Your Annual Operating Plan Is Ruined!

How to plan in a volatile market? Plus CFO survey results on 2025 shifting priorities

Spend smarter and move faster with Brex, today’s sponsor.

Meet your AI mandate faster. Facing more pressure to accelerate AI’s impact on your finance operations? The CFO’s Guide to AI Strategy is your free roadmap. You’ll get 5 best practices to fast-track AI adoption and turn high expectations into big results. Like “eliminate 60% of manual finance work” big.

Dealing with Uncertainty

We are in historic times of volatility and uncertainty. And many finance leaders today aren’t properly prepared to deal with it.

While uncertainty/volatility is generally bad for the market, those prepared will not only survive but they have unique opportunities to take advantage of (same is true for investors).

Finance leaders are being judged less on how well they predict the future and more on how well they adapt their plans. — Ben Gammell (Brex CFO)

One constant truth about forecasts is that they will ALWAYS be wrong. The only question is how wrong they will be. We entered 2025 with high optimism for IPOs, M&A, etc. But then we were all “punched in the face” (to quote Mike Tyson) with tariffs and other macro shocks that sent that optimism out the window.

How is your company adjusting to the evolving environment?

Forecasting in 2025

My favorite prediction about the volatile market comes from Goldman’s CEO 🤣

Regardless of your thoughts on the U.S. administration…volatility and uncertainty isn’t going away any time soon.

Even with the recent strong stock market recovery, there is still a high level of uncertainty. And this administration obviously isn’t afraid to create uncertainty, so it will likely continue.

There are first order impacts of tariffs and the other macro turmoil that are pretty obvious, but the second and third order impacts are a lot less clear. The vast majority of software/AI companies have no clue how they will be impacted over the next 12+ months by the macro and AI advancements:

How will sales be impacted? Will sales cycles lengthen?

Will we see pricing pressure?

How much will churn increase by?

What metrics are needed to fundraise, get acquired, or IPO now?

What efficiency targets should we set?

Annual Planning Breaks

Forget about your annual plan!

Companies can’t set an annual plan and forget about it during high volatility and uncertainty. Companies have to be agile and quick to flex their plans up/down. Updating plans at least quarterly is required for most companies today.

I don’t care that your annual sales target was $20M…If after Q1 that target is no longer possible then tell your board and update your plans now! Your board will be a lot more upset if you keep hiring/spending toward an unrealistic target.

MANY companies screw this up. They convince themselves that they have to keep plowing ahead (and sales just got pushed one quarter…).

Sure…it’s not ideal. But guess what happens when you keep spending like you will hit the plan and you don’t? Cash burn skyrockets, cash runway shrinks, everything looks inefficient, etc.

Change in Sentiment

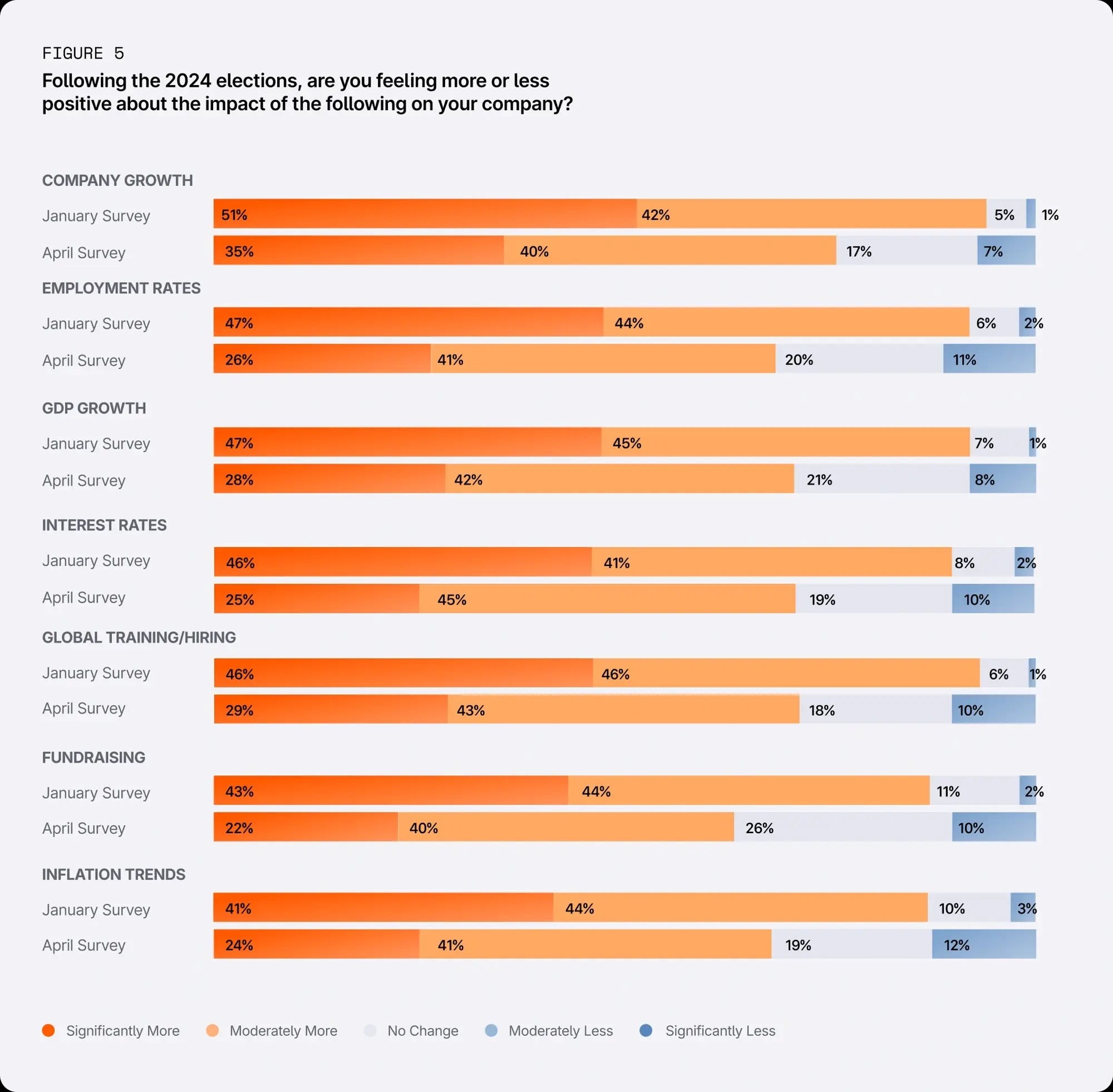

Brex just released a survey of CFOs that shows how much the CFO outlook has changed in just the past few months. Pretty wild change (negatively) after all the tariff and other broader macro uncertainty hit…

IPO Market Freezes

No one wants to IPO when the market is swinging 3% up/down on any given day. Investors are too focused on geopolitical and macro concerns.

Also, one of the most important aspects of going public is a high confidence level in your ability to forecast…. Everything going on right now is throwing a major wrench in forecast accuracy.

Klarna, Stubhub, Chime, Figma?, etc have all paused/delayed IPO plans as a result of tariff and market uncertainty. And a lot of other late stage private companies are doing the same thing.

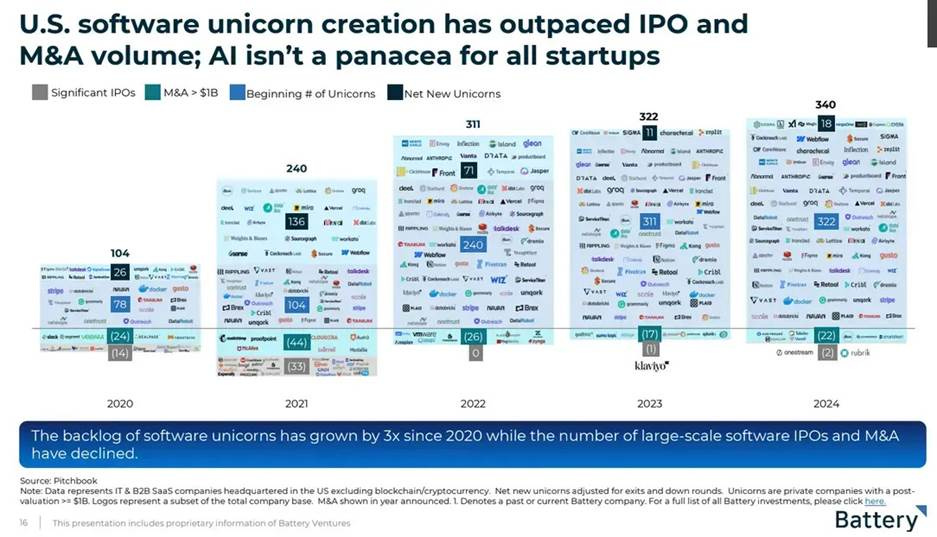

And this IPO refreeze is happening when things just barely started to thaw…We have only had a few software IPOs in the past 3.5 years. ServiceTitan and SailPoint were the latest (not on the chart below)

M&A Deals Stall

Similar to IPOs, M&A activity has tanked because of the tariffs and related uncertainty.

Public company M&A currency (its stock) is less valuable now so deals become more expensive

Cash becomes critical during uncertainty because you don’t know when/if you can raise money again. Must act like no more funding is coming. This also means potential buyers (of software and companies) are scrutinizing spend A LOT more

Buyers have a lot more leverage so they can take more time, negotiate more on price, etc

Exit math has to be re-evaluated to determine if M&A makes sense

I have talked to many CEOs/CFOs where their board has been pushing them to seriously look at M&A as an exit in 2025. Not because things are going well…but because they are not and it’s time to see how much money investors can get back - investors NEED liquidity!

No fundraising, more folks seeking to be acquired, less exits, etc…bad combination.

On the bright side, if companies are in a good cash and efficiency position (and are patient) there probably will be some REALLY good deals that come up in 2025 that they can take advantage of.

Adapting in 2025

There were a lot of plans of reaccelerating revenue growth for software companies going into 2025. After a couple of years of slowing revenue growth, lots of folks were excited about having more certainty after the 2024 U.S. election.

But…SURPRISE!

In just a few months, CFOs are extremely more bearish on company growth, hiring, and ability to fundraise.

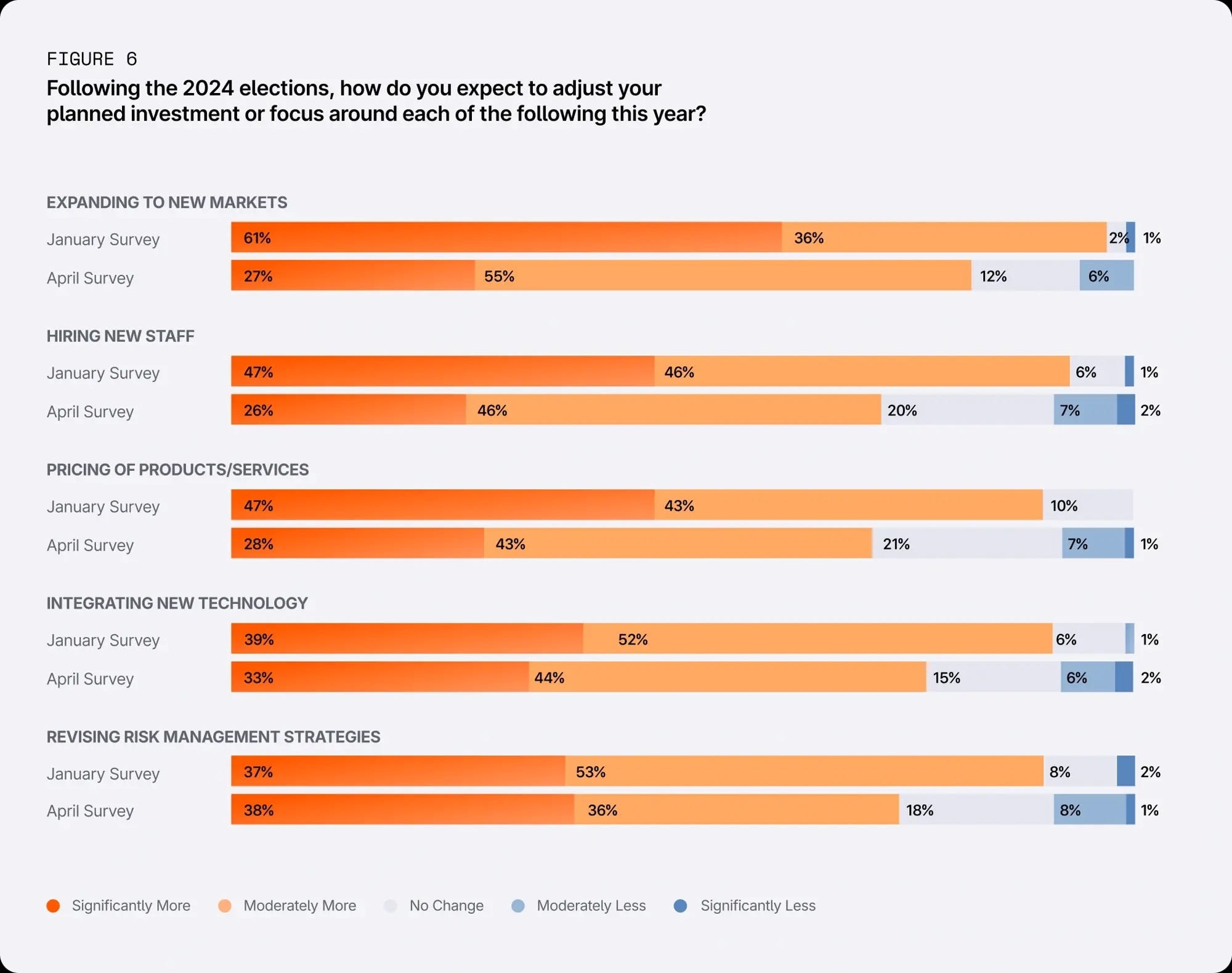

Many companies are already expecting major shifts in their plans:

Expanding into new markets feels extra risky given high uncertainty (optimism here among CFOs was cut more than 50%)

A lot less companies are hiring since their sales plans are at risk.

I have talked to a number of CFOs that have put hiring freezes in place due to broader macro concerns and a stronger push to leverage AI before hiring people.

Final Thoughts

If you take away nothing else….be adaptable. The companies that adjust to the current conditions (AI, changing macro, etc) are the ones that will win.

The stock market has been wild over the last couple of months. While it certainly has recovered a lot, the whiplash still means that companies are going to be more cautious (as they should) given more uncertainty.

Look for new opportunities created from the chaos.

M&A deals

Get more efficient

Get scrappy and try new GTM motions

Change sales tactics based on what is important to buyers today

etc

Lots of things are changing fast. Those who adapt just as fast will be the winners.

Good luck with forecasting!

Footnotes:

Download the Brex 2025 Survey

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire