Forecasting in Uncertain Environments

Lessons from ZoomInfo and forecasting tips with Runway's CEO

Today’s sponsor: Runway—the finance platform you don’t hate

Make smarter decisions in seconds.

Say goodbye to messy formulas and endless spreadsheet versions. Runway’s drag and drop interface makes it easy to answer “what if” scenarios and questions. Adjust for new hires, reorganizations, and growth scenarios, aligning each decision with your overall business goals.

See how AngelList, Superhuman, and others make confident decisions with Runway.

Forecasting in 2024

For the past decade most finance teams in the B2B software industry have been spoiled. Forecasting was relatively easy because revenue was truly recurring and pretty sticky for most software companies.

If we spend $XX in sales then we will get $XX in new ARR. And since we can increase prices by X% each year and upsell existing customers then our ARR will grow by X%. Our churn rate have been 5% for the past 5 years so we expect the same this year.

This fairly predictable modeling has made it relatively easy for SaaS finance teams to accurately forecast (particularly true for more mature SaaS companies). While SaaS companies have plenty of complexities, finance teams have had it relatively easy for a long time. Spend some time in the retail, manufacturing, or similar industries and you will quickly see how hard some forecasting can be.

There are many reasons why forecasting will become more difficult:

Sales volatility

Pricing pressure

Pricing changes - move to more usage-based pricing with AI

ARR becomes less “recurring” for SaaS

A recession causes spending cuts

Customer collectability becomes an issue if we enter a recession and the fundraising environment remains tough

etc…

The customer collectability issue is the one that I want to focus on today (I will continue to cover the others in future posts). ZoomInfo’s recent earnings report provided some interesting insights into what companies may be facing in the near future and how they may react.

I also did a Q&A with Siqi at Runway (a modern planning tool) on forecasting best practices. Siqi has some very insightful takes on forecasting in a volatile market, how finance teams can leverage AI, etc.

ZoomInfo’s Move from SMBs

ZoomInfo has been struggling for a while. It’s down 51% over the past year and fell nearly 30% after reporting Q2 earnings.

One of the major issues from its recent earnings report was that ZoomInfo took a $33M charge within Q2 because of uncollectable customer accounts.

As a result of the issues they are having with SMBs, ZoomInfo will be requiring prepayment before gaining access to their tools from a lot of their smaller and riskier customers. And naturally, ZoomInfo is shifting focus to make sure they are selling to higher-quality customers that are likely to be able to continue to pay and grow over time (i.e. less SMBs).

ZoomInfo noted two main areas of write-offs:

Customers don’t feel they got value

Companies shutting down

Customers often push back on value received and refuse to pay when times are tough. When money is free and flowing a lot of companies can’t even keep track of all the useless software they have. But when things are tight and being scruntized then this type of write-off becomes a lot more common.

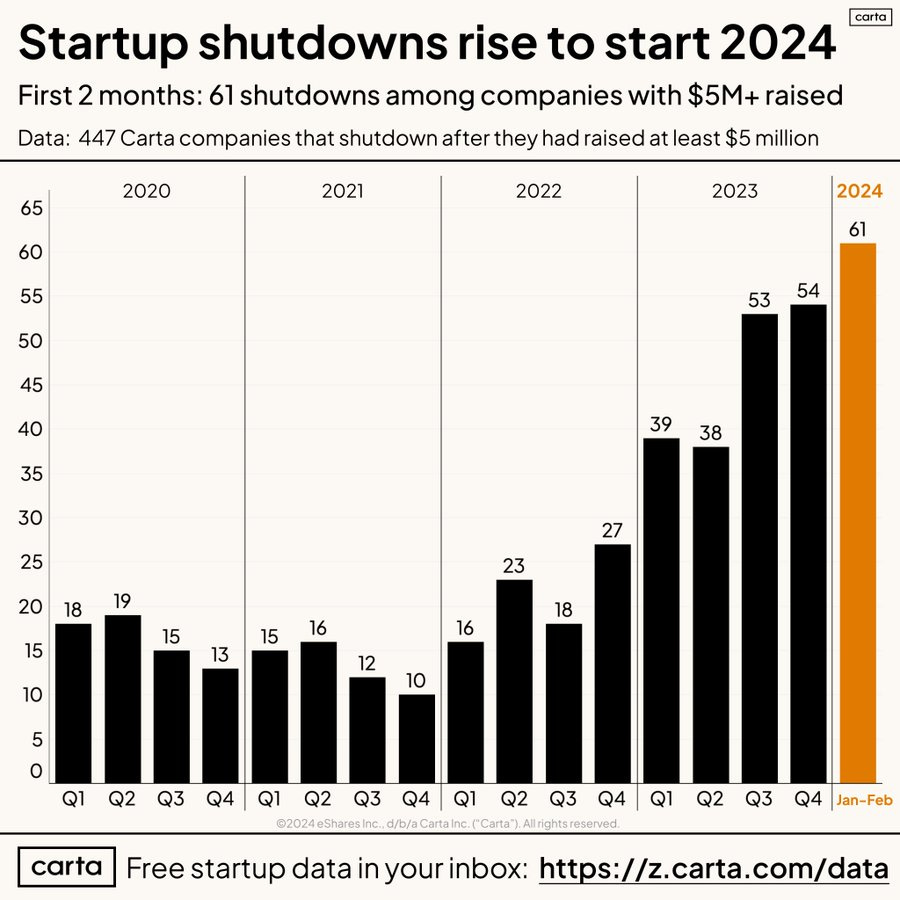

Software companies shutting down has also increased significantly since 2021 as the fundraising environment for software has been really tough. This will continue to increase as companies continue to run out of money from increased competition and tougher fundraising environment.

We extended credit to SMBs that were not creditworthy, and we’ve changed our practices now to require upfront prepayments against our riskier customers. — ZoomInfo CEO

For a long time in B2B SaaS, there has been an assumption that most companies could pay their bills — funding rounds kept coming, SaaS is sticky, etc. Many of us have had extremely light credit worthiness checks. We just knew there would be some, but not too many, that would go out of business or refuse to pay.

Similar to ZoomInfo, I think we will see many other companies face similar problems (especially those that sell to smaller companies). Companies should start re-evaluating their processes around customer/prospect collectability before it becomes a big problem like it is for ZoomInfo:

Be more proactive in credit checks

Provide less credit terms to high risk customers

Forecast a higher amount of write-offs for uncollectable accounts

Forecasting with Siqi

Siqi is the CEO of Runway, which helps companies forecast and build financial plans. He has talked to tons of finance leaders and thinks a lot about planning so I did a Q&A with him that covers best practices for forecasting, especially in a fast changing environment.

1. What are the top mistakes in forecasting you see in software companies?

The biggest mistake is that many companies don’t forecast at all. And to the extent they do forecast, it’s done for reporting to investors.

Forecasting isn't just about getting your numbers right for investors; it’s about understanding the machinery of your business, and developing deep intuition for how it actually operates.

Another common mistake is that the founder isn’t deeply engaged with the finance leader. When the model doesn’t reflect how the founder or CEO thinks about the business, you end up with a generic forecast that doesn’t accurately reflect how you operate.

It’s important to get the details right, because every company operates differently. For example: SaaS companies share similarities, but there's still a wide range of differences. The nuances become clear when you ask things like:

How do you charge your customers?

What’s your go-to-market strategy?

Where do you invest in marketing?

How do you generate leads?

What are your main drivers of growth?

Each of these factors can significantly impact your forecast. And if there’s a disconnect between how your model is built and how it’s actually used for forecasting, mistakes start to happen.

2. How should software CFOs think about forecasting in a recession? What might be different?

The two main factors to consider are: availability of capital, and propensity to spend.

First, the availability of capital is pretty straightforward and obvious. If you’re not able to raise funds at a good valuation — or at all — profitability, being cash flow positive, and preserving runway will become top priorities. The opposite is also true: in ZIRP times, you might not think too much about these things.

The second factor, propensity to spend, is more nuanced and varies depending on your business. For example, some SaaS companies can behave differently in downturns. Some sectors, like gaming, are countercyclical — they thrive when people seek affordable entertainment during a recession. Finance software can also be countercyclical. When liquidity is widely available, forecasting and planning don’t seem critical; but when capital tightens, they become super important.

In 2018, at Sandbox VR, we faced a downturn in the VR sector. We realized we would run out of money very quickly. We managed to raise additional funding, but then the pandemic hit and it wiped out our revenue overnight. As a retail company, we were badly hit.

That’s the third factor: variability or uncertainty. It’s hard to get this one right. I mean, at Sandbox VR, if we had factored in the possibility of a pandemic in our model, we would’ve been overly conservative. In hindsight, it would’ve also been the right approach.

Markets are unpredictable – right now, there’s uncertainty on the upside with AI, and on the downside with recent global volatility. Ultimately, the right forecasting strategy for you will depend on your company’s specific context, your ability to raise funding, and how countercyclical your product is.

3. A lot of companies are moving to some type of usage-based pricing (especially with generativeAI stuff). How should companies think about forecasting this?

With usage-based pricing, the one thing you need to get right is your unit economics. The key lever here is the uncertainty around the cost of serving a token.

You obviously want to have positive unit economics, but it’s worth considering that the cost to serve a token has gone down dramatically in recent years. Right now, it’s orders of magnitude cheaper than it was when GPT-3 was first released.

Running a negative unit economics business carries risks, of course. But if you can project a trend of decreasing costs, you might still be on solid ground. The trick is to model your unit economics correctly.

This also ties into capital availability, especially during a recession. When capital is flowing freely, you can afford to take more risks. But in a downturn, having positive unit economics becomes important. You’ll need to plan for maintaining positive unit economics, for lowering prices, and for increasing demand as token costs continue to decrease. Based on current trends, I think costs will continue to go down dramatically.

4. How should CFOs be using / thinking about AI in forecasting?

I primarily think about this in terms of efficiencies.

AI isn’t at a level where it can fully grasp the context and nuance of complex financial models. Large language models (LLMs) aren't widely exposed to the type of data used in formulas, spreadsheets, and modeling. So, expecting AI to do all the work for you isn't realistic right now.

Instead, it’s helpful to think about how AI can make you more efficient while you’re working.

How? For one, AI can understand the structure of your data sources, making it easier to integrate them – it can help you write SQL queries, so you don’t have to do anything manually. Or if you get lost in a model and forget how a formula works, AI can explain it in an easy-to-understand way. When analyzing variances, AI can identify the most critical deltas and input those into your forecast. AI can make your work easier and faster.

The way we think about this at Runway is that our platform should be the best tool for thought for anyone making business decisions. AI can help you think through these decisions, but it won't do the thinking for you.

I think the two biggest opportunities for making AI more useful are:

Increasing model capability and reasoning.

Designing experiences where AI proactively assists you, and understands the full context of your work.

At Runway, we're focused on increasing the surface area and context we expose to an LLM, making it more helpful proactively. Just giving an LLM a spreadsheet with formulas and numbers isn’t enough; it lacks the context to infer your goals and business nuances. This context lives outside the spreadsheet – in your head or in documents. So what LLMs really need are new abstractions that connect your context to your numbers and formulas. One example is a Plan that’s linked to your model in Runway; another is a Page that can hold text, charts, and databases. By connecting context with numbers, an LLM becomes much more helpful and accurate.

So, leveraging AI in forecasting comes down to both enhancing model capabilities, and using abstractions that can hold context.

5. Any other best practices for forecasting you can share?

I think the most important aspect of forecasting is understanding what you’re doing and why.

Many people forecast because an investor asked for it, or because they think they're supposed to, or because they work with the CFO. The right way to look at forecasting is to see it as a tool for making better decisions today. If that’s not how you think about it, your model probably isn’t as helpful as it could be.

The best forecasting model for you maps to how you think about your business. You think about your business in terms of how many people you’re going to hire in sales, what you’re going to charge, how much to invest in different marketing channels, and what happens if you try a new marketing strategy. Your model should account for that, and enable you to update and change your assumptions comfortably – so it can be a useful tool for thought. It shouldn’t be a static thing that you’re afraid to break.

Very few models are designed to be genuinely useful tools for thought. That’s why we believe a platform like Runway needs to exist. We want to build the best tool for thought for business decisions, by mapping your model to the way you think about your business.

Footnotes:

Check out Runway if you want beautifully easy financial planning (today’s sponsor)

Find amazing accounting talent in places like the Philippines and Latin America with OnlyExperts. They are accounting specialists. So all of their candidates are carefully vetted by accounting experts. I have partnered with OnlyExperts and as a reader of OnlyCFO, you can get a 20% discount on the placement fee for your first hire. Staff your accounting needs today

Interesting story about ZoomInfo. Not getting enough value may be an easy cop out for many customers not to continue the service, however, I wonder if there is some truth to it. After all, if a product truly adds value and solves a problem for me, I wouldn't skip on the bill even if cash is tight.

So, a large number of customers using this as a reason to churn should light some fire under the product team.