A Good Time to Sell?

Getting acquired by a strategic and the state of M&A

Sponsor: The Automation Imperative: Live Webinar for CFOs, VPs, and Controllers

Manual workflows are driving finance teams to their breaking point. Join Leapfin CEO Ray Lau and Anrok COO Brad Silicani for a fireside chat on The Automation Imperative: how leading finance teams are using AI to automate revenue, tax, and reporting with speed and accuracy. Walk away with practical playbooks you can apply this quarter.

Seriously Consider Selling

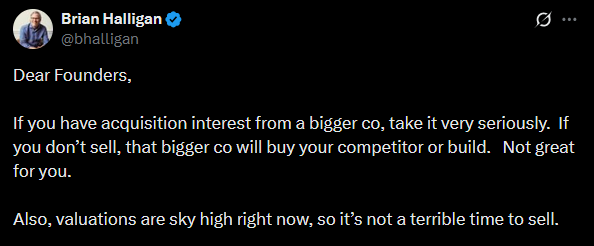

Last week, Brian Halligan (co-founder of HubSpot) said that if you receive acquisition interest from a large company, take it seriously.

Brian’s two main reasons:

They will buy your competitor or build if you don’t sell

Valuations are “sky high” right now

Brian is right. Assuming there is interest. But the M&A environment is very different in 2025…While M&A interest and valuations are high for some, for MANY it is almost completely gone.

In this post I will tackle:

The how to prepare and why to consider strategic acquisitions

The current state of M&A

Strategic Acquisitions

Prior Relationships

One of the best ways to start a relationship that leads to an acquisition is to:

Have the potential strategic acquirer participate in a fundraising round

Develop a sales partnership with them

This is how ~80% of the acquisitions I have been involved with started.

What happens is that the potential strategic acquirer is interested in a space, but they are not ready to make a decision to buy or build. Or sometimes they are building, but it’s not going well, so they want to partner.

If/when the strategic decides to acquire a company in the space, then their investments and partners are at the very top of their acquisition list. Why? Because it de-risks the transaction.

Why You Should Seriously Consider

My favorite discussion on this topic comes from Jeron Paul (founder of Spiff) on their $419M acquisition by Salesforce.

How Salesforce approached Spiff to acquire them:

We want to buy you. You are our top choice. But if you don’t, then we will just go buy one of your competitors.

Jeron explains that it was their prior relationship with Salesforce that put Spiff at the top of the list.

The reason why Salesforce bought Spiff, as opposed to other vendors, was the prior relationship. As much as I would have liked to have been, “you are the obvious leader in this market and there’s no one even close to you”. That wasn’t actually the reason. They did think we were the leader, but it was close.

And my favorite quote by Jeron on the acquisition:

It was a bit of a hug with a gun to your head.

This is spot on. And this is what Brian Halligan is saying as well. There are always multiple competitors so if they want to enter the space then they will just go buy your biggest competitor.

When PE buys your competition, you might be excited because things often get worse. But when a strategic buys…things often get harder for the competition (power of product bundling and much more resources).

I am somewhat familiar with the commission software space and from what I know, the acquisition was great for Spiff’s sales and made the competitors’ lives harder. If Spiff had turned down the acquisition then I think the same thing would be true but Spiff would have been on the other end…Salesforce would have helped make another commission company very successful, Spiff’s life would be harder, and an exit for Spiff would become more difficult.

Not All Acquisition Interest is Created Equal

🚨 This is a warning to founders

I have seen too many founders get excited about someone on the biz dev team at a some public company reaching out. You can waste a glorious amount of time talking to these folks.

Often these guys are just gathering information (key metrics, product, market, etc). And if you keep feeding them info then they will keep talking to you. Make sure there is serious intent. And that you are talking to the right people at the right level.

State of M&A

Software M&A Volume

Jason Lemkin recently said:

From 2012 through 2023, nearly every company in the SaaStr Fund portfolio that crossed $20M ARR with solid fundamentals received multiple PE offers. It was the gift of exits that kept on giving. The multiples weren’t always great, but the offers came. Again and again and again.

That’s not happening anymore.

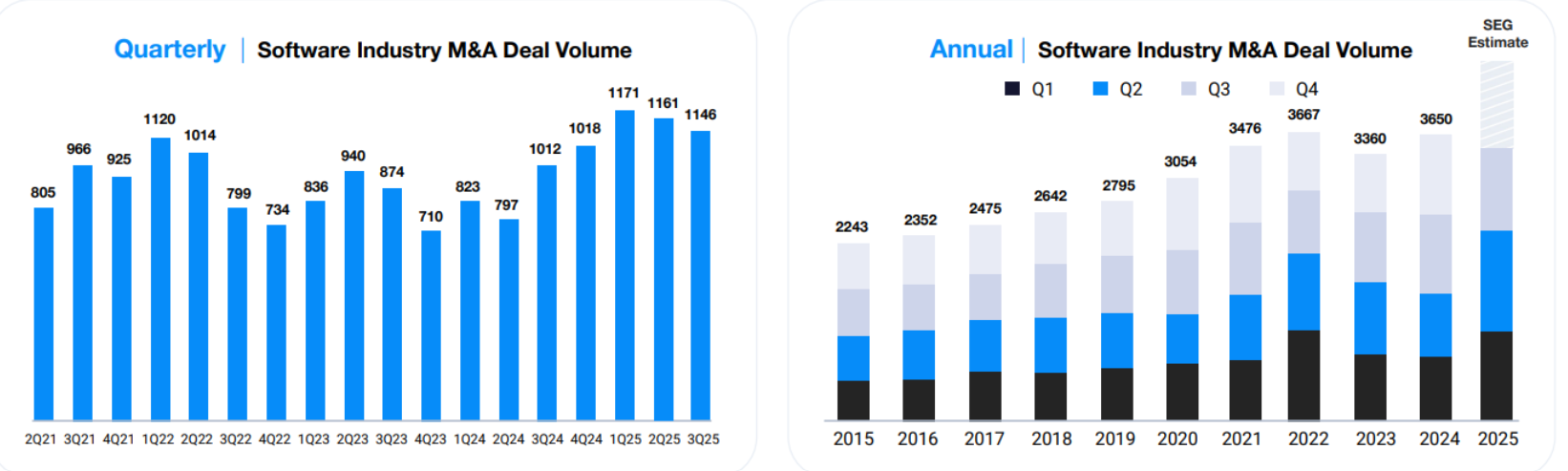

The charts below show that software M&A volume is on track to hit the highest annual total volume of deals. But…the average deal size is smaller and a lot of smaller deals are driving overall activity. And total M&A dollars are a lot more concentrated in a few companies

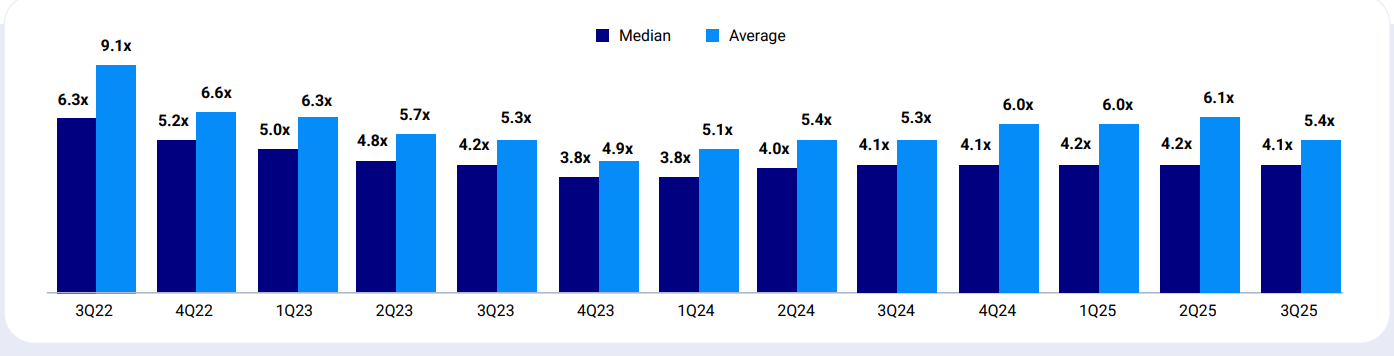

M&A Valuations

The median LTM revenue multiples in M&A are pretty steady. Caveat is that it appears that a lot more of these deals are happening at smaller scale companies.

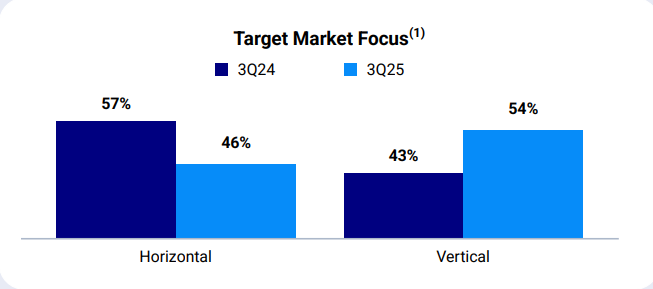

Horizontal vs Vertical M&A

I wrote last year about how the Future of Software is Vertical. Looks like acquirers agree….there has been a big shift in the last several years in the M&A market for vertical software.

Buyers want to de-risk acquisitions amid greater uncertainty resulting from AI. In most cases, proven vertical software has more durable and sticky revenue.

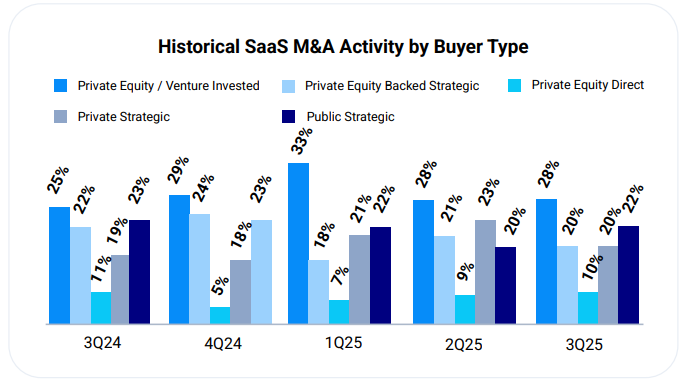

Types of Acquirers

Strategic acquirers account for 42% of acquisition while PE accounts for 48%.

Final Thoughts

A few years ago, turning down a decent acquisition offer wasn’t that risky. There was usually another buyer if the metrics were decent. But that is no longer true today. And I think it will get worse for the majority of software companies.

M&A is where the vast majority of exits come from, so seriously consider it. And plan for it.

More companies should build with M&A as the exit plan versus building toward the much more unlikely event of an IPO. Network with potential strategics and spend *some* time building the right relationships so if a likely acquirer is looking then you are who they call.

If you have acquisition interest, then perhaps it’s a good time to sell. Seriously consider it.

Footnotes:

Check out The Automation Imperative webinar put on by Leapfin to see how AI can automate revenue, tax, and reporting with speed and accuracy

Want to sponsor OnlyCFO? Email onlycfo@onlycfo.io

*Should not be considered investment, legal, or tax advice.

I think part of what we're seeing on the deal count side is a lot of "stranded" assets finally trading. There are a lot of 5-15M ARR businesses that are growing 20-30% with breakeven P&Ls out there right now. VCs need some DPI after raising a lot of $ from 20-22, and this is where it's coming from.