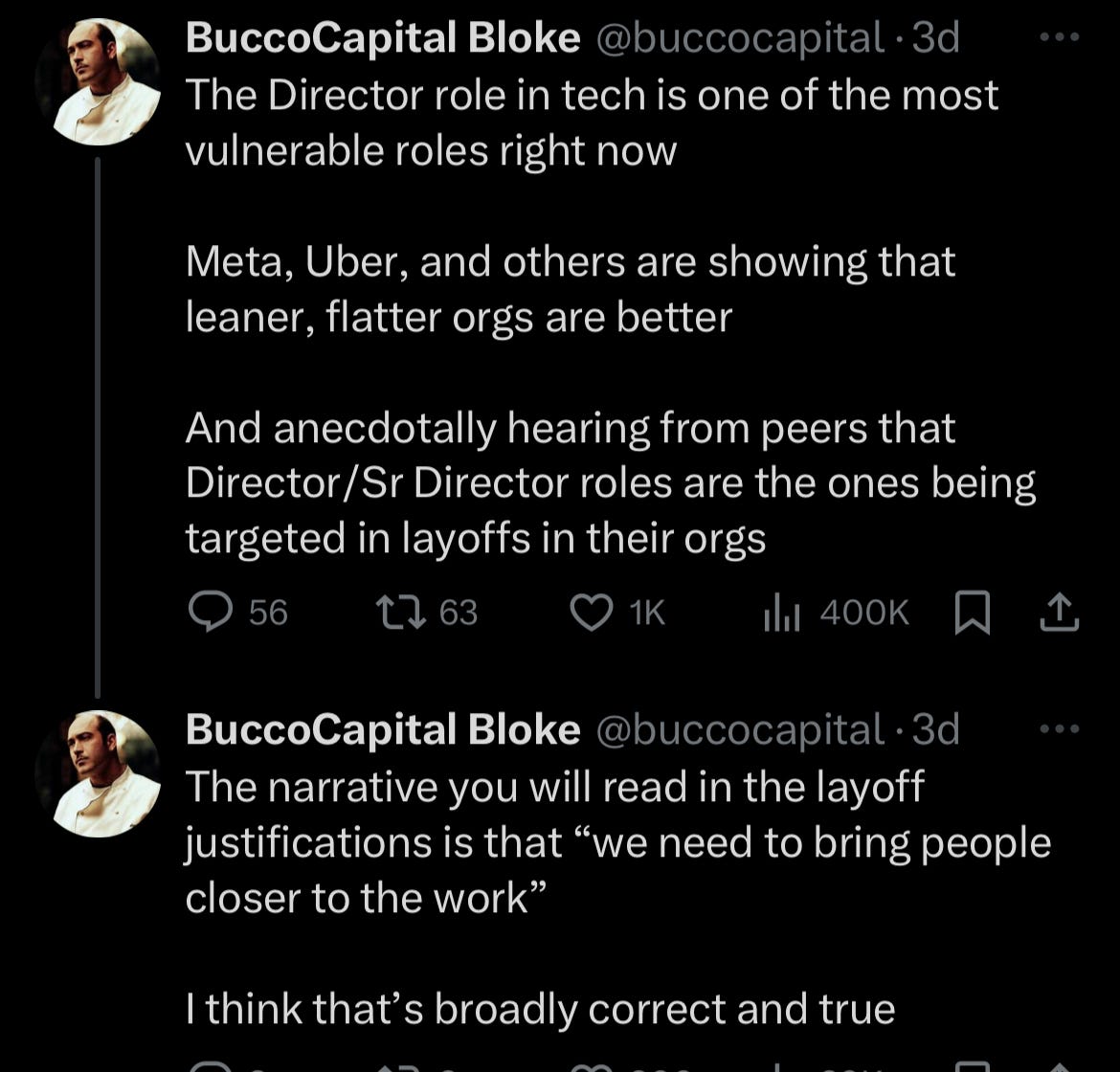

As companies continue to focus on efficiency I am frequently seeing 1) middle management get disproportionality cut and 2) stronger push for cheaper resources offshore.

Read my recent post: Warnings Signs of a Layoff

Footnotes:

Sponsor OnlyCFO Newsletter and reach 16k+ CFOs, CEO, and other leaders in the software industry.

CFO's Ultimate KPI Checklist: Check out this great checklist of KPIs that companies and CFO’s should be tracking

Subscribe if you haven’t and share my newsletter with your friends!