CrowdStrike - "Rule of X" Winner!

Lessons from CrowdStrike's Rule of X score and how they went from inefficient (~30% gross margins) to one of the most efficient public companies ever.

👋 Join 15k+ other subscribers getting software industry insights, trends, and best practices. Pro tip: most companies will reimburse a paid subscription as part of the education budget :)

Every investor wants to be able to accurately value a company so they know if a company has long-term return potential. A discounted cash flow (DCF) model is theoretically a perfect way to do this — forecast out all revenue and expenses and discount back all future cash flows to today. The problem is a DCF model is ALWAYS wrong and usually by large amounts because it is impossible to accurately forecast all future cash flows.

Because of the obvious flaws of a DCF, investors have created other shorthand metrics to value software companies that don’t require all the complexity and guesswork of a DCF. Operators should also understand these metrics because investors will use them to judge their companies.

Bessemer recently announced the creation of a modified Rule of 40 score called the “Rule of X”.

Rule of 40 Score = Revenue Growth Rate + Free Cash Flow (FCF) %

The purpose of the Rule of 40 score is to show how companies balance revenue growth with profitability — companies with a better balance will create more value for investors. This makes intuitive sense. Super fast growth with zero profits will eventually be worth very little if it can never turn a profit.

The problem with the Rule of 40 score though is that it assigns an equal weighting between growth and profits. High-revenue growth that is very durable can be significantly more valuable than a few percentage points of profit margin.

While a margin increase has a linear impact on value, a growth rate increase can have a compounding impact on value. — Byron Deeter @ Bessemer

Rule of X

Rule of X = (Growth Rate * Multiplier) + FCF Margin

The reason it is called the Rule of X is because the growth multiplier can change based on stage of the company, cost of capital, etc. Conservatively though, for public cloud companies Bessemer says a 2x ratio of growth is appropriate. Bessemer found that the correlation between EV/Revenue multiple and Rule of X was 62% while the correlation with Rule of 40 was 50% (i.e. Rule of X explains valuations much better).

Below is Bessemer’s chart of the Rule of X showing EV/revenue multiples by Rule of X. The chart below uses a growth multiplier of 2.3x and is from December 2023.

In the below chart I took the most recent data of the top 10 highest Rule of X scores and show the two components that make up the Rule of X (revenue growth and FCF margin).

CrowdStrike is the clear leader of the Rule of X and its valuation multiple rank of #1 (at 17.8x) reflects that. While the Rule of X is highly correlated to valuation, there are a few outlier companies that stick out in this top 10 list — see my previous post on Monday.com which has the 3rd highest Rule of X score but sits at the 19th highest valuation multiple.

The obvious flaw with both the Rule of 40 and Rule of X is that they both only look at current financial profiles of growth and profits while most of a software company’s value comes from longer-term durability of growth and profits (i.e. how long can they sustain high growth and strong profits).

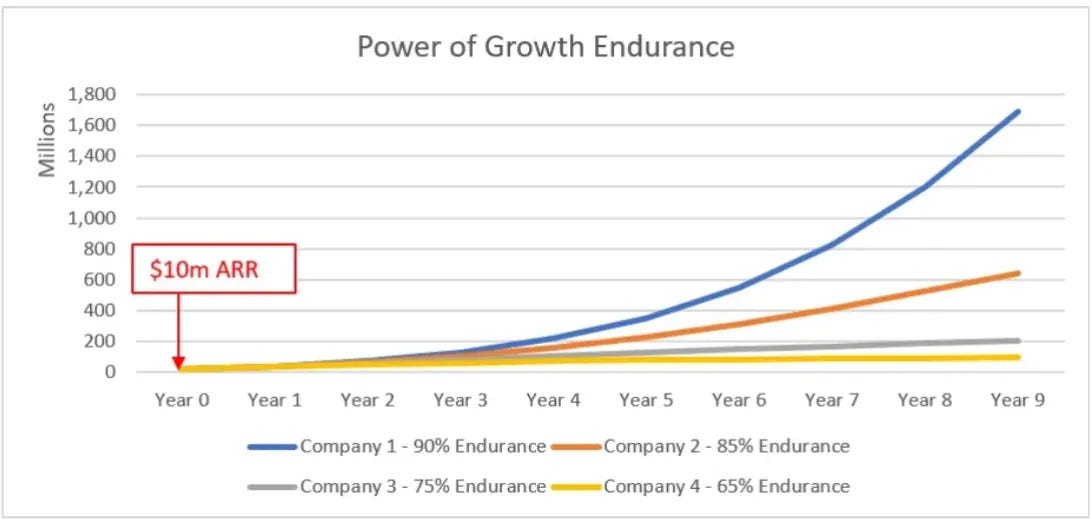

The below chart compares revenue growth of hypothetical companies with different levels of growth endurance. The company with 90% growth endurance ends with ~16x the revenue of the one with 65%….This is what is REALLY hard to predict.

Growth Endurance = the ratio of this year's growth rate to last year's growth rate

In Monday.com’s case, investors are obviously expecting revenue growth and/or profits to be less durable than the other companies on that list.

Not only is CrowdStrike one of the fastest growing companies ever, it is also extremely profitable which is why its Rule of X score is so high. Below is the top 10 FCF margin public companies:

CrowdStrike comes in at #8 in terms of FCF margins, but it is by far the fastest growing company in this list (growing revenue at 30%).

CrowdStrike has some of the best unit economics amongst all software companies. One of the key pillars of a high FCF margin is good gross margins.

CrowdStrike’s 75% gross margins are good (right around the median for public software companies), but they haven’t always been that way…shortly before its IPO CrowdStrike had ~30% gross margins 🤯

So how did CrowdStrike go from having a terrible gross margin of ~30% to being one of the most efficient and profitable companies in the world? Keep reading…