CFO Role Analysis & Insights

Path to CFO, average tenure, red flags from frequent changes, and why CFOs are important.

Brought to you by Leapfin

Accountants, what’s your love language?

For us, it’s acts of service. Helpful actions that save you time and make your life easier.

Like when your thermostat automatically adjusts before you get home.

Now imagine if your monthly journal entries could be prepared and posted automatically. All that messy transaction data from your PSPs, transformed into beautiful, balanced, accurate journal entries. And automatically posted to your ERP system.

See how Leapfin helps you create reliable journal entries automatically.

The CFO is one of the most critical roles of larger companies (besides the CEO).

In this newsletter I will discuss:

Red flags from CFO changes

The finance leadership role at private companies

Analysis of public cloud CFOs

Impact of CFO transitions

CFO Tenure Red Flags

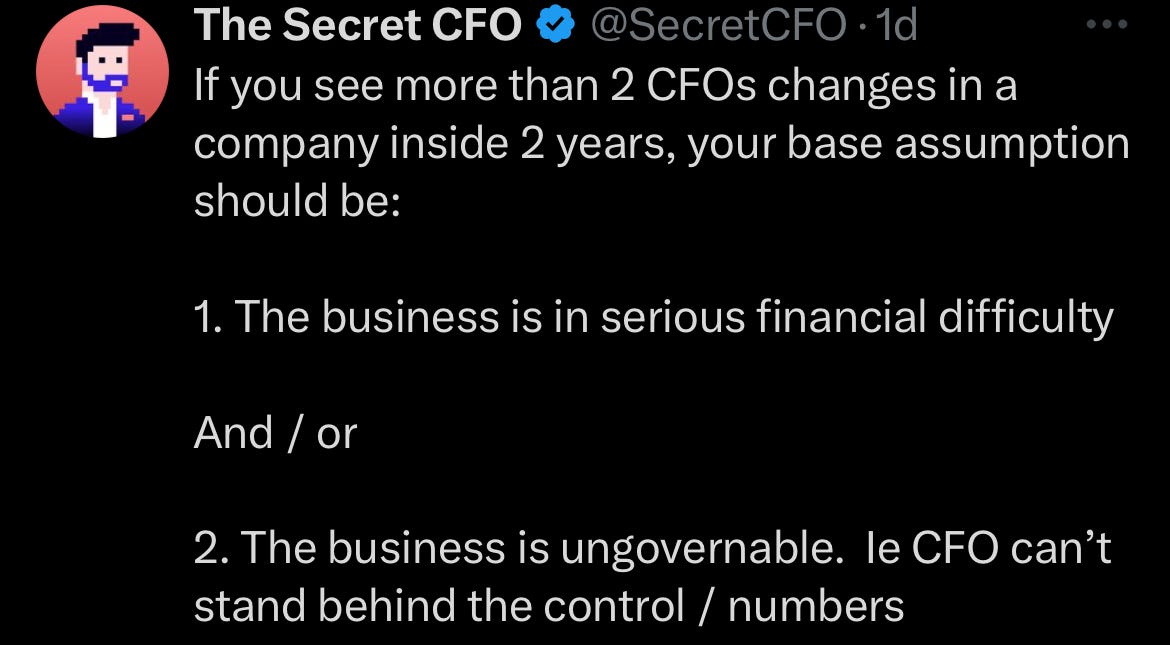

When the CFO position is not stable there are usually deeper issues. My anon brother from another mother posted the below about frequent CFO changes.

The point is 100% spot on. From what I have seen, when the CFO position is a revolving door there are always deep issues at the company.

One of the worst public company CFO tenures I have seen is from Skillz. Below is how long each CFO since 2020 has lasted…

January 2024 - Present (TBD but probably less than one year)

August 2022 - January 2024 (17 months)

June 2021 - August 2022 (15 months)

August 2020 - June 2021 (10 months)

And as expected, Skillz has been in a really bad situation for a long time. One of my more popular posts (We Were Warned - Tales of Bad Companies) covered the mess at Skillz.

Private Company CFOs

For high-growth private cloud companies changes in finance leaders is expected usually due to the company outgrowing them.

A typical journey of finance leadership looks something like the below.

<$10M in revenue: Fractional CFO (link if you need one)

$10M - $20M revenue: Head of Finance / VP Finance

>$20M revenue: Full-time CFO

Some companies will want someone full-time before $10M (potentially in additional to fractional), or hire a CFO earlier, but the general point is the same — you don’t hire a CFO that will take you public from the beginning.

Like most roles at high-growth companies, you hire for what you need for around the next 18 months. If they can grow into the next phase then great!

Once a company hits $20M in revenue they may hire a CFO, but the CFO the company needs at $20M is usually different than the CFO they will need at $300M and prepping for an IPO. Some CFOs hired at $20M in revenue can grow into the role, but certainly not all.

So a new CFO a couple of years before a potential IPO or between $20M and $150M in revenue is not necessarily reason for concern….it is expected. Once the company is public though, the idea usually is that the CFO that took them there can usually scale as far as the company can go.

Public Cloud CFOs

I reviewed most public cloud company CFOs for the past several years and discovered some interesting insights:

The average CFO tenure is nearly 5 years. This includes CFOs still in the CFO seat through today so it is actually going to be even longer.

45% of the CFOs had a public accounting background (almost all from a Big 4 firm).

25% of CFOs had a banking background

2 CFOs came from a legal background

The longest tenured CFO is Dylan Smith at Box who co-founded the company. He also had no prior finance experience

40% of the cloud companies I reviewed still have the same CFO that took them public

There are a surprising (but also unsurprising) number of CFOs that had long careers at General Electric (GE)

Something like 35% of new CFOs come from an internal promotion of the VP Finance or Chief Accounting Officer

If you aspire to be a public cloud company CFO then public accounting experience at a Big 4 firm is best. The average stint at public accounting is about 4 - 6 years. Might be a 🚩 to have > 20 years…

CFO Transitions

Given the importance of the CFO (the #2 person :) any time a CFO leaves there will be some investor concern. There can be big stock price reactions to CFOs stepping down.

A common thing that occurs with a CFO transition is that the next quarter/year’s forward looking guidance (revenue and profits plan) is frequently more conservative to help set up the new CFO to be successful with a “beat and raise” quarter.

The last thing a brand new CFO wants to do is provide a forecast that is missed after their first quarter on the job.

Below is the stock price chart from Confluent. They hired a new CFO in August 2023 and the guidance provided was disappointing and the stock tanked. However, the very next quarter they beat guidance and raised expectations and the stock shot up.

While not all of the stock price movement is likely related to the new CFO, in retrospect it does seem like the guidance was conservative. This is certainly not investment advice as it doesn’t always work out like this, but the point is that new CFOs can cause stock price volatility.

Companies, particularly public companies, want CFOs that will stick around for a long time.

Takeaways

Frequent CFO transitions is a major 🚩 at public companies

Most popular path to public cloud company CFO is public accounting at a Big 4 firm.

CFO (and finance leadership) changes at high-growth private companies is expected as the role outgrows them and they need to be topped

Footnotes:

I partner with a CFO/Accounting firm focused on software companies. If you are a software startup (less than $15M in revenue), reach out today for a free consultation.

Very interesting analysis of CFO careers and their impact on public companies.