Software’s Future is Vertical

Pros/cons of vertical software, why software will become more vertical, and some vertical software benchmarks

Today’s newsletter is brought to you by Brex. Make every dollar count with Brex.

CFOs have the tough job of balancing growth with efficiency, so how do you know when to save and when to spend? The CFO’s guide to efficient growth has the answers and advises that saving doesn’t always mean success. Learn how top leaders optimize their precious resources and confidently say yes to new business-building opportunities.

The Future is Vertical

Vertical software has been a neglected segment of software for a long time - lots of investors were not excited by it and therefore many founders avoided it. But that has been changing and will rapidly change over the next few years:

Horizontal Software: general-purpose software solutions that apply to multiple industries, rather than providing solutions that are relevant to one specific market. For example, Quickbooks can be used to do the accounting for a software company, a roofing company, or a toy manufacturer.

Vertical Software: designed for use by a specific industry or business vertical. Focused on solutions for industries that are often poorly served by general software providers. For example, a company called Toast is software for restaurants because restaurants have unique needs that aren’t easily solved with general purpose horizontal software.

Over the last decade almost everyone was chasing horizontal opportunities because they were huge and fairly untapped. But fast forward to today and a lot has changed:

Almost every space is incredibly crowded

Generative AI has made development so much faster

AI is creating new opportunities for vertical SaaS that will further increase their TAM

Companies are demanding more automation, less customization, and more functionality for their specific needs.

All of these factors will lead to more vertical software. This will mean that there are more vertical-first software companies, but also that traditionally horizontal companies will add more verticalized functionality.

Advantages of Vertical Software

What makes pure vertical software unique is the complete focus on a specific industry. And that focus creates a lot of benefits. Below are some of the advantages of vertical software:

Company Advantages

Easier GTM motion

When the target audience is more narrowly defined both sales and marketing become more efficient. Horizontal software companies often struggle with chasing too much which may allow them to grow faster but it can be really inefficient.

Customer acquisition cost (CAC) is lower

Because of the easier GTM motion and the flywheel effect that happens with vertical SaaS, the CAC payback period can be significantly smaller in vertical SaaS.

As you can see below, vertical SaaS companies have a 9 month shorter payback period for early stage companies! That can significantly extend a company’s runway before having to raise more money. The LTV/CAC ratio is also significantly higher because of this higher efficiency and the lower churn (discussed below).

Lower churn

Vertical software companies often get deeply embedded into customers as more products are layered on (know as a “layer cake”). Fully churning becomes much more difficult as customers add multiple products.

As you can see below, vertical software churn distribution is pretty similar with horizontal at <$50M revenue. But at >$50M revenue, full logo churn drops significantly for vertical software (11 percentage points lower than horizontal).

One of the most popular products to add to vertical software is a payments offering. The GRR and NRR of companies with a payments offering is substantially higher than those without one. Going multi-product allows for more expansion opportunity but it also significantly increases the stickiness of the platform.

Higher GTM Efficiency

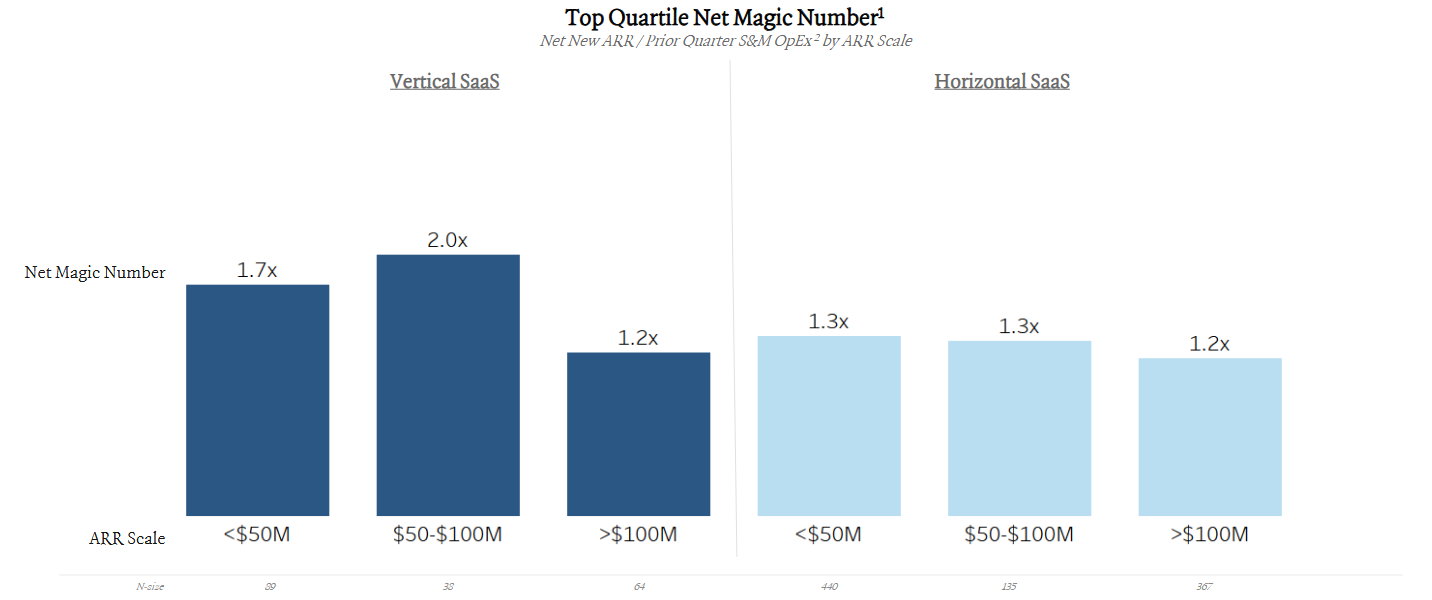

The magic number looks at net new ARR compared to S&M expense. As mentioned above, given the GTM focus in vertical software it can be much more efficient than horizontal software.

Stronger Moat

Given vertical software’s multi-product strategy and being a platform at scale, they collect very valuable data and insights that many other companies aren’t able to get. This can be a major advantage for vertical SaaS as it relates to AI and what these vertical SaaS companies will be able to do with AI.

Customer Advantages

Tailored Functionality:

Offers features that are highly specialized for a specific industry (e.g., healthcare, legal, construction). This allows for more automation and less customization.

Vendor Consolidation

Vertical software providers allow companies to purchase multiple products that work together so there is a better experience. And vendor consolidation usually creates money savings (which I obviously like).

Regulatory Compliance:

Vertical software often includes features that help businesses comply with industry regulations and standards.

Better Support:

Support teams are usually experts in the specific industry so they are able to provide more effective support.

Disadvantages of Vertical Software

It hasn’t been all sunshine and rainbows for vertical software though. Below are some of the disadvantages:

Company Disadvantages

Smaller Initial TAM:

While this is a common criticism of vertical software, many are surprised about how big the eventual TAM can become. But it requires more work to expand the TAM. Many doubted Veeva’s TAM opportunity in the early days and now it’s a $35B company.

Requires more engineering:

Vertical software companies must go multi-product earlier to sustain revenue growth and therefore they manage a wider range of products. This causes R&D expense to be relatively higher. R&D spend at vertical software companies (on the left below) is about the same as horizontal for earlier stage companies. However, at scale, vertical software creates more products that must be managed so R&D expense becomes larger (33% vs 27%)

Look at how many different products that Toast has built since its founding. There is a lot of complexity in managing so many different products.

Fintech is one of the most popular offering to add in vertical software. And a payments product is by far the most common.

Customer Disadvantages

Integration challenges:

There is almost always fewer out-of-the-box integrations with other software, especially with software not specific to its industry.

Higher cost:

Given the specialized nature of the software, vertical software providers can often charge more for their tool than similar horizontal software (at least on an individual product basis)

Vendor Lock-in

There is a reason vertical software can be very sticky…they are usually multi-product and the platform becomes critical to the business. This makes it very hard for customers to switch if they decide later it no longer meets their needs.

While there has historically been several disadvantages to vertical software, Generative AI and the software environment today is making it much more compelling.

Vertical Software Financials

Less Recurring Revenue

Vertical software revenue is often a bit different than traditional horizontal revenue because of the different types of product offerings.

Re-occurring revenue: vertical software companies frequently add fintech and other products that reoccur based on usage so they are less predictable than traditional recurring software revenue.

Non-recurring revenue: Things like hardware and professional services are more significant at vertical software companies.

On the more extreme end, Toast reports ARR of $1.5B but its annualized total revenue is ~$5B. So only 30% of total revenue is in what they define as ARR. Compare that to CrowdStrike which has 95% of its revenue as subscription.

However, this certainly is not true for all vertical SaaS (Veeva for example is 80% recurring revenue while others have near 100%), but it is more common for vertical SaaS to have a bigger mix of revenue given the different products they add.

More Durable

While revenue growth may be slower for many vertical SaaS companies, the durability is often higher for the reasons I mentioned earlier. However, vertical SaaS that has a lot of non-recurring revenue may see more volatility.

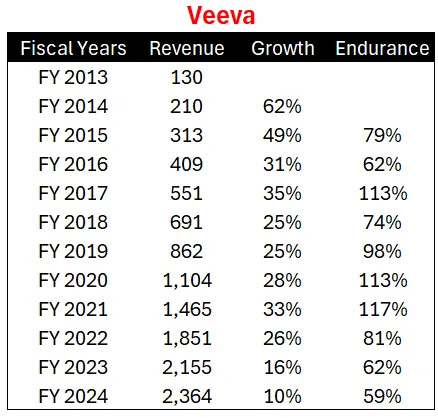

Veeva didn’t have super high revenue growth at scale, but it had good growth for a really long time.

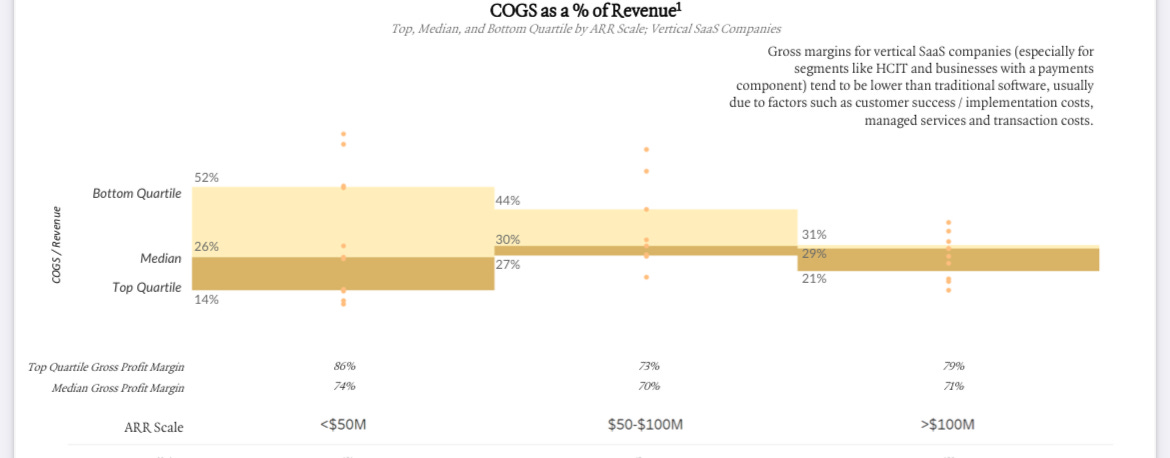

Lower Gross Margins

Gross margins are frequently lower for vertical software companies because all the different types of products that get added over time (hardware, fintech, professional services, etc) that have lower gross margins than typical SaaS.

Concluding Thoughts

The future of software will become more vertical as companies are able to more quickly and efficiently build for specific industries. And given the explosion of software vendors, software buyers are demanding purpose-built software that enables more automation.

Generative AI is unlocking new opportunities that vertical SaaS is uniquely positioned to capture.

While not all software needs to be verticalized, many can (and will be). The future is more verticalized.

Footnotes:

Check out the CFO’s guide to efficient growth

Reply to this email if you need a fractional CFO and/or bookkeeping for your SaaS business. Think of it as vertical services :)….CFOs only for SaaS.

Check out OnlyExperts for to find offshore accounting resources. They have some amazing talent.

Great article!

One call out - "Toast reports ARR of $1.5B but its annualized total revenue is ~$5B. So only 30% of total revenue is in what they define as ARR. Compare that to CrowdStrike which has 95% of its revenue as subscription."

A gross vs. net issue clouds the walk from annualized revenue to ARR. Toast reports transaction processing revenue on a gross basis (not net of pass-thru cardbrand fees). These pass-thrus fees are removed for their calculation of ARR. So if you take ARR as a % of their annualized NET revenue (as opposed to gross), ARR is much closer to 80% of annualized revenue.