Big Movers - Public Software Trends

Who had the biggest changes in their relative valuation multiples?

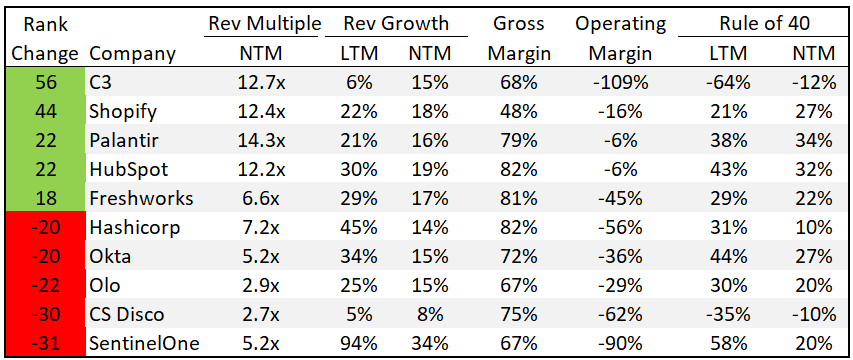

Looking at the relative revenue multiple changes for public software companies can show some interesting insights and trends. Below is a list of the top 5 and bottom 5 revenue multiples changes over the past year for public software companies. It shows how many spots a company moved up/down relative to other cloud companies over the past year in regards to their revenue multiple (i.e. how richly valued a company is compared to its revenue).

A revenue multiple looks at a companies enterprise value / revenue. In this case I am looking at the NTM (next 12 months) revenue compared to the company’s enterprise value.

Some Thoughts

C3.ai

C3’s revenue multiple is up 56 spots! The only explanation for this company’s valuation is that “ai” is right there in its name. It makes zero sense based on the financials, so the only explanation is that folks think that C3 is doing something amazing with AI to justify its valuation.

C3 has the 2nd worst Rule of 40 score (at -12%) amongst public software companies. The worst company is ON24 with a -15% Rule of 40 score. The difference is that C3 has a rev multiple of 12.7x while ON24 is 0.6x….

Rule of 40 Score: revenue growth + free cash flow margin. This metric shows how companies balance revenue growth with profitability.

Theme: AI is hot, everything else is not. For private companies, if you aren’t doing something interesting with AI then there is a good chance VCs don’t even want to talk with you right now.

A similar run up in valuation has occurred with Palantir (up 22 spots) because of AI, but at least Palantir has some decent financial metrics.

My guess is that there will be some spectacular disasters with AI companies over the next year. Some public and many private companies will see their valuations destroyed when their AI capabilities don’t live up to the incredible expectations. But there will be a few big AI winners as well….everyone is trying to find the few big winners.

SentinelOne

I wrote a post on SentinelOne last month — The Valuation Impact of Lost Trust. SentinelOne lost a lot of investor trust when it updated its revenue forecasts because of an internal error (check out the post).

Also, while SentinelOne remains one of the fastest growing public software companies, it is still incredibly inefficient. It’s revenue deceleration is massive — going from 94% revenue growth to an expected 34% over the next year. When revenue growth drops that fast it is nearly impossible to adjust efficiency at the same speed for a proper balance between growth and efficiency. This shows up on SentinelOne’s drop in its Rule of 40 score from 58% on a LTM (last 12 month) basis to 20% on a NTM basis, which is one of the largest declines in the Rule of 40 score for public companies.

Balancing growth and profitability is critical, but when revenue growth plummets then it takes a while to find the right balance.

Increasing Efficiency Takes Time

Revenue growth can hit a wall very quickly— as we have seen this past year. While revenue growth can stop abruptly, increasing efficiency takes time. Those with the highest revenue growth rates are the most susceptible to falling revenue growth and seeing an outsized drop in their Rule of 40 score.

Those that move faster toward profitability are seeing a smaller impact to their valuations. While those who don’t become efficient quickly are seeing a larger drop in their Rule of 40 score and their valuations.

Future of Software

Things in the software industry have been looking positive recently:

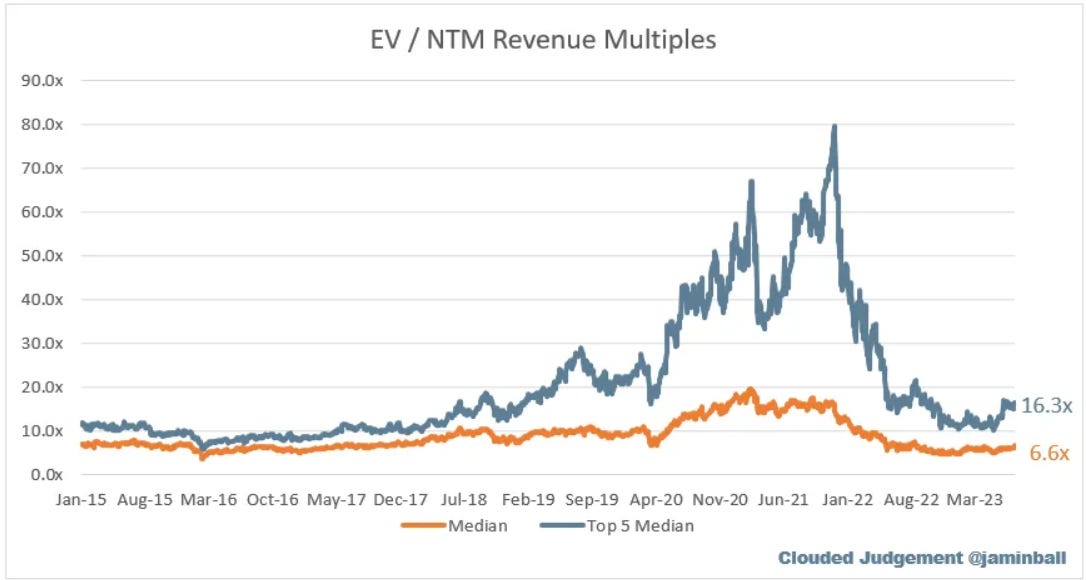

While we will probably never return to peak 2021 valuation craziness, it appears that software companies are starting to find their longer-term valuation multiples. It’s definitely been a great first half of the year with the Emerging Cloud Index up 37% YTD — a nice change after being decimated in 2022…

While still a bit volatile, the last year EV/Revenue multiples have been a lot more stable than the prior year.

Recent data from Carta shows startup valuations may be starting to bottom. Reported private company valuations generally lag the public markets since their stock isn’t regularly traded.

Unfortunately, the counterargument to all of the positive news out there for software companies came in yesterday…Cramer may have just killed the cloud (not explaining the joke / potentially serious issue).

RIP SaaS: 1999 - July 2023

*Nothing written in this article should be considered investment advice. Author may own positions in securities discussed.

C3 doing well because it as “ai” in the name! Brilliantly done...seems like most fall under this. Will be interesting, to your point, when we undergo the ai bust days

Loved the closing joke on Cramer :)