Will AI Change Profit Targets?

The goalposts are shifting and you aren’t ready

Brought to you by Brex, the modern finance platform.

Tired of choosing between tighter spend controls and faster execution? With Brex, you can break the tradeoff. Get the smartest corporate cards, banking, expense management, and travel — all in one place. You’ll save money and automate busywork while your competition is still reconciling last month's expenses. See why 30,000+ companies spend smarter and move faster with Brex.

The expectation is that cloud companies will turn into money printing machines at scale with 25%+ free cash flow margins.

But will these juicy FCF margins hold up in a world of AI?

This expected long-term profit potential combined with the ability of cloud companies to scale revenue incredibly fast is the reason why they attract high revenue valuation multiples.

The median revenue multiple for the top 10 cloud companies is 15x.

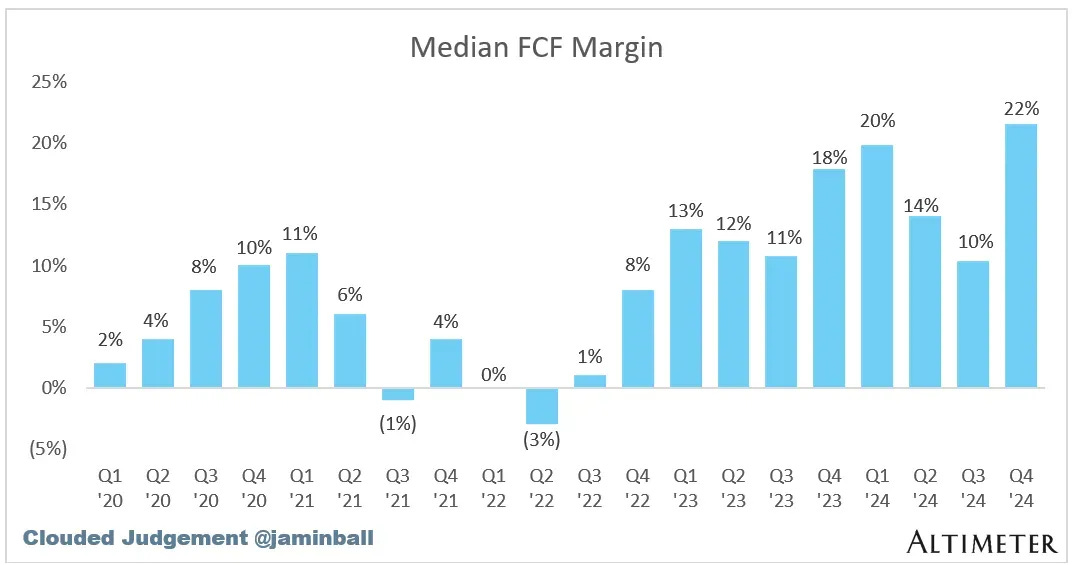

Any many public cloud companies are showing how profitable they can become — the median FCF margins have been steadily increasing as investments in revenue growth have slowed.

And private company FCF margins has been trending up as well, but they are still investing in high revenue growth (and hopefully have strong growth rates) so FCF margins are still low.

Where do profits come from?

Everyone needs to understand the different components that make a company profitable and how AI may change the game.

Gross margins: Revenue less cost of sales (COGS). COGS are the direct variable cost of selling.

Customer support

Customer success management (maybe?)

Infrastructure costs (AWS, GCP, AI costs, etc)

Dev Ops

Professional services

Operating expenses (OpEx): Costs to run the business

R&D - engineering, product, design

S&M - sales, marketing, and customer success

G&A - finance, accounting, legal, HR, etc

How does AI change the math?

The math equation stays the same, but the different variables may change a lot.

Operating Expenses

Everyone is focused here because AI has the ability to materially reduce OpEx as a % of revenue if we can hire less humans because things get automated.

People costs have historically accounted for ~65%+ of cloud company expenses. Eliminating those pesky humans will save a lot of money! More profits yay!

While true…I think people are underestimating the impact coming from the other side of the equation (see below).

Gross Margin

Cloud gross margins have historically been 70%+. These gross margins are what has driven high FCF margins and therefore also high valuations.

But…in the wise words of Jeff Bezos:

What do you think is going to happen when software gets commoditized and OpEx expenses plummet due to AI? You think you can still charge $100K for your silly app?

Nope.

Cloud pricing will fall. At a minimum you certainly can’t rely on annual price increases for a lot of your growth. While maybe this will be a bit of a longer-term impact (2-3 years), it will come…

This is also the reason why OpEx MUST start coming down now. Leverage AI and be more thoughtful in your spend.

Many financial sins have been hidden in high gross margins, but all of those will be revealed over the next couple of years as gross margins start to get squeezed.

Operating Leverage

There are two primary factors that impact the level of operating expense efficiency:

Revenue scale

Revenue growth

1. Revenue Scale

The higher the revenue the higher the leverage in operating expenses.

For example, below is the G&A expense as a % of revenue for public cloud companies. While the distribution can be quite large for the earlier stage public companies, G&A typically drops to below 15% once a cloud company reaches a significant revenue scale.

*Note that the below includes stock-based comp (SBC) so that likely drives some variability at the early stages

This happens because of the efficiencies that come with scale. After you have a fully built out G&A team (accounting, finance, legal, etc) those costs shouldn’t move proportionally with revenue.

2. Revenue Growth

The faster a company is growing revenue the higher OpEx as a % of revenue will be. This is particularly true for the S&M costs because of the much higher costs to acquire new business vs expansion.

Below is a list of public cloud companies with the highest revenue scale (sorted by revenue growth). These companies are mostly more mature with slower growth.

There are a few things worth pointing out:

S&M has the biggest change between high-growth and mature companies because of the costs to acquire new customers. This is why customer retention is the single most important factor in the long-term profit potential in a cloud business.

Gross margins become clearly critical when looking at how profitable a mature company can become. Despite Twilio having nearly the lowest OpEx % of these companies, it has by far the lowest free cash flow (FCF) margins because of its 49% gross margins. The big difference in gross margins makes it really hard to generate more free cash flow.

Final Thoughts

Not all cloud revenue is created equal. Gross margins set the ceiling on how profitable a company can become as these costs are directly variable with revenue. A company with 50% gross margins (Twilio) will never be as profitable as one with 90% gross margins (Autodesk).

Over the next few years we will see MAJOR changes in cloud financial benchmarks.

Most companies will see their gross margins get squeezed over the next few years Having a durable moat has never been more important. You NEED to focus on getting more OpEx leverage NOW before the squeezing of gross margins accelerates — it’s how you can keep your higher profits for longer. AI is one (not the only) tool to do that.

Footnotes:

Check out Brex’s guide on how to automate busywork.

Join the next OnlyCFO Webinar on how the definition of ARR is change and how you should adapt. You won’t want to miss it!

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire