Fixing Stock-Based Comp Sins

Death by a thousand stock-based compensation cuts

Today’s Sponsor: Leapfin

Ever wonder how to NOT screw up a $900M fund raise?

Alex MacGillivray, CPA wishes he’d known a few things before he became a first-time VP of Finance. Now in his role at Clio, the unicorn legal tech company that just closed a $900M round, Alex wants to share why the industry is failing accounting operators pursuing leadership roles.

Join Leapfin’s live 15-min talk tomorrow to learn: 2 things they never teach about accounting and finance leadership, how to handle a massive fund raise, and the MVP outside of your Accounting team.

Hiding Stock-Based Comp

High revenue growth can hide a lot of company sins. One of the most hidden sins is stock-based compensation expense (SBC expense). As growth has slowed for most tech companies, the SBC problem has become painfully obvious.

There are two ways to look at the impact of SBC:

SBC expense: Accounting cost associated with granting equity awards to employees, consultants or advisors. You can check out my post on SBC expense accounting if you are interested in how the accounting works.

Shareholder dilution: Number of shares added from employee equity programs (i.e. everyone’s slice of the pie shrinks)

Dilution Destroys Shareholder Value

Hopefully everyone understands that all else being equal dilution is bad for investors.

If a company is stagnant and its valuation is flat, then dilution will cause shareholders to lose money.

A company with a valuation of $100 and 10 equal shareholders means each shareholder has $10 in value. If we dilute and add 10 more equal shareholders, but the valuation remains $100 then you have cut shareholder value in half (everyone has $5 of value)

Valuation additions must outpace the dilution for the business to be investable.

Dilution Benchmarks

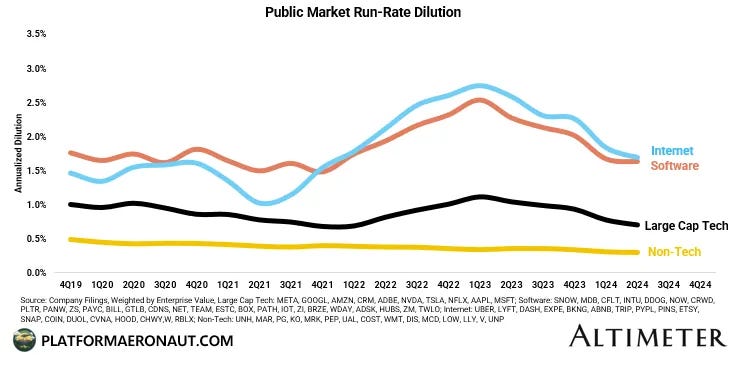

Dilution has definitely been ticking down since it peaked in late 2022. Below is a great chart from Thomas Reiner on public market dilution trends.

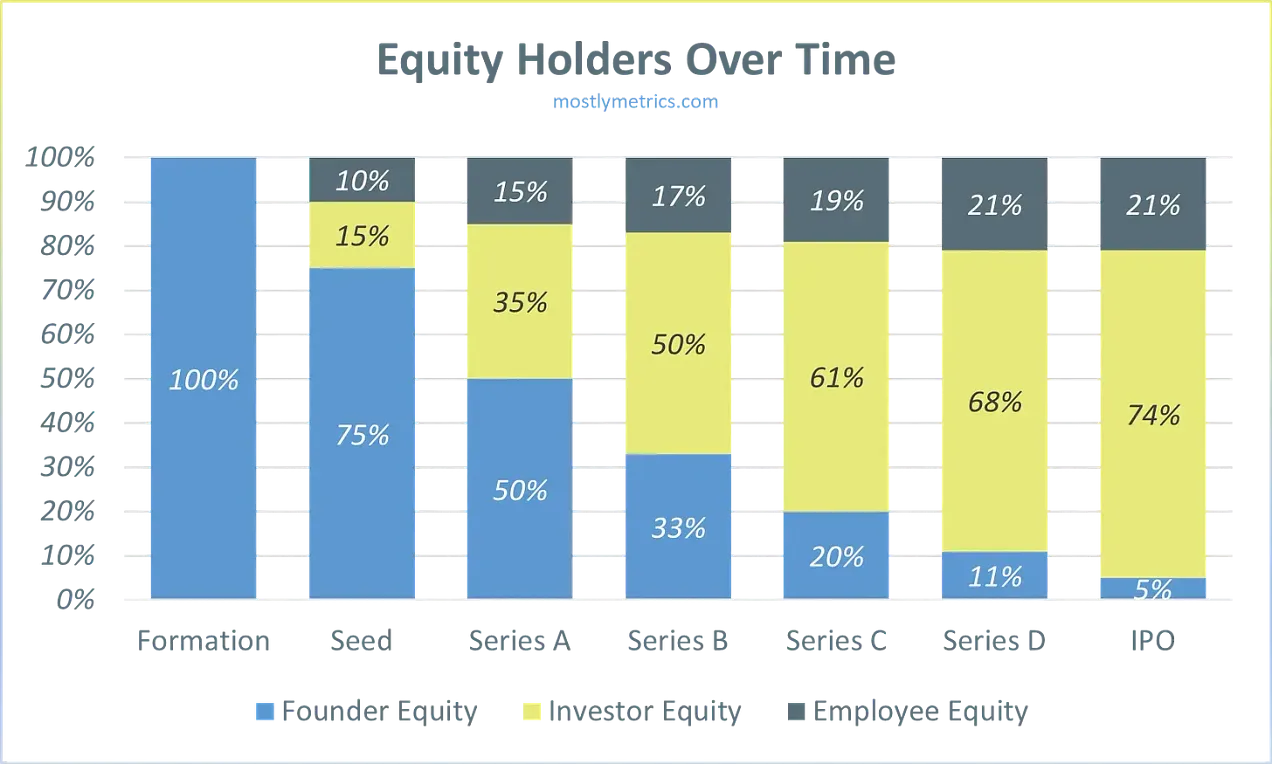

Private company dilution works in a similar way, but VC-backed companies have a lot more dilution as companies raise a lot of money relative to their valuation earlier on their journey. The below chart from CJ Gustafson is a great framework.

Dilution Death Zone

If dilution is high relative valuation gains, then shareholders will either lose money or it will be a really tough uphill battle to fight against.

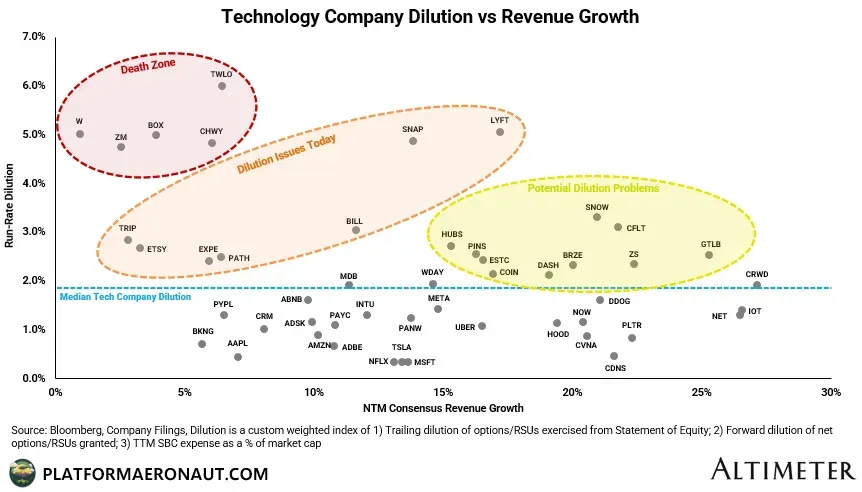

Since the best proxy for how tech companies increase valuation is through revenue growth, the below chart from Thomas does a great job highlighting the problem.

Let’s focus on what Thomas describes as the “Death Zone”. These are the companies that are diluting way too much for their growth rate. Dilution is so high compared to potential valuation increases that it will be extremely hard to generate positive investor returns.

The slice of the pie may shrink faster than the total pie expands. The goal is to increase the total size of the pie at a much faster rate than investor’s slice decreases so that an investor’s individual pie slice is actually increasing in size over time.

Zoom is within the Death Zone described above — diluting ~5% and growing revenue by less than 5%. If you have some Zoom pie then you might be going hungry. Zoom has had some unique circumstances, but its stock has struggled for a while and high dilution isn’t helping.

But like most investor metrics, the future is what matters for future investor returns (keep reading for what Zoom is doing).

Fixing High Dilution

The problems facing public companies can be a bit different than those facing private companies when it comes to fixing dilution problems.

Public Company Dilution

More public companies are proactively focusing on fixing their dilution problems. Zoom has recently announced some big some changes…

We grant a significant amount of shares each year that has led to very high dilution. Put simply, we are granting too much equity and must proactively reduce it. — Eric Yuan, CEO of Zoom

Zoom announced some significant changes to its employee equity program in order to get dilution under control:

Lower equity grants for new employees

Elimination of its annual performance equity plan

Public Company Employee Impact

The problem with fixing public company employee equity compensation is that there is a very real and immediate impact to employee compensation since employee equity in a publicly traded company is basically cash.

Public companies typically grant a certain dollar amount of RSUs (type of SBC) to an employee that vests over time. Those RSUs have value regardless of stock price movement because the employee gets the stock as long as they are employed.

When a company stock is relatively cheap, the employee equity programs can become REALLY expensive because typically they are based on a dollar amount to give to the employee. So if a stock goes from $200/share to $100/share then employee equity for new hires are nearly 2x more expensive now!

Private Company Dilution

Fixing dilution amongst private companies will be a bit easier in my opinion…

The vast majority of private companies don’t have the same issue as public companies (public company employee equity being basically like cash) because private company employees typically can’t sell their shares. They are all hoping for an exit one day so their equity can have value — IPO, M&A, etc

Most employees in private companies get stock options.

Stock options: give you a right to buy (aka exercise) a set number of shares of the company stock at a certain price, also known as the strike price.

The big problem with exercising stock options in private companies is that employees have to pay out cash (and sometimes they owe taxes on top of it) and they can’t sell it…And they may never be able to sell if there is no exit!

Because of the significant drop in tech exits over the last couple of years, more employees aren’t valuing their equity the same as the peak of 2021 when it seemed like every tech company would IPO or get acquired at amazing valuations.

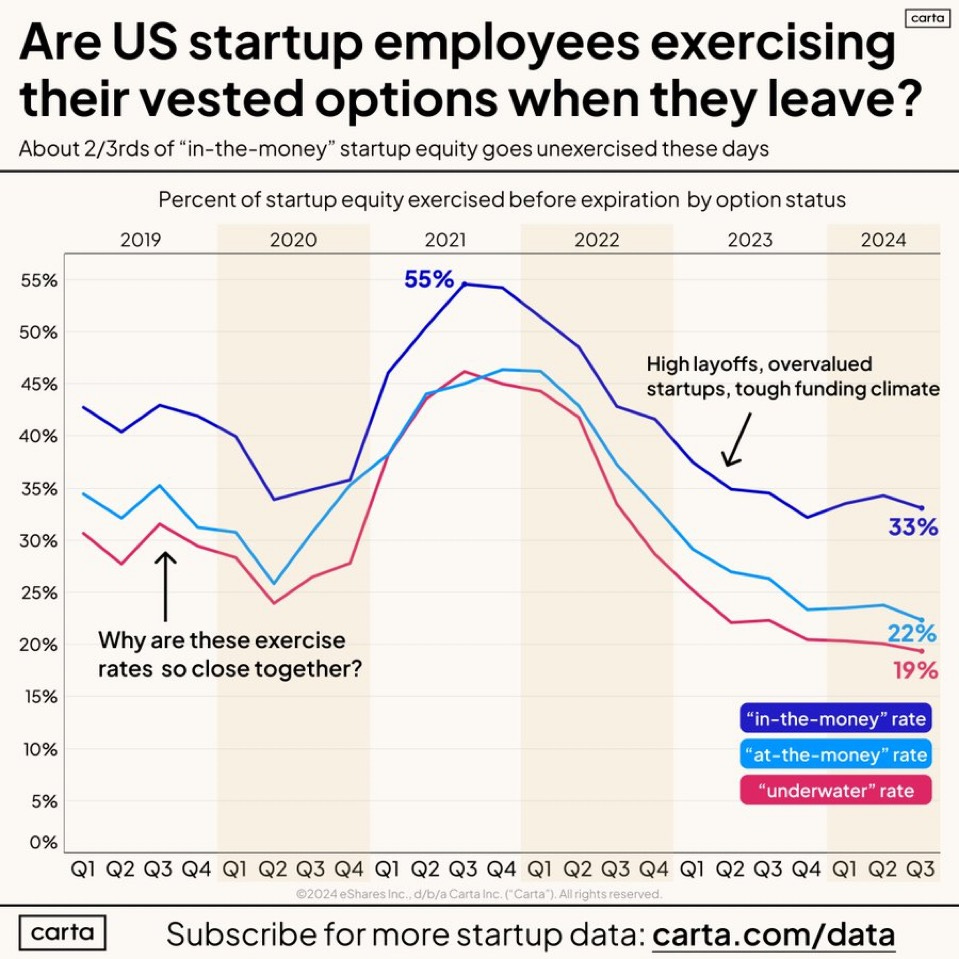

More than 2/3rds of all stock options go unexercised…which means no dilution is being added for those employees. I guess this is a good thing for existing shareholders, but I would partially worry why so many employees are deciding not to exercise…

This trend of decreased stock option exercises implies a few things:

Dilution is decreasing from less exercises

Employers can grant less stock options in a lot of cases because employees are valuing the equity less. The job market is tough and they are focused on a stable job and cash compensation.

Less people are as confident in their companies’ exit prospects as before

On a more macro level, employees don’t want to use their cash on a risky bet

Future of Employee Equity

There are a few things at play that will reduce dilution from employee equity programs. Dilution will come down naturally as the market has shifted to be more employer favorable.

Reduction in headcount: Layoffs and hiring freezes

Less competitive market: Companies can more easily find great talent so there will be smaller new hire grants, promotion grants, and less annual refreshes

Shrinking equity programs: More companies will follow what Zoom is doing and reduce ongoing equity programs.

Also, as AI becomes more adopted and headcounts relative to revenue continues to decrease, dilution will also drop. We often talk about the cash savings from adoption AI, but the equity savings from reduced headcount can be almost just as meaningful.

Footnotes:

Check the webinar from today’s sponsor (Leapfin) - How the Industry is Failing Future Accounting Leader

Fill out this form if you want to be automatically invited to all future OnlyCFO webinars (next one up is on Sales Tax)

Check out OnlyExperts to find offshore accounting resources. They have some amazing talent for 20% the cost of a U.S. hire.

How do you think about a company like Snowflake whose SBC is 40% of revenue but dilution is basically flat because of share buybacks? Do we just call it a quasi cash expense at that point and move on?