What Does It Take to IPO?

Most companies aren't on the IPO path, but most founders think they are...

Today’s Sponsor: NetSuite

Artificial intelligence technology is here, and finance leaders know it can help them make faster and more-informed decisions, says the CFO Alliance. Will you use it to enhance your financial leadership, improve operational efficiency, and drive a competitive advantage?

Download the guide to discover how NetSuite’s AI capabilities can empower your financial leadership and drive your organization’s success.

Dreaming of an IPO

We are ~2 years away from an IPO — every single VC-backed founder

Back in the glory days of 2021, every company I talked to was ~2 years away from an IPO (according to their founder). Even the companies with ~$15M of revenue and no real finance team would talk like an IPO was just around the corner.

Just a couple of those have actually IPOed since then…

While a bit more realistic today, I talk to many CEOs who are still delusional about their IPO prospects.

I don’t want to be a dream crusher, but…I do want folks to face reality. Chasing an IPO that will never happen isn’t good for anyone (other than your $1,000/hour external legal folks that round up every 15 minute phone call to one hour). And if you are actually on the IPO path, then I want to make sure you are properly preparing.

What It Takes to IPO

There are two key things to being IPO-ready:

Financial and metric readiness (is the company good enough?)

IPO/Public company readiness (is the finance and other back office stuff ready?)

99% of being IPO-ready is #1. Nothing else matters if you don’t have a successful company with a compelling story for investors.

But that last 1% of IPO preparation (#2 above) can take a surprisingly long time and delay an otherwise IPO-ready company. The bulk of this post focuses on the prep required by the finance/accounting teams.

Step 1: Financial & Metric Readiness

Are you worthy of being a public company?

I will write another post at some point on my thoughts here since there is so much to cover. But there is one point I want to make. Most of you are not worthy of the public markets…Sorry, the truth hurts.

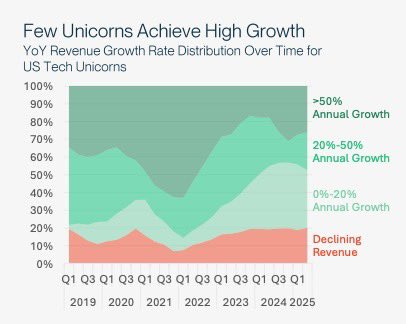

Below is some data on unicorns ($1B+ valuations) from SVB:

50% of unicorns are growing revenue less than 20% annually.

Only 5% of all unicorns are >$300M ARR (probably min bar to go public) and also have a Rule of 40+ score

So 95% of unicorns are zombies? uh oh…that’s a lot of zombies. And I would be very surprised if 5% is really able to IPO. I think the real percentage we will see from this vintage is closer to half of that.

Historically, when a unicorn was born, there was a real expectation that they could IPO. Or, in a more worst-case scenario, be acquired by private equity. Well...it seems ~95%+ are not IPO worthy. And based on conversations with several PE folks, they also don’t want to touch a significant amount of that 95% (at least anywhere near the valuation expectations they currently have).

I am being a bit of a dream crusher so companies that are not on the IPO path don’t waste precious money and time on an IPO that isn’t coming. A glorious amount of money/time can be wasted here…

If you are not IPO worthy, then your team should be focusing on:

Can you turn things around to become IPO worthy?

Are you an attractive acquisition target? If not, how do you become one?

Do you need to get to FCF positive so you have more time to figure things out?

The Reality of Software IPO Returns

One reason that typical cloud companies will continue to struggle to IPO is the dismal performance of the cloud sector and their recent IPOs.

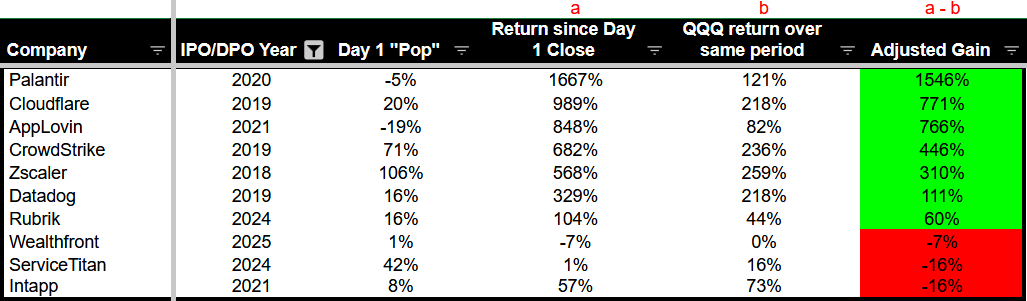

Only 7 cloud companies that have IPOed since 2018 (of the 52 that I am tracking) have beaten the QQQ ETF over the same time period since they went public.

Just 7 companies…

And look at the bottom 10 companies on this list…ouch.

The average QQQ adjusted return of all these cloud IPOs since their Day 1 IPO close is -42% 🤮. When returns are that bad, public market investors are going to be very cautious with similar IPOs.

2026 might be a blockbuster year for IPOs, but it will be because a handful of massive companies with fantastic metrics and story go public. The below shows the largest potential 2026 IPO candidates. These companies will drive most of the excitement and IPO volume.

I hope there are smaller scale IPOs, but you need to know it’s tough right now unless your metrics are excellent.

Step 2: IPO/Public Company Readiness

Great, you made it to step #2! You’ve got a business worthy of being public. The REALLY hard part is done!

But getting actually ready to be a public company can take a surprisingly long time and require a lot of hard work, particularly from finance and accounting.

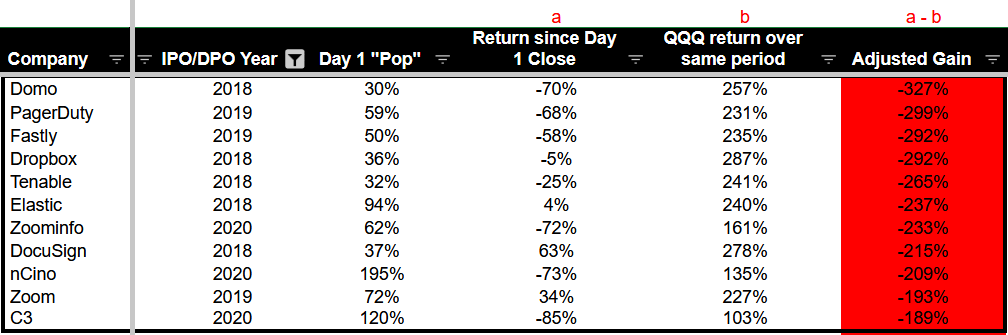

Below is a timeline and milestone summary for an IPO. If you take nothing else away from this post, remember that IPO planning should start 18 to 24 months before the actual IPO.

It can be done in a shorter timeline…but it will be HARD!

CFO Playbook for IPO Readiness

There is a lot for a CFO to consider when getting a company IPO-ready. Below are the key things that you need to get right (and in most cases, do many quarters before the actual IPO).

1. Building the IPO Team

The management team is the most important thing in preparing for an IPO and being a public company. And you need a lot of them well in advance of an IPO so they can put new processes, systems, etc in place before an IPO.

Lots of companies start thinking about this way too late…

The Board of Directors

Determine early if your board composition will satisfy SEC and listing exchange requirements so you have time to make the necessary changes. Boards are required to have a majority of independent directors within one year of being public.

Finding good independent board members can take time. Begin early so you can find the right people.

Set up the required board committees. The first two committees below are frequently established earlier while the third is often set up shortly before an IPO.

Audit committee

Compensation committee

Nominating & corporate governance committee

The CFO Team

Most of the responsibility for IPO preparation is on the CFO’s team.

Having the right CFO with IPO and/or public company experience will make things way easier and smoother. It can be OK for the CFO to not have IPO experience (many have done it) but they need to rely heavily on their network and advisors for help through the process.

Below are a few of the important resources that companies need to think about:

Technical Accounting - Should have someone internal but will likely also need outsourced technical folks. There is lots to do in an IPO process to make sure all complex accounting matters are handled properly

Controller - Someone that knows what it takes to be a public company (strong Big 4 experience, public company experience, etc). Please make sure you have a strong Controller!

Financial Reporting - Often not hired until IPO preparation begins but large private companies might need someone earlier. You will likely also need external help as well.

Tax Specialist - Becoming a public company can have huge tax implications and a tax expert should be brought on early in the process to help with optimal legal tax structures, internal controls, tax positions, etc.

Internal Audit - Maintaining a proper internal control environment is critical, especially as a company prepares to be compliant with Sarbanes-Oxley Act (known as “SOX”)

Investor Relations - Often hired during some point of the IPO preparation process.

Management Team

Are there any other areas of the management team that need to be built out?

Do any current leaders need to be “topped” (i.e. add someone above them) with the right experience?

External IPO team

There are a lot of external experts and advisors you need during the IPO process.

Underwriters - These are the folks that run the show and should be found early in the process as they will help guide everything else.

IPO legal counsel - You need strong legal counsel (both internal and external) with public company experience.

Capital markets advisors

Auditors - You may need to upgrade to bigger firm if you aren’t using Big 4. Also, ensure you have proper independence with the audit firm.

Accounting Advisors - Your internal team still has their day jobs to do so the accounting advisors will help with additional technical accounting documentation, drafting financials needed for an IPO, etc.

Risk Advisors - help support and enable companies to become SOX compliant

2. Accounting & Finance IPO Preparation

Accounting is the #1 reason for delayed IPOs. A delayed IPO can add significant risk of missing the “IPO window”, so it is important to get ahead of these issues early.

What financial information is required?

An S-1 is a document that the SEC requires companies to file in order to publicly offer new securities (i.e. an IPO). There can be A LOT of work that your accounting/finance team needs to do for all the additional required disclosures of an S-1 and being public.

Sometimes it requires upgrading systems and/or processes in order to get the required information.

There is a massive amount of work to prepare the S-1 and basically your entire IPO team will be involved. While your accounting team may own a large portion of the required work, it will be time-consuming for many others as well.

S-1 Financial Requirements

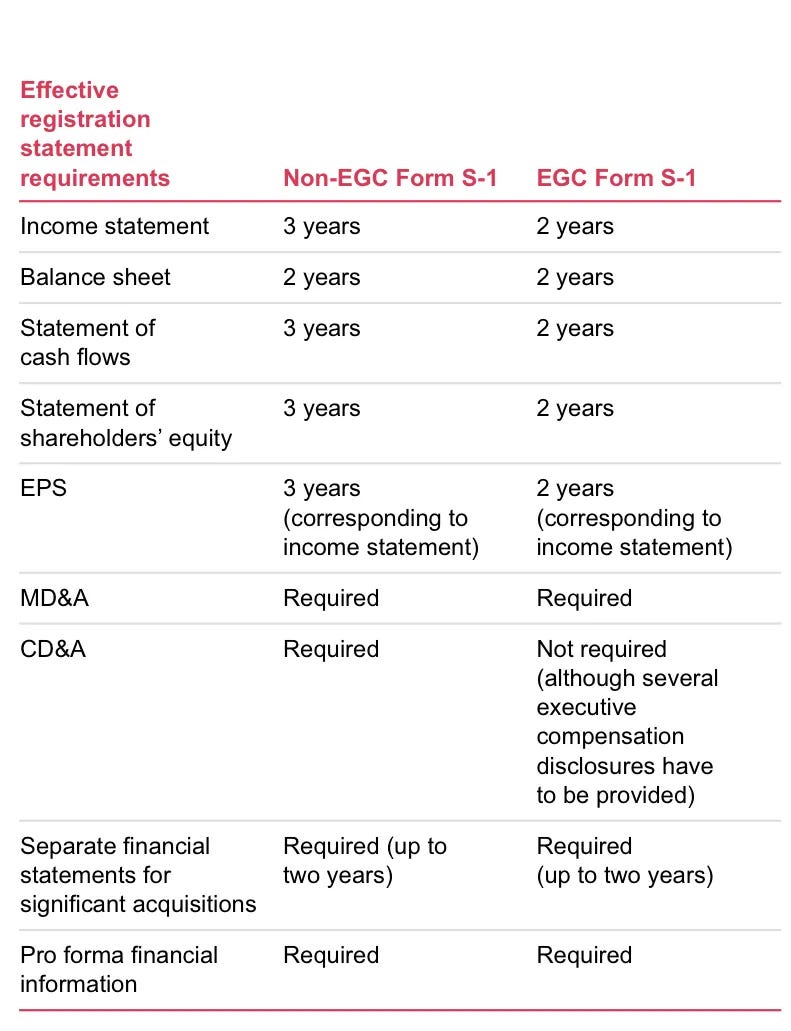

Most tech companies IPO under the EGC (emerging growth company) requirements.

The JOBS Act of 2012 provides a time period of relief from certain public company requirements:

Less financial reporting requirements (2 years of financials vs 3 years)

Can adopt new accounting standards at the same time they are required for private companies, which is usually a year later.

Provide less detailed executive comp disclosures.

Exempt from the requirement to get an audit over internal controls over financial reporting

While these exemptions provide a ton of relief, companies need to monitor when they will no longer qualify for these EGC exemptions so they are prepared to meet the full public company requirements.

Below is a nice summary from PwC of the financial reporting requirement differences between EGCs and non-EGCs.

Getting the auditors involved early is critical because even the EGC requirements can take a long time. The below two items are key milestones that can require a lot of time:

“Audited” financial statements for the last two years

“Reviewed” quarterly financials for at least 8 quarters

In addition to the annual audited financials, companies will want to present the last ~8 quarters of financial information so investors can see a trend. Quarterly financials don’t need to be audited but they must be “reviewed”.

Audits are by far the most time intensive, but the reviews can take quite a bit of time as well for both internal resources and for the auditors. If your company hasn’t been closing the books properly on a quarterly basis then they may have a lot of work to make sure each quarter is correct (often referred to as “quarterization”).

You may have been passing your previous financial audits, but those were likely under AICPA standards. When you decide to go public, you must get an audit under PCAOB standards, which is a more intense audit.

Passing AICPA annual audits DOES NOT mean your financials are ready.

Accounting Issues

There are lots of complex accounting areas and SEC hot topics that companies should make sure are buttoned up early in the IPO prep process. Below are many of the ones I have seen that require a lot of work and/or frequently receive SEC comment letters.

Non-GAAP stuff and KPIs - The SEC pays a lot of attention to these areas and they are a frequent area of SEC comment letters (a letter from the SEC requiring a response from the company)

Risk factors - Legal helps drive this but it can take a lot of work to capture everything.

Revenue recognition - Revenue is the most critical line item on the financials so it receives a ton of attention.

Cheap stock - Refers to equity awards issued 1-2 years before an IPO that is significantly below the expected IPO price. If the fair value of those awards were significantly less than the IPO price there may be concern that not enough expense is being charged.

Acquisitions - Material acquisitions that will show up in the S-1 (prior 2-3 years) may require separate financials for the acquired entity. Be careful with acquisitions during this period as it could delay an IPO.

Related party transactions - The SEC requires >$120k. Make sure you have a policy and are tracking related party transactions early. You will get made fun of if your S-1 shows lots of related party shenanigans…See Domo’s S-1 where they were buying all sorts of stuff from the CEO’s family.

Management Discussions & Analysis (MD&A) - The SEC loves to poke here and provide comment letters.

Consolidation accounting

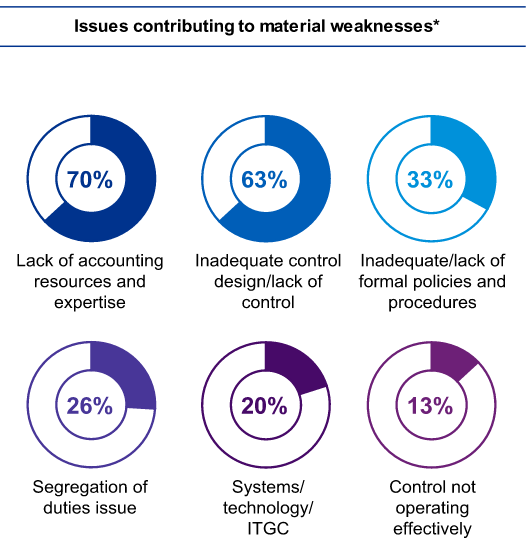

Control Environment - While there are certain SOX exemptions for EGCs, companies still need to disclose whether there are “material weaknesses” in the financial control environment. A material weakness means that controls are bad enough that there is a reasonable possibility that material misstatement in the financials may exist. Having a material weakness at the time of IPO isn’t the end of the world, but you want to be actively working on it and ideally correct it beforehand.

The below image is from a KPMG study on material weaknesses of recent IPOs. The last thing you want is to add a material weakness after you go public. Adding a material weakness is a death sentence (getting fired) usually for the Controller.

Other Accounting Considerations

Can the team consistently close the books timely and accurately?

Upgrading systems and tools appropriate for a public company

Evaluating the impact to NOLs (net operating losses) with an ownership change of IPO. When there is a 50%+ ownership change over 3 years then some of the company’s NOLs will be limited, which can create a major tax loss once the company is profitable.

Perform tax analysis to understand tax exposure and ensure proper sales tax, VAT, GST, etc are being properly collected and remitted.

3. Finance & Investor Relations Considerations

Finance IPO Preparation

How good is your finance team at consistently providing accurate forecasts?

The public markets will destroy a company that is unpredictable and can’t accurately forecast revenue and expenses.

I tell folks that companies should act like a public company for at least one year before the actual IPO. The finance team needs to show they can set accurate forecasts and create a good “beat and raise” strategy where they consistently beat forecasts (by a reasonable margin) and raise forward-looking guidance.

Executive Coaching & Education

Many CEOs and other executive team members don’t have IPO experience and/or it has been a while since they have been at a public company. These folks (and the broader company to a lesser extent) need to be educated and coached in preparation for being a public company.

Part of acting like a public company is performing mock analyst and investor presentations, test the water meetings, roadshow presentations, etc. Earnings calls and investor presentations become a major part of life for a CEO and CFO. They need to be handled well so preparation and practice are key.

Other IPO Preparations

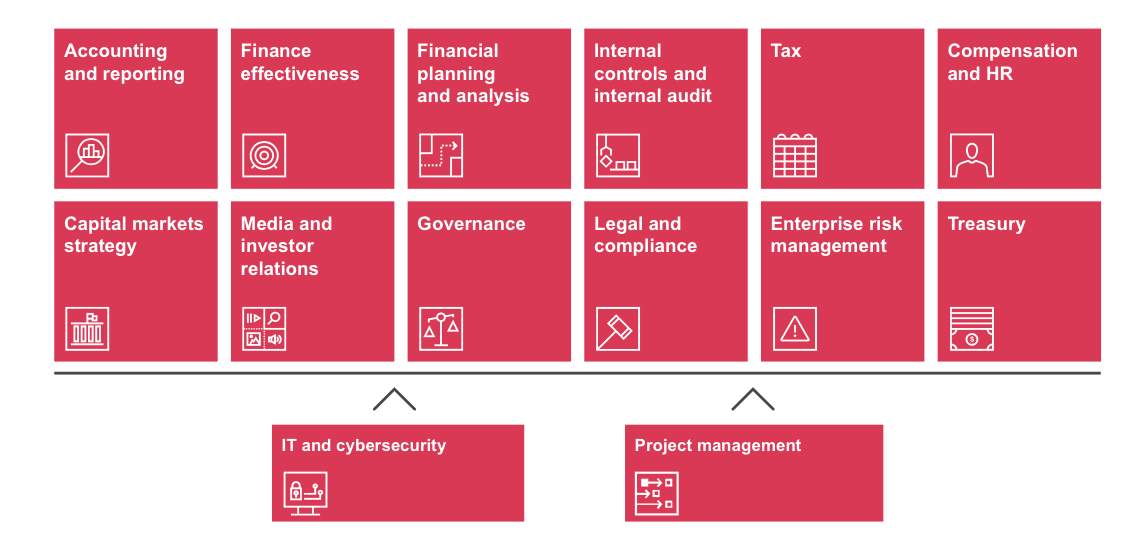

As you can tell from all the work mentioned so far, IPO preparation is a company-wide effort. While a lot of the work is concentrated with accounting and finance teams, a successful IPO requires a lot of cross-functional work.

Here are some other things to think about in IPO preparation:

HR and policies - Make sure all of these are updated and will meet a public company’s needs

Rule 701 - Your lawyers are hopefully tracking this…

409A valuation reports:

Increase frequency to quarterly, 1-2 years before an IPO

Switching to the PWERM method 1-2 years prior

Cap table - A LOT of companies have messy records and the cap table needs to be cleaned up before going public. Trust me when I say this can take a long time…

Corporate insurance needs - Exposure to liability is much higher for directors and officers of public companies than for private companies. Talk through required insurance changes with an experienced broker.

Concluding Thoughts

If you take nothing else away, remember these three things:

Make sure you are really on the IPO path

IPO preparation always takes longer (and is more costly) than you think

Having the right CFO and Controller will save you an incredible amount of money and time.

Good luck and I hope to see your company IPO in 2026!

Footnotes:

Want to adopt AI in Finance? Check out this CFO Guide to AI-Enhanced Finance from my friends at NetSuite

Want to sponsor OnlyCFO and reach 36,000 finance and other tech leaders? Email onlycfo@onlycfo.io

*Nothing contained in this post is investment, legal, tax, or any other kind of advice.

Thanks for sharing! Deloitte has a free IPO readiness tool for VC and PE backed companies to evaluate their IPO readiness which covers all of the above - https://www.deloitte.com/us/en/services/audit-assurance/articles/pre-ipo.html or https://selfassess.deloitte.com/ipo/us