Airtable “Acquires” and Kills Airplane

Lessons from Airplane’s acquisition and startup failures impact to the broader startup community.

Join 14k+ subscribers learning more about the software industry

Airplane is a developer platform for internal tools. They raised a total of $40.5M with their latest round (Series B) being announced in September 2022 for $32M. The Series B was led by Thrive Capital with Benchmark (who led the Series A) participating. At the time of their Series B Airplane had 19 employees and “almost” 100 customers.

Per the Techcrunch announcement of the Series B ~15 months ago: “We’re not yet profitable, but this funding round plus our current revenue gives us several years of runway even with aggressive growth plans”.

Their ”aggressive growth plans” appear to not have worked out so they couldn’t raise more money, cash burn relative to growth was likely high, and/or the prior high expectations were not being met.

What Happened to Airplane?

Airplane announced that they “almost” had 100 customers at the time of their Series B in September 2022. They didn’t disclose their ARR, but the CEO of Retool (a larger, successful competitor) posted the below on HackerNews regarding the acquisition:

This to me is pretty surprising... because it's actually not hard to make a SaaS business profitable. You just have to build a great product, and be disciplined at hiring. It's weird that they seem to have done well on #1, but failed at #2 (which I'd deem the "easier" problem).

RE #2, I've heard they have less than $1M in ARR, but somehow (according to LinkedIn), have 61 employees. We had 4 employees when we were at $1M in ARR (and growing around 700% YoY). Even when we were growing quickly, we hired slowly: IIRC we were at around 30 employees at around $10M ARR. (That's less than half the employees Airplane had... even though we were 10x their revenue.)

He then went on to estimate Airplane’s burn rate using the above ARR estimate and employee count.

I think the $1M ARR is a bit low given they almost had 100 customers 15 months ago, their average sales price is likely above $10K, and I would think they have at least grown a little bit over the past 15 months….but given the acquisition, I am guessing their ARR hasn’t grown very much. Or perhaps they have faced a ton of churn in the past year so maybe the $1M ARR is directionally correct.

The comment on 61 employees per LinkedIn is likely wrong though. Based on a quick search I think Airplane has less than half that number of employees….

LinkedIn stats are almost always inflated for a few reasons:

Every random angel investor adds themselves as an investor of the company

The lead VC partner in all the rounds has the company listed

Terminated employees are still listed as active employees while they look for a job or are slow to update LinkedIn

Particularly with a name like “Airplane” you get a lot of the below….

Airplane likely still have a lot of the Series B cash in the bank because I don’t think most companies can burn $32M in 1.5 years with ~30 employees….

So why would Airplane sell in an acquihire?

Regardless of how much cash they have left Airplane likely burned a high amount of cash for not very much ARR.

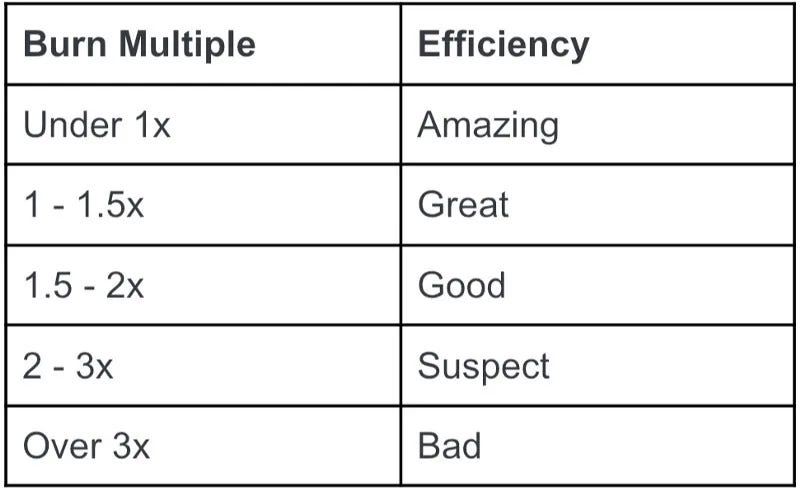

Below is David Sacks’ rule of thumb for burn multiples:

Burn Multiple = Cash Burn / Net New ARR

Unless early-stage companies with less than $5M are growing very rapidly they will have a really hard time raising capital in this market. Especially if their burn multiple is well above 3x, which I am guessing Airplane’s burn multiple was above 3x since it appears ARR growth was very slow.

Startup Shutdowns

The number of company shutdowns has been steadily increasing.

While most shutdowns so far have been companies at the Seed or Series A stage, we are entering a phase where more Series B and beyond companies will shut down as they run out of cash. Many of these companies raised huge rounds in 2021 so as long as they controlled their expenses they had a long runway. 2024 will certainly see an uptick in these shutdowns though as these cash runways dwindle and they can’t raise more money.

Impact to Startups

Airplane announced as part of the acquisition that they would be sunsetting their product effective March 1st. Any Airplane customer accounts will be disabled after this date and refunds will be provided for prepaid contracts.

Airplane’s shutdown and future shutdowns like this will have negative consequences for many early-stage companies. For many years buyers of these tools haven’t had to deal with a tool being abruptly killed. It only takes this happening once for you to really second guess purchasing a startup tool that is mission-critical, deeply integrated, or would take a long time to replace.

People will still take bets on startups, but there will be more hesitation and diligence performed. Buyers will want to know how much cash the startup has, their cash runway, they will require more favorable legal terms in contracts, etc. And most of these startup companies will need to concede and provide these things now…

Startup tools that are less complicated to implement and switch will have an easier time. The complicated tools with high switching costs will increasingly have a harder time. Startups need to find ways to further de-risk the buying decision or buyers will go to the bigger brand names.

As the old saying goes “Nobody gets fired for buying IBM”. While an outdated example, the message is starting to ring truer for many buyers these days.

Acquihire Exits

Little details have been released about the Airplane acquisition, but with the estimated small amount of ARR and the fact they are abruptly shutting down the tool this is clearly just an acquihire.

Acquihire = buying out a company primarily for the skills and expertise of its staff, rather than for the products or services it supplies.

A typical acquihire has most value going to employees since that is what the acquiring company actually wants. The acquiring company does this through retention packages when they start at the acquiring company. Any consideration paid for the actual company likely goes mostly to the VCs with preferred stock since they have liquidity preferences.

Airplane raised $40.5M so any consideration paid in the acquisition probably all went to the investors (Thrive Capital and Benchmark). Both of Airplane’s VCs are also investors of Airtable…so they get a graceful exit and also some more equity in one of their existing portfolio companies. I don’t have the data but I assume that the number of acquihires by companies with the same VCs is pretty high.

For Airtable, this acquihire has many individuals commenting that it looks really bad. Just a few months ago Airtable did a massive layoff of 237 people. And now they are diluting existing stockholders and likely providing some nice retention packages to the Airplane employees they are keeping.

There are likely reasons for this acquisition we don’t know, but it just doesn’t look great. I assume many Airtable employees without more context will think the same.

Final Thoughts

An acquihire is certainly better for employees than just shutting down. But when they announce that they are excited about being acquired just know it isn’t an ideal outcome. Employees are likely making no money from their equity, but at least they are still employed and the ones that stay at Airtable are probably getting some sort of retention package.

Unfortunately, the startup pain will continue and startup tool selling will get harder because of it. Startups will need to figure out how to eliminate even more risk in the buying process.

I wish all startups the best of luck in 2024! Keep grinding, try new things, and be more efficient.

as a bootstrapped Airplane competitor, we're both sorry and exited. the trend of startups shutting down and/or being acquired kinda shines light on those who was grinding themselves

so i'm here to offer an alternative to Airplane customers - we at UI Bakery hope to assist Airplane customers in migrating to our platform (https://uibakery.io) to minimize the impact of this unfortunate event.

UI Bakery can help build both internal tools and external-facing apps (in fact, some of our clients embed UI Bakery on public websites). Our users can: - Connect to 30 data sources (SQL and NoSQL, HTTP APIs, and 3rd-party services like Salesforce and Stripe). - Use the Drag and Drop UI builder with 75 components to build responsive web apps based on your data. - Create simple and sophisticated business logic with Actions that can read/write data from data sources on UI interactions and as scheduled jobs/webhooks. - Generate code/SQL with AI code generation and Chat with UI Bakery documentation Assistant to build apps faster

Superb article. Thx OC.