Driving Efficient Growth in 2025

What efficient growth looks like in 2025 and lessons from how Ramp has been efficient during its high revenue growth.

Today’s Sponsor: Ramp

Tired of being the policy gatekeeper and chasing down manual expense reports? Ramp's corporate credit card automatically enforces spending rules, allowing employees to snap and go with instant receipt capture. Get financial visibility and control with expense management software employees actually love to use.

Everyone I have talk to about 2025 planning is focused on how they can keep their same revenue growth targets but continue to improve efficiency.

Operate with less headcount

Reduce software sprawl and related costs

Improve GTM efficiency

Protect gross margins from being squeezed

We are entering a year with the most unknowns that I have ever seen. There are a lot of potential wildcards in 2025 that can significantly screw up your annual plan.

What is your “margin of safety” in your financial plan?

For a long time cloud companies have been able to hide operational inefficiencies/laziness in their high gross margins. When gross margins are 75%+ then it is easy to hide those operational sins of inefficiency and waste.

But as I have discussed in previous posts…the ability to hide this waste is going to get a lot harder.

High-growth companies often struggle the most with efficiency because they are focused almost exclusively on growth. But…investors now want BOTH - growth and efficiency. And companies should want that too!

One of the fastest growing companies out there is Ramp, so I spoke with their VP of Strategic Finance to learn what Ramp has done (and plans to do) to continue to grow efficiently.

Learnings From Ramp’s VP of Strategic Finance

High-growth VC-backed companies typically struggle with efficiency. The primary cause is that these companies are dropped huge bags of money and then commanded by their VCs that they must grow fast.

Efficiency has not typically been a priority for high growth companies. While that has changed a bit over the past few years, most cloud companies still have plenty of inefficiencies.

Spending a bit of extra time thinking about efficiency can yield huge results without impacting revenue growth. Higher efficiency means companies will have more runway and options to invest in high ROI initiatives….so you might as well spend a bit more time and do things efficiently.

I sat down with Ramp’s VP of Strategic Finance to discuss how Ramp thinks about driving efficient growth after raising a total of $1.2B and growing REALLY quickly:

2022: $100M run rate revenue just 2 years after launch

2023: $300M+ run rate revenue (200% YoY growth)!

2024: New revenue numbers haven’t been disclosed, but Ramp raised an additional $150M in April at a $7.65B valuation, so I assume things are going pretty good…

North-Star Metric: Contribution Profit

Ramp uses a very underrated north-star metric to track efficiency: contribution profit.

Contribution Profit is a more fully-burdened version of GAAP gross profit that represents how much value Ramp keeps when considering the dollars they spend to achieve their revenue.

They focus on this more burdened version of gross margin because they have a wide range of solutions with different unit economic profiles so looking at contribution profit enables Ramp to make better decisions around efficiency across their business.

More companies NEED to do this in 2025.

AI products and other changes to the software industry are making this type of analysis critical. More companies have products with wildly different gross margins profiles so you can’t treat all revenue as equal.

Looking at a fully burdened contribution margin may highlight broken unit economics sooner. It will point the company to areas that need to be fixed or where investment dollars should be spent.

Incremental Contribution Profit

How much contribution profit is each incremental customer delivering relative to the cost it takes to acquire them?

Ramp spends a lot of time measuring and evaluating their marginal LTV / CAC – what does the next customer cost to acquire relative to how much they’re worth to Ramp over their lifetime?

It is shocking how few companies actually perform an analysis like this, but it’s so important when making investment decisions.

Efficiency Metrics

Ramp obsesses over their operating expenses across S&M, R&D, and G&A. To ensure their efficiency constantly improves, they track a few key metrics. Below are a few of them:

How much contribution profit is generated per FTE?

What’s the overall operating margin and is it expanding as they expect?

What’s the Rule of 40 Score?

Revenue per FTE has been a popular metric for a long time, but I like contribution profit per FTE a lot better because it eliminates the gross margin variability and shows the actual incremental profits being added by FTE (which is what really matters).

When Inefficiency Is OK

Not everything a company does can be highly efficient. Companies are typically a bit less efficient when they are growing really fast. You can’t have the same efficiency metrics when you are growing 100% compared to a company only growing 10%.

Also, you are probably not taking enough risk if everything is efficient.

We think of our business in terms of core vs. bets. We need our core business to operate extremely efficiently. We do not need our bets to be nearly as efficient – and actually, it’s preferable to have loss-making initiatives that can mature into efficient contributors over time as we learn and scale them. We wouldn’t be betting big enough if that weren’t the case. —Will Petrie, Ramp VP of Strategic Finance

Will gave three example of where Ramp is taking bets where efficiency isn’t the goal:

New products they have launched in the last 12 months or will launch in the next 12 months

Non-performance marketing designed to drive awareness or other up-funnel metrics

Controlled credit underwriting experiments with new customer populations

Efficiency Through Transparency

When done properly (with the right team), financial transparency can significantly improve efficiency and even drive revenue growth. Financial transparency empowers employees to act like owners. And when they have the larger financial context they can make better decisions.

I was happy to hear that Ramp also believes in financial transparency:

We’re very transparent. We believe the biggest superpowers we have as a leadership team are clear goals, honest communication, and accountable teams. It’s hard to create those things without transparency about what’s working well and what’s not working well. —Will Petrie, Ramp VP of Strategic Finance

Ramp doesn’t go into all the cash nuances every month with the full company, but that is because they are in a fortunate position of having a very healthy balance sheet so it isn’t needed. But if there is an area they want to improve then it does get discussed in more detail with more frequency.

But the key to success here is having exceptional people on your team. If you don’t have the right people then not only will being transparent with financial info not benefit them but it might hurt the company as employees get overwhelmed and become preoccupied with the information (instead of using the info to find solutions and improvements).

When companies are not transparent it is usually either 1) management was given bad advice or 2) management doesn’t trust their people.

Leveraging AI in Finance

A lot of finance teams are slow to adopt new technologies and based on my conversations with many CFOs, AI adoption has been no different. So I wanted to know what the finance team at a leading finance tool (Ramp) was doing.

Probably to nobody’s surprise, the finance team at Ramp is using Ramp a lot. If your teams are not dogfooding their own product then that is a major red flag. Ramp’s finance team is the testing ground for all products and AI applications.

Here are a few things where Ramp’s finance team has seen efficiency gains from AI:

Ramp AI Features: A big challenge in Procure-to-Pay is accurately reading complex POs, invoices, and receipts. The newest LLMs are better at reasoning, which has allowed Ramp to introduce “agentic critics” into their OCR technology that review each other’s work, iterate to better answers, and help them more accurately determine how much to pay or if they are getting over-charged vs. the contract they signed. This new approach increased their OCR accuracy from 91-92% to 98-99% overnight.

Non-Ramp AI Usage: Outside of Ramp, their accounting team is experimenting with new functionality from Floqast to further streamline journal entries. They also encourage use of ChatGPT or Claude, and they are seeing widespread adoption to write emails, draft memos, conduct desktop research, and even perform light analysis.

Ramp’s finance team also plans to do a lot more with AI in 2025:

More agentic AI stuff: In 2025, Ramp’s product & engineering teams are aiming to push further with more agentic, zero-touch applications across the finance tech stack. The finance team will of course be dogfooding those products as well.

AI workflows: Ramp finance team wants to use more functionality that helps them augment workflows like flux analysis, accrual postings, and journal entries. Additionally, they plan to experiment with AI-assisted financial statement note creation, making these processes faster and more accurate.

AI finance operators: Ramp is planning on experimenting with AI-powered finance operators. Think of these as junior financial AI analysts who will take on tasks in treasury operations, corporate accounting, and strategic finance. This will enable their team to shift to supervisory roles – validating the work done by AI agents and ensuring that the output is informed and reliable.

The biggest takeaway for me on what Ramp’s finance team is doing with AI is that they are experimenting with new things. Not every AI solution will be perfect or work as expected, but teams should be trying them out. There is a lot of efficiency to gain in 2025!

Managing People Costs

People typically account for 70%+ of a cloud company’s total spend. Maybe this ratio changes in the future as AI can automate more work currently performed by humans, but it likely stays a significant part of spend for a long time.

Like most companies, Will said that Ramp is constantly trying to find new frontiers of efficiency to do more with less. Will gave a few interesting examples of how Ramp does this with their people resources:

Technical Resources: Nearly 50% of all direct headcount investment at Ramp goes to highly technical roles. Every team at Ramp has engineers building internal tools to make workflows more automated and efficient.

Small Teams: Ramp is a believes that big teams move slower and get less done than small, focused, empowered groups. As a result, they worry less about the precise efficiency of an incremental FTE on a given initiative because they don’t allow >10 people to be dedicated to any particular project. Small teams are the future, especially as AI further allows small teams to have big impacts.

Talent Bar: In 2024, 0.2% of applicants received an offer to join Ramp. Eric & Karim (Ramp founders) spend a significant portion of their time on hiring, personally reviewing every recommended hire. This level of attention ensures everyone is focused on finding not just the best people, but also the kind of high-slope, high-agency people who thrive in an environment where teams are small and expectations are high.

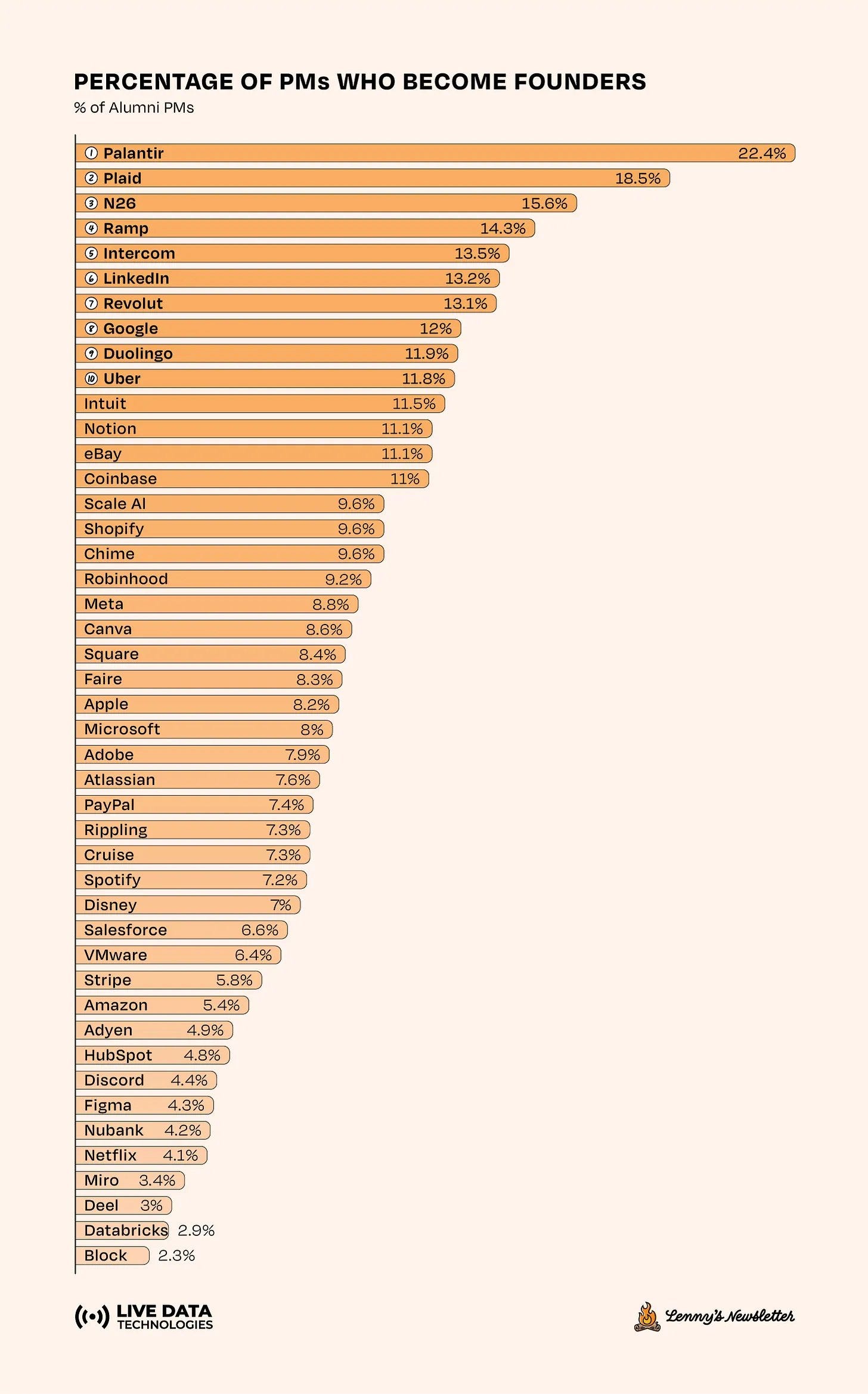

The below chart shows the companies with the highest percentage of product managers that become founders. Ramp comes in at #4 and they are the youngest company on this entire chart….They are clearly hiring some really smart people.

Eric Glyman, Ramp CEO, said “just shy of 10% of Ramp’s team today have started a company”. Not only do they mint a lot of founders but they hire a lot too!

Final Thoughts

Improving efficiency in 2025 is critical. If you don’t become more efficient now then your company will get left behind and will have a really hard time competing in the future.

It’s not too late.

Just because your annual planning is done doesn’t mean you can’t push for more efficiency. I promise that your board won’t mind if your revenue targets stay the same but expenses decrease :)

But hopefully you have the right people to help make these changes…

Footnotes:

Check out Ramp if you want to see how Ramp’s finance team remains so efficient.

Sign up for the OnlyCFO webinar series! Don’t forget our Metrics webinar today at 11am PST!

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire

Hi! Could you please elaborate on how to calculate "contribution profit" please? (an example could be useful). Thank you. I did Contribution Margin across cohorts which proved useful to see how ICO, value proposition, pricing impacted the overall financial equation of the business 🙂

Great article.

I want to call out a concept mentioned in your article that's extremely important: being transparent about company financials and other business metrics is key.

As a CFO, I share financial data with my company quarterly, along with specific churn and sales data that are core to understanding how well our business is doing. It was very uncomfortable at first, but we go into a rhythm and it's become a core part of our culture.

The concept is called open-book management, and it’s been a game changer for us. I'd love to see you go deeper in this area—I'm really curious if other CFOs take a similar approach.