Wild Ride at Bill.com

Disappointing revenue guidance, acquisition rumors, acquisition denials, and lessons from the Divvy acquisition

BILL’s (aka Bill.com) stock price has been on a wild ride since going public in 2019 and the last few weeks were no exception. BILL’s stock price has cratered by 50% in the past few weeks due to a 1) disappointing quarterly earning/guidance and 2) rumored $2B acquisition that was subsequently denied by BILL.

Outline:

Timeline of events, what happened, and lessons (free)

BILL’s prior acquisitions (paid)

Lessons from Divvy acquisition (paid)

Final thoughts on BILL and acquisitions (paid)

Timeline of Events

November 2nd - Reporting Quarterly Earnings

BILL reported earnings and forward looking guidance after market close. They beat current quarter expectations with revenue of $305M vs estimates of $299M and $0.54 earnings per share (EPS) vs estimates of $0.50. This represents a pretty good beat for BILL.

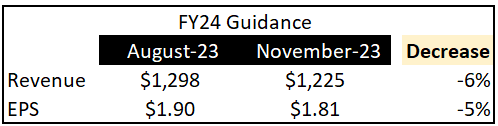

But…the company slashed guidance by 6% and came in significantly under analyst expectations.

During market hours the next day, the stock traded as far as 35% lower and closed “only” down 25%.

November 8th - Acquisition Rumor

Bloomberg released an article after the stock market close on November 8th that said BILL was in talks to acquire digital payment tools company Melio Payments for $2B.

November 9th - Acquisition Denial

At market open BILL’s stock tanked as investors seemed to hate the possible acquisition. The stock price dropped as much as 16% before BILL issued a statement during market hours that it was not pursuing an acquisition of Melio.

After the acquisition denial, the stock jumped up to only being down to 6% - the stock actually got halted for a few minutes after the denial due to high volatility.

So why didn’t all of the stock price decline get erased after the denial?

BILL never denied that the Bloomberg report wasn’t true. They just said that they were “not pursuing any such acquisition at this time”.

Maybe a day earlier they were pursuing the acquisition but based on the market’s highly negative reaction to the rumor they changed their mind.

Maybe after the ~30% drop in stock price following their quarterly results a few days earlier they decided that an acquisition that heavily relied on stock consideration would be too expensive.

Maybe the deal still happens but BILL uses the market reaction as leverage to get a better price.

It seems unlikely that the acquisition rumor was completely fake. And that is why investors were still upset and the stock price continued to trade lower despite BILL saying that they aren’t pursuing the acquisition.

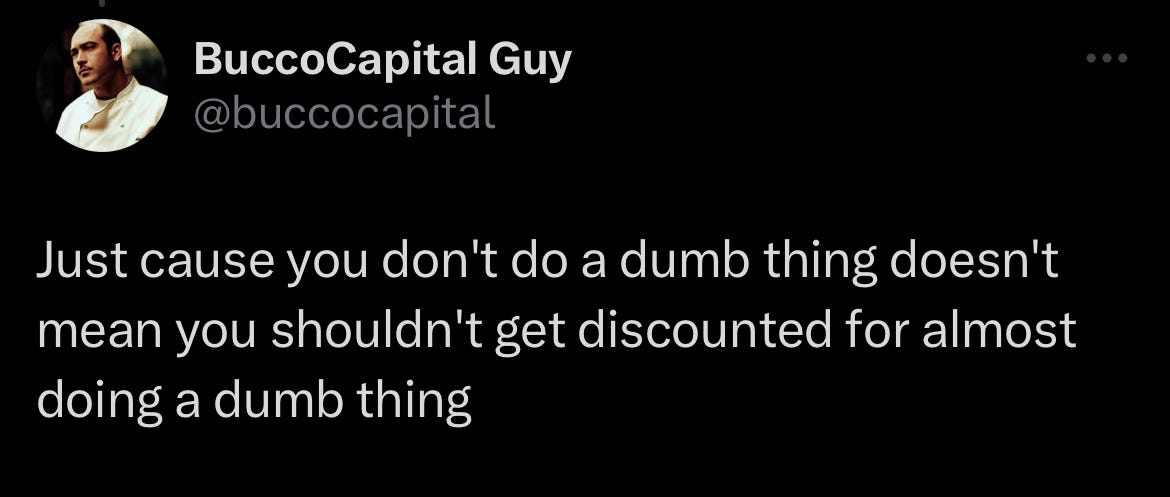

If investors think some of management’s ideas are stupid, then they lose trust in management for considering the stupid thing. If they lose trust in management, then investors should further discount the company’s ability to drive long-term value through growth and profitability.

Proper capital allocation is the #1 priority of management to maximize value creation for shareholders. If the executive team is bad at capital allocation or they start to drive in the wrong direction, then long-term growth and profits will eventually fall off a cliff.

Capital Allocation = the distribution, re-distribution, and investment of financial resources to maximize stakeholder profits.

High growth for a couple of years means very little if it isn’t sustainable. Great capital allocation is required for software companies to sustain high growth and achieve high profit margins.

I don’t know enough to say whether the acquisition would definitely be a stupid idea other than the fact that the reported $2B acquisition price was almost 1/3 of BILL’s valuation and the stock trades at a fairly low revenue multiple.

Great capital allocators know when their stock is overvalued or undervalued. They then use their equity currency (i.e. their stock) accordingly. If their stock trades at a high premium then all else being equal, it is a good time to use equity currency since it’s relatively cheap. If the stock is cheap, then it’s a bad time to use that currency.