Are More Layoffs Coming?

Here are the early warning signs that a layoff is coming

Meet your AI mandate faster.

Facing more pressure to accelerate AI’s impact on your finance operations? The CFO’s Guide to AI Strategy is your free roadmap. You’ll get 5 best practices to fast-track AI adoption and turn high expectations into big results. Like “eliminate 60% of manual finance work” big.

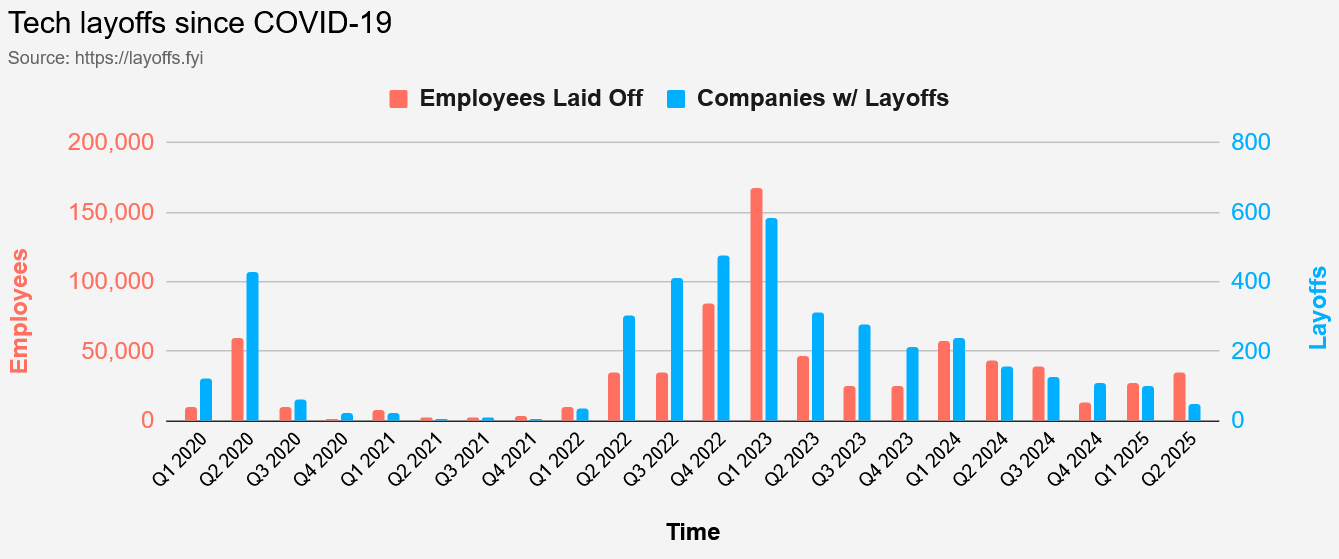

An unfortunate reality of the tech environment over the past few years is that we have become desensitized to layoffs. We are constantly bombarded by LinkedIn layoffs announcements, layoff news alerts, viral layoff videos, etc.

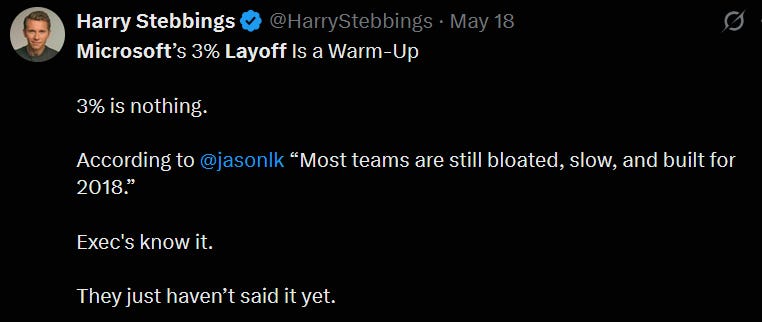

And the layoffs likely aren’t stopping in 2025.

While it seems we are past peak layoffs that occurred in late 2022 / early 2023. Layoffs remain elevated compared to historical levels in tech.

I am going to answer the following questions:

Why layoffs happen?

Where to cut?

What are the signs a layoff is coming?

1. Why layoffs happen?

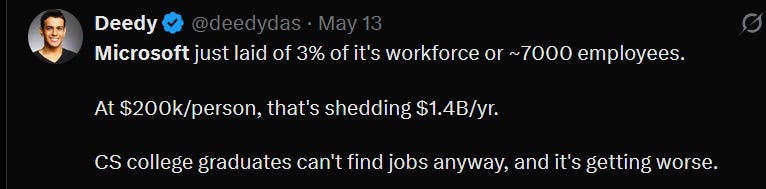

Layoffs typically occur to manage costs due to slower than expected revenue growth. But there is also a new reason/excuse in 2025….AI.

Usually if revenue is growing at a decent rate, then a hiring freeze will work to get the balance right fairly quickly. But a hiring freeze will fail to adjust costs fast enough for three reasons:

Revenue growth drops MUCH more than expected

Technology (like AI) enables radically improved people efficiency

Change in company direction (scrapping product/direction, seeking acquisition by PE, etc)

Lots of companies are being hit with both #1 and #2 at the same time. Double whammy

2. What will be cut?

The beauty of high growth software is that it can be very forgiving for inefficient spend. But…when revenue growth slows dramatically then that inefficient spend becomes painfully obvious.

Below is the buckets and order of cuts I make when there is a need to cut costs.

Existing tool usage (AWS hosting more efficient or find a way to decrease that Datadog overage bill)

Find non-headcount waste. I previously wrote an article about software tool waste (duplicative software, overpaying, poor ROI, etc) that CFOs should consider when looking to cut costs. In addition to software waste there can be other things like facilities, useless quarterly offsites, etc.

Cut people. Hiring freezes often come first but layoffs are the next step

People should be the last to cut on the list for a couple of important reasons:

Optics - the company should show that layoffs are a last resort

Tool management - You can’t really determine how many people you can layoff until your tool environment is assessed. Do you have archaic tools? Would adding some software/AI let you cut 10% more people? You also don’t want to cut too many and further destroy growth.

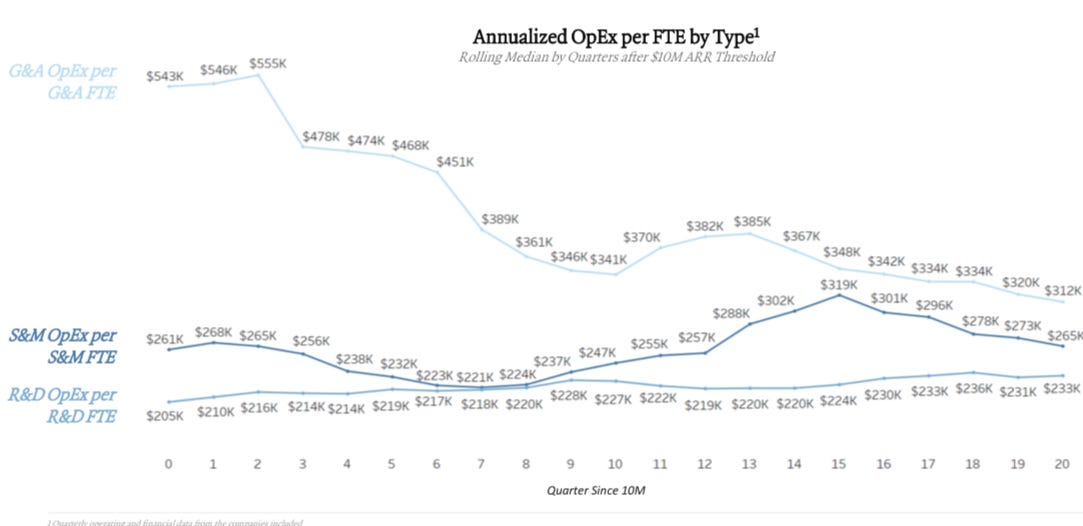

People costs still account for ~70%+ of the total costs of software companies. Below are the average costs per employee (FTE) broken out by department (tech folks are well paid and have a lot of tools).

With so much of total costs directly tied to people, if a software company needs to reduce costs by any significant amount then it almost always has to reduce people.

3. What are the signs that a layoff is coming?

Missing sales targets and revising down forecasts.

In a recurring revenue business, unless a company grossly over hired (many did) then they should be able to freeze hiring and let revenue catch up. But if revenue growth drops fast enough compared to plan, then it may take too long to get to appropriate spend levels. Missing revenue targets is the most important indicator.

Hiring and spend freezes.

Layoffs should be a last resort. Management will typically freeze hiring/spend and take time to investigate where else money can be saved first. They want to do their diligence to make sure they can avoid laying off as much people as possible.

Unit economics are bad.

If sales results/targets are being missed and the company’s unit economics are bad then layoffs are definitely being considered. Understand software unit economics.

Projects put on hold.

Similar to spend freezes, but when management plans on doing a large layoff they don’t want to commit to new projects or continue ones that won’t be finished. Things are paused or put on hold.

Management stops providing direction and guidance.

Performing any sizable layoff is extremely time-consuming and draining for management. They also don’t want to make any big decisions when they know a layoff is coming and they don’t know how it will impact the business.

Increased executive turnover.

Most execs have the experience to know when the ship is starting to sink or very rocky times are ahead. They are also part of the early layoff discussions so they know it is coming and may jump first.

Change in leadership behavior and working relationship.

Convos become less comfortable, they micromanage more, want to know the details of what you are working on and how to run your processes. This is true for the leaders in the know about the layoff, but would also be true for a manager of an employee who is going to be part of a normal performance-based termination

AI is coming for your job

Not sure how to characterize this one because every company should be adopting AI, but if the above indicators are true AND your company is pushing AI hard then a bigger layoff may be coming.

There might be other signs but these are some of the most important. Each individual one may mean nothing, but when there are several of these signs then there is a strong possibility that layoffs are being considered.

Final Thoughts

A few final thoughts:

Finance teams NEED to have their data in order so quick (informed) decisions can be made. Layoffs or not, a good spend management strategy is important for efficiency.

By the time you see these warnings signs it’s kind of too late. Either you will be on the list or not. Make yourself critical before it’s too late and build your network early to find the next job.

AI is throwing a wrench in warnings signs / cut sizes. Companies might be doing OK but AI means much fewer people are needed in 2025. Many companies have already hit pause on hiring amid the uncertainty

It’s a tough job market out there for many folks. I hope revenue growth accelerates for companies so layoffs don’t become more painful.

Footnotes:

Brex’s 2025 CFO survey offers advice for navigating market swings and economic volatility.

Get on the CFOPilot list. I am building the ultimate resource center for finance & accounting professionals

How do they decide who to lay off? Would be an interesting article

Every CFO today was once the junior who stayed late to fix a broken model. Who caught a missed assumption in the variance analysis. Who closed books with spreadsheets and Red Bull?

That pain trained judgment.

But what happens when the new generation never touches the numbers?

When the AI does the work and they just click approve?

We’re raising editors. Not experts.

AI handles:

Rolling forecasts

First drafts of board slides

P&L and variance checks

80% of management reporting

But without understanding why numbers move, your team becomes surface-level smart.

The risk: a finance org that’s fast, clean, and hollow.