Dangers of ARR vs GAAP Revenue

What do you mean by "revenue"?

Today’s Sponsor: Vesto

If you run a business with multiple banks or entities, you should check out Vesto.

Vesto makes it easy to connect all your banks for a real-time view of your cash position, transactions, and cash flow across accounts. They've helped 100+ teams – from startups to publicly traded companies – replace bank portals and spreadsheets with Vesto.

Learn how you can get the reporting you need in a fraction of the time

What is “revenue”?

Investor: What was your revenue over the last 12 months?

Me: What “revenue” are you talking about?

Anyone reading financials needs to understand the different variations of “revenue” and how they all connect to each other (and how AI, pricing changes, etc impact them)

ARR, MRR, ACV, Contracted ARR, Committed ARR, GAAP Revenue, deferred revenue, TCV, RPO, and the list goes on…

In this post I am going to cover what you (and your teams) should understand about the different types of “revenue” and related numbers. If you don’t understand the below…then keep reading. I will also cover some frequent issues I often see for each “revenue” type.

Accounting Numbers

Only three of all the “revenue” numbers noted above are accounting numbers that follow rules governed by Generally Accepted Accounting Principles (GAAP).

Everything else is the wild west (i.e. you can define it however you want).

1. GAAP Revenue

If you ask your accountants for “revenue” then this is what they will give you. And this SHOULD be what everyone understands “revenue” to be. Make sure your team uses the right language so there isn’t confusion.

GAAP revenue is the number reported on your income statements. Both private and public companies follow the same accounting principles to determine the amount of revenue to recognize.

While GAAP rules should mean the same treatment across companies…1) there are some small differences that can happen based on judgement from specific circumstances and also 2) small private companies often just don’t follow GAAP revenue rules very well so there may be larger comparability differences there.

How it works

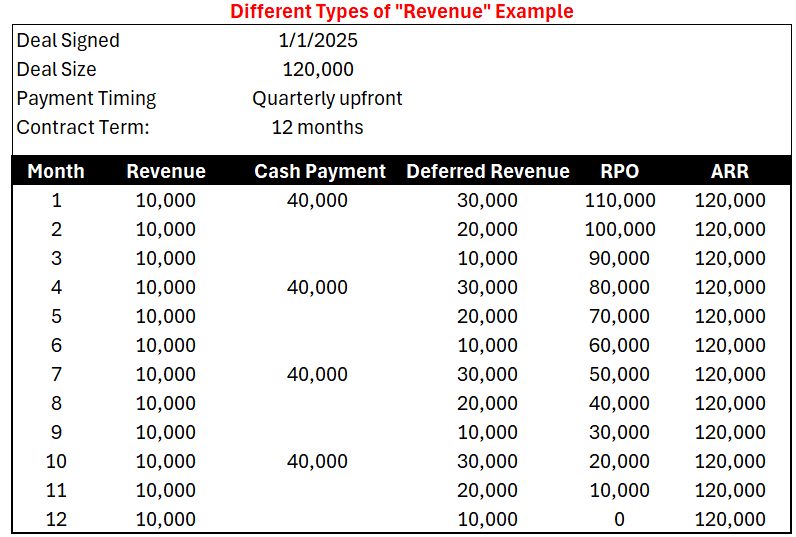

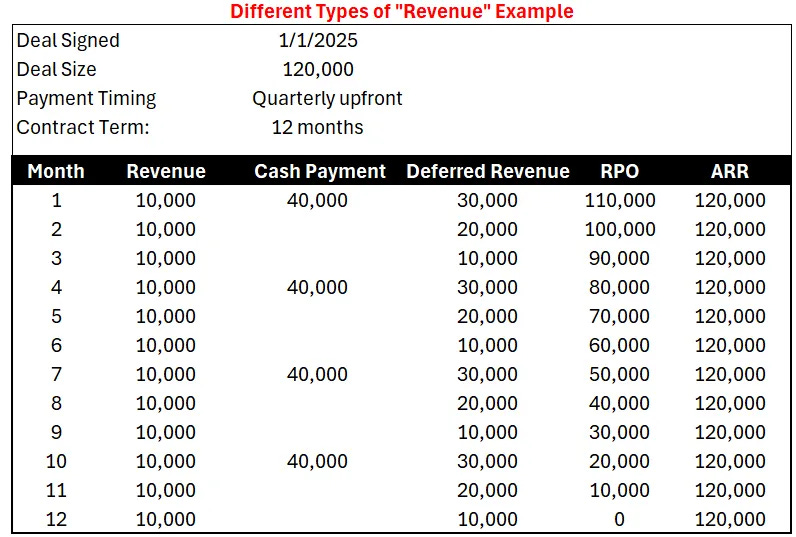

GAAP revenue is recognized when a customer “obtains control of promised services”. In a SaaS agreement that delivers fixed value throughout the term of the contract, the revenue is spread ratably over the contracted term.

Example: 120K SaaS contract for 6 month expansion: You would recognize the $120K ratable over the 6 months — ~$20K per month.

This is a major simplification of how revenue recognition works, but essentially how it works for a simple SaaS deal.

Revenue Allocation: MANY companies will give away their professional services (or heavily discount) in order to recognize more subscription ARR. But GAAP rules (ASC 606) require you to allocate revenue based on “standalone selling price”, which basically means if you discount professional services revenue then you have to move some of your subscription revenue to professional services anyways. But if there are no professional services in the renewal contract then the entire amount would go to subscription revenue (making it look like expansion in GAAP revenue even though contractually nothing changed).

Consumption-Based Pricing (aka usage-based)

For companies with a pure consumption-based pricing model, GAAP revenue will be recognized as consumed.

Example: Same deal as above — 6 month contract for $120k. But it’s based on AI product usage.

Solution: Revenue is only recognized as it is consumed so usage-based pricing revenue will be lumpier than the traditional SaaS model (see below).

Professional Services & Other

This revenue is almost always broken out from subscription revenue unless it is so immaterial that it doesn’t really impact gross margins. Most investors look at professional services revenue as either bad or neutral to a company’s valuations because of the following:

Professional service gross margins are usually very low (or even negative) for SaaS businesses.

The scalability and distribution of SaaS is why it can grow so fast. Service businesses just can’t do that because of the reliance on people.

High professional services may mean people are making up for a bad SaaS product.

If implementation services are high due to product complexity, then the distribution of the SaaS solution might be significantly slower.

When is professional services revenue recognized?

It depends, but typically professional services are recognized as they are performed.

2. Remaining Performance Obligations (RPO)

RPO: the contracted revenue that a company expects to recognize in the future for services that have been contracted to but not yet recognized as revenue. It represents future revenue visibility from existing contracts.

Example: Company ABC signs a fixed 2 year contract for $240K ($10K/month) that is paid monthly. After 6 months on the contract the RPO is $180K.

One important distinction with deferred revenue (discussed next) is that RPO has nothing to do with payment timing. Only the contracted amount relative to the revenue recognized matters.

Who cares about RPO?: Most private companies don’t directly track RPO for accounting purposes. It’s not a required disclosure for private companies, but as companies get larger (and especially when public) they pay more attention to it since its required for public companies and investors ask about it. RPO shows how much future revenue is locked in so a high RPO de-risks future GAAP revenue.

AI’s impact on RPO: On the extreme, pure usage-based pricing (with no committed amount) will have zero RPO. Similarly, if companies do shorter contract periods (with smaller commitments) because of AI-related risk then RPOs will go down. A declining RPO because of pricing/contract changes isn’t necessarily bad but…it certainly comes with higher risk for future revenue.

I have mixed feelings on using RPO as a key metric from an investor standpoint. But during times of major transition (like with AI) where contract lengths and pricing models change, RPO becomes an even less valuable metric.

3. Deferred Revenue

Deferred Revenue: cash received but not yet recognized as revenue.

Deferred revenue is similar to RPO but it uses the amount paid upfront as the starting point instead of the contracted amount. Which means changes in payment cadence (e.g. moving from annual to quarterly upfront) would have major impacts to deferred revenue.

Every company is required to report deferred revenue as part of basic accounting (unless all payments are paid in arrears).

Investors look at deferred revenue less so when you are small and more so when you are large. If deferred revenue doesn’t follow revenue growth then the explanation is often a change in payment cadence, contract lengths, etc.

Non-GAAP Topline Metrics

The non-GAAP topline metrics is where private company investors spend most of their time. Then as companies get bigger (and growth starts to slow), the GAAP metrics above come in focus.

Annual Recurring Revenue (ARR) - the current annual recurring revenue of subscription agreements from all customers at a point in time.

ARR = ARR at the beginning of the Year + ARR gained from new customers + ARR gained from expansion – ARR lost to downgrades – ARR lost to customer churn

ARR = MRR (monthly recurring revenue) * 12

ARR (especially with AI now) can mean lots of different things…

ARR: typically best for companies selling to B2B / enterprise customers that do longer-term contracts.

MRR: Better for shorter-term customer lives/contracts that are often in the SMB or when selling B2C.

There are lots of other non-GAAP topline metrics than these - ACV, CARR, exit ARR, etc but it’s all the same concept — make sure it is clearly defined and makes sense for your business.

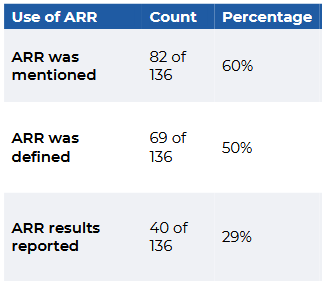

Fun fact: Less than 1/3rd of public cloud companies actually disclose ARR.

ARR vs Revenue

Finance teams NEED to reconcile between GAAP revenue and their reported ARR so they can explain any differences.

Investors will ask:

Why isn’t ARR similar to your last month’s GAAP revenue times 12?

Maybe because you book things as ARR with long delayed starts? Or you are heavily discounting professional services so GAAP revenue is being adjusted? Or you are giving lots of customer concessions which impact revenue but ARR is staying the same?

You should always be able to bridge ARR to revenue

Why isn’t ARR growing faster/slower than revenue?

ARR is a leading metric and GAAP revenue is a more lagging metric. How much of a leading metric ARR is also depends on how aggressive your ARR definition is…

Differences in growth rates during times of volatility

Below is a company that has strong ARR growth and even accelerates in year 2 from 90% to 120%. Then things normalize and ARR grows 100% the following year. But then ARR growth hits a wall and is expected to only grow 50% in year 4.

The growth rate difference of 17% between ARR and GAAP revenue in year 4 is caused by:

Revenue is a lagging metric compared to ARR

SaaS companies don’t typically close deals linearly throughout the year

Because GAAP revenue is a lagging metric compared to ARR, the GAAP revenue growth in year 4 lags the steep deceleration of ARR growth. Similarly, the revenue growth % doesn’t accelerate as fast as ARR in year 2 because most of the revenue recognized in year 2 comes from the previous year’s ARR growth.

Final Thoughts

Do you understand my original example now?

Be careful with using different top-line definitions interchangeably, particularly as they are used within other SaaS metrics. For example, if you are looking at an efficiency score (i.e. Rule of 40) then the 17 percentage point growth difference in my example above is huge and can change how you evaluate the health of a company.

Your leadership team should understand how these metrics work and the differences between them (forward them this newsletter :)

Make sure your team regularly reconciles between ARR and GAAP revenue. Are you comfortable explaining the differences to your investors/board? Or is your ARR definition too aggressive?

Great article. Love the different definitions used for ARR which also impact down stream metrics such as Gross & Net Revenue Retention when benchmarking firms.

Great overview, see this trip up so many young investors - especially deferred revenue. That piece also means you have a liability to serve (sometimes means extra costs) which creates overhang if growth slows.