Closing Sales Deals in 2023

The state of software sales, how the best sales reps shine, and how to protect the business from bad deals

There are 9,000 of you now reading my newsletter after just a few months! If you have found it helpful please share with your co-workers, friends and loved ones :)

There have now been 6 straight quarters of year-over-year (YoY) deceleration in public software company growth rates. The below chart shows the median YoY growth rates of public software companies.

The level of decline over the past 2 quarters has been really significant. Remember that these are the growth rates of public software companies so they are generally top-tier companies because they are the ones that made it to the public markets. The growth rates of VC-backed private companies might be higher but the deceleration % is even larger in many cases.

Software companies have quickly gotten religion about the importance of efficient and durable growth. The ones that are slow to become efficient will face the following:

Public companies will get slapped with a terrible valuation multiple, lose investor trust, etc

Private companies will become unfundable, get a terrible valuation multiple and/or be forced to accept “dirty” term sheets.

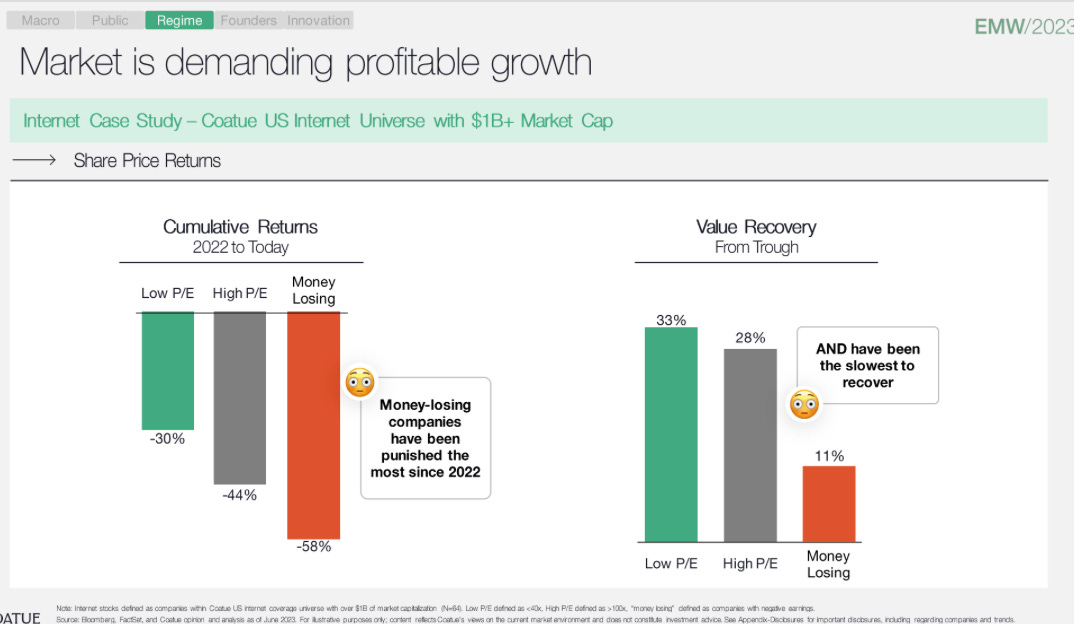

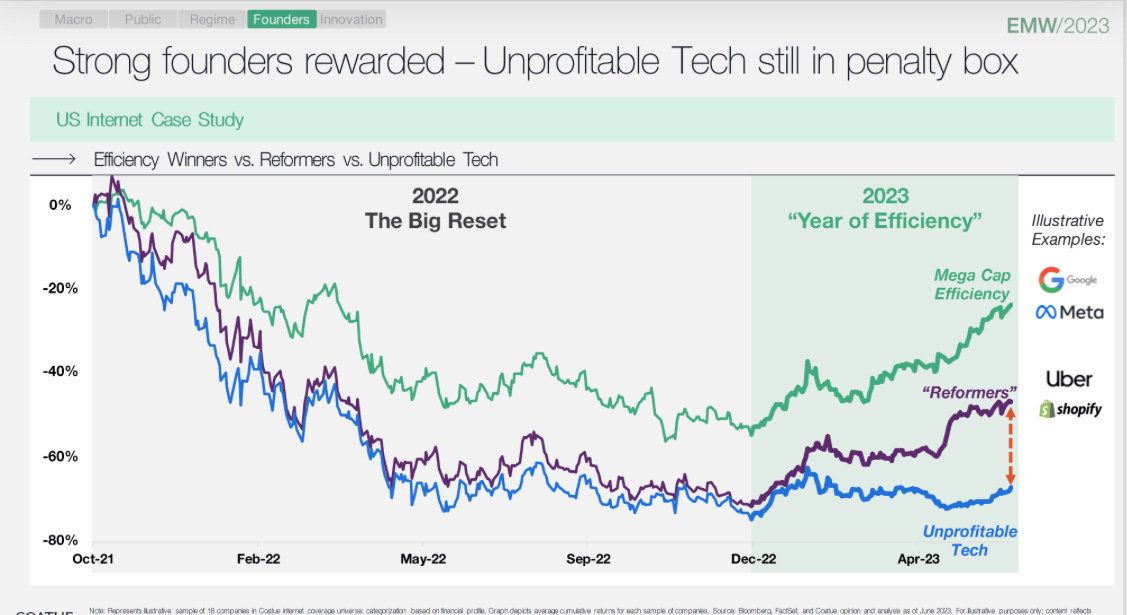

The below two images are from the recent Coatue conference on the importance of profitable growth.

Buyers Controlling Spend

Because of the focus on efficiency, companies are putting in more/better processes and controls to mitigate waste and promote durable growth:

More approval layers

CFOs being involved in a lot more deals (at lower thresholds)

Larger companies with procurement teams are getting pressured to save more and push on discounts

Holding the line on budgets and/or further cutting from existing budgets

Companies are spending time to understand the ROI and all the costs (both direct and indirect). A lot of these indirect costs got ignored during the good times of 2021 when there was less process.

Reading Recommendation: Every operator should understand best practices around monthly financial reviews. SecretCFO has an awesome newsletter on best practices for finance organizations. I highly recommend you subscribe to him as well!

Sales Rep Quota Attainment

The significant deceleration in sales growth has caused large declines in sales rep quota attainment.

Most enterprise software reps have a 50/50 compensation plan — 50% base and 50% variable. So large declines in quota attainment can have a big impact on their pay.

Thanks to my friends at RepVue, the below chart shows the average sales rep attainment for the tech industry (software, internet, IT). N = 35k+

Some interesting insights:

Startups (headcount of 1-50): Had the least volatility amongst the company segments. Maybe they were still building the GTM engine and hadn’t over hired as much?

Headcounts between 250 and 10K: Had the most severe drop in attainment % over this period of time. This group is likely the ones that over hired the most on GTM thinking their incredible 2021 revenue growth would continue. But then growth plummeted, companies had too much sales capacity, RIFs happened, etc…and all of that has been impacting rep attainment.

Headcounts of 10K+: Less of a drop as the previous group perhaps due to less over hiring and having a more repeatable, predictable, and more mature GTM motion. And on a positive note, this segment is showing some early positive signs of stabilization/improvement.

Signs of Sales Rep Issues

When the sales environment gets harder the best sales reps shine and stick out more. Companies need to make sure they are keeping their best reps.

There are quite a few quantifiable things you can look at to spot issues with the sales team that should be regularly reviewed. Here are a few:

Review their calendars: This doesn’t necessarily mean they are bad but if they have wide open calendars and are not talking to prospects then they certainly aren’t busy…at least with work that matters.

Opportunities held by sales stage by rep: This report allows you to quickly see the distribution of deals. Tracking this over time allows you to also see interesting trends.

Level of discounting by rep: The bad reps overuse discounting. It is the only tool in their tool belt that they know how to use.

Conversion and closed deals: Ultimately the good reps consistently close more deals in any environment and they move opportunities through the deal stages at a higher rate and faster.

Most of us have heard about the sales rep that got handed a huge wale deal on a silver platter and hit their entire annual quota from it…And then they barely did anything for the next year. Good reps are consistent!

Thoughts on Discounting

Sales discounting is not bad…it is actually expected in enterprise software sales (20% discounts are pretty normal). There is psychology to it — As software buyers we have been trained to expect a sales discount and getting one makes use feel good about the deal. This is especially true in an environment where everyone is focused on saving money.

The CFO wants to say they got another X% off the deal because they are great at negotiating. Larger companies with procurement teams want to say the same thing —they often have bonuses tied to it.

So enterprise software companies need to price their product accordingly - assume X% of discount is going to be given.

Discounting isn’t a magical bullet

As I said before, bad reps overuse discounting because its the only thing they know how to do to create urgency and win a competitive deal.

Reps that discount their way to a won deal not only leave money on the table, but many of those customers probably won’t be as successful because they were not sold on value so they churn faster too.

Blaming price on lost competitive deals

Of course some deals are lost because the competition was cheaper, but it is too easy to blame price.

It’s easy for the prospect to blame price because then they don’t need to explain the perceived value differences. It’s easy for the sales rep to blame price because then it becomes someone else’s fault — “the deal would have closed but our stupid CFO wouldn’t approve a 40% discount.”

Was it actually price that killed your deal?

The Fraud Triangle

In finance/accounting you learn about the “fraud triangle” — a concept where if these three things are present then the risk of fraud is heightened.

I am NOT saying that anyone is committing fraud, but I think its an interesting analogy because these elements of the fraud triangle are heightened right now which may cause things to be done (besides fraud) that are also destructive to business value.

Pressure: This is at an all time high. Not just for sales folks but all of GTM and executive teams

Rationalization: We can easily rationalize during tough times because almost every tech company is struggling

Opportunity: This is what companies can control to prevent individuals from making bad decisions for the company.

Deal Approval Matrix

A good deal approval matrix is a good place to start to add in some controls around sales deals and remove the opportunity for bad business outcomes.

If you don’t have anything, then start with a simple approval matrix (Notion or Excel is fine). As you scale and have a good repeatable process then it can be automated through a system like CPQ.

Some examples of things that should be on a deal approval matrix include:

Sales discounting

Payment terms

Free periods of service or delayed starts (disguised discounts if they have access on contract signature)

Waiving true ups for overages

Minimum professional services attach rates

All custom language must be approved by legal

The matrix should have different level of approvers for each.

Example using sales discounting:

<10% discount: No approval needed

10 - 15% discount: Manager approval

15-20% discount: VP approval

>20% discount: CFO approval

Pressure to make exceptions

If the above controls are not in place, then its too easy for sales reps to push on things they they didn’t need before. Discounting will increase a lot, free periods will appear, professional services will drop (reps get paid a lot less on that!), etc. All of these controls are suppose to protect the business — protect profitability, avoid bad customers, increase trust, not screw up revenue recognition for the accountants, etc.

Sales reps are often just compensated on gross revenue closed…so they don’t care about gross margin or customer churn….but those are critical for a software company’s success. That’s why the above controls/process must exist!

Making exceptions to /processes/policies in order to hit a number is a slippery slope!

But…if you do want to trick investors then be sure to check out my prior post — How to Trick Investors & VCs. Hint: it is actually things you shouldn’t do 🤣

Concluding Thoughts

It’s tough out there for sales reps right now, but it’s also the time when the really good reps stick out. Make sure to keep them happy!

Make sure your company has proper workflows and controls around sales deals so deals that are bad for the business are avoided.

Lastly…let’s hope we are nearing the bottom and everything will be up and to the right from here for sales growth and rep attainment!