AI Company Accused of Fraud?

AI SDR company (11x) is being accused of wrongdoing. Was it FRAUD or was it just bad processes and definitions?

Today’s Sponsor: NetSuite

I created an OnlyCFO guide for financial dashboard reporting in partnership with NetSuite. This guide is exactly how I have built great financial dashboards for my leadership team and board.

Get my free guide and template for financial reporting dashboard 👇

A TechCrunch article came out this week that implied an AI company called 11x committed fraud by misrepresenting its revenue and customers. There were also several other accusations of potential wrongdoing and problems.

11x is an AI SDR (sales outbound) tool that reportedly grew to $10M+ in ARR in just two years after launch and raised two large financing rounds in 2024 for a total of $74M from top-tier VCs (such as Andreesen Horowitz and Benchmark).

Below is my breakdown of these accusations and my thoughts on potential wrongdoing👇. LOTS of companies are in a similar boat (and not just startups)…

What did 11x do?

1. Revenue Fraud

This accusation is the most serious and could actually be considered fraud if the 11x team was intentionally deceiving investors on their financials.

While TechCrunch didn’t say “fraud”, it is implied by the assertion that investors are suing and that 11x misrepresented financials.

Accusation:

11x used “shady tactics” and inflated ARR numbers by counting ARR that didn’t exist.

There was a lot of talk about 11x’s “break clauses” which is an opt out clause after 3 months on 1 year deals that allowed customers to cancel their contracts early.

TechCrunch reported the following:

Break Clauses:

Most early customers used break clauses to get out of their contracts because the product didn’t work

11x pushed annual contracts for enterprise customers with break clauses (instead of doing trials) to count more ARR

11x didn’t distinguish contracts with break clauses and full year contracts. Everything was treated as ARR.

11x continued to count ARR after customers opted out after 3 months

Customers were sometimes double billed for 3 month trial periods

OnlyCFO Response:

ARR (annual recurring revenue) is not a GAAP (generally accepted accounting principles) metric. There is no regulatory body governing how we define ARR. People can define it however they want but…there are some basic guidelines expected to be followed.

Break Clauses:

I have no problem with opt-outs or what they call “break clauses” after 3 months. I generally don’t like them because annual contracts without opt outs are better but I would not be opposed to them for new tech at a startup. They are actually fairly common in startup sales.

There is no wrongdoing with simply having break clauses.

Jason likes break clauses in the early days…

BUT…I would make sure my team and investors are fully aware of the dollar value tied to these types of deals, especially if they are significant. Be clear in definitions and reporting.

Inflating ARR with Churned Customers:

This could fall into the "fraud” bucket if it was intentional. However, I generally think most people are not fraudsters, so my default opinion would be that if this was happening it was because 11x had bad churn processes for eliminating the ARR (especially around opt out churn) and that it wasn’t intentional.

But if under reporting material amounts of churn was intentionally happening then someone should be fired…

Double Billing:

As for double billing, I struggle to believe this was intentional because there is little for 11x to gain (most customers wouldn’t pay twice) and there is A LOT to lose (customers being really upset).

Having seen many fast growing companies with immature and developing processes, double billing sometimes accidentally happens…

Is it even ARR?

There was discussion in the article and lots of social media debate whether customers with 3 month opt outs should be considered ARR. Like I said before, there is no standard definition of ARR so is 11x treatment of this as “ARR” inappropriate?

ERR vs ARR: A lot of AI company revenue currently falls into what should be called “ERR” versus true ARR. Most companies don’t make this distinction though because everyone is used to using ARR, ERR sounds much worse, and everyone hopes they have ARR (not ERR).

Experimental Runrate Revenue (ERR): Projected annual revenue from AI solutions that are still in a nascent, experimental stage, where the procurement and usage are not yet fully mature

Whether you call it ARR, ERR, or something else, the key is to be very clear on definitions of your key metrics and what gets included. I make sure to always have these definitions available to my board and team so there is no confusion (including it in every board deck). And stay consistent in your definitions!

My second argument: How is treating these contracts with a 3 month opt-out different than pure usage-based pricing where the customer can stop usage anytime? The vast majority of companies are calling that revenue some version of “ARR”.

The bigger problem is the tech industry has a metric definition problem and the introduction of AI is making it worse. I wrote a blog post on this called Is ARR Dead?

2. Fake Customer Logos

Accusation:

Many customer logos on 11x’s website aren’t actual customers and one is threatening legal action for not taking their logo off.

We did not give them permission to use our logo in any manner, and we are not a customer,” a ZoomInfo spokesperson told TechCrunch.

OnlyCFO Response

There are few problems here:

Using logos of trial users

Not getting logo use permission

Not taking down logos of churned customers

I personally would not promote a customer’s logo on my website if they were clearly in a trial (within the 3 month opt out period). There is a temptation to use all the big logos to look more successful, but make sure they love your product and they are a true customer first (trial period passes).

The next two issues mentioned seem like they can also be process problems (and hopefully not intentional).

11x should ensure they have contractual rights to use customer logos and that logos are immediately removed if that customer churns. It’s a REALLY bad look and will come back to bite you if you don’t.

11x’s CEO admitted to not having good processes around customer logos on their website.

3. Intense Culture

Accusation:

The environment is stressful and takes “hustle culture” to an extreme.

Demanded to work >60 hours per week

11x doesn’t believe in holidays

Must work weekends

CEO messaging employees at 3 am for something urgent

Most early employees have left

OnlyCFO Response:

If you don’t like the environment then quit. Lots of people are OK working long hours if they are excited about the company/product/etc. If you have to work long hours and you don’t like the people or don’t believe in the product then just leave.

11x CEO denied not believing in holidays 🤣

4. High Churn

Accusation:

We were losing 70-80% of customers that came through the door

11x says retention (aka GRR) in the TechCrunch article is misleading and that while churn was high for initial cohorts of customers, their retention today is 79%.

OnlyCFO Response:

Having horrible retention isn’t fraud, but lying about churn and misrepresenting revenue health might be. And as I mentioned earlier, high churn does call into question the use of the term “ARR” since the revenue is not really recurring (a key part of the ARR definition).

79% GRR for new tech for an AI SDR tool doesn’t sound too horrible though (certainly not great either).

Retention is a critical metric (especially for AI companies). Define it properly and provide accurate reporting. Don’t do anything funny with churn….like reporting it whenever convenient (like after a fundraise closes or pushing to the next year).

Not sure if 11x tried to massage their churn numbers or if they simply had bad processes.

5. 11x has a Financial Crisis

Accusation:

TechCrunch reported that investors and employees said the company is experiencing financial struggles.

OnlyCFO Response:

Obviously, it is not fraud to be in financial trouble otherwise 70%+ of VC-backed SaaS founders would be going to jail 🤣

But on top of that, 11x CEO responded yesterday saying that they have nearly $70M of cash. Assuming he isn’t rounding up too much, that would mean of the total $76M they have raised that they have “only” burned $6M since the seed round in August 2023. That would actually be pretty good!

There are LOTS of SaaS companies in much worse financial conditions than that…

6. Investors are Suing

Accusation:

The TechCrunch article reported the following:

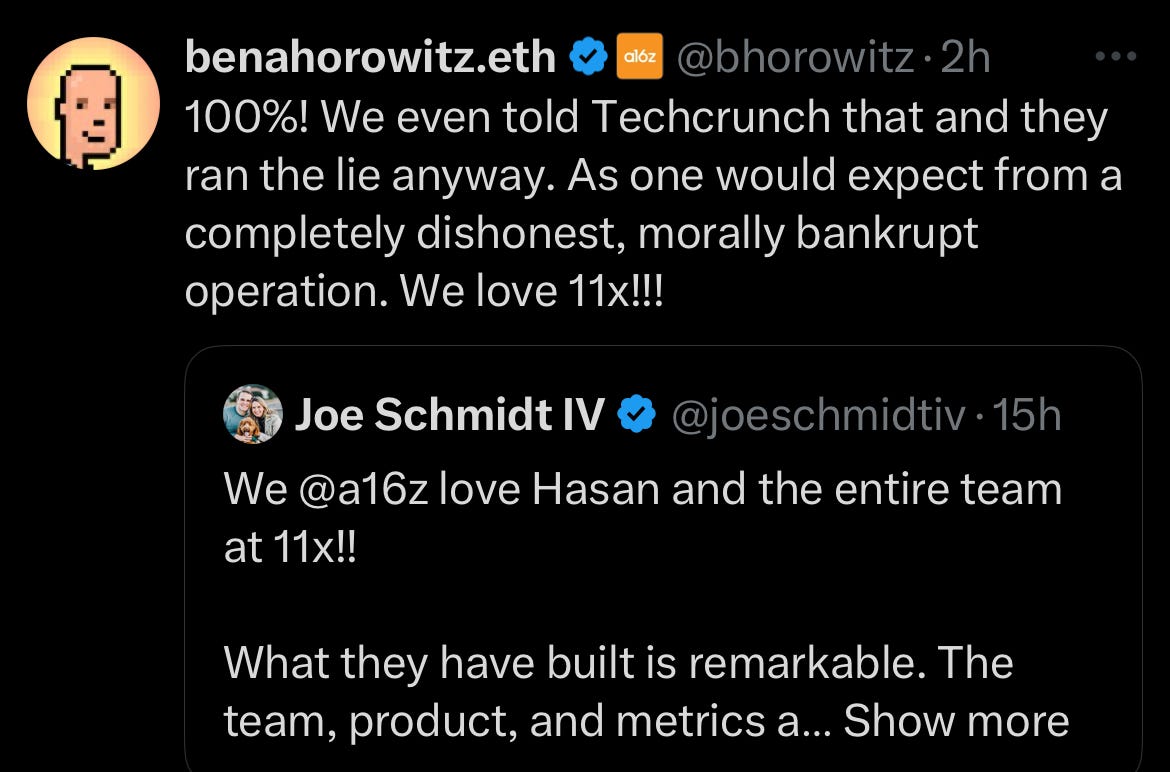

The situation has become so tenuous that 11x’s lead Series B investor, Andreessen Horowitz, may even be considering legal action. However, a spokesperson for Andreessen Horowitz emphatically denied such rumblings, telling TechCrunch that a16z is not suing.

OnlyCFO Response:

It seems dumb to report that investors may be considering legal action after that investor adamantly denied to TechCrunch that they are considering legal action…

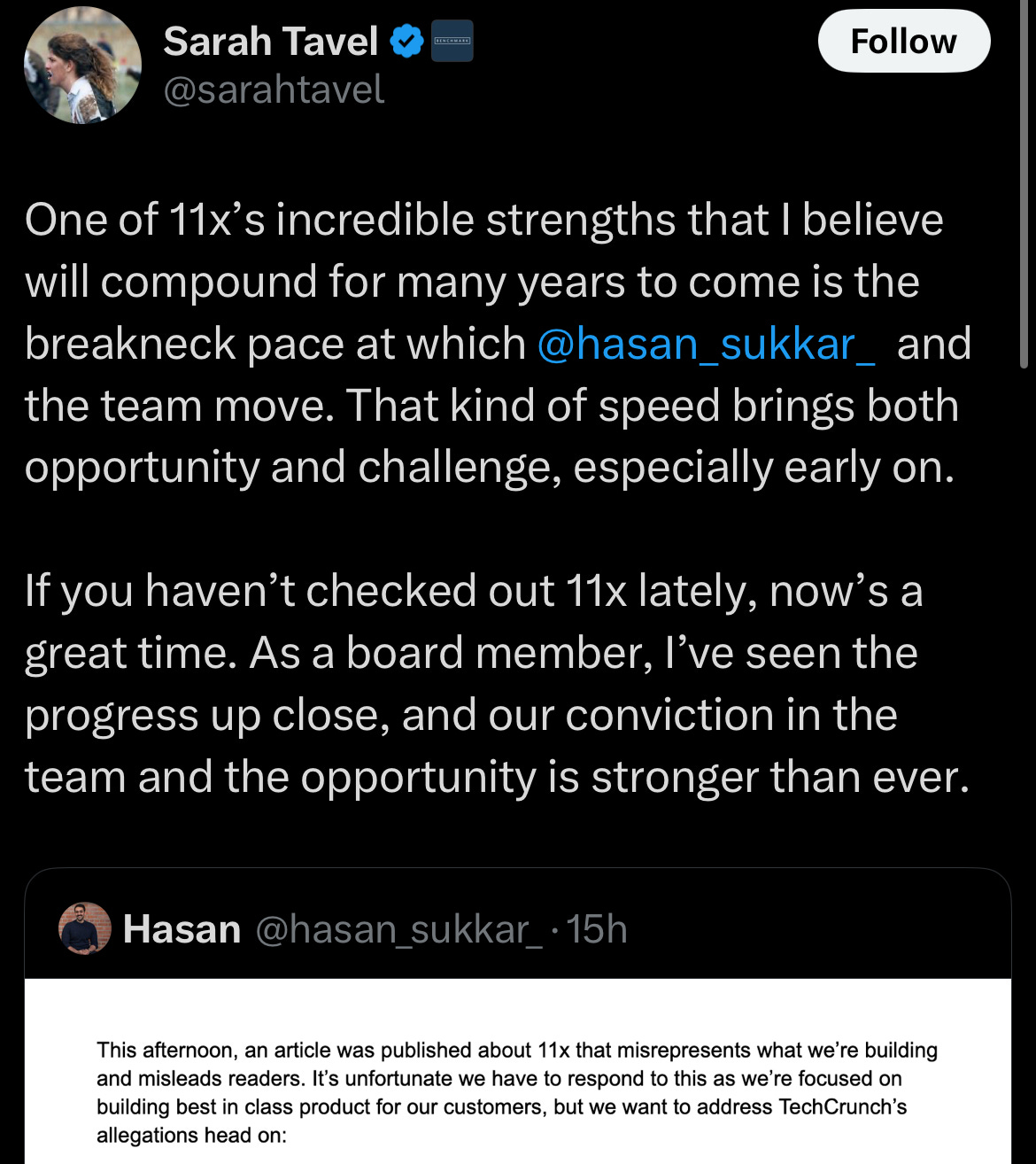

And the two lead investors (Benchmark and Andreessen Horowitz) were quick to support 11x after the TechCrunch article was released.

Below is Ben Horowitz supporting 11x and not holding back on his thoughts about TechCrunch.

Below is the Benchmark General Partner also supporting 11x.

Final Thoughts

Weak Transparency. Team members (and potentially investors) felt 11x wasn’t as transparent as they should have been. Always make sure you clearly define metrics, have good reporting , and you are consistent.

Bad Processes. Many fast growing companies have bad processes, but you want to make sure you clean them up as you grow, especially for the processes around critical metrics like ARR and customers.

Not all revenue is created equal. 11x’s AI revenue is not like traditional SaaS ARR because it appears to have very high churn and a lot of it seems to be experimental given the amount of customers on paid trials. Understand the difference, define your metrics, and discuss revenue accordingly.

Don’t fudge the numbers. From the info we have, I don’t know the level of wrongdoing at 11x. But I do know that fudging the numbers to make things look better is never worth it. More companies than most realize are fudging numbers to some extent (especially around ARR). Don’t play those games.

11x Team - if you need a good fractional CFO or bookkeeper just let me know. I partner with some great folks :) onlycfo@onlycfo.io

Footnotes:

Check out the OnlyCFO Financial Reporting Dashboard Guide & Template

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Great analysis. Will be fascinating to see how this plays out. Forbes 30 under 30 is turning into a red flag, but tech crunch also has questionable ethics.

Great rundown, even better warning -- not the first, won't be the last, hopefully less