Why "RPO" Sent Oracle Stock to the Moon 🚀

Larry Ellison’s net worth increased by as much as ~$100B yesterday...

Spend smarter and move faster with Brex, today’s sponsor.

CFOs finally get speed AND control.

Control usually means red tape, speed usually means chaos. CFOs have been forced into that tradeoff for too long. Brex rewrites the rules: expenses flow in real time, categorized automatically, with full visibility baked in. It’s why 30,000+ global businesses, including 250+ public companies, trust Brex’s intelligent finance platform to spend smarter and move faster. Join them in breaking the tradeoff.

Oracle announced its quarterly earnings on Tuesday afternoon and the stock soared by as much as 43%, which is its best trading day since 1992!

The stock is up ~50% over the last 5 days and it’s nearly a trillion-dollar market cap. Insane!

What caused Oracle stock to explode?

The stock price reaction to an earnings release is driven by the 1) quarterly actuals (what happened) and the 2) updated guidance (i.e. forecast).

The best outcome is a “Beat & Raise”, which means they beat expectations and they raise forecasts even higher.

Both the “beat” and the “raise” have two parts:

Revenue growth

Profits

Usually, you would expect a “beat” in order to have a “raise”.

Quarterly Actuals

Oracle had a double miss on actuals…missing on both revenue and profits:

Revenue: $14.93 billion vs. $15.04 billion expected

Earnings per share: $1.47 adjusted vs. $1.48 expected

That’s obviously not something that would send the stock soaring…

Updated Guidance

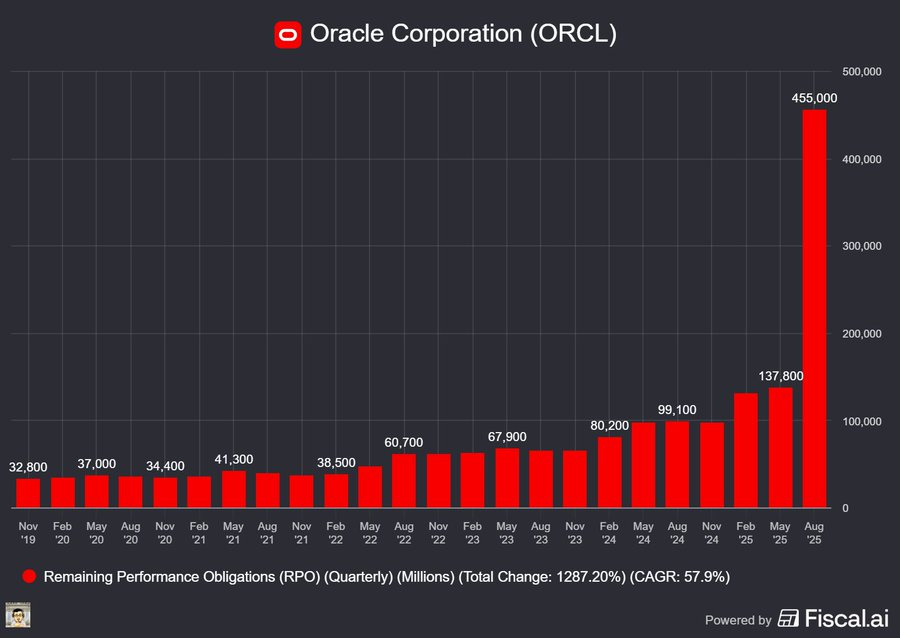

This is what shocked everyone. Oracle announced a MASSIVE increase in RPO 📈

It’s not something anyone has ever seen…This 359% unexpected increase is what sent the stock to the moon.

Before I go into the details, you need to understand what RPO is 👇

What is RPO?

Unlike many software metrics that get thrown around (ARR, NRR, GRR, etc), RPO is governed by Generally Accepted Accounting Principles (GAAP). So RPO is clearly defined and should be uniformly applied across companies.

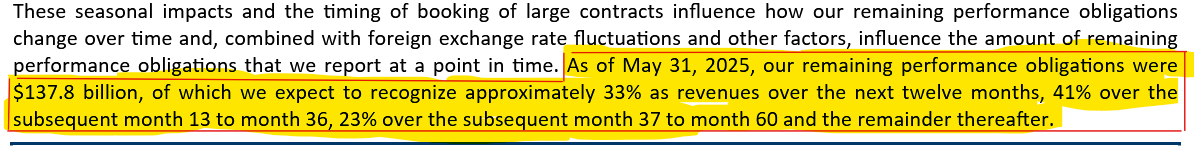

RPO (remaining performance obligation) is the amount of contracted future revenue that has not yet been recognized, including 1) deferred revenue and 2) non-cancelable contracted amounts that will be invoiced and recognized as revenue in future periods.

RPO does not show up on the balance sheet. It’s just a required disclosure to report RPO (for public companies) as of the end of the reporting period and then to report when that revenue will be recognized. You must report how much will be recognized as revenue over the next 12 months and then most companies will just say “and the remaining thereafter”.

Oracle adds years 2-3 and years 4-5 given the materiality of those time frames for their RPO.

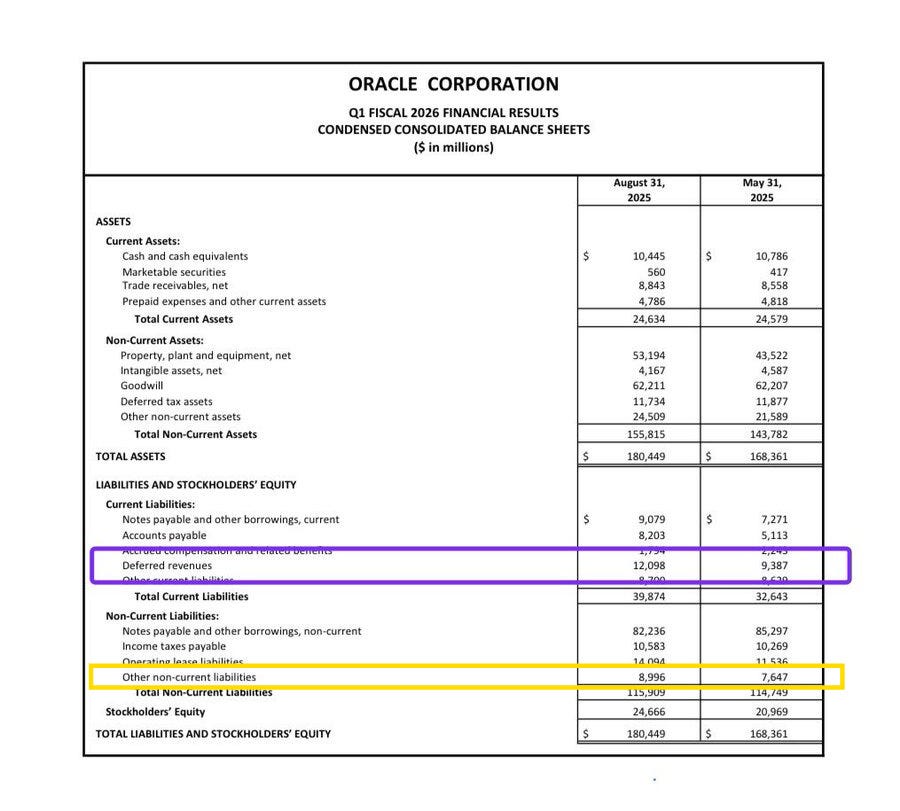

RPO vs Deferred Revenue

Deferred revenue is just the amount that has been invoiced (or cash received) and is then reduced by revenue recognized under that contract.

RPO includes both deferred revenue and contracted amounts that have not yet been billed/paid. On day 1 of the contract, RPO is the total contract value ($120K in the below example) and then reduced by the revenue recognized each month ($10K in the example).

Oracle’s Massive RPO Jump

This is what was said on the Oracle earnings call:

We signed four multi-billion-dollar contracts with three different customers in Q1. This resulted in RPO contract backlog increasing 359% to $455 billion.

Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars.

We expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Most of the revenue in this 5-year forecast is already booked in our reported RPO

Oracle raised their cloud infrastructure revenue forecasts massively! And said that most of the revenue is in their RPO, which (in theory) should be mostly guaranteed.

How guaranteed is Oracle’s RPO?

We found out yesterday that Oracle signed a $300 BILLION deal with OpenAI.

Yes, billion with a B.

That is incredible, but also…a risk and potentially means the RPO is not as good as many investors are assuming.

Basically all of the RPO jump came from one single customer. There may have been a couple other “multi-billion agreements”, but OpenAI was almost all of it.

There are two main things investors need to consider with this.

Did Oracle have to sacrifice margins to get this deal done?

It is very likely that a commitment this size was done at favorable terms for OpenAI so margins will be lower than if the future revenue had been spread across many customers.

We don’t know the answer to this yet, but it seems very possible that margins on this deal are lower.

How should we think about the customer concentration risk?

Oracle is basically betting their future on OpenAI. Not the worst bet, but OpenAI isn’t currently sitting on $300B of cash…

So there certainly is customer concentration risk.

To qualify as RPO, the contract must meet the below ASC 606 criteria:

Signed and enforceable contract that is approved by both parties

Identifiable rights and obligations

Clear payment terms

Commercial substance

Collectibility is probable

Some people have claimed on social media that OpenAI can probably cancel the contract.

This cannot be true, because to qualify as RPO the contract cannot be cancelable (at least without “significant penalty”). You can only count the amount that isn’t subject to cancellation.

So while Oracle is expecting the RPO to turn into revenue (they have to in order to consider it as RPO), there is still risk.

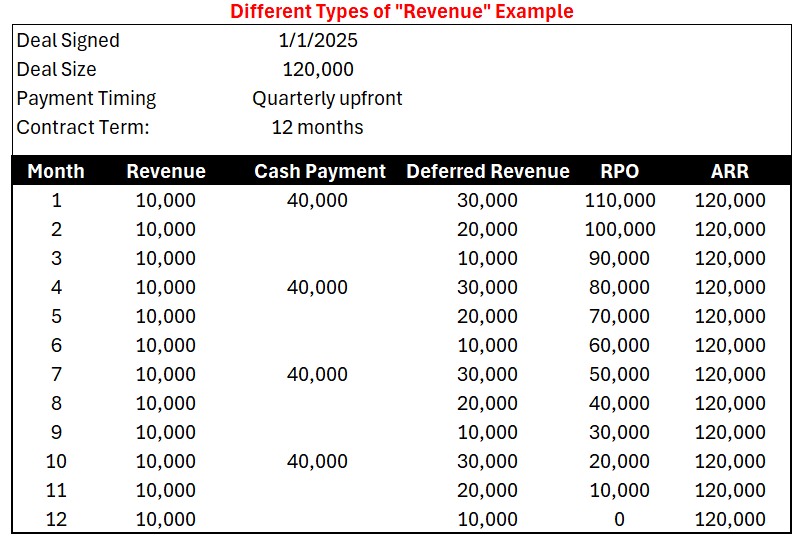

Oracle Deferred Revenue

Some folks have also questioned the RPO number because the change in Oracle’s deferred revenue is so small….

Oracle has deferred revenue in two places on the balance sheet.

Under the section “Current liabilities” that is labeled as “Deferred revenue”

Under the section “Non-current liabilities” that is labeled as “Other non-current liabilities”

The amount of deferred revenue inside non-current liabilities is relatively small (<$2B) and hasn’t changed much. So in total, deferred revenue hasn’t changed very much in the last quarter.

So how did RPO increase so much if deferred revenue barely changed?

Easy…Oracle signed a $300B contract for future services with OpenAI and essentially all of that hasn’t been billed yet (it’s for the future) so it isn’t in deferred revenue but it is in RPO.

Final Thoughts

RPO can be an insightful metric for forecasting future revenue, but it can sometimes be misleading so you should understand why it’s moving.

The deal with OpenAI is obviously great for Oracle, but there are risks to consider.

Very few private companies talk about RPO. It’s not a required disclosure for them, so it usually isn’t calculated. But as companies get larger (and especially when public) they pay more attention to it since it is required for public companies and investors ask about it to help forecast future revenue.

Footnotes:

Get CFO-specific playbooks, templates, and advice in the CFO Corner from Brex (today's sponsor)

Subscribe and share OnlyCFO with your friends :)

One of your best

Fantastic post (as expected)

Looks like a bubble and quacks like a bubble.